The cryptocurrency world is opening attractive income opportunities and has made payments accessible irrespective of geographical boundaries. All this has become possible due to Decentralized Finance. DeFi has brought innovations in the crypto and blockchain world and has garnered the attention of numerous crypto investors and blockchain enthusiasts. Not only this, both start-ups and established investors are entering this remunerative industry by taking advantage of DeFi wallet development to enhance their earning prospects. This segment will be successful in the years to come. DeFi is decentralized and permissionless and brings numerous benefits to those in the financial segment. Users are seeking safe and secure wallet solutions that are provided by DeFi protocols that give the best of upgraded security features and offer complete control over the assets.

Both businesses and investors can pave the way to this remunerative segment and use these applications to access every segment of the financial industry, including loans, insurance, savings, and also trading, just with a single click using DeFi applications. Furthermore, these enthusiasts have started focussing on DeFi wallet development to thrive in the DeFi world. However, before creating a wallet, it is vital to understand how DeFi wallets work, the difference between DeFi and traditional wallets, and the step-by-step process of developing a DeFi wallet.

Before moving ahead, let us understand DeFi wallets in detail:

History of DeFi Wallet

The history of the DeFi wallet commences with Bitcoin. However, the drawbacks offered by Bitcoin programming language with script allowed developers to create expanded applications via Blockchain.

In the present times, they are integrated with dApps and decentralized protocols. Initially, DeFi crypto wallets were slow and simple. Bitcoin qt, which was introduced as the first Bitcoin wallet in history, was supposed to be downloaded before connecting it with other applications.

An Insight into DeFi Wallet

Users can work smoothly and efficiently within a DeFi convention using a DeFi wallet. This wallet helps users store and manage crypto assets safely using public and private keys. These keys offer security to prevent hacks or breaches. A safe DeFi wallet must be considered while applying for loans, trading tokens, enhancing liquidity, and performing other tasks. Also, DeFi is open source, permissionless, and operates without any third-party intervention, making them the preferred choice of global entrepreneurs.

One can create financial and banking systems with DeFi crypto wallets that provide complete transparency, security, accessibility, and, most importantly, freedom. The entire control of the funds is in the hands of the users, and this feature helped them widen their reach in the crypto space.

DeFi Wallets: An Integral Aspect of DeFi Ecosystem

DeFi wallets increase the likelihood of survival within the DeFi ecosystem. In the case of centralized systems, users relied on banks or custodial wallets that were susceptible to security risks. DeFi wallets have eliminated these issues as they have helped users conveniently perform financial functions and have implemented the idea of “Being their Own Bank.” Furthermore, third parties do not regulate them, so it provides complete accessibility, transparency, and freedom to the users.

These are multi-purpose wallets that allow users to buy, sell, and trade and foster dApp communication, financing, loans, and exchange. In addition, the introduction of wallets paved the way for innovation, as banks were solely responsible for managing the funds earlier.

These wallets are developed on popular Blockchain like Ethereum and hold other tokens, including ETH, ERC – 20, and ERC- 721. Furthermore, the users don’t have to enter any personal or background information to ensure its confidentiality. However, the users must note that recovering the login data can be risky once lost.

DeFi Crypto Wallet Vs. Traditional Wallet

Decentralized wallets allow users to manage their funds how they want. These features weren’t provided by centralized systems like banks and financial institutions and provided limited power to the users. Let us explore the differences between a DeFi crypto wallet and a traditional wallet.

Crucial Components of a DeFi Crypto Wallet

First, obtain insights into the wallet’s characteristics and keys. After that, determine the wallet solutions you want to implement during the process of DeFi wallet Development. No matter how many features are integrated within the wallet, the emphasis is on functionality and ease of use. Also, Below is the list of key features that you can incorporate into your wallet:

- Opt Non-Custodial Options

Non-custodial options provide complete ownership over the assets as funds won’t be handled by third-party. Therefore, preference must be given to non-custodial options.

- No Separate Wallet Integration Needed

DeFi wallets can be integrated with other platforms in a hassle-free manner. Moreover, due to in-built features, customers can swap the tokens without any hassle.

Develop your own DeFi Wallet

Schedule Free Demo- Key-Based Transactions

Transactions can be performed and processed via private keys.

- Seamless Compatibility

One can integrate DeFi wallets with web3 wallets and access them via smartphones.

- Immune from Breaches

Wallets are free from security threats and breaches, enhancing security and helping users control their funds the way they want.

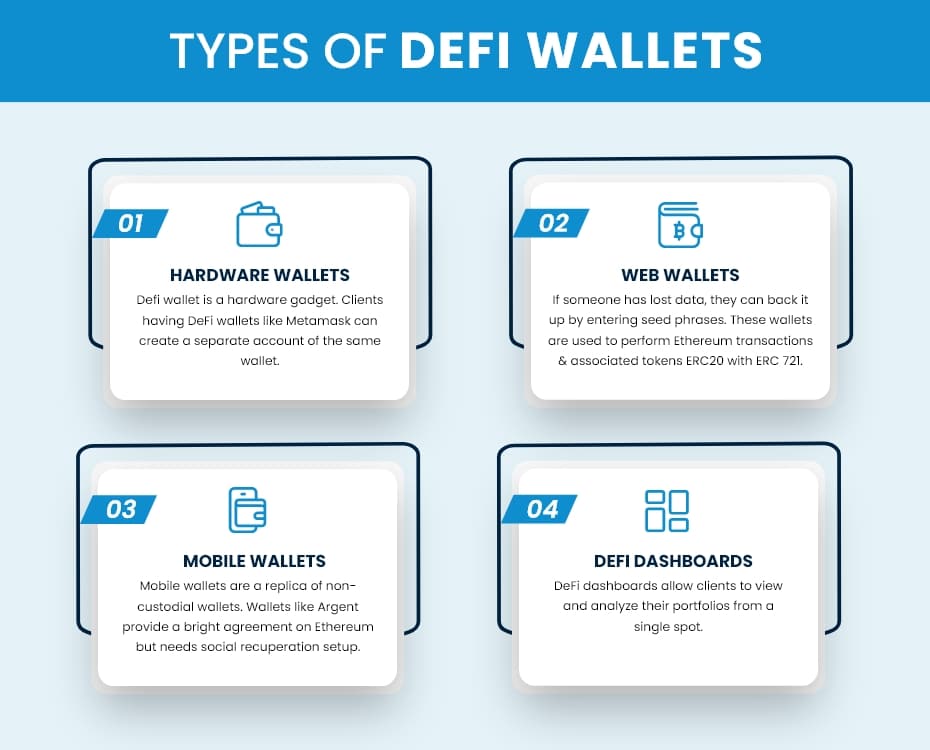

Types of DeFi Wallets

DeFi wallets have been divided into different categories that are listed below:

- Web Wallets

- Hardware Wallet

- Mobile Wallets

- DeFi Dashboards

1. Web Wallets

Web wallets are accessed using private keys, and data can be backed up using seed phrases. One such example of a wallet is the Metamask wallet which helps users access different DeFi applications and helps to access ETH and ERC -20 and ERC-721 tokens. However, if the user misplaces the private key, accessing the DeFi wallet might become a concern.

2. Hardware Wallets

This type of wallet is placed on a hardware device and can be used to store several assets. One can enter these wallets using private keys. This wallet offers an extra benefit in the case of Metamask, i.e., you can set up a separate account for the same wallet.

3. Mobile Wallets

Mobile wallets are a kind of non-custodial wallets as handling the funds is the responsibility of the users. It is integrated with smart contract functionality on Ethereum and gives control to the users. Also, these wallets allow users to freeze their funds and set transfer limits at their convenience.

4. DeFi Dashboards

Users can see their combined collections of their earnings on DeFi dashboards. In addition, other wallets can be connected via these dashboards so that financial transactions can be initiated seamlessly.

DeFi Wallets Solutions Businesses and Investors Must Consider :-

- Metamask

Metamask wallet can be accessed from any internet device and plays a significant role across all applications and industries. All this has been possible because of the plugin system. This wallet renders support to the DeFi ecosystem, ENS compatibility, and wallet-readiness for mobile devices and enables faster transactions.

- Coinbase Wallet

The wallet has transformed the way people buy and sell cryptocurrencies. Users don’t have to manage their funds but can still store their cryptos safely. Interacting with decentralized applications has become simpler with this solution. All the transactions on the wallet are performed using public keys. The biggest benefit of using this wallet is that it helps users enjoy seamless transfers between the applications and off-ramp platforms provided by the users.

- Argent

Argent provides free transactions and a simple address free from paper backups. Crypto accessibility is one of the most significant features that the wallet provides without putting functionality at stake. The stunning designs offered by the application aim to offer users an exhilarating experience. It is free from transaction fees and doesn’t require ETH storage to carry out the transactions.

Step-By-Step Wallet Set-Up Process with Usage :-

Step1: Determine the Problem and Set Objectives

Initially, determine whether a DeFi crypto wallet will resolve an issue or will be handled by a particular Blockchain. If you cannot determine it by yourself, hiring a business analyst from a reputed DeFi wallet development company will be the best course of action.

Step 2: Design an Architecture

Choose a framework where you want to keep your DeFi wallet: in-house, hybrid, or cloud. Also, find a suitable accessibility solution from private, permissionless, public, or hybrid. For example, a private approach might prove profitable and an ideal approach for your decentralized wallet.

Step 3: Selecting a Consensus Mechanism

The consensus mechanism is divided into two categories: Proof of Stake and Proof of work. The transactions are authenticated using these mechanisms. You can get recommendations from a trusted Blockchain developer who can recommend an optimum consensus mechanism for your DeFi wallet.

Step 4: Select the Right Blockchain Platform

Choose a Blockchain platform considering parameters like stability, budget, and requirements. Alternatively, you can go for options like Ethereum, which has become a preferred choice of global businesses. Also, the cost of DeFi wallet development enables transactions promptly.

DeFi Wallet: Transforming Lives and Its Scope in Future

Only DeFi crypto wallets will make the DeFi ecosystem successful. These help users handle their digital assets securely and help them connect with other DeFi apps. They will be considered a better alternative than traditional banking systems. DeFi will be ruling the financial segment in the future and will be an ideal replacement for centralized systems.

Antier: Create your Wallet with a Prominent DeFi wallet Development Company

Commence your DeFi wallet development journey with leading Blockchain firm Antier. We will streamline your journey and help you reach your goals. We provide highly secure and scalable DeFi wallet solutions that enable users to have complete control over their funds. Moreover, they will launch the wallet in the least amount of time and provide post-deployment services so that the application runs seamlessly.

Discuss your business requirements with our subject matter experts today!