The rise of Decentralized Finance, or DeFi, has revolutionized the financial landscape. DeFi offers a vision of finance that is open, accessible, and decentralized. It harnesses blockchain technology to provide a wide range of financial services without the need for traditional intermediaries. At the heart of this transformative ecosystem lies a powerful tool: DeFi aggregators. In this blog, we’ll explore what DeFi aggregators are, why they matter, and how they are shaping the future of finance.

Understanding DeFi Aggregators

DeFi Aggregator development is one the rise because of the huge popularity of DeFi aggregators due to their various benefits. Let’s understand what actually DeFi aggregators are – platforms or protocols that streamline and optimize the DeFi experience for users. They serve as intermediaries in the DeFi space, DEX Aggregator Platforms provide various decentralized financial services and provide users with a unified interface to access these services.

The primary goal of a DeFi aggregator is to simplify the complex DeFi ecosystem and enhance user experience.

Here’s how DeFi aggregator achieve this:

Single Interface

DeFi aggregators offer users a single point of access to multiple DeFi services. Rather than navigating a multitude of decentralized applications (DApps) and protocols, users can interact with various services through a unified interface.

Optimization

DeFi aggregators use algorithms and smart contracts to analyze and optimize DeFi transactions on behalf of users. They seek out the best swap return, DeFi derivatives, the lowest fees, and the most favorable terms, ensuring that users get the most value from their DeFi activities.

Efficiency

DeFi aggregators automate complex operations such as token swapping, crypto swap, yield farming, and liquidity provision. This automation not only saves users time but also minimizes the risk of errors.

Cost Reduction

Gas fees, the transaction costs on the Ethereum blockchain, can be significant. Aggregators aim to reduce these fees by batching transactions and executing them at optimal times, saving users money. Aggregators actually do smart work with price impact. They work on the SOR (smart order route), which provides the multi split and multi hopping of routes on the basis of price impact. It prevents the pools from unbalancing reserves by distributing the assets into the multiple pools. It keeps pools safer than Arbitrage.

Security

DeFi aggregators typically integrate services and protocols that have undergone rigorous security audits. This helps users make informed decisions and reduces the risk of falling victim to malicious smart contracts.

Creating a DeFi aggregator platform requires expertise of an experienced DeFi Aggregator development Company. Check out this blog to understand the development process of DeFi aggregators.

Exploring the Essential Features of DeFi Aggregators

DeFi aggregators, also called as DEX aggregators or swapping platforms are indispensable tools in the world of decentralized finance, simplifying and enhancing the user experience across various DeFi services and protocols. These platforms or protocols offer a range of features designed to streamline DeFi interactions and provide users with the best possible outcomes.

Top DeFi aggregators have the following features:

Multi-Platform Access

One of the primary functions of DeFi aggregators is to provide users with access to multiple DeFi platforms and services from a single interface. This multi-platform access eliminates the need for users to navigate multiple decentralized applications (DApps) and protocols separately.

Token Swap Optimization

DeFi aggregators often include decentralized exchange (DEX) aggregators that optimize token swaps. These features ensure that users get the best possible exchange rates and lowest fees by routing their transactions through various DEXs.

Single Wallet Connection

Users typically connect a single cryptocurrency wallet (e.g., MetaMask) to the aggregator, which streamlines the process of interacting with multiple DeFi protocols and eliminates the need for multiple wallet connections.

Liquidity Provision Assistance

DeFi aggregators may assist users in providing liquidity to decentralized liquidity pools. They can help users find the most profitable pools and provide the necessary guidance for participation.

Gas Fee Reduction

Gas fees on the Ethereum network can be prohibitively high, especially during periods of network congestion. DeFi aggregators aim to reduce these fees by optimizing transaction batching and timing.

Security and Risk Management

Aggregators often integrate services and protocols that have undergone security audits and have a strong track record. This helps users make informed decisions and minimize the risk of interacting with vulnerable or malicious smart contracts.

User-Friendly Interfaces

DeFi aggregators prioritize user-friendliness by providing intuitive and easy-to-navigate interfaces. They aim to make complex DeFi operations accessible to users with varying levels of technical expertise.

Portfolio Management

Some aggregators offer comprehensive portfolio management tools. Users can track and manage their DeFi assets, investments, and liabilities across various protocols from a single dashboard.

Privacy Considerations

Certain DeFi aggregators prioritize user privacy by minimizing the collection of personal information. This approach aligns with the principles of financial privacy that are core to DeFi.

Education and Information

DeFi aggregators may provide educational resources and information about DeFi protocols and strategies. This helps users stay informed and make well-informed decisions.

Cross-Chain Compatibility

While many DeFi protocols operate on Ethereum, cross-chain compatibility is becoming increasingly important. Some aggregators extend their services to other blockchains, allowing users to access DeFi opportunities on multiple networks.

Integration with Hardware Wallets

Security-conscious users often prefer hardware wallets for storing their assets. Some DeFi aggregators integrate with hardware wallets to provide a secure and seamless user experience.

Community and Support

Aggregators often have active communities and support channels to assist users with their questions, concerns, and technical issues.

Real-Time Data

Aggregators provide real-time data on token prices, interest rates, and other relevant information, helping users make timely decisions.

Token Support

Aggregators typically support a wide range of tokens and assets, ensuring that users can access the DeFi services they need.

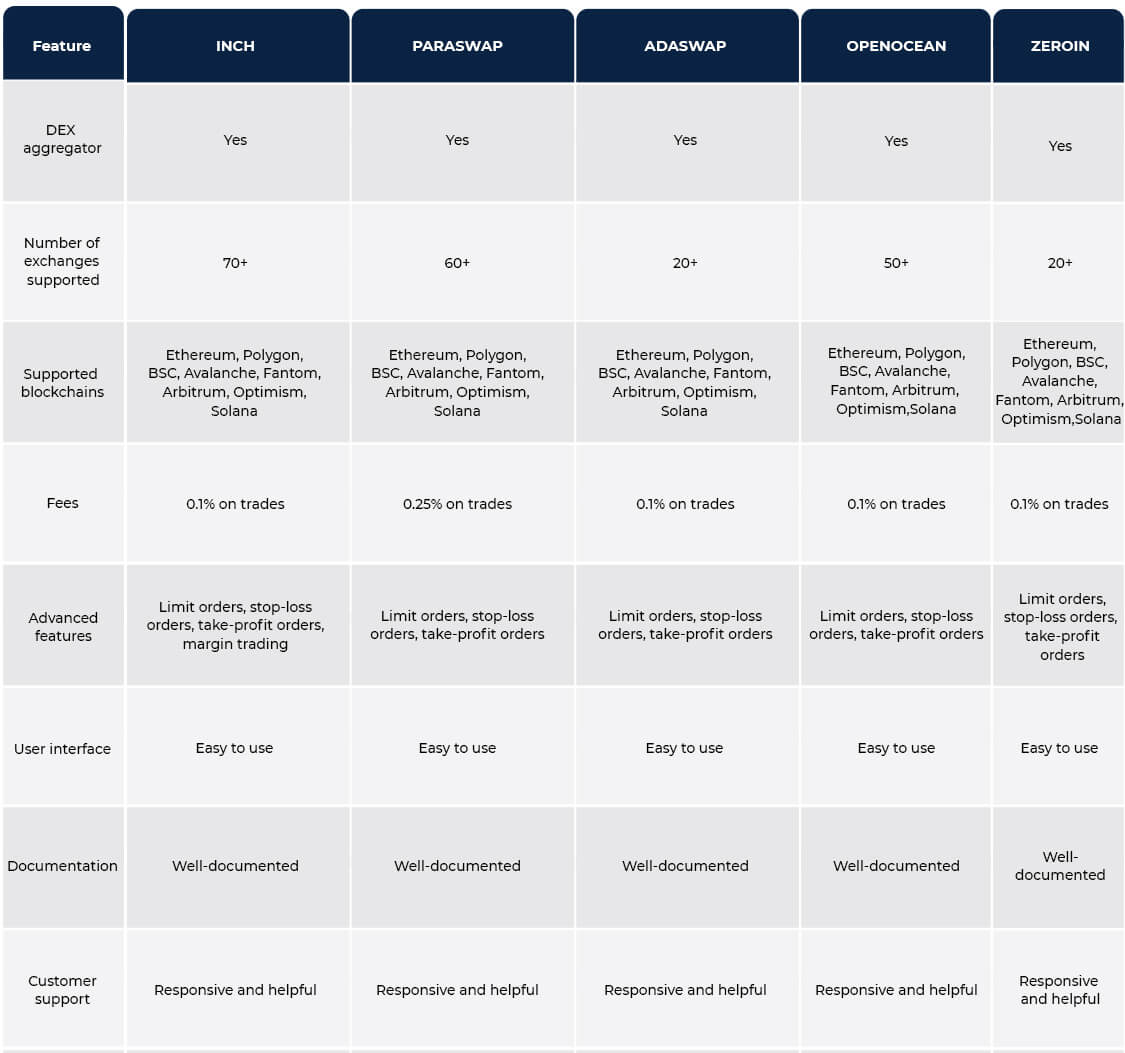

Popular DeFi Aggregators

Several DeFi aggregators have gained popularity within the ecosystem. Here is a DeFi aggregator list with top DeFi aggregators:

1inch

Known for its efficient routing and aggregation of decentralized exchanges, 1inch offers users the best possible token swap rates. It offers a number of features that make it a popular choice for DEX traders, including:

- Multi-DEX Integration: 1inch aggregates liquidity from various decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and more. This ensures users get the best rates for their trades.

- Optimal Trade Routing: The platform automatically routes users’ trades to DEXs offering the most competitive rates and minimal slippage, maximizing the value of their assets.

- Token Swap: Users can easily swap one cryptocurrency for another on 1inch, taking advantage of aggregated liquidity for a wide range of tokens.

- Limit orders: 1inch allows users to place limit orders, which are orders to buy or sell an asset at a specific price or better. This gives users more control over their trades and can help them to avoid slippage.

- Gas optimization: 1inch uses a number of gas optimization techniques to reduce the cost of trading on its platform. This includes features such as batching transactions and using Chi Gas Tokens.

ParaSwap

- Multi-DEX Aggregation: ParaSwap aggregates liquidity from various DEXs like Uniswap, SushiSwap, Balancer, and others, ensuring users access the best prices and liquidity pools.

- Best Price Execution: The platform automatically routes trades to DEXs with the most favorable rates and terms, helping users achieve optimal execution.

- User-Friendly Interface: ParaSwap provides an intuitive interface that simplifies complex DeFi interactions, making it accessible to users of all experience levels.

- Multi-Chain Support: ParaSwap is compatible with multiple blockchains, allowing users to access DeFi opportunities on different networks.

Adaswap

- Cardano Ecosystem Integration: Adaswap is designed specifically for the Cardano blockchain, providing users with access to decentralized exchanges and DeFi services within the Cardano ecosystem.

- Token Swapping: Users can swap ADA and other tokens directly on Adaswap, taking advantage of liquidity pools and competitive rates.

- Liquidity Provision: Adaswap allows users to provide liquidity to pools and earn rewards in ADA or other tokens.

OpenOcean

- Cross-Chain Aggregation: OpenOcean aggregates liquidity from various blockchains, enabling users to trade and transfer assets seamlessly across different networks.

- Integrated Wallets: Users can connect multiple wallets, including MetaMask and Trust Wallet, to access DeFi opportunities.

- Smart Order Routing: OpenOcean employs smart order routing to find the best prices and execute trades efficiently.

ZeroIn

- Gas Fee Optimization: ZeroIn provides information about gas fees on various networks, helping users make cost-effective transaction decisions.

- Portfolio Tracking: Users can monitor their DeFi portfolio and keep track of token holdings and liquidity pool participation.

- Security: ZeroIn is a non-custodial DEX, which means that users never have to give up custody of their funds.

Zapper

- Portfolio Management: Zapper offers portfolio tracking, allowing users to manage their DeFi investments in a single dashboard.

- Token Swapping: Users can swap tokens directly on Zapper, taking advantage of liquidity aggregations.

Matcha

- Ethereum-based DEX: Matcha is an Ethereum-based DEX that offers competitive rates and easy-to-use trading features.

- Liquidity Aggregation: Matcha aggregates liquidity from various sources, providing users with optimal trading opportunities.

The Future of DeFi Aggregators

As DeFi continues to grow, aggregators will evolve to meet the needs of a broader user base. We can expect more innovation, improved security measures from DeFi aggregator platform development services providers. DeFi aggregators will play a pivotal role in making DeFi a mainstream financial ecosystem.

In conclusion, DeFi aggregators are catalysts for the widespread adoption of decentralized finance. They simplify access, enhance efficiency, and reduce costs for users, making DeFi more accessible to individuals worldwide. As the DeFi ecosystem continues to mature, aggregators will remain essential tools in the ever-expanding toolkit of decentralized finance, empowering users to navigate this exciting financial landscape with ease and confidence.

Are you looking for the best DeFi aggregator platform development Company, Antier has extensive experience and expertise in building DEX Aggregator Platforms. We can build DEX aggregators with in-house SOR algorithms or with 3rd party API (1inch, open ocean etc). Get in touch for a free consultation!