DeFi Staking Development - Passive Income Opportunities

Taking part in DeFi staking allows the generation of passive income, thereby proving to be beneficial. In DeFi staking users contribute their tokens to a common pool and the ones who possess a greater number of staked tokens have increased chances of being selected by the algorithm, even though the node selection is itself random in nature.

Proof-of-stake happens to be the main technique used by DeFi and the most popular PoS consensus mechanism is Ethereum. In this regard, DeFi staking platform development is the ideal solution for people looking forward to earning additional profits. Get in touch with our expert team to craft a customized and feature-rich staking platform.

DID YOU KNOW!

According to DeFi Pulse, more than 13.62 billion dollars has been locked in the decentralized ecosystem globally.

Our DeFi Staking Platform Development Services

As a premium DeFi staking platform development company, we offer a wide range of services and solutions to appropriately cater to the needs of users.

Build Your Own Staking Platform with Our Team

Benefits of DeFi Staking Platform Development

Let us browse through the benefits of DeFi staking platform development

Popular Tokens Operating in the DeFi Ecosystem

Get Ready to Build Your Own Customized DeFi Staking Platform Today

A Few Use Cases of DeFi Staking

Check out a few of the use cases of DeFi staking.

Why Choose Antier as a DeFi Staking Platform Development Company?

Antier is a top-rated DeFi staking development company suitably catering to the varied needs of different DeFi projects, thereby ensuring complete satisfaction among all. Here are a few benefits you get when you choose us to build your DeFi yield farming platform.

Our Partners

Frequently Asked Questions

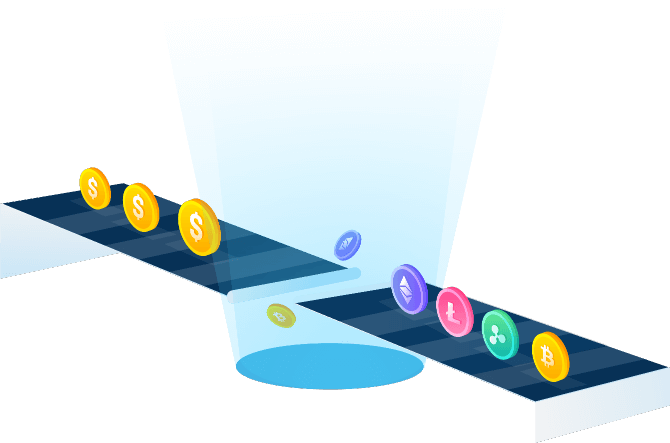

Staking in DeFi protocol - Here investors can lock their tokens in a DeFi protocol and get interest in return which is referred to as yields.

Yield farming - In this case, crypto investors become liquidity providers by depositing funds in liquidity for the purpose of providing liquidity to other users.

Rebase rewards for staking - Here the token holders need to stake their tokens to receive a representative token of a specific platform representing rebases. Rebase staking enhances the total number of tokens in circulation.

Liquid staking - Liquid staking protocols issue liquid staking tokens or LSTs, which are used to provide staking returns. Investors need to deposit ETH, withdraw LST, and keep it for earning rewards.

Refraction staking reward - It is a special mechanism or feature on a staking platform that rewards particular users from its stakeholders depending on the algorithm of the platform.

Annual percentage rate or APR

Annual percentage yield or APY