Imagine owning a fraction of a Picasso painting, investing in a wind farm in Scotland, or participating in real estate ownership without needing millions of dollars, this isn’t a fantasy; it’s the revolution unfolding through real world asset tokenization. By converting ownership rights into digital tokens on a blockchain, this technology is fundamentally reshaping how we interact with assets, unlocking a spectrum of revolutionary possibilities.

Understanding Asset Tokenization

Instead of physical certificates or deeds, asset tokenization utilizes blockchain technology to create digital tokens representing ownership of an asset. Think of it as fractionalizing a tangible asset (e.g., real estate, artwork, intellectual property) into smaller, easily tradable units; these tokens reside on a distributed ledger, ensuring transparency, security, and immutability of ownership records.

Benefits of Tokenization of Real-world Assets

Are you thinking “why would you tokenize an asset”? Well, you are not alone! Let’s explore- there are many advantages that tokenization of real-world assets offers. Some of them are listed below:

For Asset Owners:

- Increased Liquidity: Convert traditionally illiquid assets into tradable tokens, attracting new investors and unlocking previously inaccessible capital. Imagine tokenizing a historic building and opening investment opportunities to a wider audience.

- Fractional Ownership: Divide assets into smaller, more affordable units, democratizing investment and offering broader participation. Own a piece of a luxury car collection or a solar energy plant through fractional ownership.

- Reduced Friction: Automate processes with smart contracts, minimizing administrative costs and expediting transactions. Imagine streamlined rental payments for tokenized real estate or automated royalty distribution for tokenized music rights.

- Enhanced Transparency: Blockchain immutability guarantees transparent and tamper-proof ownership records, fostering trust and reducing fraud risk. Track ownership changes and asset usage with increased transparency and security.

For Investors:

- Democratized Access: Invest in previously unavailable asset classes with lower entry barriers thanks to fractional ownership. Gain exposure to high-value assets like classic cars or fine art without needing significant capital.

- Global Reach: Participate in a globally accessible market for tokenized assets, regardless of location. Invest in overseas real estate projects or emerging market infrastructure initiatives across borders.

- 24/7 Trading: Enjoy continuous trading opportunities, unlike traditional markets with limited trading hours. Trade tokenized assets anytime, anywhere, with increased flexibility and accessibility.

- Potential for Higher Returns: Gain exposure to potentially high-yielding assets like real estate or infrastructure through tokenized vehicles, potentially offering attractive returns.

Why Tokenize Your Assets in 2024?

Several factors make 2024 an opportune time to tokenize your assets in 2024:

- Growing Market Adoption: The size of the tokenized asset market is projected to reach $16.1 trillion by 2030, indicating significant adoption and growth potential.

- Evolving Regulations: Regulatory frameworks are actively shaping the landscape, providing clarity and guidance for responsible tokenization activities.

- Technological Advancements: Blockchain technology is maturing, offering solutions for scalability, security, and enhanced user experience.

Features of Robust Tokenization Platforms:

- Secure Blockchain Technology: Utilizes a well-established, secure blockchain network (e.g., Ethereum, Hyperledger Fabric) to ensure the authenticity and immutability of tokenized assets.

- Smart Contract Functionality: Programmable contracts automate transactions, ensuring transparent and efficient execution of processes. For example, smart contracts can automate rental payments based on predetermined terms.

- Compliance and Integration: The platform adheres to relevant regulations (e.g., security token offerings, KYC/AML) and integrates seamlessly with existing financial systems for smooth transactions.

- User-Friendly Interface: An intuitive interface simplifies interaction with the platform for both issuers and investors, promoting wider adoption and user-friendliness.

Process of Asset Tokenization

Tokenizing an asset unlocks new possibilities and transforms traditional ownership models. But what exactly does the process entail? Let’s embark on a journey through the intricate steps of asset tokenization:

1. Define Your Goal and Strategy:

- Identify the asset: What asset are you tokenizing? This could be real estate, art, intellectual property, or even data.

- Determine your objectives: What are you hoping to achieve through tokenization? Increased liquidity, fractional ownership, or access to new markets?

- Select the token type: Will you issue security tokens, utility tokens, or non-fungible tokens (NFTs)? Each type has different characteristics and regulations.

2. Choose Your Platform and Partners:

- Blockchain selection: Decide which blockchain platform best suits your needs. Consider factors like scalability, security, and regulatory compliance.

- Tokenization platform: Select a platform specifically designed for asset tokenization, offering features like smart contract development and regulatory compliance tools.

- Legal and compliance experts: Partner with professionals experienced in navigating the legal and regulatory landscape surrounding tokenized assets.

3. Design and Develop the Token:

- Tokenomics design: Establish the total supply of tokens, allocation mechanisms, and governance models to ensure a sustainable and value-driven ecosystem.

- Smart contract development: Develop secure and robust smart contracts that will automate key processes like token issuance, trading, and ownership transfers.

- User interface and experience: Design an intuitive and user-friendly interface for both issuers and investors to interact with the tokenized asset easily.

4. Regulatory Compliance and KYC/AML:

- Thoroughly understand: Research and comply with relevant regulations related to your specific asset, jurisdiction, and chosen token type.

- KYC/AML procedures: Implement KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols to ensure investor verification and compliance with financial regulations.

5. Token Sale and Distribution:

- Choose your approach: Decide whether to conduct a public token sale, pre-sale, or private placement based on your goals and regulatory requirements.

- Marketing and promotion: Develop a marketing strategy to attract potential investors and raise awareness about your tokenized asset.

- Distribution and launch: Successfully launch your token on the chosen platform and distribute it to investors according to your pre-defined terms.

6. Ongoing Management and Maintenance:

- Post-launch support: Provide ongoing support to investors and ensure smooth operation of the tokenized asset platform.

- Compliance monitoring: Continuously monitor and adapt to any changes in regulations and legal requirements surrounding tokenized assets.

- Community engagement: Foster a strong community around your tokenized asset to ensure its long-term success and value growth.

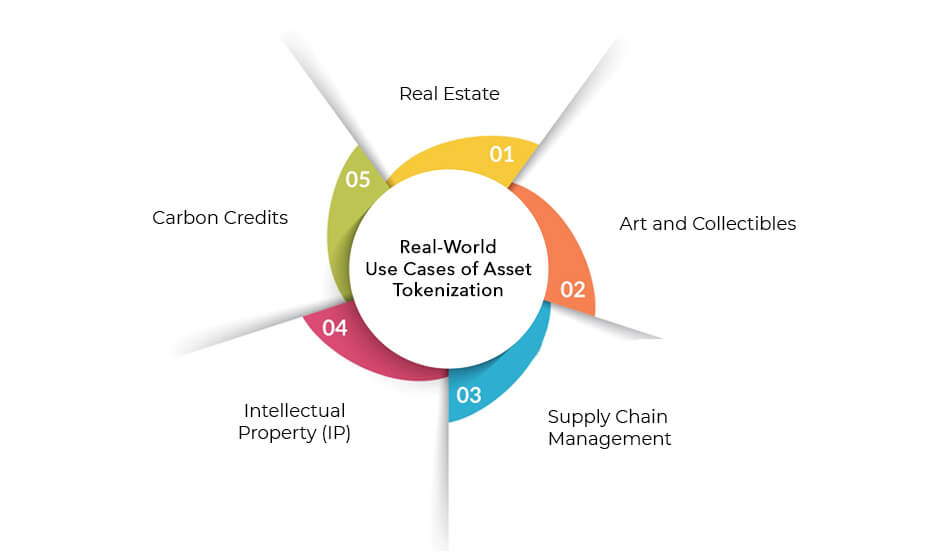

Real-World Use Cases of Asset Tokenization

Let’s explore real-world applications of digital asset tokenization across domains, highlighting the potential and current implementations of this exciting technology.

1. Real Estate:

- Fractional Ownership: Tokenization unlocks fractional ownership of properties, making high-value assets accessible to a broader investor base. Imagine co-owning a luxury apartment in Dubai or a historic building in Europe through tokenized shares.

- Increased Liquidity: Traditionally illiquid real estate becomes more readily tradable with tokens, attracting new investors and unlocking capital. Imagine selling your share of a tokenized property instantly on a global marketplace.

- Streamlined Transactions: Smart contracts automate tasks like rent collection and property management, reducing costs and increasing efficiency. Imagine automated rental payments distributed directly to investors.

- Improved Transparency: Blockchain-based ownership records ensure transparency and immutability, fostering trust and reducing fraud risk. Imagine tracking ownership changes and property usage with enhanced accountability.

Examples:

- StREIT: This platform tokenizes US commercial real estate, offering fractional ownership opportunities to global investors.

- Brickblock: This company facilitates tokenized real estate investments in Europe, simplifying ownership and transactions.

2. Art and Collectibles:

- Fractional Ownership: Own a piece of a Picasso masterpiece or a rare vintage car through tokenization, opening up previously inaccessible assets. Imagine owning a fraction of a renowned artwork while diversifying your investment portfolio.

- Enhanced Liquidity: Tokenized art and collectibles become more easily tradable, offering greater liquidity and potential price discovery. Imagine selling your share of a tokenized artwork on a dedicated secondary market.

- Provenance and Authenticity: Blockchain immutability guarantees transparent ownership history and authenticity, reducing forgery risks. Imagine verifying the provenance of a tokenized artwork with increased confidence.

Examples:

- Maecenas: The platform tokenizes fine art masterpieces, democratizing access and facilitating fractional ownership.

- Artory: The company uses blockchain to track art ownership and provenance, enhancing transparency and combating forgery.

3. Supply Chain Management:

- Track and Trace: Track the movement of goods throughout the supply chain using tokenized inventory, ensuring transparency and efficiency. Imagine real-time visibility into every step of a product’s journey from source to consumer.

- Enhanced Security: Blockchain technology protects against counterfeiting and tampering, improving product authenticity and safety. Imagine verifying the origin and quality of imported goods with greater certainty.

- Automated Payments: Smart contracts automate payments upon product delivery, streamlining transactions and reducing administrative costs. Imagine automated payments triggered upon arrival of goods at specific checkpoints.

Examples:

- VeChain: The platform focuses on supply chain solutions, utilizing blockchain for transparent and secure tracking of goods.

- IBM Food Trust: The blockchain-based platform tracks food across the supply chain, enhancing visibility and food safety.

4. Intellectual Property (IP):

- Secure Licensing: Tokenize patents, copyrights, and trademarks for secure and efficient licensing agreements. Imagine streamlining royalty payments and tracking IP usage with enhanced transparency.

- Fractional Ownership: Divide IP rights into smaller tokens, enabling wider participation and potential funding opportunities. Imagine co-owning a patent and sharing in royalty streams.

- Improved Monetization: Facilitate new ways to monetize IP assets beyond traditional licensing models. Imagine fractionalized IP fueling innovative crowdfunding campaigns.

Examples:

- IPChain: This platform provides blockchain-based solutions for IP management and secure licensing.

- Publica: This company focuses on tokenizing IP assets and facilitating efficient royalty distribution.

5. Carbon Credits:

- Reduce Fraud: Tokenize carbon credits to combat fraud and ensure transparent issuance and trading. Imagine verifying the legitimacy of carbon offsets you purchase and support eco-friendly initiatives with confidence.

- Increased Liquidity: Create a more liquid market for carbon credits, facilitating wider participation and driving climate action. Imagine easily buying and selling carbon offsets on a global marketplace.

- Improve Project Funding: Tokenization can attract new investors and funding for environmental projects through fractional ownership of carbon credits. Imagine supporting carbon reduction initiatives through direct investment.

Examples:

- Verra: Verra issues verified carbon offsets and is exploring blockchain integration for enhanced transparency.

- Nori: The platform uses blockchain to tokenize carbon removals and connect buyers with high-quality offset projects.

Popular Blockchain Platforms for Tokenization Solutions

The choice of blockchain platform for asset tokenization depends on various factors, including the specific goals of your project, desired features, scalability, regulatory considerations, and community support. Here’s a detailed breakdown of some popular options:

1. Ethereum:

- Pros: Most established and widely used platform, large developer community, diverse ecosystem of tools and dApps, ERC-20 token standard widely adopted, relatively good scalability solutions like Polygon and Optimism.

- Cons: High transaction fees on the mainnet, potential network congestion, ongoing scalability concerns.

- Use Cases: Security tokens, utility tokens, NFTs, fractional ownership of real estate and artworks.

2. Hyperledger Fabric:

- Pros: Permissioned blockchain, ideal for private deployments within institutions or consortia, high privacy and security, modular architecture allows customization.

- Cons: Less developer community compared to Ethereum, limited public liquidity for tokens, less transparency due to permissioned nature.

- Use Cases: Tokenization of private assets like intellectual property, supply chain management solutions, trade finance applications.

3. Stellar:

- Pros: Fast and low-cost transactions, built-in decentralized exchange (DEX), focus on cross-border payments, strong support for stablecoins.

- Cons: Smaller developer community compared to Ethereum, less established ecosystem of tools and dApps.

- Use Cases: Payment tokens, stablecoins, tokenized securities, international remittances.

4. Tezos:

- Pros: On-chain governance mechanism, formal verification of smart contracts for enhanced security, focus on sustainability and energy efficiency.

- Cons: Smaller developer community compared to Ethereum, less widespread adoption of Tezos tokens.

- Use Cases: Security tokens, governance tokens, NFTs, tokenized carbon credits.

5. Algorand:

- Pros: Scalable and energy-efficient blockchain with proof-of-stake consensus, fast transaction speeds, low fees, built-in governance mechanisms.

- Cons: Smaller developer community compared to Ethereum, relatively new platform, ecosystem of tools and dApps still developing.

- Use Cases: Payment tokens, NFTs, DeFi applications, central bank digital currencies (CBDCs).

Other Notable Platforms:

- EOS: High-speed platform with scalability features, but centralized elements raise concerns.

- Solana: High-performance platform with rapid transaction processing, but network outages raise stability concerns.

- Polygon: Layer 2 scaling solution for Ethereum, offering faster and cheaper transactions, but inherits some security concerns of Ethereum.

Choosing the Right Platform:

- Regulatory Considerations: Different platforms have varying compliance implications depending on your legal context and token type.

- Technology Stack: Evaluate your development team’s expertise and the available tools and resources on each platform.

- Scalability and Performance: Consider the anticipated volume of transactions and the platform’s ability to handle them efficiently.

- Fees and Costs: Compare transaction fees, gas costs, and other platform-specific expenses.

- Community and Ecosystem: Consider the size and activity of the developer community and the available tools and services within the platform’s ecosystem.

How Much Does It Cost to Build an Asset Tokenization Platform?

When building an asset tokenization platform, there isn’t a one-size-fits-all answer to the cost of asset tokenization as it depends on several factors:

1. Type of Asset:

- Complexity: Simplifying a physical asset into digital tokens requires varying degrees of work, impacting cost. Simpler assets like artwork may be easier to tokenize than complex entities like real estate.

- Regulatory Requirements: Depending on your asset and jurisdiction, compliance with regulations adds to the cost, particularly for security token offerings (STOs).

2. Chosen Platform:

- Blockchain Fees: Ethereum, the popular choice, can have high transaction fees depending on network congestion. Look at platforms with lower fees or scaling solutions.

- Platform Features: Platforms offering advanced features like smart contracts or integrations may come with higher costs.

3. Project Scope:

- Token Development: Designing and launching the tokens, including smart contracts, requires technical expertise and incurs costs.

- Legal and Compliance: Partnering with legal and compliance professionals ensures regulatory adherence but adds to the expense.

- Marketing and Distribution: Attracting investors and promoting the tokenized asset involves marketing efforts, increasing the overall cost.

4. Team Expertise:

- In-House vs. Outsourcing: Building an in-house team adds personnel costs, while outsourcing to tokenization firms may incur service fees.

Estimates and Averages:

While pinpointing exact costs is challenging, depending upon your project, it can cost you anywhere from $30,000 to $300,000+ to build an asset tokenization platform.

How Antier Can Help You in Asset Tokenization Platform Development?

At Antier, we’re pioneers in the world of asset tokenization, empowering businesses to leverage this transformative technology to achieve real-world results. Let us show you how:

Deep Expertise, Proven Track Record:

- Experience matters: We boast a proven track record of successfully delivering robust and user-friendly asset tokenization platforms across diverse industries. From real estate to art, supply chain to intellectual property, private equity to hedge funds, we understand the nuances of different asset classes and how to tailor solutions that unlock their full potential.

- Unmatched expertise: Our team comprises seasoned blockchain developers, experienced tokenomics specialists, and regulatory compliance experts. We have the knowledge and skills to guide you through every step of the tokenization journey, ensuring legal and technical compliance along the way.

- Collaborative approach: We don’t believe in one-size-fits-all solutions. We work closely with you to understand your unique needs and objectives, designing a customized tokenization platform that aligns seamlessly with your business strategy.

- End-to-end support: We offer comprehensive support throughout the entire process, from initial consultation and platform development to token launch and ongoing maintenance. You’ll have a dedicated team at your side every step of the way.

Key Features and Benefits We Offer:

- Secure and scalable platform: Built on leading blockchain technologies, our platforms are designed for security, scalability, and performance.

- Compliance-first approach: We ensure your platform adheres to relevant regulations and legal requirements in your jurisdiction.

- Advanced smart contract development: Our team builds custom smart contracts that automate key business processes and ensure transparent and efficient token operations.

- Streamlined user experience: We create intuitive and user-friendly interfaces for both issuers and investors, promoting wider adoption and seamless interaction.

- Integration with existing systems: We help you integrate your tokenization platform with existing financial systems for easy integration and data management.

Ready to Tokenize Your Future?

Don’t navigate the complex world of asset tokenization alone. Partner with Antier and gain access to our experience, expertise, and commitment to your success. Contact us today for a free consultation and let’s unlock the transformative power of tokenization for your business.