Empowering a Comprehensive Economy: The Significance of Tokenizing Physical Assets

August 11, 2023

AI-Enabled P2P Lending Platform Software: Bridging Borrowers and Lenders

August 16, 2023As cryptocurrency trading has become increasingly popular, there has been a constant buzz around crypto arbitrage bots. This groundbreaking development empowers traders to tap into the price discrepancies of a cryptocurrency across different exchanges. Their agile approach and ability to unlock new avenues of profit potential and automate processes have emerged as game-changers.

In this comprehensive blog post, we will dive into the realm of arbitrage crypto bots, shedding light on:

The Rise of Arbitrage Trading Bots

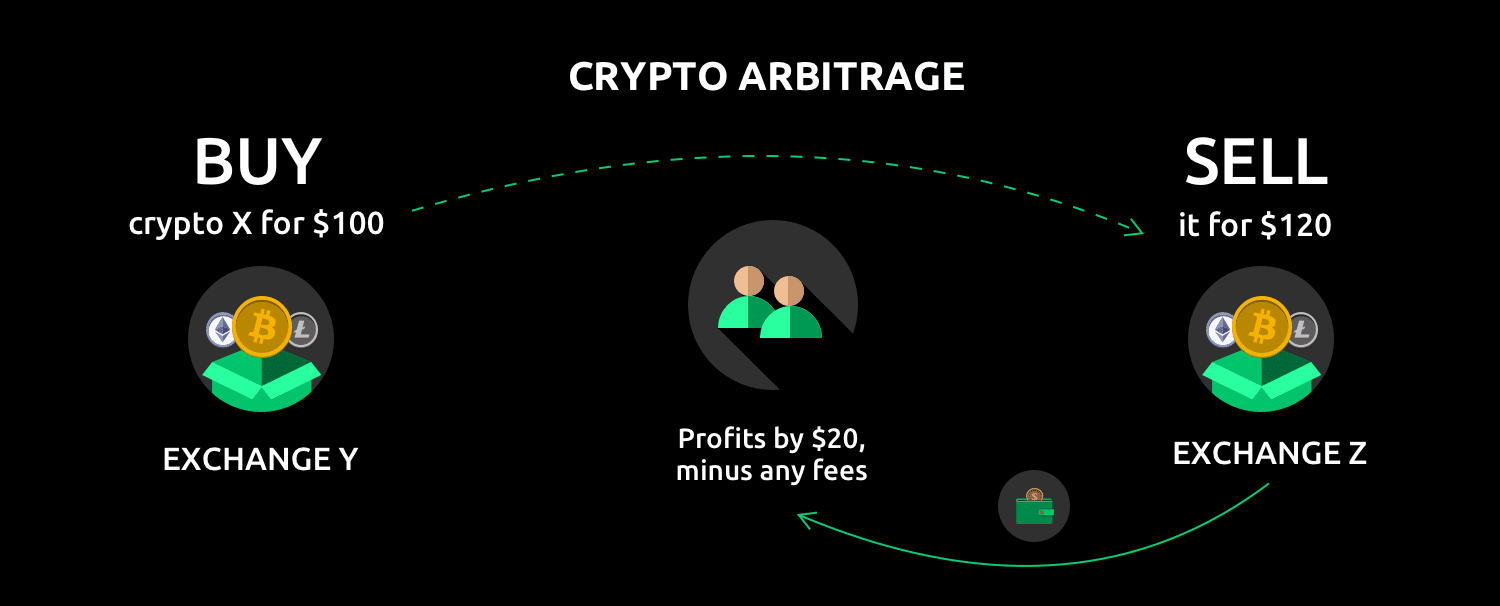

Cryptocurrency arbitrage trading is a strategy involving traders taking advantage of price disparities for the same digital asset across different exchanges. They instantly buy the asset on the exchange where it is priced lower and sell it on the exchange where it is priced higher.

For example, if crypto X is trading at $100 on exchange Y and $120 on exchange Z, an arbitrageur can buy it on exchange Y and sell it on exchange Z for a profit of $120 per coin.

However, crypto arbitrage trading is not as easy as it may sound. It demands rapid responsiveness, vigilant tracking of price fluctuations, and seamless access to many trading venues and liquidity sources. Furthermore, various risks are associated with it, such as price slippage, network congestion, hacking, exchange fees, etc., that may pose a roadblock to its successful execution.

Related: Crypto Arbitrage Trading Bots Development and its Working

This is where cryptocurrency arbitrage bots exhibit immeasurable worth. These autonomous marvels can swiftly scan multiple markets, determine favorable trading opportunities, and execute trades in milliseconds on the traders’ behalf, based on their predefined rules and strategies. Moreover, they can effortlessly and efficiently handle intricate calculations, risk management, and portfolio optimization.

7 Ways Crypto Arbitrage Bots Are Revolutionizing The Cryptosphere

“According to a recent Binance research report, the cumulative lifetime trading volume facilitated by Telegram bots has surpassed US$190 million, reaching an all-time high of US$10 million in daily trading volume recorded on July 23, 2023.”

While the use of trading bots might not assure profits, arbitrage trading bots have demonstrated their ability to automate complex processes, substantially minimize risks, and greatly enhance profits, particularly in dynamic markets.

Here are seven ways arbitrage crypto bots make an impact:

- Capturing fleeting opportunities

Arbitrage bots leverage advanced, agile algorithms to identify and capitalize on price disparities across multiple markets in real time, ensuring that arbitrageurs don’t miss out on profit-making opportunities.

- Executing trades in real-time:

Unlike manual trading methods, these crypto exchange arbitrage bots execute numerous profitable trades almost simultaneously at lightning-fast speed, allowing traders to make the most of time-sensitive opportunities.

- Creating a win-win for all:

While they enable arbitrageurs to exploit market inefficiencies and pocket the price difference for the same assets at different exchanges, they also balance the prices across different exchanges.

- 24/7 Multi-market monitoring and trade execution

Arbitrage trading bots can tirelessly monitor price movements across various exchanges. ensuring that arbitrageurs seize potentially profitable trades 24/7, even when they’re unavailable. They don’t need sleep or rest like human traders, confirming maximum uptime.

- Improved market liquidity:

They perpetually buy low and sell high across different platforms, which increases the frequency of trades, leading to enhanced organic liquidity and market depth. This means there are more buyers and sellers available to trade at a given price level and time.

- Enhancing profits and mitigating risks:

As crypto arbitrage bots execute trades independently within predefined parameters, they eliminate the risk of human error. Besides, they diversify trades across various platforms and cryptocurrencies, which minimizes the impact of unfavorable market movements on overall profits.

- Enhanced speed and precision:

The automatic execution of trades prevents human errors from getting in the way while enhancing speed and accuracy. The ability to perform transactions in a fraction of a second leaves manual trading methods in the dust.

Arbitrage Crypto Bot: A Valuable Addition to Crypto Exchange Development

For cryptocurrency exchanges aiming to enhance their value proposition and attract a broader user base, integrating an arbitrage trading bot is a strategic move.

Here are some of the benefits of setting up an arbitrage bot for your crypto exchange:

- 24/7 Operations

- Enhanced Liquidity

- Market Efficiency

- Diversified Revenue Streams

- Competitive Edge

- User Attraction

Integrating a crypto exchange arbitrage bot can therefore position the exchange for long-term success.

How to maximize your profits with cryptocurrency arbitrage bots in 2023

With crypto arbitrage trading bots development, investors and traders can safely earn money without taking many risks. Let’s study how arbitrageurs can amplify their revenue by leveraging this transformative technology in 2023:

- Begin your custom arbitrage trading bot development:

We recommend building one of your own as you can then customize it according to your preferred trading strategies, supported exchanges, and other preferred parameters. In case you want to pick an off-the-shelf arbitrage bot available in the market, make sure to consider your preferences, security features, and user reviews.

- Carefully analyze cost and performance:

A crypto exchange arbitrage bot development company will provide one with pre-loaded, back-tested strategies and customizable templates. Consider researching the costs and benefits of various off-the-shelf offerings in the market before purchasing the software and even the custom-built ones before getting one developed.

- Diverse exchange integration:

By integrating the APIs of numerous crypto exchange software platforms, a trader can increase the chances of spotting lucrative opportunities. API integration enables arbitrageurs to view real-time market statistics and execute trades over multiple exchanges using a single platform.

- Stay ahead of market trends:

Staying current with market movements is the key to successful crypto arbitrage. Regularly analyzing price disparities, trading volumes, and emerging market developments around exchanges and cryptocurrencies can help you optimize your cryptocurrency arbitrage bot’s performance.

- Minimizing the Latency:

A very small delay may prevent you from earning a substantial profit. So, it is recommended to reduce the time that it takes between identifying and executing a trade. Using cutting-edge bots to reduce the time lag can improve the overall productivity of arbitrage trading activity.

- Risk Management Protocols:

Sophisticated crypto exchange arbitrage bots are fortified with risk management protocols to enable traders to protect their gains and prevent losses. If you are getting your arbitrage bot built from scratch, you can get risk management protocols of your choice integrated within.

- Realistic expectations:

At last, don’t expect substantial profits all the time. If you are new to arbitrage trading in cryptocurrency markets, you must know that the market is highly volatile and you might not yield impressive profits in every trading session.

Final Thoughts

As new crypto exchange platform development projects sprout and flourish, the scope for the price difference will widen, unleashing remunerative opportunities for arbitrage trading. The market, therefore, is opined to stay fertile for arbitrageurs.

Whether you are a crypto enthusiast or an entrepreneur interested in tapping into the frenzy around cryptocurrency and arbitrage trading, now is the time to build your cryptocurrency arbitrage bot.

As a distinguished leader in the realm of technology and finance, Antier stands firm as a pioneer in offering cutting-edge technology that redefines the contours of profit maximization.

Partner with us as you embark on your journey toward maximizing profits with an arbitrage trading bot.