Table of Content

- Introduction

- Market Overview: Flash Loan Bots & Polygon Ecosystem

- Features of Crypto Flash Loan Arbitrage Bot Polygon

- Types of Flash Loan Crypto Arbitrage Bots

- Benefits of Flash Loan Arbitrage bot Polygon

- Conclusion

Introduction

Let’s begin with a quick recap of what crypto flash loan arbitrage bots are. These groundbreaking technological innovations have made collateral-free loans possible in the world of crypto and arbitrage. The spectacular bots exploit market inefficiencies to yield substantial profits sans significant investments, all within seconds.

Flash loan crypto arbitrage bots have gained colossal popularity due to their ability to borrow and repay loans within the same transaction. This distinctive feature amplifies profit-making from arbitrage trading, making the bot more desirable for traders and institutional investors alike. Tapping into the momentum, businesses benefit from the frenzy around these bots by setting up tailored crypto flash loan arbitrage bot solutions for their customers.

Market Overview: Flash Loan Bots & Polygon Ecosystem

Before going headfirst into the convergence of these two technologies, one must learn comprehensively about these revolutionary concepts. Flash loans have emerged as powerful tools, reshaping how traders leverage opportunities within the dynamic crypto markets. Meanwhile, the polygon ecosystem (formerly known as the Matic Network) has garnered significant attention for enhancing scalability and interoperability within the Ethereum network. Crypto flash loan arbitrage bot have evolved into a groundbreaking invention for traders seeking to generate substantial profits from quick transactions with minimal capital investment. They leverage smart contracts to exploit price differentials and execute profitable trades across multiple decentralized exchanges (or DEXs). Flash loan Crypto arbitrage bots don’t just fuel the demand for algorithmic strategy automation tools through their profit-making but also impact market dynamics by facilitating efficient price discovery and liquidity provision.

Polygon, with its high transaction speed and low fees, becomes the perfect playground for flash loan arbitrage bot polygon solutions to operate efficiently. Polygon has evolved as a leading layer 2 solution for Ethereum, leveraging sidechains, plasma chains, and other scaling solutions to address scalability limitations and foster seamless interoperability with decentralized applications (dApps) and smart contracts. The exponential growth of the polygon ecosystem is attributed to a vibrant community of developers committed to leveraging its scalability, enhanced throughput, and reduced transaction fees.

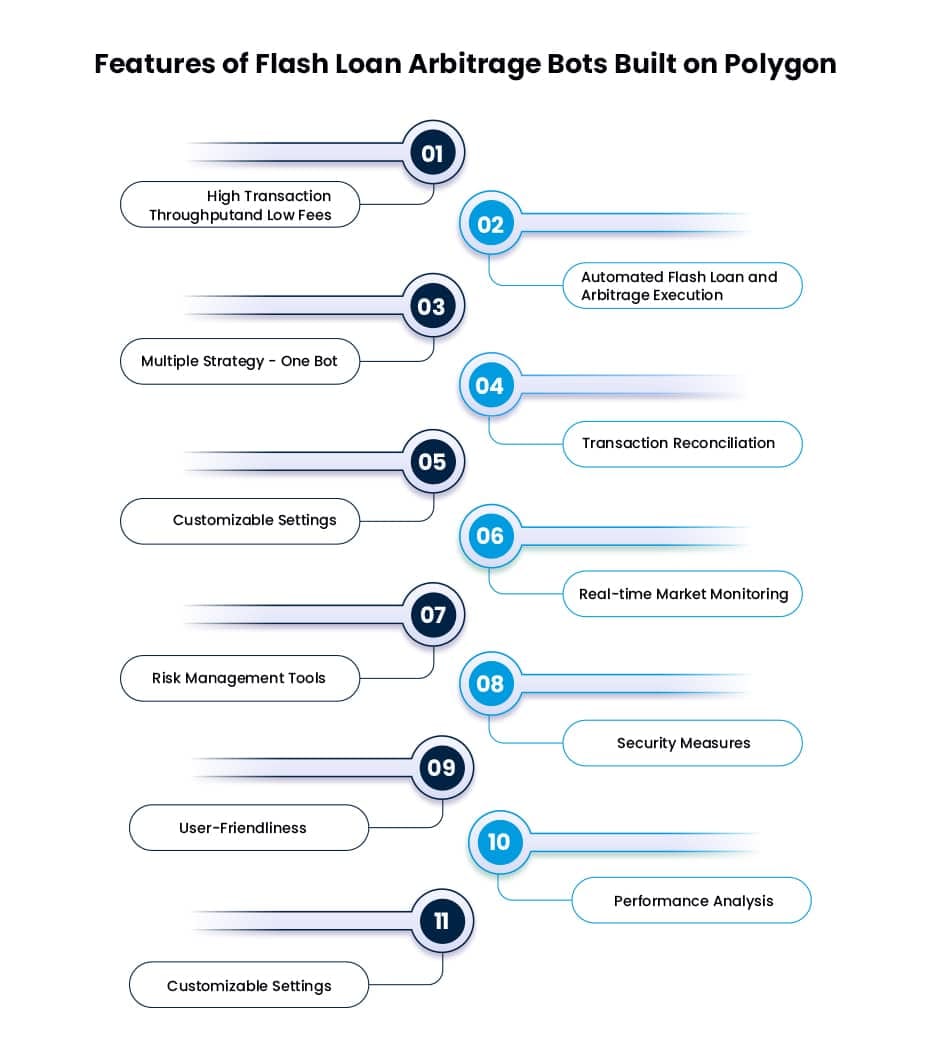

Features of Crypto Flash Loan Arbitrage Bot Polygon

Flash loans are a revolutionary DeFi concept. Coupled with the constantly evolving Polygon ecosystem, the dynamic intersection demonstrates the following attributes:

- High Transaction Throughput and Low Fees:

A Crypto flash loan arbitrage bot can efficiently facilitate blazing-fast flash loan and arbitrage transactions at lowered costs through seamless integration with the Polygon network. Faster execution translates to a higher chance of capitalizing on all the market inefficiencies.

- Flash Loan Execution

The flash loan arbitrage bots possess a distinctive ability to borrow massive funds instantly and without collateral from liquidity pools on the Polygon network on the condition that they would be repaid within the same transaction.

- Automated Strategy Execution

With arbitrage automation bots, traders can effortlessly execute advanced algorithmic strategies designed to identify and exploit price differentials across DEXs and liquidity pools, maximizing their yield. No need for constant manual monitoring, only enhanced profits!

- Transaction Reconciliation

Crypto flash loan arbitrage bots can foster transparency and accountability by allowing traders to monitor the status of flash loan transactions and view previous transactions through transaction reconciliation and tracking functionality.

- Customizable Settings

This feature allows flexible settings and configurable options, allowing users to tailor the bot’s behavior and trading strategy according to user preferences and risk tolerance levels. This may include adjusting entry and exit thresholds or specifying minimum price differences for arbitrage.

- Real-time Market Monitoring

The flash loan arbitrage bot polygon is integrated with real-time market data-feeding reliable sources, ensuring continuous monitoring of market conditions and price movements on the Polygon network.

- Risk Management Tools

The built-in risk management features such as stop-loss functionality, maximum borrowing limits, blacklist/whitelist functionality, etc allow traders to mitigate potential risks associated with flash loan arbitrage bot, including slippage and market volatility.

- Security Measures

Crypto flash loan arbitrage bot interact with DeFi protocols and hold substantial funds. Robust security measures such as multi-factor authentication, secure communication protocols, face recognition unlock, etc. coupled with regular smart contract audits assure user funds protection against threats or exploits.

- Performance Analysis

Integration of in-depth performance analysis and reporting tools enables traders to access abd track the bot’s profitability, ROI and overall performance, from a single dashboard.

- Multiple Strategy Execution

With flash loan arbitrage bot polygon, traders can go beyond the cookie-cutter arbitrage. They can offer support for cross-exchange, liquidity, triangular, basis trade arbitrage, etc., widening traders reach to profitable opportunities.

- User-Friendly Interface:

With automation comes convenience but user-friendliness of a trading bot only unlocks its access to non-technical customer base. This enables users to monitor performance, adjust parameters and stay informed about the flash loan crypto arbitrage opportunities and trades.

By incorporating these features, flash loan arbitrage bots built on Polygon can empower users to generate passive income by exploiting market inefficiencies while leveraging the speed and affordability of the Polygon network.

Types of Flash Loan Crypto Arbitrage Bots

As the adoption of this ingenious bot soars, the world of crypto flash loan arbitrage bots will keep on evolving. Some of the most common types of flash loan arbitrage bot built on Polygon include:

- Cross-Exchange Arbitrage

It is the most common type of flash loan arbitrage bot built to scan markets of the same asset across multiple exchanges platforms for price differences.

- Liquidity Pool Arbitrage

Inspite of capturing and exploiting price inefficiencies on several exchanges, these flash loan crypto arbitrage bots lookout for temporary inefficiencies within the liquidity pools on DEXs.

- Triangular Arbitrage

Just like cross-exchange arbitrage bot, this bot also fishes for price discrepancies but for three or more assets.

- Basis Trade Arbitrage

This crypto flash loan arbitrage bots pinpoints and exploits the price differences for perpetual futures contracts and their underlying asset.

Benefits of Flash Loan Arbitrage bot Polygon

- Passive Income Generation

- 24/7 Market Coverage

- Recued Trading Costs

- Increased Captial Efficiency

- Increased in DeFi adoptio

- Enhanced Market Inefficiency

- Innovation in DeFi platforms

Conclusion

Flash Loan crypto arbitrage bots represent a power-packed innovation in the revolutionary DeFi scope. However, since there is a mixed sentiment around the bots due to inherent risk of DeFi market, flash loans and general arbitrage execution.

Whether you want to set up a crypto arbitrage for your customer, it is always better to conduct a thorough analysis of your requirements and connect with a reliable flash loan arbitrage bot polygon development company. Antier specializes in building high-frequency, strategy optimized flash loan arbitrage bots for diverse clientele needs. Equipped with unparalleled expertise and rich portfolio of flash loan and arbitrage bots, they are the best people to count on for your flash loan crypto arbitrage bot development project.

Get in touch with our sales representatives today!