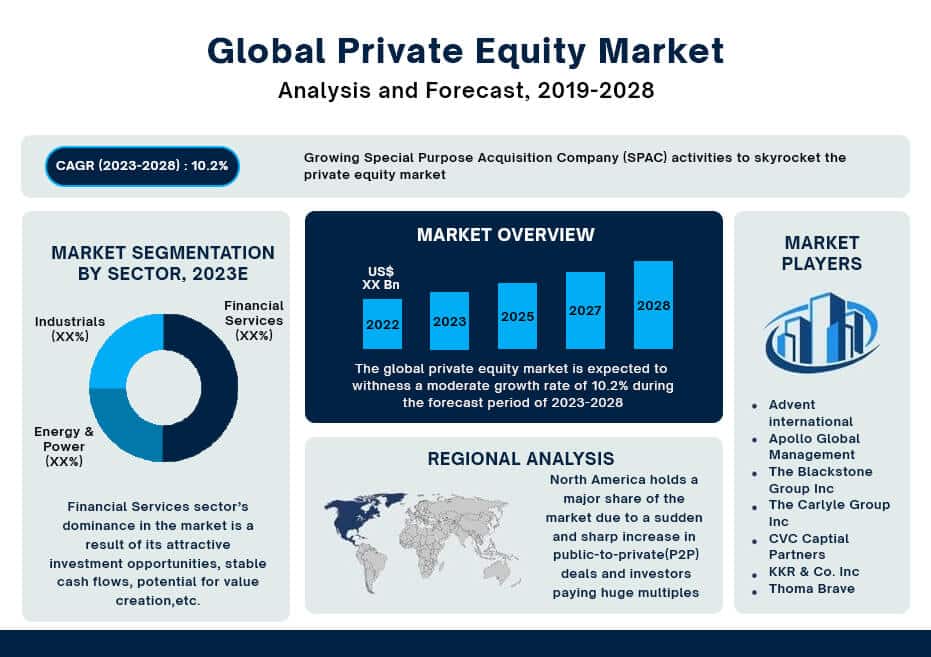

The global private equity sector, valued at a staggering US$ 655B in 2022, represents a dynamic industry characterized by investments in non-public enterprises via privately arranged deals, resulting in the establishment of private ownership structures for businesses. Over the past three decades, this sector has witnessed remarkable growth. In the early 1970s, only a handful of firms raised private equity funds. Today, there are more than a thousand active private equity firms and even Private Equity tokenization is in full swings. According to a report by rationalstat the global private equity market is anticipated to grow at a CAGR of 10.2% between 2022-2028.

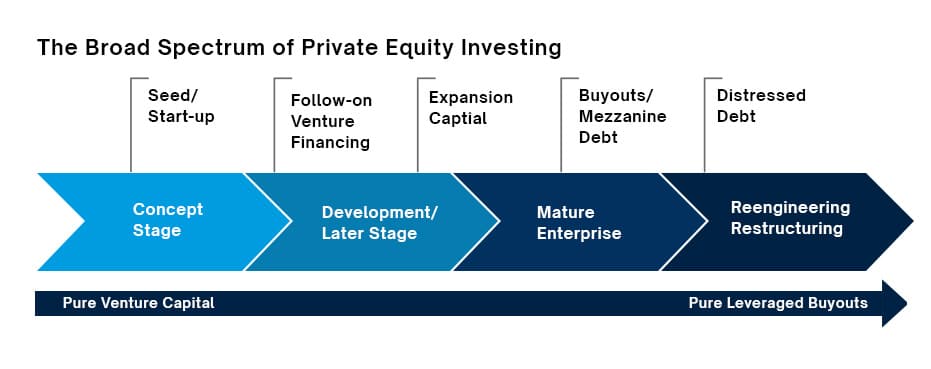

Although the predominant focus of private equity transactions is on investments in privately held firms, the spectrum of involvement can be quite diverse. It encompasses activities such as providing funding to startups, injecting growth capital into expanding enterprises, and acquiring well-established public or private companies, irrespective of their maturity level. A common thread in most private equity investments is that the investor consortium frequently attains a substantial or influential ownership position within the target company. These positions are typically secured through meticulously structured and negotiated agreements.

Demystifying Private Equity: How Private Equity Works

Private equity is a dynamic and often mysterious realm of finance that plays a vital role in shaping the business landscape. Behind the scenes, private equity firms work diligently to acquire, transform, and ultimately monetize businesses, often yielding substantial returns. In this blog, we’ll demystify private equity by exploring how it works, the key mechanisms that drive this industry, and tokenization in private equity.

What is Private Equity?

Private equity is a form of investment that involves directly investing in private companies, typically through privately negotiated transactions. These investments result in the private ownership of businesses. Private equity firms pool capital from various investors, including institutional investors, high-net-worth individuals, and even pension funds. They then use this capital to acquire, invest in, or provide financing to businesses. With the changing technology, tokenized private equity funds are gaining traction as well.

Four common subclasses of private equity are:

- Venture Capital

- Leveraged Buyout

- Mezzanine Debt

- Distressed Debt

Venture Capital

The VC Ecosystem:

At its core, venture capital involves financial investment in early-stage or emerging companies with significant growth potential. This critical funding source typically comes from VC firms, high-net-worth individuals, or corporate investors. These investors, often referred to as venture capitalists, pool their resources to provide startups with the capital they need to launch, expand, or scale their operations.

Key Aspects of Venture Capital:

- Risk and Reward: Venture capital investments are inherently risky. Many startups fail, but the ones that succeed can yield substantial returns. VC investors accept these risks in exchange for the possibility of significant rewards.

- Early-Stage Funding: VC firms often focus on startups in their early stages, typically during the seed or series A funding rounds. This critical capital injection helps entrepreneurs turn their concepts into tangible products or services.

- Expertise and Mentorship: Beyond capital, venture capitalists often provide valuable expertise, mentorship, and access to their networks. This support can be instrumental in a startup’s success.

- Exit Strategies: VC investors expect a profitable exit, typically through an initial public offering (IPO) or acquisition by a larger company. These exits generate returns for investors and help fund future startups.

- Diverse Portfolio: To manage risk, VC firms maintain diversified portfolios, investing in a range of startups across different industries and sectors.

Venture Capital in Action:

Venture capital has played a crucial role in the success stories of many tech giants we know today. Companies like Apple, Google, Amazon, and Facebook all received early-stage funding from venture capitalists, enabling them to transform into industry leaders.

Leveraged Buyout

Leveraged Buyout (LBO) is a financial strategy that plays a pivotal role in reshaping the corporate landscape. It involves the acquisition of a company, typically a publicly traded one, using a significant amount of debt or leverage. The LBO process is characterized by meticulous financial engineering and an intricate interplay of capital sources, with the ultimate goal of transforming the target company’s ownership structure.

Key Aspects of Leveraged Buyout (LBO):

- Debt-Centric Financing: LBOs rely heavily on borrowed capital, often secured by the assets and cash flows of the target company. This debt financing enables the acquirer to assume control with a comparatively modest equity investment.

- Private Ownership: Following a successful LBO, the target company transitions from being publicly traded to private ownership. This change offers greater flexibility, confidentiality, and insulation from the demands of public shareholders.

- Risk and Reward: LBOs are inherently high-risk, high-reward endeavors. While the debt-heavy approach can amplify returns on investment if executed astutely, it also elevates the risk of financial distress if the business doesn’t perform as anticipated.

- Operational Transformation: LBO firms often embark on comprehensive operational improvements within the acquired company. These may include cost-cutting measures, restructuring, and growth initiatives to enhance profitability.

- Exit Strategies: LBO investors generally have a predefined exit strategy. This can entail selling the company to another entity, taking it public again through an IPO, or even executing a secondary LBO, among other options.

Leveraged Buyout in Action:

LBOs have been instrumental in the transformation of numerous iconic companies. One of the most famous LBOs was the acquisition of RJR Nabisco in the late 1980s, chronicled in the book and film “Barbarians at the Gate.” This landmark deal underscored the influence of LBOs in shaping corporate destinies.

Mezzanine Debt

Mezzanine debt, a hybrid financial instrument, occupies a unique space in the world of corporate finance, serving as a versatile bridge between traditional debt and equity. It plays a pivotal role in funding growth, acquisitions, and other strategic initiatives for companies seeking a flexible and strategic capital infusion.

Key Aspects of Mezzanine Debt:

- Hybrid Nature: Mezzanine debt combines elements of both debt and equity. It typically includes features such as subordinated debt, convertible debt, or equity warrants.

- Risk and Return: Mezzanine debt is inherently riskier than traditional senior debt but less risky than equity. Investors demand higher returns to compensate for the elevated risk profile.

- Flexible Terms: Mezzanine financing offers greater flexibility in terms of repayment schedules, interest rates, and conversion options. This flexibility aligns with the unique needs of the borrowing company.

- Use Cases: Mezzanine debt is often used to finance expansion, acquisitions, management buyouts, and recapitalizations. It can fill the financial gap when traditional loans fall short.

- Subordination: Mezzanine debt ranks lower in priority than senior debt in the event of bankruptcy or liquidation. This subordination reflects its higher risk profile.

Mezzanine Debt in Action:

Companies across various industries have leveraged mezzanine debt to fuel their growth and strategic initiatives. It has been particularly valuable for mid-sized firms seeking capital for acquisitions or expansion when conventional bank loans may not provide sufficient funds.

The Private Equity Lifecycle

Private equity investments follow a distinct lifecycle, typically consisting of the following phases:

Fundraising

Private equity firms start by raising capital from investors to create a fund. These funds can range from hundreds of millions to billions of dollars, depending on the firm’s size and focus. Investors commit their capital to the fund with the expectation of earning a return.

Deal Sourcing

Once a fund is established, the private equity firm identifies potential investment opportunities. This involves extensive research and due diligence to select businesses that align with the fund’s investment strategy.

Acquisition

After identifying a suitable target, the private equity firm negotiates the terms of the acquisition. This often involves purchasing a controlling stake in the target company, which grants the private equity firm significant influence over its operations.

Value Creation

Once the acquisition is complete, the private equity firm works closely with the management team to enhance the target company’s performance. This may involve strategic changes, operational improvements, cost reductions, and growth initiatives.

Exit

The ultimate goal of private equity is to generate returns for investors. This is typically achieved through an exit strategy, which can take various forms:

- IPO (Initial Public Offering): Taking the company public through an IPO allows the private equity firm to sell its shares on the public market.

- Sale to Another Entity: The company may be sold to another corporation, private equity firm, or strategic buyer.

- Secondary Buyout: Another private equity firm may acquire the business from the original private equity investor.

- Recapitalization: A portion of the business may be sold, or debt may be used to return capital to investors while maintaining ownership.

Key Mechanics of Private Equity

Understanding how private equity works involves grasping several key mechanics:

1. Capital Structure Optimization

Private equity firms often assess and optimize the target company’s capital structure. This may involve refinancing debt, reducing interest costs, and improving the overall financial health of the business.

2. Active Management

Private equity investors take an active role in the companies they acquire. They work closely with management teams to implement strategic changes, introduce operational efficiencies, and drive growth.

3. Exit Planning

The timing and method of exiting an investment are critical considerations. Private equity firms carefully evaluate market conditions and the company’s performance to determine the most opportune moment to exit.

4. Risk Mitigation

Private equity investments carry inherent risks, including market volatility and business-specific challenges. Private equity firms employ various risk mitigation strategies to protect investors’ capital and optimize returns.

5. Portfolio Diversification

To spread risk, private equity firms often maintain diverse portfolios with investments across various industries and stages of development. This diversification helps balance risk and potential returns.

Private Equity Tokenization

Tokenizing private equity involves converting ownership rights in private companies or investment funds into digital tokens that are recorded on a blockchain. This process can enhance liquidity, lower barriers to entry, and streamline investment management. Here’s a detailed step-by-step process for private equity tokenization:

Step 1: Regulatory Compliance

- Legal Framework Analysis: Start by conducting a thorough legal analysis to understand the regulatory environment in the jurisdiction where the private equity assets are based. Different countries have varying rules for securities and token offerings.

- Legal Structuring: Work with legal experts to determine the most suitable legal structure for the tokenized private equity, such as a Security Token Offering (STO), Reg D, or Reg S compliant offering.

Step 2: Asset Selection and Due Diligence

- Select Assets: Choose the private equity assets that you want to tokenize. This could be a private company, a venture capital fund, or any other equity-based investment.

- Due Diligence: Conduct thorough due diligence on the selected assets to assess their financial health, ownership structure, legal compliance, and any potential risks.

Step 3: Tokenization Platform Selection

- Choose a Blockchain: Select a blockchain platform that suits your requirements. Ethereum is a popular choice, but other platforms like Tezos and Binance Smart Chain are also viable options.

- Token Standards: Decide on the token standard to be used. Security Token Standards like ERC-20, ERC-1400, or ST-20 are commonly used for private equity tokenization.

Step 4: Smart Contract Development

- Smart Contract Creation: Develop smart contracts that represent the ownership rights of private equity assets. These smart contracts should comply with local securities regulations.

- Custody Solutions: Implement secure custody solutions to safeguard the digital assets and protect them from theft or loss.

Step 5: Token Generation

- Token Issuance: Generate digital tokens that represent the ownership of the private equity. Each token corresponds to a specific ownership stake, and their value is derived from the underlying assets.

- Compliance and KYC/AML: Implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to ensure compliance with regulations.

Step 6: Offering and Distribution

- Private Placement: Depending on regulatory requirements, offer the tokenized private equity to accredited investors through a private placement memorandum (PPM).

- Marketing and Investor Relations: Promote the private equity tokens to potential investors through marketing campaigns and maintain strong investor relations.

Step 7: Trading and Liquidity

- Secondary Market Listing: To enhance liquidity and provide investors with exit options, consider listing the private equity tokens on security token exchanges or secondary trading platforms that comply with regulatory requirements.

- Trading Regulations: Ensure that the secondary market trading of the tokens adheres to securities regulations in relevant jurisdictions. Implement trading restrictions if necessary.

Step 8: Asset Management and Reporting

- Asset Management: Continuously manage the underlying private equity assets, making strategic decisions that benefit token holders, such as dividends, profit distributions, or voting rights.

- Reporting and Transparency: Provide regular financial reports and updates to token holders to maintain transparency and trust in the asset’s performance.

Step 9: Governance and Decision-Making

- Governance Framework: Implement governance mechanisms that allow token holders to participate in decision-making processes regarding the asset, such as voting on key proposals or changes in the investment strategy.

Step 10: Regulatory Compliance and Maintenance

- Ongoing Compliance: Stay vigilant about evolving regulatory requirements and adapt the tokenization structure and processes accordingly to remain compliant.

- Security and Maintenance: Conduct regular security audits and maintain the smart contracts and infrastructure to ensure the security and functionality of the tokenized assets.

Step 11: Exit Strategy

- Plan for Exits: Develop a clear exit strategy for investors, which may involve options such as secondary market sales, buybacks, or asset liquidation, depending on the asset’s performance and investor preferences.

Step 12: Investor Relations

- Investor Communication: Maintain open and effective communication channels with token holders. Address their inquiries, concerns, and feedback promptly to build trust.

Benefits of Tokenized Private Equity

Here are some of the benefits of tokenization in private equity:

Increased Liquidity

Tokenized private equity can be traded on exchanges like stocks, making it more liquid than traditional private equity. This could make it easier for investors to enter and exit the market.

Fractional Ownership

Tokenized private equity can make fractional ownership of private equity funds more accessible. This means that people could invest in smaller portions of funds, rather than having to invest large sums of money. This could open up investing in private equity to a wider range of people.

New Investment Opportunities

Tokenized private equity could open up new investment opportunities in the private equity market. For example, investors could invest in international private equity funds or funds that invest in niche markets. This could make private equity more attractive to investors.

More Efficient Transactions

Tokenized private equity could make private equity transactions more efficient and less expensive. This is because tokens can be transferred directly between buyers and sellers without the need for intermediaries. This could save buyers and sellers time and money.

More Transparency

Tokenized private equity could make the private equity market more transparent. This is because all of the information about a fund and its investments can be stored on the blockchain. This could make it easier for investors to make informed decisions and reduce the risk of fraud.

Tokenized Private Equity Examples

Here are some examples of tokenized private equity:

- Quadrant Biosciences was one of the first companies to tokenize its private equity. In 2018, the company raised over $13 million by issuing Quadrant Tokens, which represented 17% of the company’s diluted equity.

- BFToken is a tokenized private equity fund that invests in early stage blockchain and crypto companies. The fund raised over $100 million in its initial token offering (ITO) in 2018.

- The Elephant Private Equity Coin is a tokenized private equity fund that invests in micro-cap companies with high growth potential. The fund raised over $30 million in its ITO in 2019.

- Securitize is a platform that allows companies to tokenize their assets and securities. In 2020, Securitize partnered with real estate firm Rialto Capital to launch a tokenized private equity fund that invests in commercial real estate.

- Tokeny is another platform that allows companies to tokenize their assets and securities. In 2021, Tokeny partnered with asset manager Covario Capital to launch a tokenized private equity fund that invests in a diversified portfolio of assets.

Get Obligation Free Quote

[widget id=”custom_html-3″]

Conclusion

Private equity is a dynamic and influential force in the world of finance and business. It involves a structured lifecycle, from fundraising to exit planning, and employs various strategies to create value and generate returns for investors. Private equity tokenization has opened the world of opportunities for investors. Want to delve into Tokenization Platform Development for private equity? Get in touch with Antier, the top Tokenization Platform Development Company for cutting-edge solutions.