Decentralized Finance (DeFi) has been the driving force in the blockchain ecosystem while becoming a hideout for the traditional finance system. DeFi development services have revamped the conventional system in numerous forms such as uplifting the old financial procedures, improving security parameters, decision-making, and giving rise to new financial concepts like synthetic assets.

As per a recent report by Statista, Decentralized Finance users grew by 300,000 since early 2022, less than half the increase during the same period in 2021.

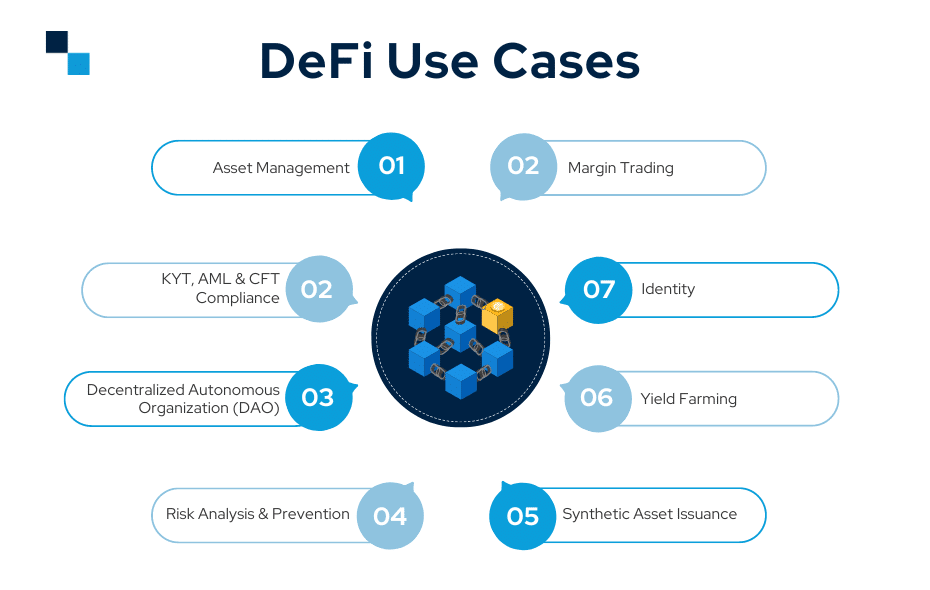

Top 8 Use Cases of DeFi

With DeFi gaining global traction across the globe, there are countless use cases that every DeFi enthusiast and emerging market leader must be aware of. In this blog, we’ll dive deeper into the most popular DeFi use cases that have taken the world by storm.

Without any further ado, let’s get you started!

-

- Asset Management

One of the notable use cases of DeFi is that individuals get the authority to experience more control over their assets than ever before. Since the users now have the power of managing their virtual assets, they can even earn from those assets. Unlike the traditional system where the users had to share their account credentials with third parties, DeFi development safeguards the confidential data of customers with no need of sharing it with any third party as the concept of DeFi simply removes the involvement of intermediaries. - KYT, AML & CFT Compliance

Traditional financial institutions are majorly based on Know Your Customer (KYC) standards which further help in implementing AML and CFT measures. However, KYC rules impede the confidentiality initiatives of DeFi. This is where Know Your Transaction (KYT) combats the challenge and focuses on payment patterns rather than identifying users. The prime issues solved by KYT include safeguarding customers’ anonymity and analyzing actual transaction activity. Therefore, this is one of the notable decentralized finance use cases that grabs the attention of emerging crypto enthusiasts. - Decentralized Autonomous Organization (DAO)

Similar to controlled banking institutions that tackle core financial operations like establishing governance, generating funds, and maintaining resources, blockchain-powered ecosystems ensure decentralized systems carry out the same but in a completely decentralized manner. DAOs are completely independent and don’t have the control and involvement of any central agency. DAOs act as the pillar of DeFi development services. - Risk Analysis & Prevention

Due to decentralization and transparency, individuals can now identify and analyze silos of data which further helps in making better and more accurate decisions, discovering innovative economic opportunities, and practicing improved threat management strategies. Stepping forward, there are numerous analytics and risk management tools such as CoDeFi and DeFi Pulse which hold a lot of potential in this area. This is one of the prominent DeFi use cases.

- Asset Management

- Synthetic Asset Issuance

Synthetic asset issuance is one of the complicated applications of DeFi which involves a process to build a digital asset token representing the properties of anything- from commodities, digital assets, metals, and derivatives, to stocks. Synthetic assets can be purchased, sold, or even traded while enabling the users in gaining knowledge of other assets. - Yield Farming

The term yield farming has gained wide popularity in the DeFi blockchain development space. Under yield farming, users lock up digital assets and get rewards in return which are automatically provided by smart contracts. The majority of the time, yield farming projects need the user to stake liquidity provider (LP) tokens received after providing liquidity at some particular decentralized exchanges. - Identity

Another area where DeFi development companies are reaping the benefits from DeFi is identity. DeFi protocols backed with blockchain-powered identity systems hold the ability to assist locked-out users in gaining access to a completely global economic system further minimizing the collateralization needs for individuals who lack sufficient funds. Besides this, DeFi also helps in improving users’ creditworthiness through parameters like reputation and financial activity rather than traditional data points like overall income, home ownership, etc. - Margin Trading

In the case of traditional finances, margin traders utilize their trades while they borrow funds from a broker further creating collateral for a loan. However, when it comes to DeFi blockchain development, it is backed by non-custodial and decentralized lending protocols, and the power of smart contracts has automated traditional brokerage activities and become one of the potential DeFi use cases.

The Takeaway

Decentralized finance technology is a broader term that is not confined to the above use cases, but has countless areas where its potential can be implemented. DeFi development has become mainstream lately while grabbing the attention of global tech giants and market leaders. Making an entry into the DeFi landscape at this moment can be a wise decision for emerging DeFi enthusiasts as this space is thriving at a great pace.

Prior to getting started, it is important to look for an experienced yet professional DeFi development company that can guide you from scratch and help you gain a competitive edge in the market. Antier is one of the award-winning DeFi development companies that has delivered multiple DeFi blockchain projects across the globe backed by a certified yet skilled team of over 500 professionals. Connect with a subject matter expert now to get started.