Develop Your Metaverse on Solana: The Hows & Whys

July 23, 2024

Unveiling the Cost & Timeframe of Building a White Label Crypto Wallet Card

July 23, 2024Table of Contents

- Introduction

- Why are Centralized Exchanges So Popular?

- Essential Components For Centralized Crypto Exchange Development

- 4 Components For Successful Centralized Exchange Development in 2025

- A Roadmap For Centralized Crypto Exchange Development with Timeline

- Technology Stack For Centralized Cryptocurrency Exchange Development

- How Much Does Centralized Cryptocurrency Exchange Development Cost?

- Final Word

Introduction

The last quarter of 2023 saw the onset of explosive growth and the evidence is before us. The total crypto market capitalization continued skyrocketing by +64.5 in Q1 2024, hitting a high of $2.9 trillion on March 13. The doubled market growth during the hype of Bitcoin halving showcases huge potential in centralized exchange development. In Q2 2024, the long-anticipated Bitcoin’s halving took place, and guess what? The market’s potential was undermined and yet to be unwrapped and then the Q3 2024’s Bitcoin Bullrun happened.

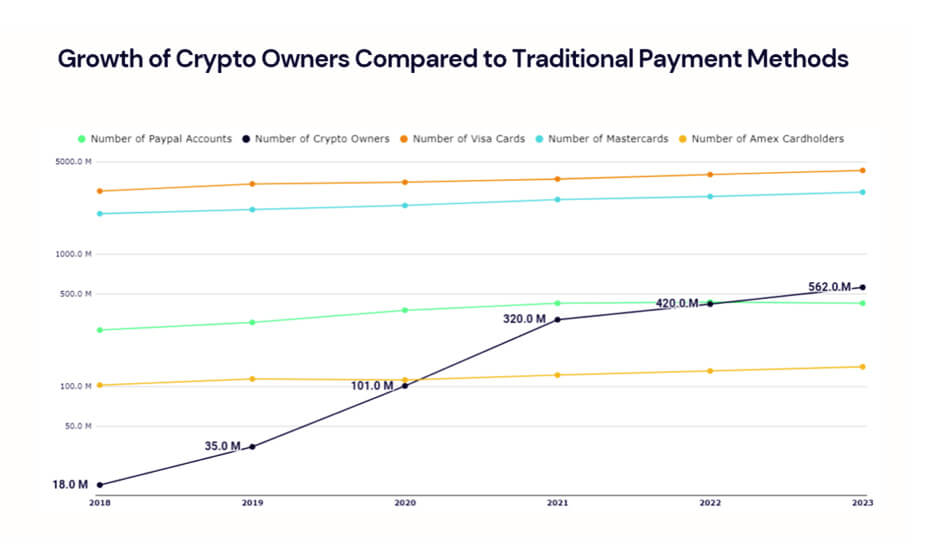

As per Triple-A, cryptocurrency ownership growth rates surpass the growth of conventional payment methods. Crypto’s compound annual growth rate of 99% is exemplary compared to an average of 8% for traditional payment methods from 2018 to 2023.

Amidst the era of fast-paced crypto growth, if you are a business planning to position your centralized crypto exchange development project and revolutionize the user experience, this guide will equip you with everything you need to learn.

Without much ado, let’s first learn why centralized exchanges remain the honeypots even after facing tough competition from DEXs and hybrids.

Why are Centralized Exchanges So Popular?

Centralized exchanges are not just the eldest of all the exchange categories but also the most popular ones. Before you learn how profitable centralized exchange development is, you must know why different trader bases adore this type of digital asset trading platform.

- Seasoned traders: These bustling exchange platforms are full of funds every time. The high liquidity ensures a constant flow of funds and, therefore, smooth and efficient execution of trades. No time is wasted waiting for a buyer or seller to trade in the vast expanse of centralized cryptoverse.

- Crypto Cadets: Centralized cryptocurrency exchange development is also done to attract crypto cadets. Being the friendly co-pilots guiding the learners through their initial stages of the crypto journey, they make trading more manageable with familiar, user-friendly interfaces.

- Security and Customer-Support Seeking Traders: Some security freaks and those looking for dedicated customer service also prefer CEXs. Your centralized exchange development project can be enticing if you invest heavily in security measures and customer support.

- Risk-Averse Traders: CEXs are secure digital asset trading stations where the presence of a reliable central authority offers comfort and stability to their users. It’s similar to banks, where crypto assets are safely stored and transactions monitored.

- Features-Lovers: Centralized crypto exchange development can also target feature-lovers traders who want all-encompassing experiences with various features and modules on a single platform.

- Community-driven Explorers: Forums, educational resources, and social trading features make CEXs a platform not just for trading but for knowledge sharing and shared experiences as well. It’s like a crew of fellow traders to learn from, collaborate with, and swap stories about crypto adventures.

- Legitimate Trading Platform Seekers: Many centralized exchange development projects plan to operate under strict regulatory frameworks, mimicking the top exchanges that set standards in terms of compliance. Those looking for a secure, reliable, and legit trading experience usually rely on centralized trading platforms.

In short, centralized cryptocurrency exchange development is profitable, as these platforms offer a familiar and accessible launchpad into the ever-expanding cryptoverse.

Looking for more reasons why CEX development is a profitable venture? Read this>>> 7 Reasons Centralized Cryptocurrency Exchange Development Is Profitable in 2024

Essential Components For Centralized Crypto Exchange Development

Centralized crypto exchange development involves putting together different components of an exchange. Some of those essential components that have always been there include:

- Trading and Matching Engine

- Wallet Integration

- User Interface

- Security Features

- Admin Panel

- API Integration

- Compliance Tools

- Payment Gateway

Read more about these essential components here>>> Crucial Aspects of a Centralized Crypto Exchange Development

4 Components For Successful Centralized Exchange Development in 2025

Let’s now discuss those pillars that will hold the success of your centralized exchange development project in 2024 and beyond:

Cutting-Edge Technology

- Blockchain Technology:

The ethereum was deseated from its monopolistic position long ago. Smarter blockchain choices have emerged over the past few years for CEX development projects. The popular Layer 1 protocols suitable for building centralized digital asset exchanges include Binance Smart Chain (BSC), Solana, Base, and Avalanche. Each integration into centralized cryptocurrency exchange development brings a unique transactional experience to CEXs. So, it is always recommended to choose wisely after considering your desired scalability, security, developer ecosystem, transaction fees, and regulatory compliance.

- Top-notch Security Features:

Since the cryptoverse is evolving, hackers are also getting smarter with their tactics. Combating modern security threats requires sophisticated security solutions during centralized exchange development. MFA, AI-based anomaly detection systems, cold storage, advanced encryption mechanisms, consistent security audits, DDoS protection, etc. are some of the measures that protect users’ and platforms’ interests.

Also Read>>> Centralized Exchange Development: Top Security Enhancements For 2024

- AI and ML Integration:

AI and ML integration in crypto exchanges is revolutionizing trading experiences. Implementing personalized trading dashboards, intelligent chatbots, sentiment and predictive analytics, risk management, fraud and anomaly detection, etc. during centralized crypto exchange development can create a more secure, efficient, and user-centric trading environment. AI/ML-based features offer an innovative edge to crypto exchange businesses and amplify their revenue streams significantly.

Adhering To Regulations

- Regulatory Compliance Features:

The cryptocurrency industry has experienced rapid growth, but it has also been a focal point for regulatory scrutiny. As a result, regulatory compliance has emerged as a non-negotiable aspect of centralized exchange development. With evolving regulations in various jurisdictions, exchanges must be agile and adaptable to ensure continued operations. KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are mandatory tools that ensure compliance with regulatory bodies.

Also Read>>> Licensing in 2024: Navigating Regulatory Frameworks

- Joining Forces With Legal Experts:

Collaborating proactively with the cryptocurrency exchange governing authorities of the concerned state is what comes next after integrating mandatory regulatory features. A centralized crypto exchange development company with legal expert teams or partners can help exchanges navigate the complicated compliance maze effortlessly. Additionally, businesses need to stay abreast of rapidly evolving regulations in target jurisdictions and therefore initiate measures as per policies and procedures to remain compliant.

- Contributing To Evolving Legal Framework

Centralized exchange development projects can contribute towards the construction of a comprehensive compliance structure around cryptocurrency exchanges by adhering to global standards and local laws around data protection, financial reporting, consumer protection, etc. Setting robust examples in the face of sharpening regulatory scrutiny and a rising number of security and regulatory breaches can enhance the chances of success for a centralized crypto exchange development project and the overall cryptocurrency ecosystem.

Strategic Partnerships

- Financial Institutions and Payment Providers

Shaking hands with established banks can help exchanges facilitate frictionless fiat-to-crypto on/off-ramps, enhancing the user experience for a huge trader base. By collaborating with renowned payment processors like Visa, Mastercard, PayPal, etc., exchanges can also expand payment options for users, enhancing accessibility.

- Infrastructure Providers:

Partnership with the right centralized exchange development company is crucial for anyone seeking to build their CEX. Don’t only look for platform development companies but also for end-to-end service providers offering smart contract development, security audits, marketing and PR, legal expertise, and robust hardware wallets. This also narrows your list of centralized cryptocurrency exchange development providers and allows you to choose from the top 2-3 players in the domain.

- Investment Firms and Promising Blockchain Projects

Unlock your business’ access to substantial funding opportunities and institutional investors by partnering with top investment firms. You can also introduce innovative financial products and services to your exchange by partnering with fintech startups offering promising integrations and outcomes.

- Cybersecurity and Insurance Partnerships

By partnering with cybersecurity firms, centralized exchange development projects can ensure a proactive, or at least a timely, response to any emerging threat. Moreover, insurance services covering digital assets perfectly complement a defensive security system. This integration adds a layer of protection and enhances the interests of risk-averse investors in the trading platform.

Enhancing User-Centricity

- Intuitive Interfaces

Till the cryptocurrency industry reaches the stage of mainstream adoption, user-friendly interfaces will be the topmost priority for centralized crypto exchange development projects. However, since the industry has progressed and has come far from the novice stage, designing responsive and user-centric interfaces that suit beginners and entice professionals has become a daunting task. Some not-to-miss features include simply navigable dashboards, real-time market data, and customizable trading charts.

- Customer Support

Another major requirement is an unwavering commitment to customer support and satisfaction, achieved through implementing a multichannel customer support system during centralized cryptocurrency exchange development. Live chat, a comprehensive FAQ section, email support, etc. may assist customers during any time of their trading journey with account issues, transaction snags, technical glitches, or general inquiries.

- Educational Resources

Providing comprehensive tutorials, webinars, and articles on various modules present in trading platforms enhances the user experience and helps exchanges target experienced as well as beginner traders. Ensure that you start with the basics, expand the knowledge base gradually, and move towards professional and innovative features. Implementing an educational resources section during centralized exchange development ensures that users engage confidently with all the features of the trading platform.

A Roadmap For Centralized Crypto Exchange Development with Timeline

Developing a centralized exchange involves several stages. The first and foremost step is to partner with a leading centralized crypto exchange development company offering end-to-end services. At Antier, we have an exclusive 8 years of blockchain development experience, cybersecurity, compliance, and marketing expertise.

Get Your Personalized Roadmap For CEX Development

1. Planning and Research (1-2 months)

- Market Analysis: Conduct an exhaustive market analysis that includes identifying top trends, players in the CEX industry, regulatory requirements, target customers’ interests, and demographics.

- Defining Scope and Requirements: Before you approach your centralized cryptocurrency exchange development partner, you must get clarity on what you want. Outline features, functionalities, and technical requirements of the exchange.

- Budgeting: Get quotes from some reliable technology providers and prepare an estimation of the costs involved in the development, launch, and maintenance of the exchange.

2. Design (2-3 months)

- UI/UX Design: Coordinate with the centralized exchange development team to create an intuitive and user-oriented interface. Ensure that it is attractive as well as easy to navigate.

- Prototype Development: The technology provider will create a prototype to visualize the design finalized by you and your technology provider in coordination. Approve or reject and share your feedback on the approved prototype.

- User Testing and Feedback: Being a customer-first centralized cryptocurrency exchange development project, you can also conduct user tests to refine the design based on feedback before it goes into development.

3. Development (4-6 months)

- Front-End Development: Now it’s time to put the finalized design into development and build the customer side of the exchange. Coordinate closely with your tech team to build exactly what you want your customers to view while they trade.

- Back-End Development: This step of centralized exchange development involves putting together all the components of CEXs, developing the server-side logic, trading engine, and database management.

- Wallet Integration: Integrate secure, multicurrency wallets so that your exchange’s infrastructure supports your future business expansions.

- Security Implementation: This step involves integrating advanced security measures to protect user data and funds. Ensure to include advanced encryption techniques, DDoS protection, MFA, etc.

4. Testing (2-3 months)

- Unit Testing: Test the centralized cryptocurrency exchange development components individually for their functionality and reliability. Unit testing helps identify the errors with the components closely.

- Integration Testing: After assessing each component closely, it is time to check how they work in harmony. This integration testing ensures that all the components work together seamlessly.

- Security Testing: Since the security of your centralized crypto exchange development project is a foremost concern, thorough security assessments are required to identify and mitigate the vulnerabilities.

- Performance Testing: The exchange must sanely work in all conditions and loads and therefore at this step, the tech team evaluates the exchange’s performance under different conditions and loads.

5. Launch (1 month)

- Beta Testing: Before the final launch of your centralized exchange development project, it is advisable to launch a beta version to a limited audience to gather real-world feedback.

- Deployment: After refining the platform’s functionality and UI/UX based on feedback, you can get the exchange deployed on live servers.

- Marketing Campaign: The marketing shall start before the launch to foster awareness and hype. You can join forces with marketing experts at your centralized crypto exchange development company to promote the exchange and attract users.

6. Post-launch (ongoing)

- Continuous Monitoring and Regular Updates: Even after the launch, you must closely monitor the exchange for any issues and ensure smooth operations. Continuously update and improve the platform to enhance features and security.

- Customer Support: Your commitment to regulatory compliance, marketing efforts, and customer support must continue even after centralized cryptocurrency exchange development. Provide ongoing support to address user queries and issues.

So, here’s the tentative timeline for a centralized cryptocurrency exchange development project. If you opt for a white label exchange, you can minimize not just the timeline but your development costs as well.

Technology Stack For Centralized Cryptocurrency Exchange Development

A robust technology stack is crucial for secure and efficient centralized exchange development. Here are the recommended technologies:

- Programming Languages: Python, C++, JavaScript (Node.js, React.js)

- Database: MySQL, PostgreSQL, MongoDB, Cassandra

- Blockchain Platforms: Ethereum, Binance Smart Chain, Solana

- Cloud Services: AWS, Google Cloud, Microsoft Azure

- Security Protocols: SSL/TLS, AES Encryption, MFA

- DevOps Tools: Docker, Kubernetes, Jenkins

- Monitoring Tools: Prometheus, Grafana, Splunk

How Much Does Centralized Cryptocurrency Exchange Development Cost?

The centralized crypto exchange development costs can vary significantly based on several factors, including the scope of the project, the technology stack used, and the geographical location of the development team. Here are some approximate cost estimates:

- Basic Exchange: $50,000 – $100,000

- Advanced Exchange: $100,000 – $200,000

- Enterprise-Level Exchange: $200,000 and above

Final Word

Building a centralized exchange is a preferred choice for entrepreneurs because trading on CEXs is preferred by different classes of traders for distinct reasons. Centralized cryptocurrency exchange development in 2024 requires a comprehensive understanding of the market, a robust technological foundation, and a focus on security and compliance. By following the roadmap and leveraging the right technology stack, businesses can create a competitive and secure exchange platform that meets the needs of modern cryptocurrency traders.

For successful centralized crypto exchange development, the first step is to find a reliable technology company. At Antier, we are equipped with unparalleled technical expertise, business acumen, marketing, and legal expertise to not just build your centralized crypto empire but make it a success.

Hire us today and let us together tread towards crypto El Dorado.