How the Euler Finance Hack Occurred and Why Smart Contract Audit is Necessary?

August 29, 2024

How Is Stablecoin Development Redefining The Game for Real Estate Transactions?

August 30, 2024KYC, or Know Your Customer, has become a major norm in various sectors as it helps ensure that businesses are dealing with legitimate customers and prevents illegal activities like money laundering and fraud. The KYC concept was introduced to safeguard both businesses and the broader financial ecosystem from misuse and abuse. However, this system also has drawbacks due to its centralized nature. Centralized systems can raise concerns about security, transparency, and efficiency. This is where the demand for a secure and decentralized KYC system arises, and a blockchain KYC solution provides the answer.

In this blog, we will explore the concept of Blockchain KYC, its benefits for businesses, and blockchain KYC use cases.

The Limitations of a Legacy KYC System

Let’s understand how legacy KYC works with a simple example-

Whenever a customer wishes to open an account with a financial institution, they must first undergo a comprehensive KYC verification process. Access to the institution’s services is granted only after the customer provides the necessary identification documents. Once these documents are verified, the customer can fully utilize the services offered.

However, if a customer needs to engage with a new institution, they are often required to repeat the entire KYC verification process. This repetitive procedure can lead to significant frustration and unnecessary friction for the customer.

The following are the drawbacks of the legacy KYC system, highlighting the urgent need for a more efficient solution, such as a Blockchain KYC solution.

- Regular Update

KYC needs to be updated and maintained regularly due to the AML, compliance, and anti-terrorism regulations. Managing this process can be tedious and has proven to be highly inefficient.

- Lack of Standardization

Companies often lack standardized KYC data fields, which complicates the verification process, increases the risks of errors, and hinders the efficient exchange of information between institutions.

- High Expense

The legacy KYC verification process can be costly due to its manual, labor-intensive nature, requiring significant resources for data collection, verification, and compliance, often leading to high operational expenses.

- Time-Consuming

The KYC process is a long process that involves complex, formal communication between multiple institutions and their departments. This complexity often results in delays, extending for over weeks or even months.

- Poor Customer Experience

Customers often need to go through repeated processes for the same onboarding documents at different institutions, which results in prolonged turnaround times for new client acceptance and a frustrating experience.

Blockchain-based KYC- A New Paradigm in Identity Verification & Security

Blockchain-based KYC (Know Your Customer) is a modern approach to verifying customer identity using blockchain technology. Unlike traditional methods that basically involve manual paperwork and dependency on multiple institutions, the blockchain KYC solution leverages the decentralized nature of blockchain to store and verify customer data.

The data recorded on a distributed ledger of a blockchain KYC solution can’t be altered or deleted, reducing the risk of data tampering and fraud to a great extent. The KYC verification process can easily be managed through a single source of truth that can be shared across multiple institutions.

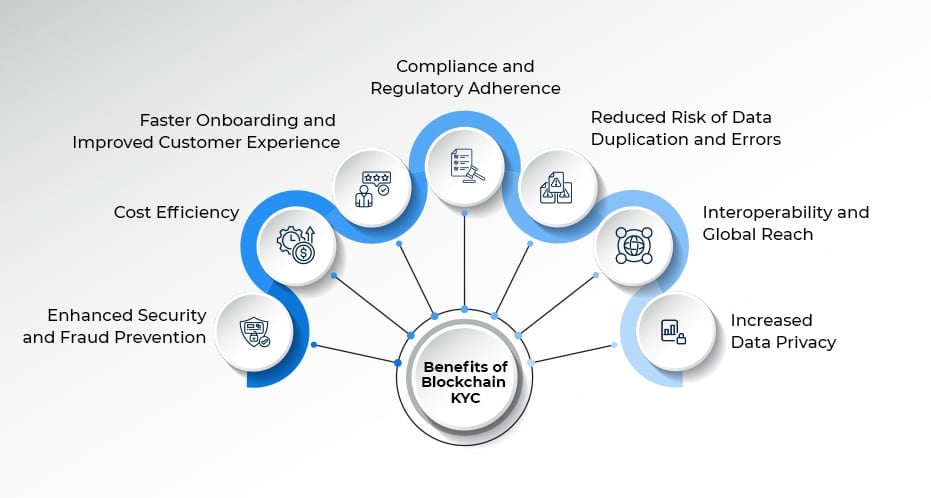

The Benefits of Blockchain KYC for Businesses

A blockchain KYC solution offers significant benefits to businesses, driving growth and innovation. Here are some key advantages:

- Enhanced Security and Fraud Prevention

Security remains a top priority for businesses, particularly amid a rising number of data breaches and cyber threats. A blockchain KYC solution offers a decentralized & immutable ledger that ensures once customer data is recorded, it cannot be modified or deleted. The cryptographic security feature of blockchain also hinders unauthorized access. This level of data integrity enables businesses to safeguard sensitive customer information and build greater trust.

- Cost Efficiency

Unlike the traditional KYC process, the blockchain KYC verification process doesn’t involve multiple stages of verification, paperwork, and the requirement of coordination between various departments. The blockchain KYC solution offers a unified, digital platform for identity verification that helps businesses reduce administrative overhead and minimize the costs associated with manual processing.

- Faster Onboarding and Improved Customer Experience

In today’s digital age, customers demand swift interactions, but traditional KYC processes can cause delays and frustration. Blockchain-based KYC solutions streamline verification with real-time data access, accelerating onboarding and boosting customer satisfaction and retention. This efficiency addresses customer expectations and minimizes potential business loss.

- Compliance and Regulatory Adherence

The regulatory landscape for KYC and AML compliance is increasingly becoming stricter. It is vital for businesses to adhere to various regulations and standards as compliance failure can result in several penalties and damage to a business’s reputation. A blockchain KYC solution simplifies compliance by recording KYC transactions in a transparent and tamper-proof ledger. Businesses can audit and report their compliance efforts, ensuring adherence to regulatory requirements.

- Reduced Risk of Data Duplication and Errors

The traditional KYC processes involve customer data duplication across multiple institutions, which can result in inefficiencies and inaccuracies in the verification process. A blockchain AML KYC solution addresses this issue by maintaining a single, verified digital identity for each customer. It eliminates the need for tedious data entry and minimizes the risk of errors.

- Interoperability and Global Reach

Traditional KYC processes can be fragmented and region-specific, leading to challenges in managing cross-border compliance and data sharing. Blockchain-based KYC facilitates interoperability by providing a standardized platform for identity verification. This global approach enables businesses to efficiently manage KYC processes across different jurisdictions, ensuring consistent and compliant operations.

- Increased Data Privacy

Traditional KYC processes involve sharing sensitive personal information with multiple entities, increasing the risk of data breaches and privacy violations. With a KYC as a service blockchain, customers can grant permission for specific parties to access their data, ensuring that their information is only shared with authorized entities.

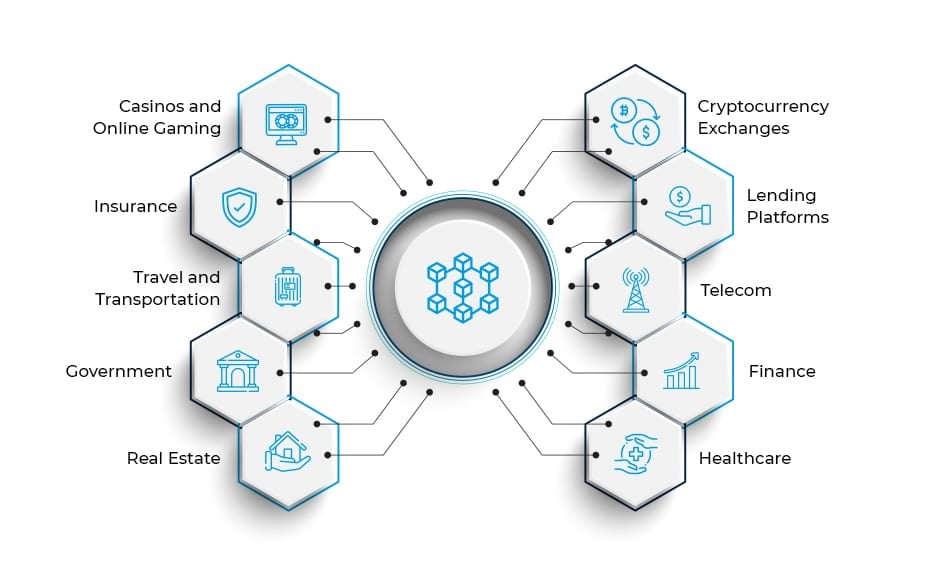

Explore the Blockchain KYC Use Cases

- Cryptocurrency Exchanges

Blockchain KYC verification complies with regulatory standards and brings transparency to the verification of user identities, helping to build a safer environment for crypto trading.

- Lending Platforms

The blockchain-based KYC method builds a transparent, secure & expeditious framework for lending platforms. It mitigates the risk associated with borrower identity fraud.

- Telecom

Today, telecom companies are actively exploring the blockchain KYC solution to store and manage customer data and enhance the accuracy of identity verification processes.

- Finance

The onboarding processes can be expedited, ensuring compliance with stringent regulations. This expeditious framework reduces the risk of money laundering and fuels customer trust.

- Healthcare

The Blockchain KYC solution enables healthcare and pharmaceutical companies to strengthen their KYC processes and improve their patient’s data privacy and security practices.

- Real Estate

Blockchain-based KYC provides a secure, decentralized way to verify the identities of individuals and entities involved in real estate transactions.

- Government

Our list of blockchain KYC use cases also includes the government sector who leverage a blockchain KYC for digital identity management to ensure that citizen data is completely secure & easily verifiable.

- Travel and Transportation

The passenger identification through blockchain KYC solution streamlines the check-in process, reduces wait times, and enhances security.

- Insurance

From automated claims processing to cross-border compliance, several benefits can be enjoyed with blockchain KYC verification in the insurance sector.

- Casinos and Online Gaming

The blockchain KYC solution enables casinos and online gaming platforms to verify the identities of players, ensuring compliance with anti-money laundering (AML) and anti-fraud regulations.

Conclusion

Adopting a blockchain KYC solution is not only beneficial but also an essential decision for businesses seeking growth in a digital landscape. Blockchain-based KYC enhances security, reduces costs, and speeds up customer onboarding, while also simplifying compliance with stringent regulations. Its ability to provide real-time, immutable records ensures data integrity and fosters trust with customers.

Embracing a blockchain KYC solution positions businesses for sustained success, ensuring they remain competitive and compliant in the modern world, providing a better customer experience in terms of identity verification. With Antier, you can leverage blockchain technology to offer a better identity verification experience. Antier is a leading blockchain development company, specializing in developing top-notch blockchain KYC verification solutions tailored to business needs. With 700+ blockchain specialists and years of industry experience, Antier has been a trusted partner for businesses in blockchain KYC solution development. Connect with our team to get started today!