Build DePIN Infrastructure That Drives Tomorrow’s Economy

Enable transformative growth through decentralized physical infrastructure networks. Leverage advanced blockchain architecture to create scalable, secure, and energy-efficient solutions that redefine how industries operate and interact.

Get Started

Unleash Multi-Chain Potential with Cutting-Edge Chain Abstraction

Accelerate your blockchain strategy with seamless interoperability across networks. Our chain abstraction solutions simplify complex ecosystems, enabling rapid communication between multiple chains. Optimize performance, ensure scalability, and future-proof your operations with flexible, decentralized applications.

Get Started

Crafting Non Fungible Excellence

Delivering Web3 Strategic Objectives

BLOCKCHAIN

Antier delivers breakthrough blockchain solutions to shape the next generation of enterprises move smarter and faster than ever.

Metaverse

We create the critical mass needed to help organizations mark their breakthrough moments in new virtual environments.

Finance Solutions

Through the lens of our extensive industry expertise, we offer a customized suite of capabilities designed to address your specific use cases.

Artificial intelligence

We activate next-generation autonomous algorithms and generate highly actionable predictions to achieve true north for your business

BLOCKCHAIN

Antier delivers breakthrough blockchain solutions to shape the next generation of enterprises move smarter and faster than ever.

Metaverse

We create the critical mass needed to help organizations mark their breakthrough moments in new virtual environments.

Finance Solutions

Through the lens of our extensive industry expertise, we offer a customized suite of capabilities designed to address your specific use cases.

Driving Ingenuity with Relentless Blockchain Innovation

Ethereum

Polygon

Binance

Solana

Skale

Tron

Avalanche

Polkadot

Cosmos

NEAR

Protocol

Corda

Harmony

Tezos

ZetaChain

Hyperledger

Fabric

Cardano

ICP

Ton

Klaytn

Telos

Ripple

Boba Network

Pirichain

Ethereum

Polygon

Binance

Solana

Skale

Tron

Avalanche

Polkadot

Cosmos

NEAR

Protocol

Corda

Harmony

Tezos

ZetaChain

Hyperledger

Fabric

Cardano

ICP

Ton

Klaytn

Telos

Ripple

Boba

Network

Pirichain

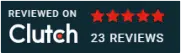

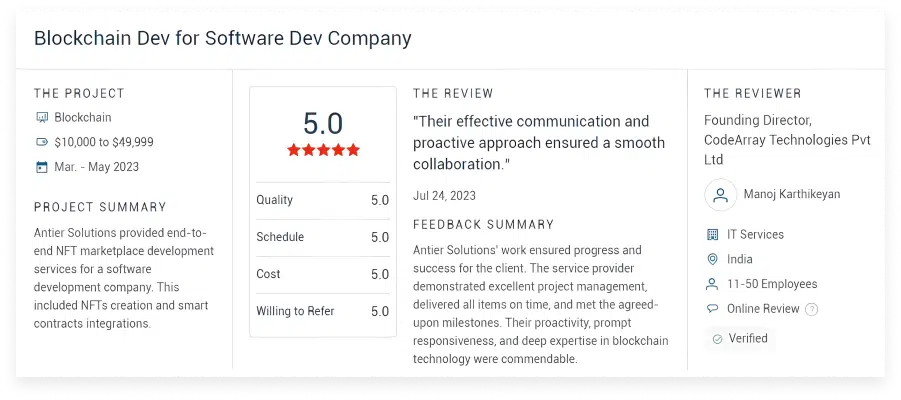

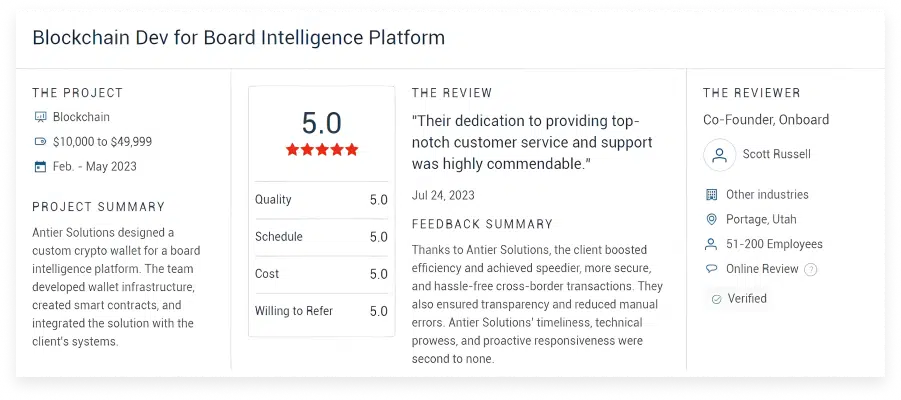

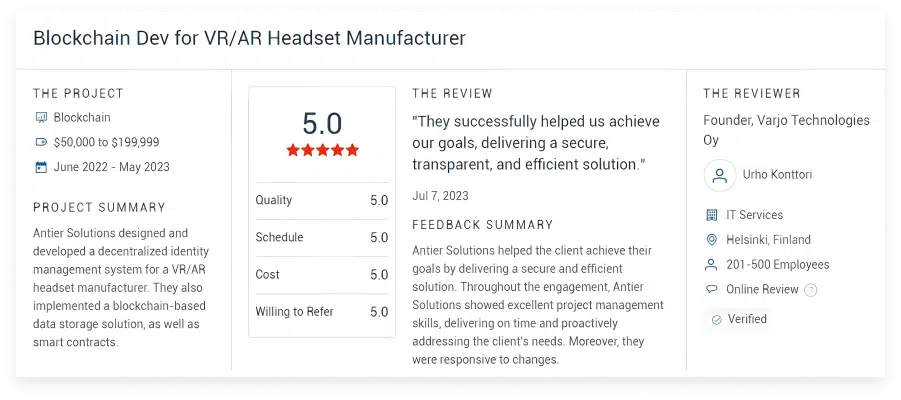

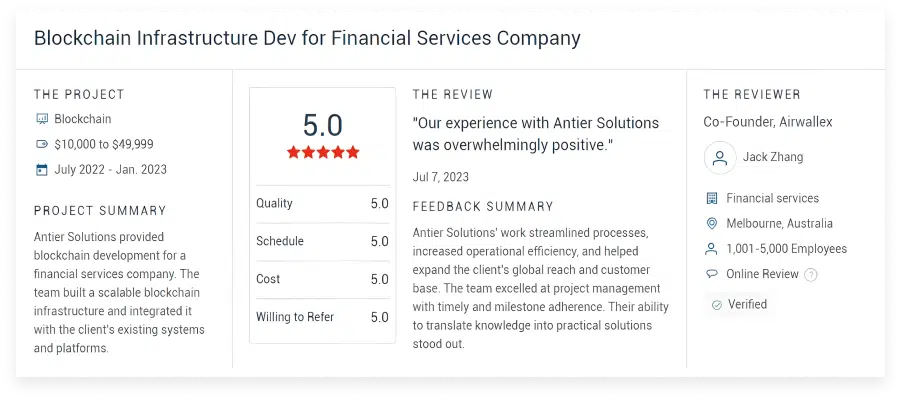

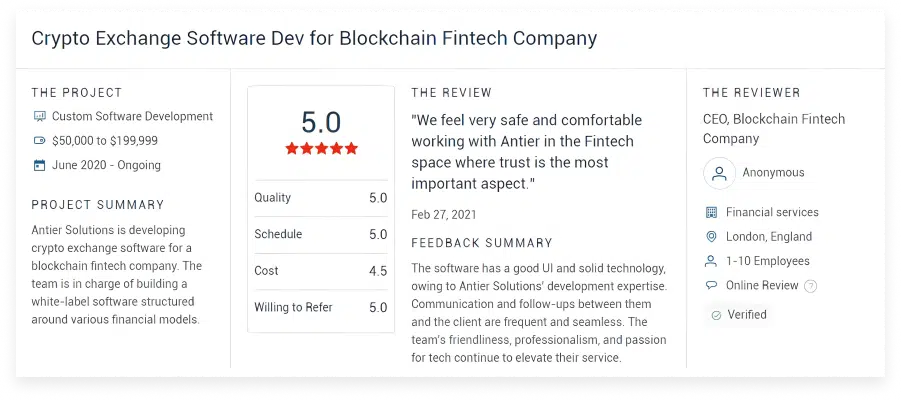

What Clients Say