How To Create Stable Coin To Mitigate Market Volatility

March 4, 2024

White-Label Web3 Wallet on Cosmos: Your Shortcut to Bull Market Success

March 5, 2024The real estate market, while offering significant investment opportunities, presents limitations for some participants. Real estate tokenization, leveraging blockchain technology, offers innovative solutions by fragmenting ownership and facilitating digital trading of previously illiquid assets. The potential for expansion in real estate tokenization is immense. In the year 2022 alone, the market reached a size of $2.7 billion, and forecasts suggest a remarkable increase to $18.2 billion by the year 2032.Presently, there is notable advancement in cash tokenization initiatives. Various regions, including but not limited to the European Union, Japan, Singapore, and the United Kingdom, have implemented regulatory frameworks for digital assets. Market participants also demonstrate an improved comprehension of the underlying technology.

This comprehensive guide delves into the compelling reasons to consider tokenization of real estate assets, explores the potential challenges, and provides a step-by-step breakdown of the process.

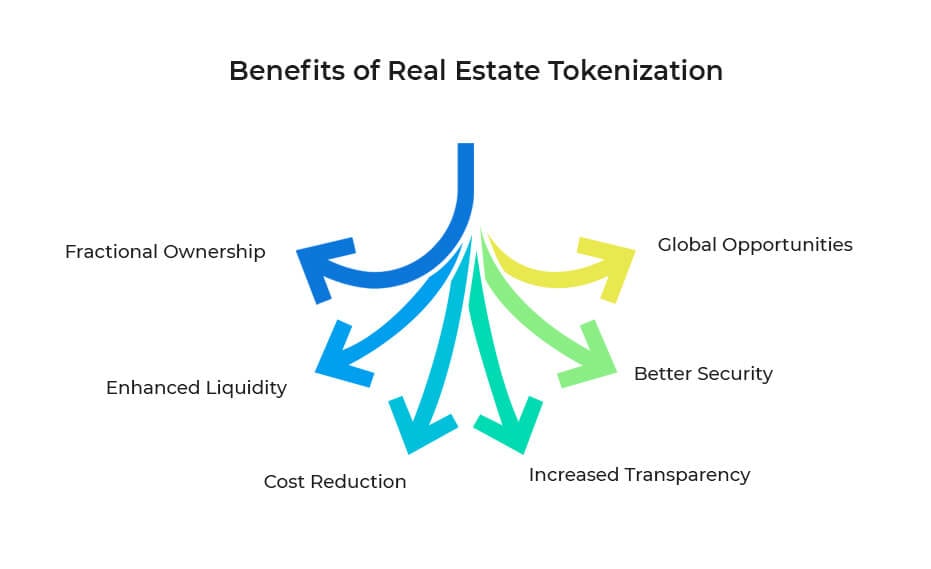

Unveiling the Benefits of Real Estate Tokenization

Let’s first explore the various benefits of real estate tokenization:

Democratizing Access through Fractional Ownership: Tokenized real estate allows investors with limited capital to participate in the real estate market by purchasing fractional ownership of high-value properties. This opens doors for a wider investor base, previously excluded due to high entry barriers associated with traditional methods.

Enhancing Liquidity in a Historically Illiquid Market: Unlike traditional real estate investments, which can be illiquid and take months to sell, tokenized assets can be easily bought and sold on dedicated platforms. It provides investors with greater flexibility and control over their investments.

Streamlining Processes and Potentially Reducing Costs: The traditional real estate investment process often involves intermediaries, leading to higher transaction costs. Tokenization streamlines the process, potentially reducing transaction fees associated with legal and administrative procedures.

Fostering Transparency and Security with Blockchain Technology: Blockchain technology provides a secure and transparent record of ownership and transactions. This reduces the risk of fraud and fosters trust among investors by ensuring immutable and verifiable data.

Global Opportunities at Your Fingertips: Tokenization removes geographical barriers, allowing investors to participate in international real estate markets, previously inaccessible due to logistical or regulatory hurdles. It opens doors to diversification opportunities and potentially higher returns; you can invest in real estate without any hurdle.

Real-World Applications of Asset Tokenization

There are many real-world applications of tokenization of real estate, which compels investors to explore this space. Let’s get to know about them:

Real Estate Investment Funds

Tokenization offers a streamlined approach to managing real estate investment funds, making them more accessible and transparent.

Fractional Ownership in Commercial Real Estate

Real estate crowdfunding, powered by tokenization, facilitates project financing by allowing a large number of investors to contribute.

Enhanced Liquidity in the Secondary Market

Tokenized real estate assets can be traded on secondary markets, providing enhanced liquidity compared to traditional real estate transactions.

A Step-by-Step Guide to Tokenizing Real Estate Assets

Tokenizing real estate assets involves several key steps:

- Property Selection and Valuation: A suitable property is identified that aligns with the intended investment strategy and undergoes a rigorous valuation process by qualified professionals to determine its fair market value.

- 2. Legal and Regulatory Framework: Consulting with experienced legal counsel is crucial to ensure compliance with relevant regulations governing token offerings, ongoing management of the tokenized asset, and anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Tokenization Process: The chosen platform or service provider utilizes blockchain technology to create digital tokens representing fractional ownership of the property. These tokens are typically secured by the underlying asset and may incorporate smart contracts to automate specific functions, such as dividend distribution or voting rights.

- Token Offering and Distribution: The tokens are offered to investors through an Initial Token Offering (ITO) or secondary market platforms. The chosen strategy depends on various factors like regulatory considerations, target audience, and desired liquidity, which helps users to invest in tokenized real estate.

- Property Management and Income Distribution: A designated entity, often referred to as a Special Purpose Vehicle (SPV), manages the underlying property in accordance with legal requirements and investor agreements. Rental income or capital gains are distributed proportionally to token holders, often through automated mechanisms facilitated by smart contracts.

Pro Tips for Successful Implementation of Real Estate Tokenization Initiatives

Here are some pro tips, which can significantly increase your chances of successfully implementing a real estate tokenization project and ensure success in tokenization investments.

1. Pre-Development Stage:

Clearly Define Your Vision and Goals:

- What problem are you solving? (e.g., democratizing access, improving liquidity)

- Who is your target audience? (e.g., individual investors, institutions)

- What type of real estate is suitable for tokenization? (e.g., commercial, residential, specific project types)

- What value proposition do you offer investors? (e.g., returns, voting rights, diversification)

Conduct Thorough Market Research:

- Assess the competitive landscape: Who are the existing players in the space?

- Evaluate regulatory landscape: Understand relevant regulations and potential legal hurdles.

- Gauge investor interest: Conduct market research to understand investor appetite for your tokenized asset.

Assemble a Competent Team:

- Seek expertise: Build a team with specialists in real estate, blockchain technology, legal and regulatory compliance, and marketing/investor relations.

- Consider partnerships: Partner with established platforms or service providers to leverage their expertise and infrastructure.

2. Development & Implementation:

Prioritize Security and Compliance:

- Conduct thorough smart contract audits: Identify and address potential vulnerabilities.

- Implement robust security measures: Utilize secure storage solutions and access controls for tokenized assets.

- Ensure legal and regulatory compliance: Consult with legal counsel to navigate relevant regulations and licensing requirements.

Develop a Robust Tokenomics Model:

- Define token utility: Determine the rights and benefits associated with owning the tokens (e.g., voting rights, dividend distribution).

- Establish token distribution and pricing strategy: Determine how tokens will be distributed (e.g., ITO) and the pricing model.

- Consider long-term sustainability: Design a tokenomics model that incentivizes participation and fosters a healthy ecosystem.

Focus on User Experience and Transparency:

- Develop a user-friendly platform: Ensure a seamless user experience for purchasing, managing, and trading tokens.

- Provide clear and concise information: Communicate project details, legal documents, and risk factors transparently to potential investors.

- Maintain regular communication: Engage with your community through consistent updates and communication channels.

3. Post-Launch:

Build a Strong Community:

- Engage with potential investors: Participate in industry events, host webinars, and leverage social media to build awareness and foster community engagement.

- Maintain transparent communication: Address investor concerns promptly and continue providing updates on project development and performance.

- Foster collaboration: Explore partnerships with other industry players to expand reach and create a more robust ecosystem.

4. Monitor Market Trends and Adapt:

- Continuously monitor the legal, regulatory, and technological landscape.

- Be adaptable: Be prepared to adapt your strategy based on market conditions, investor feedback, and regulatory changes.

- Innovate and iterate: Continuously seek opportunities to improve your platform and offerings to stay ahead of the curve.

Looking Ahead: The Future of Tokenized Real Estate

Despite its nascent stage, real estate tokenization holds immense potential to revolutionize the industry by offering greater access, transparency, and efficiency. As regulations evolve, technology matures, and market adoption increases, we can expect to see:

- Enhanced Security Protocols: Continuous innovation in blockchain technology and security protocols will further mitigate potential risks associated with tokenized real estate investments.

- Novel Financial Instruments: New financial instruments and investment strategies may emerge, catering to diverse investor profiles and risk appetites within the tokenized real estate space.

- Increased Institutional Participation: As the market matures and regulatory clarity is established, we might see greater participation from institutional investors, further bolstering liquidity and market confidence.

Conclusion

Real estate tokenization presents a compelling alternative to traditional methods, offering numerous benefits to investors and stakeholders alike. While challenges exist, continuous innovation, evolving regulations, and increasing market adoption are paving the way for a more inclusive, efficient, and transparent real estate market. As the space matures, we can expect to see greater collaboration between industry players, enhanced security protocols, and the emergence of novel investment opportunities within the tokenized real estate landscape.