2025 is approaching and it is undeniable that the cryptosphere has evolved significantly over the past few years. While volatility— the boiling blood keeping the crypto markets alive with brisk price movements, keeps the game going, the relentless innovation behind the scenes causes trading infrastructures to evolve. Consequently, it has changed how individuals engage in digital asset trading. Spot markets or CEXs, are no longer the solitary titans as traders demonstrate an increasing inclination towards sophisticated strategies.

Amidst the soaring madness around complex trading strategies, perpetual futures DEXs are making significant strides. Their rampant popularity and value have been attributed to the efficiency drawn by layer 2s and vertical scaling solutions. These transformative innovations strengthen and scale the core infrastructure, introducing unprecedented speed and cost-efficiency to the transactional experience. Before such solutions arrived, only CEXs dominated the landscape of the perpetual future as DeFi lagged due to slow execution speeds and high costs.

Polygon (formerly Matic), a scalable, secure, and robust layer-2 solution for Ethereum, offers a promising environment for perpetual futures DEX development. While introducing cost-efficiency and speed, the innovative platform maintains the security and interoperability of the Ethereum platform. In this guide, we will explore:

Essential Components of a Perpetual Futures DEX

1. Trading Interface

The trading interface is one of the vital elements of a perpetual futures DEX development. Curate an interactive UI with delineative charts to enable traders to observe price action, analysis tools to spot opportunities, easily accessible leverage sliders to adjust profit/risk preferences, and other tools and buttons.

2. Governance Token

Perpetual futures DEX protocols generally issue governance tokens, empowering users to own a stake in the platform and a share in its revenue. Protocols may issue escrow tokens, liquidity tokens or governance tokens, each serving their purpose. By acting as a liquidity efficiency tool, they present a lucrative growth opportunity for early-stage businesses.

3. Community-Funded Liquidity Pool

Liquidity tokens are another core component of decentralized perpetual exchanges. These tokens enable retail investors to make money by indulging in market making prominently through two popular models. The former involves investors minting liquidity tokens by simply offering any assets within the index that they can redeem anytime. However, the latter involves traders locking their stablecoin for a fixed period. The community-driven liquidity pool acts as a counterparty for all trades and liquidity providers are often rewarded with a share of the perpetual futures DEX platform’s profits.

4. Leverage

Leverage is in general a wealth enhancement tool and its scope definitely outpours the cryptocurrency cup. The term is deeply ingrained in conventional finance, as there are many instances where borrowed capital enhances purchase power. Given their proven potential in mature markets and popularity in crypto markets, this has become a cornerstone of sophisticated crypto trading strategies.

If you are considering investing in perpetual futures DEX development, the above-mentioned are pivotal elements for your customers. So, they must be strategically planned and developed.

Why Choose Polygon for Your Decentralized Perpetual Exchange Development?

Perpetual futures are among the most popular derivatives contracts traded in the cryptocurrency markets. According to Dunes Analytics, the total trading volumes across various perpetual DEXs surpassed the $210 billion trading volume and user base of nearly 2 million unique traders in May 2023.

The Polygon network (formerly Matic) is an innovative platform combining the best of Ethereum and sovereign blockchains into a full-fledged multi-chain system. Let’s now discuss how it stands out as a blockchain for decentralized perpetual exchange development:

1. Scalability: Polygon can seamlessly handle thousands of transactions per second, making it an ideal network for high-frequency perpetual futures DEX development.

2. Low Gas Fees: Unlike Ethereum, where gas fees can be prohibitive, Polygon’s network allows for much lower transaction costs, attracting retail and institutional traders alike.

3. Interoperability: Polygon’s compatibility with Ethereum Virtual Machine allows seamless integration with existing DeFi protocols, liquidity pools, and dApps.

4. Growing Ecosystem: With an expanding DeFi landscape, Polygon presents new opportunities for partnerships, liquidity providers, and developers, creating fertile ground for launching a Perpetual Futures DEX. Moreover, its vibrant developer community gives access to tools, libraries, and support.

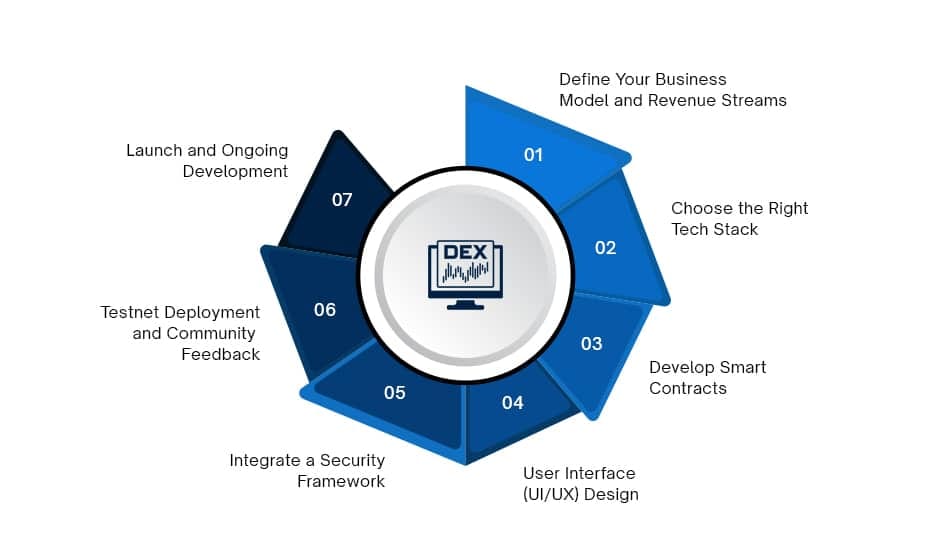

Steps to Building a Perpetual Futures DEX on Polygon

1. Define Your Business Model and Revenue Streams

Before jumping into perpetual futures DEX development, it’s critical to outline how your platform will generate revenue. Popular models include

- Trading Fees: Charge a small percentage of each trade.

- Staking: Introduce a staking mechanism where users can lock tokens and earn rewards. This module strengthens the core of your perpetual futures DEX by enhancing liquidity.

- Premium Features: Offer advanced trading tools, analytics, or access to higher leverage as premium, paid features.

- Liquidity Mining Programs: Incentivize users to add liquidity to your platform by rewarding them with your native token.

- Liquidation Penalties: With leverage comes risk and therefore it becomes a robust revenue model for perpetual futures DEX on Polygon.

2. Choose the Right Tech Stack

The core of any DEX is its technology stack. For building a perpetual futures DEX on Polygon, you’ll need to work with technologies like:

- Solidity: For writing smart contracts on Ethereum-compatible blockchains.

- Chainlink oracles: For accurate price feeds to prevent manipulations and ensure that the funding rate mechanism functions smoothly.

- Layer 2 scaling: Utilize Polygon’s full potential to scale your DEX, ensuring fast transactions and low fees.

3. Smart Contract Development

Smart contracts will govern the decentralized perpetual exchange system. You’ll need to design smart contracts that handle the following:

- Trade execution

- Leverage management

- Liquidation

- Funding rate calculations

Ensure these smart contracts are secure, as any vulnerabilities can lead to loss of funds or platform exploitation.

4. UI/UX Design

Coordinate with your DEX development company to meticulously create a user-friendly interface that appeals to both seasoned traders and newcomers. The following are considerations for an enhanced user experience:

- Intuitive Dashboard: A clear and visually appealing dashboard that provides an overview of user positions, portfolio value, and market trends.

- Clear and Concise Information: Perpetual futures DEXs can be intimidating. Present information clearly and concisely, avoiding jargon or technical terms that may confuse users.

- Responsive Design: Ensure the platform is responsive and works well on different devices (desktop, tablet, mobile).

The goal is to make perpetual futures trading simple and intuitive without compromising on powerful trading tools like charting, position management, and real-time market data.

5. Focus on security and liquidity:

Security is paramount in any DeFi project. Ensure your smart contracts are thoroughly audited by a reputable third party. Moreover, to ensure hackproof perpetual futures DEX development, you can implement cutting-edge security measures such as

- Multi-factor authentication

- Data encryption

- Oracle security

- DDoS protection

- Bug bounty programs

- Cold storage and other measures to safeguard user data and funds.

For liquidity, you can establish liquidity incentivization programs or partner with renowned market makers.

6. Testnet Deployment and Community Feedback

Before going live with your perpetual futures DEX, deploy your DEX on a testnet.

- Allow users to experiment with your platform

- Gather feedback for quick improvements

- Address any bugs or security issues

Engaging with the community early on will help build trust and improve the user experience.

7. Launch and Ongoing Development

Once testing is complete, deploy your decentralized perpetual exchange on the Polygon mainnet. Post-launch, stay committed to improving the platform by adding new features, enhancing security, and integrating additional assets or cross-chain functionalities.

Leading Perpetual Futures DEXs in 2025

- GMX

- Gains Network

- Vela

- Metavault Trade

- Hydra

- MUX

- Kwenta

Final Words

Building a Perpetual Futures DEX on Polygon is a forward-thinking venture that taps into the evolving DeFi landscape. By leveraging Polygon’s scalability and combining it with smart contract innovations, you can offer traders a seamless, low-cost, and efficient way to engage in perpetual futures trading.

Though defeating CEXs is an uphill battle for the decentralized perpetual exchanges, innovative DEXs like Hyperliquid are playing it right. With higher leverage, multiple asset support, optimized liquidity incentive mechanisms, faster trades, chain abstraction, and powerful Oracle integration, perpetual futures DEX on Polygon can position themselves for success in a CEX-dominant landscape.

Want to blaze the trail and get ahead of the curve with a standout innovation in the perpetual futures DEX space? Shake hands with Antier, a leading DEX development company with more than 8 years of experience in the domain and a track record of hundreds of successful implementations.

Share your requirements today!