The world of decentralized finance (DeFi) has been rapidly evolving, offering innovative financial solutions that are reshaping traditional systems. One such advancement is the tokenization of real-world assets (RWAs), which brings the benefits of blockchain technology and DeFi to tangible assets. In this blog, we will explore how tokenized RWAs are revolutionizing the financial landscape, enabling global access, increased liquidity, and unlocking new investment opportunities.

Decentralized Finance (DeFi)

The growth of decentralized finance has been extraordinary, and this growth is being driven by a number of factors, including:

- The rise of decentralized exchanges (DEXs), which allow users to trade cryptocurrencies without the need for a centralized exchange.

- The increasing popularity of yield farming, which allows users to earn interest on their cryptocurrency holdings by providing liquidity to DeFi protocols.

- The growing demand for decentralized lending and borrowing platforms, which allow users to borrow and lend cryptocurrencies without the need for a bank.

Noteworthy Examples of DeFi

Several examples demonstrate the recreation of traditional financial primitives in an on-chain format, utilizing the properties of DeFi. Consider the following illustrations:

Decentralized Exchanges (DEXs)

DEXs are platforms that facilitate the trading of digital assets directly between users without the need for intermediaries. They leverage smart contracts to enable peer-to-peer trading, providing users with control over their funds and eliminating the reliance on centralized exchanges. DEXs benefit from transparency, programmability, and security features of blockchain, offering efficient and accessible trading options.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging their price to an underlying asset, such as a fiat currency or a commodity. They provide stability within the volatile crypto market and act as a medium of exchange and store of value. Stablecoins on DeFi platforms enable seamless and low-cost transactions, as well as access to global markets without the need for traditional banking systems.

Decentralized Lending and Borrowing

DeFi protocols offer lending and borrowing services without intermediaries. Users can lend their crypto assets and earn interest or borrow assets by collateralizing their existing holdings. These protocols utilize smart contracts to automate lending processes, determine interest rates, and manage loan repayments. Decentralized lending and borrowing platforms provide users with global access, transparency, and the ability to earn passive income or access liquidity.

Automated Market Makers (AMMs)

AMMs are decentralized liquidity pools that use mathematical algorithms to determine asset prices and facilitate trading. These pools enable users to provide liquidity and earn fees in return. AMMs utilize smart contracts to automatically adjust asset prices based on supply and demand, providing continuous liquidity and reducing reliance on order books. AMMs are a key component of DEXs and contribute to the efficiency and accessibility of decentralized trading.

Yield Farming and Staking

Yield farming involves earning rewards by providing liquidity or staking assets on DeFi platforms. Users can contribute their assets to liquidity pools or lock them in smart contracts and earn additional tokens as rewards. Yield farming and staking incentivize participation in DeFi protocols, foster liquidity, and provide opportunities for users to earn passive income based on their asset holdings.

Decentralized Insurance

DeFi platforms offer decentralized insurance protocols that allow users to protect their digital assets against risks, such as smart contract failures or hacks. These protocols utilize pooled funds and automated processes to provide coverage and distribute claims. Decentralized insurance improves the accessibility and efficiency of insurance services, as well as provides transparency in claims management.

Decentralized Asset Management

DeFi platforms enable decentralized asset management through protocols that offer automated portfolio management and investment strategies. These protocols allow users to invest their assets in diversified portfolios or follow predefined investment strategies, all executed through smart contracts. Decentralized asset management offers users control over their investments, reduced fees, and increased transparency.

These examples illustrate how DeFi applications have recreated traditional financial primitives on-chain, leveraging the properties of decentralization, transparency, programmability, and accessibility. By doing so, they provide users with innovative and efficient financial solutions, revolutionizing the way people transact, invest, and manage their assets.

Understanding Asset Tokenization

Asset tokenization refers to the process of representing real-world assets (RWAs) as digital tokens on a blockchain network. By converting tangible assets such as real estate, artworks, commodities, or even intellectual property into tokens, asset owners can unlock their value and offer fractional ownership to a wider range of investors. RWA tokenization breaks down assets into smaller units, allowing for increased liquidity and enabling fractional ownership that was previously inaccessible to many. These tokens are typically issued on a blockchain platform, ensuring transparency, immutability, and secure record-keeping.

Connection Between DeFi and Asset Tokenization

The connection between DeFi (Decentralized Finance) and tokenization of real-world assets lie in the utilization of blockchain technology to transform traditional assets into digital tokens. DeFi provides the infrastructure and tools necessary for the creation, issuance, and management of tokenized assets.

DeFi complements asset tokenization by offering a range of decentralized financial services and protocols built on blockchain networks. These services include decentralized exchanges (DEXs), lending and borrowing platforms, liquidity pools, and yield farming mechanisms. DeFi protocols enable the seamless trading, lending, and utilization of tokenized assets within a decentralized ecosystem.

By integrating DeFi with real world asset tokenization, individuals and businesses can unlock the potential of their assets. Tokenization brings liquidity and divisibility to traditionally illiquid and indivisible assets, while DeFi provides the financial infrastructure to facilitate efficient and secure transactions, lending, and yield generation on these tokenized assets.

Advantages of Tokenized RWAs

Tokenized RWAs offer several significant advantages that contribute to the scaling of DeFi on a global level:

Increased Liquidity

Tokenizing real world assets provides liquidity to traditionally illiquid assets. By allowing fractional ownership, investors can buy and sell smaller portions of high-value assets, reducing barriers to entry and enabling a broader investor base.

24/7 Market Access

Unlike traditional financial markets with limited operating hours, tokenized RWAs are traded on decentralized platforms, ensuring round-the-clock market access. This global availability enhances market efficiency and facilitates instant transactions across time zones.

Reduced Transaction Costs

Tokenization real world assets eliminates the need for intermediaries, such as brokers or custodians, reducing transaction costs associated with asset transfers. Additionally, blockchain-based transactions eliminate the need for manual paperwork and streamline the entire process.

Enhanced Transparency

Blockchain technology ensures transparent and auditable ownership records. Token holders can verify their ownership and track the history of asset transfers, bringing transparency to asset transactions and reducing the risk of fraud.

Accessible Investment Opportunities

RWA tokenization provides investors with access to a wider range of investment opportunities. Previously illiquid assets, such as real estate or high-value artworks, can now be accessed with lower investment amounts, enabling diversification and democratizing investments.

Real World Opportunities of RWAs

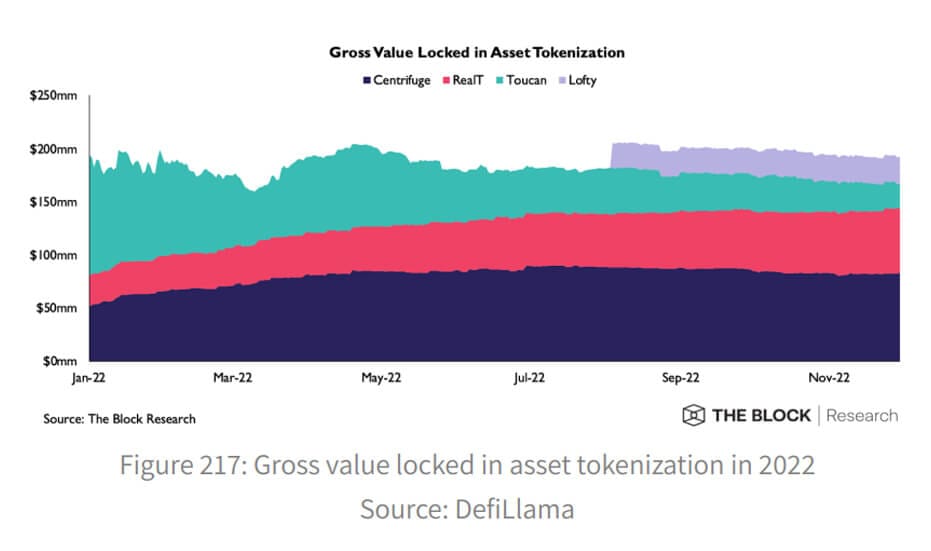

The emerging realm of Real World Asset tokenization is witnessing significant growth, with a total gross value locked, encompassing borrowed amounts, reaching an impressive $193 million. At the forefront of this market stands Antier, a pioneer in bringing cutting-edge technologies in tokenizing real world assets.

Institutional interest in the tokenization of real-world assets (RWAs) has been growing, with pilot tests conducted by both traditional institutions and crypto-native projects. For instance, the Singapore Central Bank’s Project Guardian explored the use of DeFi for wholesale funding markets, with DBS Bank, JP Morgan, and SBI Digital Asset Holdings conducting transactions using tokenized government securities bonds and currencies. This pilot utilized permissioned versions of DeFi protocols on the public Polygon blockchain, demonstrating the feasibility of asset tokenization and DeFi while managing risks. The objective was to test the potential of open, interoperable networks to address challenges such as fragmented liquidity and compliance controls. These developments indicate a strong market opportunity and institutional interest in the tokenization of RWAs.

Siemens exemplifies institutional interest in asset tokenization through its recent issuance of a €60 million digital bond on the public Polygon mainnet. This bond, complying with Germany’s Electronic Securities Act (eWpG), attracted notable purchasers such as DekaBank, DZ Bank, and Union Investment. By opting for a public blockchain issuance, Siemens eliminated the reliance on paper-based global certificates and centralized clearing processes. This approach enabled the direct sale of the bond to investors, bypassing the need for intermediary banks. The utilization of blockchain technology in this context highlights Siemens’ commitment to exploring innovative avenues for capital market transactions and embracing the potential benefits offered by asset tokenization.

In an exciting development, Swift has joined forces with Chainlink and several prominent financial institutions and FMIs to explore the utilization of existing Swift infrastructure for seamless tokenized value transfers across various public and private blockchain networks. Participants in this collaboration include ANZ, BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SDX, and DTCC. The Chainlink Community Interest Project (CCIP) will play a crucial role in establishing connectivity and interoperability between these blockchain networks. This collaboration signifies the industry’s recognition of the potential benefits of integrating blockchain technology into traditional financial systems, aiming to enhance efficiency, security, and accessibility. By leveraging Swift’s established infrastructure and partnering with Chainlink’s expertise in blockchain connectivity, these institutions are collectively exploring innovative solutions to facilitate the seamless transfer of tokenized assets across various blockchain networks.

Final Words

Real world asset tokenization presents significant opportunities for both established financial institutions and the emerging DeFi ecosystem. While the initial focus of DeFi has been on speculative use cases, the time has come for the ecosystem to transition towards offering tangible value to society. While there are obstacles to overcome, the potential market for tokenized real-world assets is enormous, amounting to trillions of dollars.