According to a crypto.com report, the total number of cryptocurrency owners as of November 2023 had reached 575 million. Given the market conditions, a projected surge is expected, potentially elevating the numbers to approximately 700-900 million.

As cryptocurrency adoption grows by leaps and bounds, many businesses plan to tap into its rage. With crypto exchange development, they can become people’s gateways into the dynamic world of crypto but that’s not what the race is about. As there are numerous options available for traders to trade cryptos, an exchange has to stand out to enhance its desirability.

Numerous factors determine the success of a trading platform. However, in this blog post, we will guide passionate newcomers in the crypto space on how they can navigate the regulatory landscape and ace crypto exchange development.

Key factors that determine the success of crypto exchange development

These are some of the critical factors that shape the success of a crypto exchange venture:

- Advanced security protocols

- Regulatory compliance

- User-friendly interfaces

- Diverse asset listings

- Seamless fiat-to-crypto onboarding

- Low transaction fees

- High Liquidity

- Innovative Features

- Customer Support

By considering the abovementioned factors in crypto exchange development, exchange owners can attract and retain users in the dynamic cryptocurrency landscape.

Current State of Regulatory Landscape Around Crypto Exchanges

Currently, the cryptocurrency regulatory landscape seems fragmented, uncertain, and inconsistent. Different legislations and regions practice different ideologies and laws around digital currencies and businesses facilitating exchange and custody. However, most countries have not set outright laws for or against crypto.

2023 was characterized by multiple administrative agencies accusing crypto operators of scams, fraud, money laundering, and bankruptcies. It ignited resentment among fervent cryptopreneurs eager to establish their lucrative ventures by partnering with Cryptocurrency Exchange Development Services. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) aggressively projected enforcement actions to regulate crypto exchanges and crack down on illicit activities in the crypto space after realizing the implosion of lawsuits.

While regulators worldwide ramped up efforts to enhance lawfulness around digital currencies in 2023, the current year can bring a boom in the number of crypto operators attempting to enter the industry lawfully. If you are one of those, seek professional legal advice before committing to incorporating a crypto exchange development company.

Countries that require a Crypto Exchange License

- Japan

- Estonia

- Singapore

- Lithuania

- USA

- Great Britain

- Hong Kong

- Malta

- Poland

- Czech Republic

- El Salvador

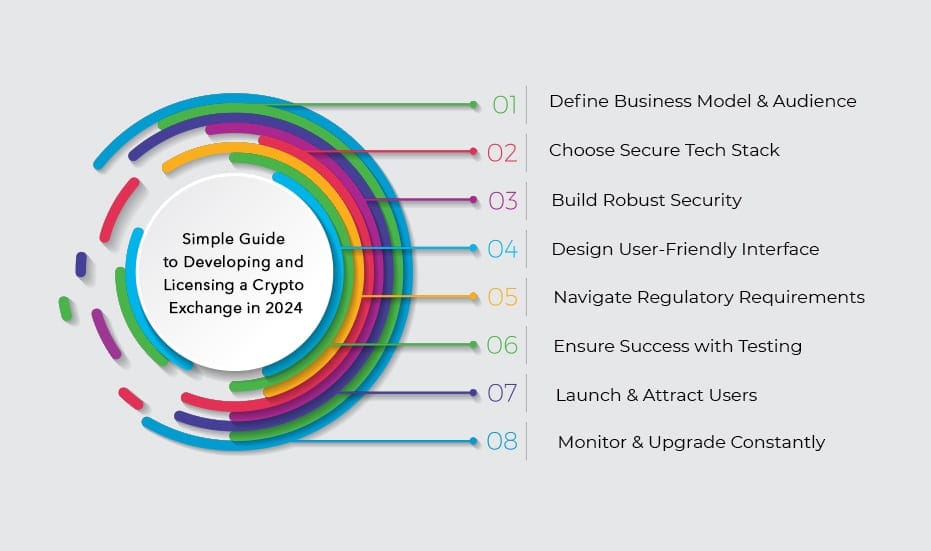

Step-by-Step Guide to Crypto Exchange Development and Licensing in 2024

Step 1: Define Your Crypto Exchange’s DNA: Business Model and Target Market

- First and foremost, plan a unique value proposition for your crypto exchange. It can be low fees, support for some specific coins, margin trading, derivatives trading, etc.

- Apart from what makes your exchange approachable, you must consider how it serves your motives. Meticulously draft a remunerative revenue model and then plan your budget accordingly to accommodate crypto exchange development, security, compliance, and operational costs.

- Carefully study your target audience – their age, income, location, experience level, pain points, etc. The next thing on your to-do list should be analyzing the exchanges catering to your target market’s interests. Take charge and think strategically to clearly define what distinguishes you from your competitors.

Step 2: Selecting Your Secure and Scalable Tech Stack for Crypto Exchange Development

- Some preferable options for backend development are Go (efficient, scalable), Java (robust, secure), and Python (flexible, data-driven) while for frontend development, JavaScript is unexcelled for its interactivity.

- Select from public, permissioned, or hybrid blockchains as per your scalability, security, transaction speed, smart contract capabilities, or other specific needs for your crypto exchange development.

- Collaborate with the Crypto Exchange Development Company to choose pertinent databases and web frameworks for your project. While choosing any of the technologies, consider budget, security requirements, scalability, and reliability.

Step 3: Safeguarding the Fort: Build a Robust Security Framework For Your Exchange

- Follow a multilayered security approach with encryption, firewalls, intrusion detection, and regular audits. Layering the access, network, application, data, fund, and incident defenses creates a holistic security posture.

- Reliable Cryptocurrency Exchange Development Services can help you integrate basic security measures and combat emerging threats by continuously innovating to address vulnerabilities.

- Investing in regular security audits and penetration testing helps exchanges evade threats before they do much harm to users or business owners.

Step 4: Craft a User-Friendly Haven: Intuitive UI for your Crypto Exchange Development

- Ensure prioritized clarity by using simple layouts with an uncluttered interface, emphasizing actionable items, and using colors, icons, and charts intuitively to distinguish asset types, trends, and order details.

- Enhance user experience and facilitate seamless workflows with a responsive mobile-first design, optimized navigation, and use of search bars or filter views during crypto exchange development.

- Live charts, order books, latest market news, built-in tutorials, FAQs, glossaries and clear and concise details of real-time order status enhance customer’s trust in trading platforms.

Step 5: Navigating the Regulatory Maze: Licenses & Compliance for Your Crypto Exchange

- You might require money transmitter licenses or digital asset trading licenses based on your intended regions. Research regulatory requirements in your target jurisdictions or seek legal counsel from a specialized Crypto Exchange Development Company to navigate the legal intricacies.

- Implement anti-money laundering (AML), know your customer (KYC), fair trade practices, clear disclosures, and dispute resolution mechanisms to deter illicit activities and protect customers’ interests.

- Adherence to data privacy regulations like GDPR and CCPA is also essential to launching an exchange legally. Exchange owners must also produce business plans, financial statements, and AML/KYC policies as and when required.

Step 6: Scrutinize to Ensure Success: Rigorous Testing for Your Crypto Exchange

- Before launch, the Crypto Exchange Development Company must comprehensively test and verify the user interface and core functionalities like order placement, execution, cancellation, and reporting.

- This involves testing integrations with wallets, payment processors, and other systems on various devices and browsers. Stress and load testing should also be conducted to ensure stability and efficient performance during high volumes.

- Collaborate with your cryptocurrency exchange development services provider to conduct penetration testing to identify and address vulnerabilities in code and infrastructure and stress test security to check the integrity of exchange against denial-of-service attacks.

Step 7: Blast Off! Launch Your Crypto Exchange and Start Attracting Users

- Go live with a bang and generate buzz through press releases, social media campaigns, influencer partnerships, etc. Establish yourself as a thought leader by creating informative blog posts, guides, and educational materials, and keep your community engaged and active through social media, forums, and events.

- Strategically plan and implement your marketing tactics with the help of a reliable crypto exchange development company. Consider referral programs, limited-time promotions, and welcome bonuses to attract and reward early adopters and targeted advertising or SEO optimization to reach your ideal audience.

- In case of any issues, promptly communicate with users and keep them informed.

Step 8: Stay ahead of the curve: Keep Monitoring and Upgrading

- Even if you have gathered many users in the initial few months, exert to sustain this success or all your efforts for crypto exchange development will go in vain. You would need to monitor market trends, emerging technologies, and competitors’ activities to keep feature updates, security enhancements, performance, and compliance optimization in check.

- To keep evolving as per customer expectations and market trends, exchange owners must conduct constant market monitoring, collect user feedback regularly, keep an eye on regulations, perform periodic security audits, and constantly collaborate with crypto exchange development company to ensure fast execution.

Licensing in 2024: Navigating Regulatory Frameworks:

Overcoming legislative obstacles is paramount for the success and sustainability of crypto exchanges. As we progress toward the second quarter of 2024, the landscape of licensing requirements continues to evolve, posing opportunities and challenges for both established exchanges and newcomers to the industry.

Common Steps Involved in Navigating the Regulatory Frameworks

- Executing crypto exchange development, incorporating the company, and selecting a jurisdiction:

You may choose to register your crypto exchange company in Estonia, the USA, Malta, Gibraltar, Switzerland, Great Britain, Singapore, Hong Kong or other jurisdictions. However, there are issues around payment solutions required for operations with fiat money. With support and guidance from dedicated cryptocurrency exchange development services, you can overcome such challenges.

- Obtaining the necessary licenses to commence with your cryptocurrency exchange business:

Cryptocurrency licenses enhance the credibility of cryptocurrency exchanges and advocate for project stability. To obtain the licenses, it is important to comply with several requirements, which may include diligent transaction monitoring, payment of required state duties, the availability of a physical office, and local management member.

- Working with a bank or setting up a payment system with the help of a crypto exchange development company:

For the ability to accept and issue deposits, exchanges might require setting up a robust payment system or opening a bank account. The most preferable option is opening a bank account, which requires them to present an understandable business model, minimum deposit, a transparent company structure, etc.

- Collaboration with Payment Processing Companies:

To accept payments from customers via Visa and Mastercard, crypto exchanges might need to open merchant accounts with an extensive range of payment processing providers based on their turnovers and currencies, processing history and the countries of outgoing and incoming payments.

From the steps mentioned above, the process might seem like a plain sailing process. One must know that for every step, companies need to produce a large number of documents. Therefore, it is better to count on an experienced cryptocurrency exchange development services provider offering cryptocurrency legal solutions along with technology solutions.

Deciphering the Regulatory Maze: Best Practices

- AML/KYC Compliance

- Stringent Security Measures

- Comprehensive Compliance Strategy

- Engagement with Regulatory Authorities

- Continuous Monitoring and Adaptation

- Collaborating with a reliable legal team

Conclusion

Establishing and running a crypto exchange will not be a cakewalk in 2024, as more and more regulatory bodies will lay their rules and many might grow more suspicious than before.

Hiring a comprehensive cryptocurrency exchange development services provider like Antier can be beneficial for addressing various challenges associated with launching and operating a cryptocurrency exchange. With their technical expertise, dedicated legal team, and marketing support, you can not only legitimately establish an exchange but also explore strategic business approaches, offer diversified services, and execute market expansion tactics and compliance audits for sustainable growth.

Frequently Asked Questions

01. What are the key factors that determine the success of a crypto exchange?

The key factors include advanced security protocols, regulatory compliance, user-friendly interfaces, diverse asset listings, seamless fiat-to-crypto onboarding, low transaction fees, high liquidity, innovative features, and customer support.

02. What is the current state of the regulatory landscape around crypto exchanges?

The regulatory landscape for crypto exchanges is fragmented and inconsistent, with different regions having varying laws and ideologies regarding digital currencies. Most countries have not established clear laws for or against crypto.

03. How can businesses navigate the regulatory requirements for crypto exchange development in 2024?

Businesses can navigate regulatory requirements by following a step-by-step guide that includes understanding the licensing process, adhering to best practices, and staying informed about the evolving regulatory frameworks.