Strategic DeFi Lending Platform Development Services

The DeFi market has gained a lot of momentum over the past few years. DeFi lending and borrowing happens to be one of the major contributing factors to this rising market. Start-ups as well as enterprises across the globe are capitalizing on the opportunity to tap into the million-dollar DeFi market by launching their DeFi lending and borrowing platform.

If you are a start-up or an already established company looking forward to riding the next wave of DeFi, let our team of proficient DeFi experts help navigate your journey. Our team has a sheer level of expertise to craft DeFi lending platforms fortified with market-leading features to deliver top-notch performance that aligns with your business needs.

DID YOU KNOW!

As of March 2023, there are about 220,000 active borrowers and 840,000 active lenders on DeFi lending & borrowing platforms according to a report from DeFi Pulse..

Our DeFi Lending Platform Development Services

As a premium DeFi lending platform development company, we offer a wide range of services and solutions to appropriately cater to the needs of users.

Get Ready to Build Your Own Customized DeFi Lending Platform Today

Features of Our DeFi Lending Platforms

The meticulously crafted DeFi lending/borrowing platforms by our team come with the following useful features.

DID YOU KNOW!

According to a report from Statista, the revenue of the DeFi market is expected to reach USD 16,960 million in 2023 with a compound annual growth rate or CAGR of 19.60% from 2023-2027, thereby resulting in a projected total amount of USD 34,700 million by 2027.

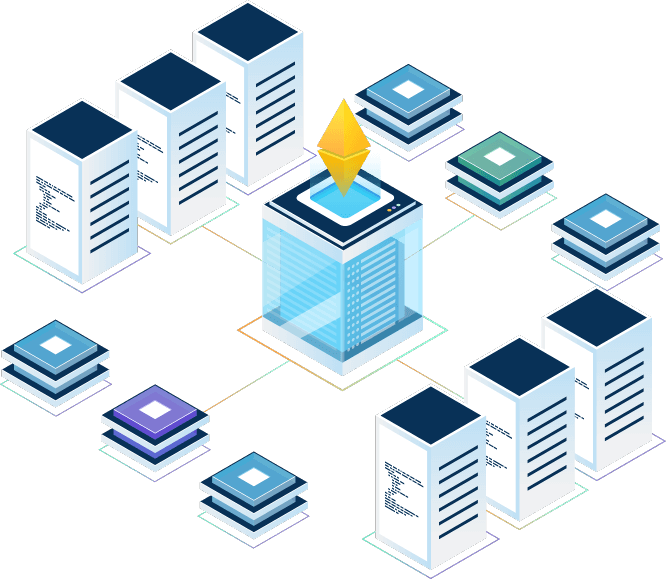

Working Process of DeFi Lending Platforms

DeFi lending platforms work seamlessly as the presence of smart contracts eliminates the need for intermediaries and facilitates automated

transactions, making it a cost-effective solution.

Working Process of DeFi Borrowing Platforms

The borrowing process in DeFi is much simpler as compared to the traditional borrowing system which is time-consuming and has elevated rates of

interest, thereby making it difficult for the borrowers.

Features of Our DeFi Lending Platforms

The meticulously crafted DeFi lending/borrowing platforms by our team come with the following useful features.

Are You Ready to Discuss Your DeFi Lending Platform Development Project with Us?

Why Choose Antier as a DeFi Yield Farming Development Services Company?

Antier is a top-rated DeFi yield farming development company appropriately catering to the varied requirements of different projects, thereby ensuring complete satisfaction among all. Here are a few benefits you get when you choose us to build your DeFi yield farming platform.