Since ancient times, people have been drawn to gold as a trustworthy store of value and status symbol. However, a ground-breaking cryptocurrency development is emerging: Gold-backed tokens. These innovative assets bridge the gap between the timeless appeal of gold and the dynamic world of cryptocurrencies. Envision possesses a portion of the gold standard, easily obtainable on your mobile device, along with the supplementary advantages of blockchain technology. Excited? Discover the workings of gold-backed token development solutions, their distinct benefits, and their possible influence on the financial system by reading this article.

This article isn’t just for seasoned investors – it’s for anyone curious about the future of finance. Whether you seek to diversify your portfolio, understand the role of gold-backed tokens, or simply appreciate technological innovation, this exploration will equip you with valuable insights into the gold-backed token development space.

Introducing the Hottest Trend- Gold-Backed Tokens

A recent development in the constantly changing cryptocurrency market is the rise of gold-backed tokens. These cutting-edge digital assets present a special opportunity by fusing the benefits of traditional gold stability with the advantages of digital currencies.

Gold-backed tokens are essentially digital representations of physical gold held in secure reserves by a trusted custodian. Each token corresponds to a specific weight or number of troy ounces of gold, ensuring its value remains directly tied to the underlying gold price. This connection to a tangible asset provides a layer of stability often missing in the volatile world of cryptocurrencies. Investors seeking portfolio diversification or a hedge against market fluctuations are drawn to gold-backed tokens. Unlike owning physical gold, these tokens eliminate the hassle of secure storage and insurance, while still offering the benefits of gold ownership. Additionally, the digital nature of these tokens allows for easier transactions and wider utility compared to physical gold.

It is imperative to bear in mind, though, that the viability of a token development backed by gold depends on how reliable the custodian or issuing company is. Regular audits and transparency regarding gold reserves are essential to ensure the value proposition of these tokens holds true. Ultimately, gold-backed tokens present an exciting new chapter in the crypto market, offering a bridge between the established value of gold and the dynamic world of digital assets. Let us now investigate and comprehend the dynamic distinction between traditional tokens and tokens backed by gold, to fully equip the advantages and future potential.

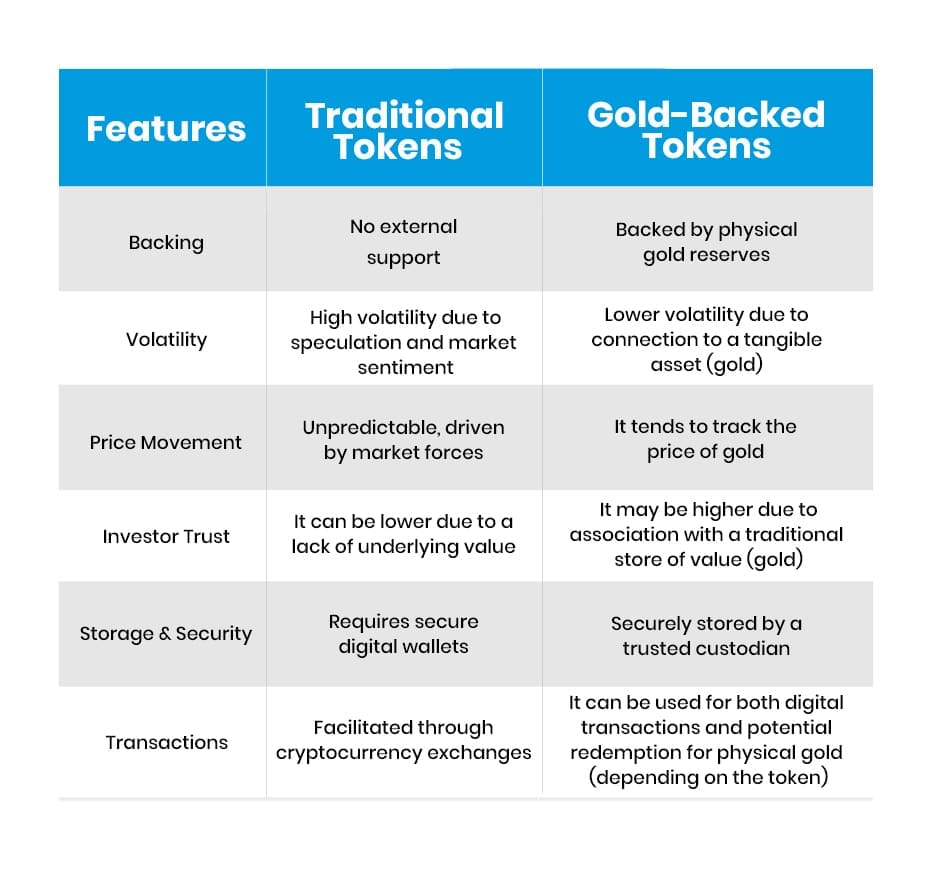

Traditional Tokens Vs. Gold-Backed Tokens

A fundamental question plagues investors: How do we navigate the inherent volatility of traditional tokens?

Traditional tokens rely solely on market sentiment and speculation for their value. This dynamic often leads to wild price swings, making them a riskier investment proposition for those seeking stability. Gold-backed tokens, on the other hand, leverage the established value of physical gold. Each token represents a specific amount of gold held in secure reserves by a trusted custodian. This tangible connection acts as a buffer against extreme price fluctuations, offering investors a sense of security and predictability not found with traditional cryptocurrencies.

Investor Considerations:

Although gold-backed token development solutions present a more reliable option, it is crucial to keep in mind that their viability depends on the legitimacy of both the custodian and the issuing business. Investors must carefully evaluate the reputation and transparency surrounding the gold reserves before investing. Additionally, while gold-backed crypto token generally tracks the price of gold, they may not experience the same dramatic surges if the gold market experiences a boom. Ultimately, the choice between traditional tokens and gold-backed tokens depends on individual risk tolerance and investment goals. Those seeking stability and a hedge against market fluctuations may find gold-backed tokens appealing. However, investors should conduct thorough research and prioritize reputable issuers to ensure the value proposition holds true.

What are the benefits of Gold-backed Token Development?

Gold-backed tokens rapidly become a compelling investment option, offering a unique blend of traditional stability and modern innovation. These crypto token development solutions capture the investor’s desire for security and provide several trending benefits that are boosting confidence in this new asset class:

Businesses and investors are becoming more confident in tokens backed by gold as a result of these combined benefits. In addition to providing investors with a safe and convenient way to trade gold, they can be used by businesses as a trustworthy store of wealth. This new asset class can serve as a bridge between the dynamic world of digital assets and the proven value of gold. Any business or investors seeking to include gold-backed tokens in their investment strategies must shake hands with an experienced token development company to develop the finest solutions on premium blockchain networks.

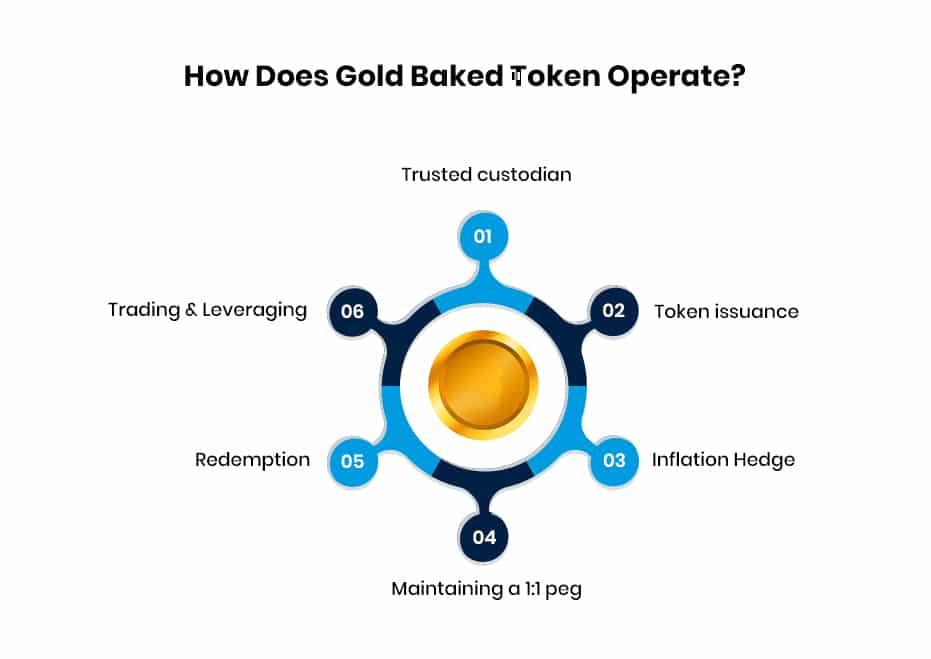

How Does Gold Baked Token Operate?

Gold-backed tokens, a recent innovation in the cryptocurrency landscape, offer a compelling proposition: the stability of physical gold combined with the convenience and efficiency of digital assets. But how do these tokens function precisely? Understanding the mechanics behind them empowers investors to make informed decisions.

Future Potential Of Gold-Backed Token Development

The future of gold-backed token development solutions shimmers with exciting possibilities. Imagine a world where these tokens are seamlessly integrated into DeFi protocols, allowing for collateralized lending backed by the inherent value of gold. This could unlock new borrowing and lending opportunities for both individuals and businesses. Additionally, programmable gold ownership may become possible due to developments in smart contract technology.

Furthermore, the potential for fractional ownership through gold-backed tokens could be further democratized. These tokens may draw in more investors by lowering the entry barrier, which might result in a more active and liquid market. As the technology matures, exploring the use of gold-backed tokens in cross-border payments or even integrating them with the burgeoning world of the metaverse are possibilities that beckon on the horizon. The future of gold-backed tokens is anything but set in stone, and the potential for innovation and disruption is vast.

Build Gold-Backed Tokens With Expert Token Development Company

Gold-backed tokens come to the limelight as a bright spot, providing a safe and reliable way to enter the world of digital assets. these tokens are tethered to the timeless value of physical gold, acting as a buffer against market swings. They are an appealing choice for investors looking for a haven within the cryptocurrency ecosystem because of this concrete connection that builds confidence. Consider using them to open up a new chapter of financial flexibility through collateralized lending in DeFi. Advancements in technology have the potential to enable programmable ownership, which would enable automated sales of gold contingent on pre-established triggers. Fractionalized ownership could further democratize access, fostering a more inclusive and liquid market. The possibilities extend beyond finance – cross-border payments and integration with the metaverse are just a glimpse into the transformative power of these innovative assets.

Responsible investment, however, demands due diligence. Explore and choose the best gold-backed cryptocurrency development company to scrutinize their custodial practices, and ensure transparency through audit reports when designing tokens. The best part about connecting with us is that our proficient and talented blockchain experts leverage their immense expertise in the blockchain and cryptocurrency ecosystem to craft feature-rich and advanced crypto tokens on the leading blockchain platforms. Consult our professionals to discuss your business requirements, today!