Smart Contracts for Cross-Chain Bridges: Enabling Efficient Blockchain Interactions

September 12, 2024

Perks of building a cross-chain compatible P2P Lending Software

September 13, 2024Table of Contents

Introduction

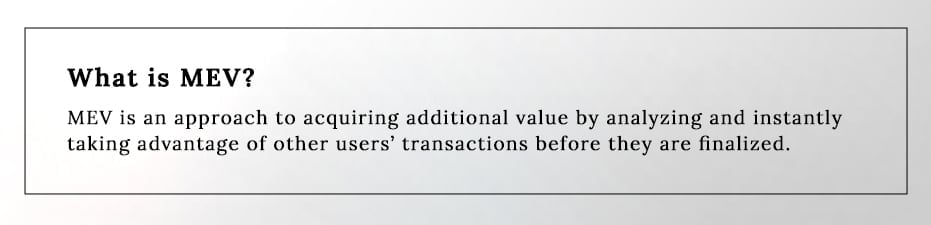

As MEV (Maximum Extractable Value) cements as a committed component of public blockchains, CEXs and DEXs struggle to mitigate its adverse effects on transactional efficiency. MEV has always been around decentralized networks and is not inherently malicious but its unethical exploitation has created a stir over the past few years.

To combat MEV, cryptocurrency exchange software solution providers implement various strategies and protocols to protect end users and maintain the reliability and integrity of platforms. In this blog, we will discuss the concerns surrounding MEV, strategies that exchanges can consider to mitigate its impact, and highlight the top 5 MEV-protected Crypto Exchange Development Company considerations.

Also Read: MEV Bots: A Comprehensive Analysis

MEV: How Is It A Grave Concern For DEXs and CEXs?

Source: Cow.Fi

MEV accounted for the loss of $1.3 billion of Ethereum users till January 2023.

For traders, MEV is just like a hidden, additional tax or fee. Any time a DeFi trade takes place or an NFT is bought or sold, “searchers” (opportunistic traders who manipulate trades) identify and exploit emerging opportunities, resulting in unfavorable prices or failed trades. Such events deter user experience with crypto exchange software. Henceforth, they must be addressed during future-ready trading platform development.

MEV, or maximal extractable value, generally refers to the additional value miners or network participants can strategically extract from a transaction beyond the block rewards and base fee. Since miners are able to arrange the sequence and include or censor transactions in the block they build, they can maximize their profits by executing the following:

-

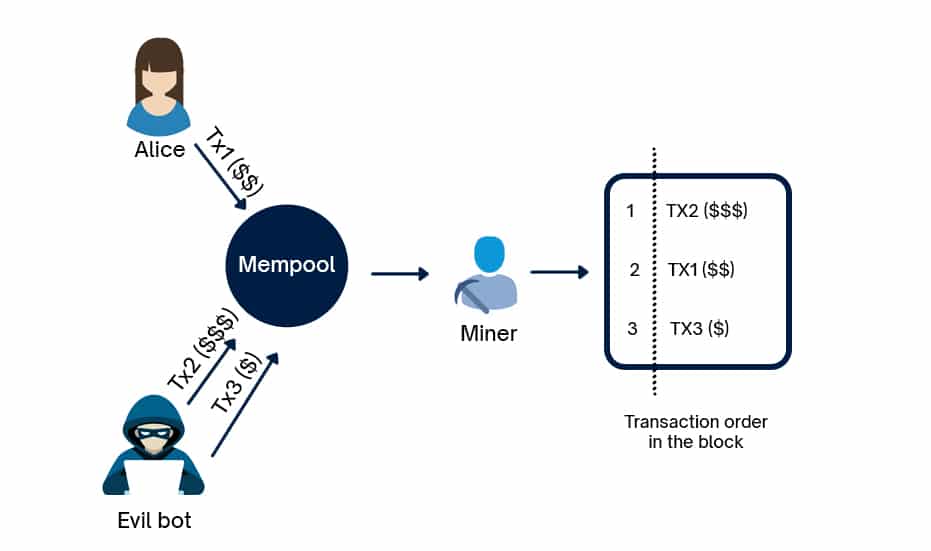

Front-Running Attacks:

One of the most common forms of MEV is front-running. Miners or MEV bots observe pending transactions, anticipate their effect, and place their transactions ahead of them to profit from the price changes caused by the original transactions.

-

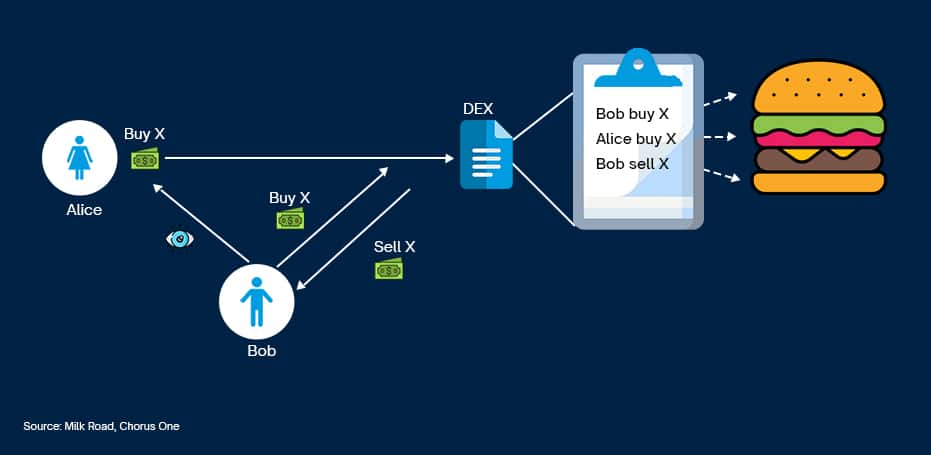

Sandwich Attacks:

In this form of attack, an adversary places one transaction before and one after a victim’s transaction, manipulating the price and exploiting the profit potential at the victim’s expense.

Source: Milkroad

-

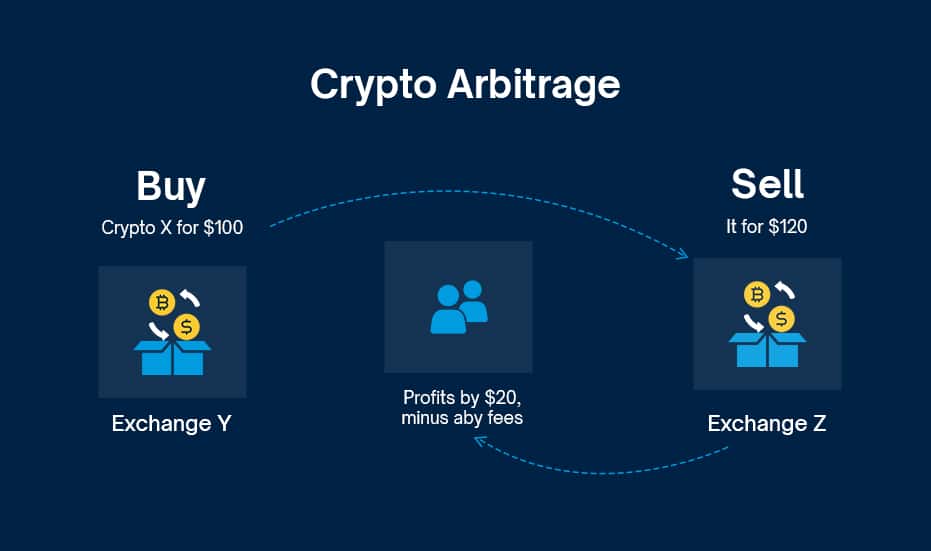

Arbitrage Exploitation:

Miners can identify and exploit price differences of the same assets across different exchanges or different assets over the same exchange.

These actions not only lead to unfair trading practices but also erode the reliability and efficiency of both decentralized and centralized crypto exchange software. They can either be miners executing such practices or traders leveraging specialized bots programmed and trained to execute such malicious trades but the result is similar. Traders face increased slippage, higher transaction costs, and ultimately, a less predictable and secure trading environment. Traders leveraging MEV bots to maximize their benefits usually manipulate the miners into sequencing transactions as per the trader’s plan by offering more gas fees than the target transaction.

Additionally, it is important to note that DEXs are more prone to MEV attacks, while centralized crypto exchange software solutions face the least adversities due to MEV. The reason? On-chain transparency and the fact that in AMMs, market makers’ strategies can be easily observed and predicted. Once the adversaries crack the code, market makers are at the mercy of DeFi snipers, front-running bots, and whatnot. Moreover, blockchains update slowly and market makers cannot adjust their prices once they sense the risk of getting sniped. Therefore, the market makers who are incentivized to provide liquidity to the crypto exchange software are disincentivized and demotivated due to the challenges posed by MEV. On the contrary, centralized or order-book-based counterparts must design their order-matching systems strategically to enable market makers to modify their quotes efficiently as the market demands. This will invite the best market makers and robust liquidity to crypto exchange software, therefore the highest transactional quality for users.

These are some of the ways MEV bots disrupt the user experience at crypto exchange software:

- Unfair Playing Field: MEV bots can extract significant profits from unsuspecting traders, making exchanges an unfair playing field.

- Reduced Trust: MEV attacks can erode user trust in the exchange, potentially driving away customers.

- Market Manipulation: MEV can be used to manipulate market prices and destabilize the ecosystem.

Also Read: MEV Bots: Unleashing the Potential of Maximal Extractable Value

Best Strategies to Incorporate in Crypto Exchange Software to Combat MEV Attacks

Given the significant threat that MEV poses, it’s crucial to implement robust strategies within your crypto exchange software to mitigate these risks. Below are some of the best approaches:

- Transaction Privacy:

Encrypting transaction details can help prevent front-running by hiding transaction data from miners and bots until it’s too late for them to take advantage. The implementation of zero-knowledge proofs that allow for the verification of transactions without revealing their underlying information can provide a higher level of security. Similarly, by deploying homomorphic encryption, your crypto exchange development company can help conceal the transaction data effectively.

- Bundling and Batching:

This technique involves combining multiple user transactions into a single batch, making it difficult for miners or bots to single out specific transactions for MEV exploitation. This transaction aggregation approach can effectively reduce the transaction’s exposure to MEV. Alternatively, AI-based searcher detectors built by leading cryptocurrency exchange software solution providers can be developed and deployed to enable exchanges to differentiate and prioritize user transactions. Advanced transaction randomizing mechanisms can also help prevent MEV bots from predicting the order.

- MEV-resistant solutions:

Another solution calls for leveraging security-first, MEV-resistant blockchains, smart contracts or order routing mechanisms. Your cryptocurrency exchange software solution provider can suggest blockchains that are specifically designed to resist attacks, such as those leveraging decentralized sequencing mechanisms. Offloading the transactions from the mainchain can reduce the visibility of transactions to malicious market players so exchange owners can collaborate with the best crypto exchange development company to explore such solutions.

- MEV Protection Protocols

By collaborating with experienced MEV-resistant exchange development experts, an exchange can introduce time-lock mechanisms where transactions are only processed after a certain period. They can potentially reduce the ability of miners to exploit MEV opportunities. Moreover, implementing fair ordering protocols, which prioritize transactions based on the time they are received, can help eliminate the advantages of front-running. A reliable cryptocurrency exchange software solution provider can suggest other alternative integrations to minimize the impact of MEV.

- Bots and Bot Blockers

Deploying internal arbitrage bots that operate within the exchange can counteract external arbitrage attempts, stabilize prices, and significantly minimize MEV opportunities. Specialized RPC endpoints can also be set up to block any MEV activity. A reliable crypto exchange development company can help set MEV blockers and flash bots that can protect transactions from the eyes of malicious minds in the public meme pools.

Even after setting up the necessary measures, trading platforms must educate users about the risks of MEV and encourage them to adopt effective MEV protection features.

Top 4 MEV-Protected Cryptocurrency Exchange Software Solution Providers

When considering building the best MEV-protected crypto exchange software solutions, it’s essential to look for providers that have integrated advanced mechanisms to mitigate MEV risks. Here are the top five providers leading the wave:

1. Antier

Antier is at the forefront of developing MEV-protected cryptocurrency exchange solutions. With advanced features such as transaction encryption, batching and bundling, zero-knowledge proofs, and other pertinent measures, the cryptocurrency exchange software solution provider ensures the security and fairness of their clients’ exchanges. Their exceptional expertise in Layer 0 to Layer 3 solutions and advanced AI-based protocols makes them a top choice for businesses looking to protect against MEV threats.

2. ChainSafe

ChainSafe is known for its robust blockchain infrastructure and has incorporated various MEV-resistant mechanisms into various DeFi protocols and crypto exchange software solutions. Their solutions emphasize privacy and fairness in transaction processing, making it harder for miners or validators to exploit MEV opportunities. ChainSafe’s focus on research and innovation has positioned them as a leader in the space.

3. OpenZeppelin

OpenZeppelin, a recognized name in blockchain security, offers tools and frameworks designed to safeguard crypto exchange software from MEV attacks. Their solutions include the implementation of transaction ordering protocols and smart contract auditing services, ensuring that the exchange’s infrastructure is resistant to MEV exploits.

4. Blockchain App Factory

Blockchain App Factory is a leading blockchain and crypto exchange development company offering comprehensive exchange solutions with advanced MEV prevention measures. They enable exchanges to monitor and mitigate MEV threats before they’re exploited.

Conclusion

MEV is a multimillion-dollar problem and if you’re on a mission to mitigate MEV exploitations on your exchange, you must carefully consider the available MEV protection protocols. You can also partner with a leading cryptocurrency exchange software solutions provider specializing in building such protocols to create groundbreaking possibilities in the crypto trading space.

Before the MEV monster devours users’s trust in your crypto exchange platform, integrate sophisticated MEV-resistant solutions and facilitate an exemplary user experience. At Antier, we understand the cryptocurrency and MEV inside out and help you stay ahead in the expeditiously evolving crypto landscape with pertinent solutions. Being a pioneering crypto exchange development company, we design resilient trading platforms and DeFi protocols impervious to the growing threat of MEV.

If you’re looking to build or upgrade your cryptocurrency exchange, reach out to us to explore how we can help you stay protected and competitive.