Understanding Triangular Arbitrage Bot and its Benefits

March 15, 2024

How Developing a White Label Arbitrage Trading Bot Saves Your Time & Money?

March 18, 2024In the rapidly evolving landscape of finance and investment, traditional models are giving way to innovative approaches that leverage blockchain technology and tokenization. Real-world asset tokenization has taken the world by storm. The size of the tokenized asset market is projected to reach $16.1 trillion by 2030. There are many assets that can be tokenized; two prominent investment avenues, hedge funds and venture capital, have seen significant transformation through tokenization. This blog aims to delve into the nuances of hedge fund tokenization and venture capital, highlighting their differences, advantages, and considerations for investors.

Understanding Hedge Fund Tokenization

Hedge funds, known for their flexibility and active management strategies, have traditionally catered to high-net-worth individuals and institutional investors. With the advent of tokenization, hedge funds are undergoing a transformation, allowing for fractional ownership of fund assets through digital tokens. Hedge fund tokenization offers several advantages, including increased liquidity, lower barriers to entry, and enhanced transparency through blockchain-based smart contracts. Investors can access diversified portfolios and actively manage their investments while enjoying the benefits of tokenization, such as instant settlement and automated compliance.

Strengths:

- Seasoned Leadership: Hedge funds are typically helmed by experienced fund managers with proven track records in generating alpha (returns exceeding market benchmarks).

- Diversification Arsenal: They employ diverse strategies across various asset classes (stocks, bonds, commodities, derivatives) potentially mitigating risk while maximizing potential returns.

- Partial Transparency: Hedge funds typically provide regular reports to investors, offering some level of insight into their performance and investment strategies.

Exploring Venture Capital

Venture capital (VC) plays a crucial role in funding early-stage startups and innovative projects with high growth potential. VC firms typically invest in private companies in exchange for equity stakes, providing capital and strategic support to fuel their growth. Unlike hedge funds, venture capital has traditionally been less accessible to retail investors due to regulatory constraints and high investment minimums. However, with the emergence of tokenization, venture capital is becoming more inclusive, allowing retail investors to participate in early-stage funding rounds through tokenized securities. This democratization of venture capital enables a broader pool of investors to access promising startups and potentially lucrative investment opportunities.

Strengths:

- High Growth Potential: VC investments offer the possibility of outsized returns if a startup succeeds in disrupting its market and achieving significant growth.

- Active Support System: VC firms often provide valuable support to portfolio companies, including mentorship, strategic guidance, and access to their network of industry experts.

- Driving Innovation: VC funding plays a vital role in fueling technological advancements and fostering the next generation of groundbreaking companies.

Comparing Hedge Fund Tokenization and Venture Capital Tokenization

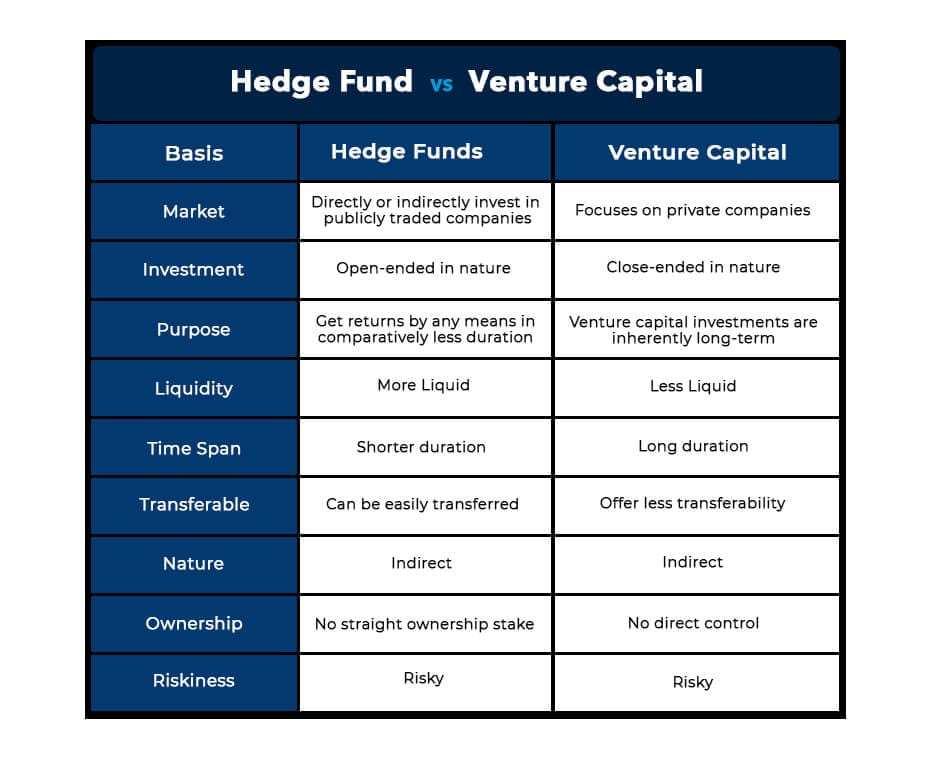

While both hedge fund tokenization and venture capital offer opportunities for investors to diversify their portfolios and potentially generate attractive returns, they differ in several key aspects:

Investment Focus:

- Hedge Fund Tokenization: Hedge funds typically employ diverse investment strategies, including long-short equity, arbitrage, and quantitative trading, with the aim of generating consistent returns regardless of market conditions.

- Venture Capital: Venture capital focuses on financing early-stage companies with disruptive technologies or innovative business models, aiming for substantial growth and eventual exit through acquisition or initial public offering (IPO).

Investment Horizon:

- Hedge Fund Tokenization: Hedge funds often have shorter investment horizons, with the flexibility to adjust their portfolios based on market dynamics and investment opportunities.

- Venture Capital: Venture capital investments are long-term in nature, with investors expecting significant returns over several years as startups mature and achieve milestones.

Risk Profile:

- Hedge Fund Tokenization: Hedge funds may employ leverage and derivative instruments to enhance returns, resulting in higher volatility and risk compared to traditional investment vehicles.

- Venture Capital: Venture capital investments are inherently risky, with a high likelihood of failure for early-stage startups. However, successful investments can yield substantial returns, making venture capital an attractive asset class for risk-tolerant investors.

Benefits of Tokenizing Hedge Funds and Venture Capital Investments

There are several benefits of tokenizing hedge funds and venture capital investments, such as:

Increased Liquidity

Tokenization allows investors to trade their investment tokens more easily and efficiently on secondary markets, providing liquidity that traditional investments may lack.

Access to a Larger Investor Base

Tokenization can attract a broader range of investors, including retail investors who may not have had access to these investment opportunities before.

Fractional Ownership

Tokenization enables fractional ownership of hedge funds and venture capital investments, allowing investors to diversify their portfolios with smaller amounts of capital.

Transparency and Security

Blockchain technology provides a transparent and secure record of ownership and transactions, reducing the risk of fraud and improving trust among investors.

Lower Costs

Tokenization can potentially reduce administrative costs associated with traditional investment structures, such as paperwork, legal fees, and intermediary expenses.

Automated Compliance: Smart contracts can automate compliance with regulatory requirements, ensuring that transactions adhere to legal standards and reducing the burden on fund managers.

Hedge Fund Tokenization vs. Venture Capital: Choosing Your Champion

The choice between tokenized hedge funds and venture capital depends on your investment goals and risk tolerance:

- Seeking Diversification & Steady Returns: Consider tokenized hedge funds with a focus on lower-risk strategies that aim to generate consistent, predictable returns.

- Embracing High Risk for High Rewards: Venture capital might be more suitable if you’re comfortable with a higher degree of risk in exchange for the potential of outsized returns from successful startups.

- Liquidity Matters: Invest in tokenized hedge funds for easier entry and exit.

To know about the global regulatory landscape for tokenization, give this blog a read!

Conclusion

In conclusion, hedge fund tokenization and venture capital represent distinct yet complementary investment opportunities in the evolving landscape of finance. Hedge fund tokenization offers liquidity, transparency, and flexibility, while venture capital provides access to high-growth startups and disruptive technologies. By understanding the differences and considerations associated with each investment avenue, investors can make informed decisions to diversify their portfolios and capitalize on emerging opportunities in the digital economy.

Want to build a tokenization platform that provides exceptional user-experience? Get in touch with Antier to discuss your requirements!