Introduction to Crypto Arbitrage

Arbitrage trading is one of the most rising trends in the cryptocurrency sector. Using this technique, traders can make use of price differences between several trading exchanges. With more and more crypto trading platforms coming up, there is a growing demand for reliable arbitrage bot development services.

The prices of cryptocurrencies are different on different exchanges due to a variety of factors like transaction costs, market fluctuations, geographical disparities, liquidity deviances, etc.

Buying a cryptocurrency at a low price on one exchange and selling it rapidly for a high price on another is known as crypto arbitrage.

In this article, we dive into the working, significance, and development of crypto arbitrage bots, as well as the top companies offering related services.

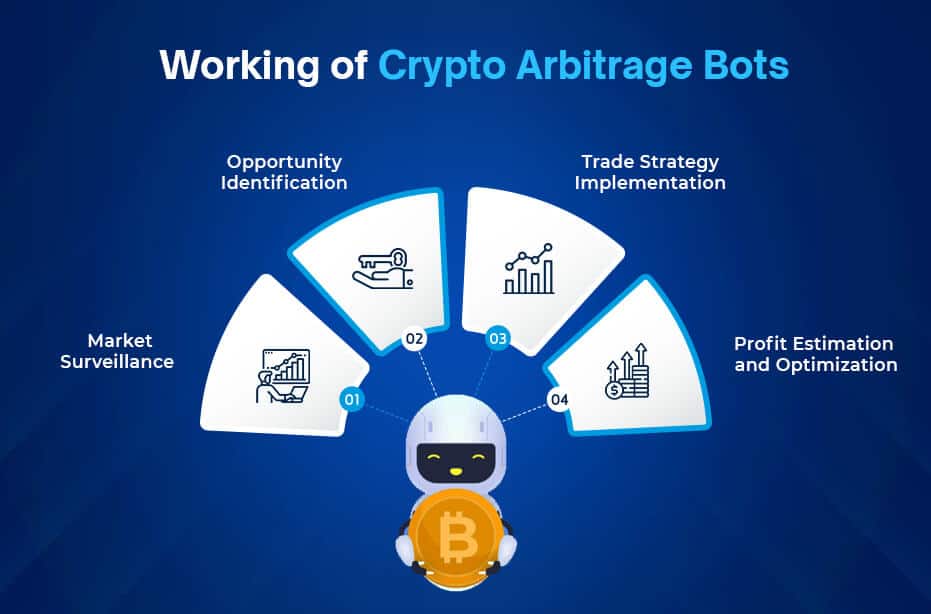

How do Crypto Arbitrage Bots Work?

Crypto arbitrage trading bots are basically automated software systems devised to constantly monitor the markets for arbitrage opportunities and then execute transactions accordingly. In other words, every time these programs detect price gaps, they automatically purchase the given crypto asset at a low cost on an exchange and then sell it at a high cost on another exchange.

Depending upon the specific purpose of trading, crypto arbitrage bot development service providers build the requisite software programs.

In general, these bots work in the following steps:

- Market Surveillance

The arbitrage bot keeps track of the prices of different cryptocurrencies across many exchanges by sending repeated API calls to each exchange. This way, it gets the latest price data. - Opportunity Identification

The process of spotting an arbitrage possibility involves the bot analyzing the collected price data. In this step, the bot tends to compare the prices of the same crypto asset across various exchanges. - Trade Strategy Implementation

When the bot finds an opportunity for arbitrage, it automatically carries out the associated trade strategy. - Profit Estimation and Optimization

The bot computes the profit made from each trade and consistently improvises its approach as per market trends and past performance.

Types of Crypto Arbitrage Bots

All sorts of crypto arbitrage bots work by examining market data. However, they may differ in their purposes. Apart from general trading bots, the crypto trading bot development industry has come up with specialized programs that focus on a distinct sort of trading activity. Explained below are the common types of trading bots used in the crypto sector:

- Triangular Arbitrage Bots

Triangular bots analyze the price variations of three different cryptocurrencies. After scanning for opportunities to sell high, buy low, and then purchase the original crypto at a reduced cost, they create a profit loop that is repeated multiple times. - Spatial Arbitrage Bots

Spatial bots exploit the price discrepancies of the same cryptocurrency on various exchanges situated in various geographic locations. These differences arise out of the variation in local market conditions. - Convergence Arbitrage Bots

These bots tap into the prospects of convergence in the prices of crypto assets. So, the convergence bots look for the possibilities where the current and future value of cryptocurrency will level out. - Decentralized Arbitrage Bots

Also known as automated market makers (AMMs), these bots follow the algorithms as per the smart contracts. They depend on user-provided liquidity pools and also facilitate cross-exchange trades between centralized and decentralized exchanges.

In addition to the above mentioned, there are arbitrage bots for statistical trading strategies, market-making, high-frequency trading, etc.

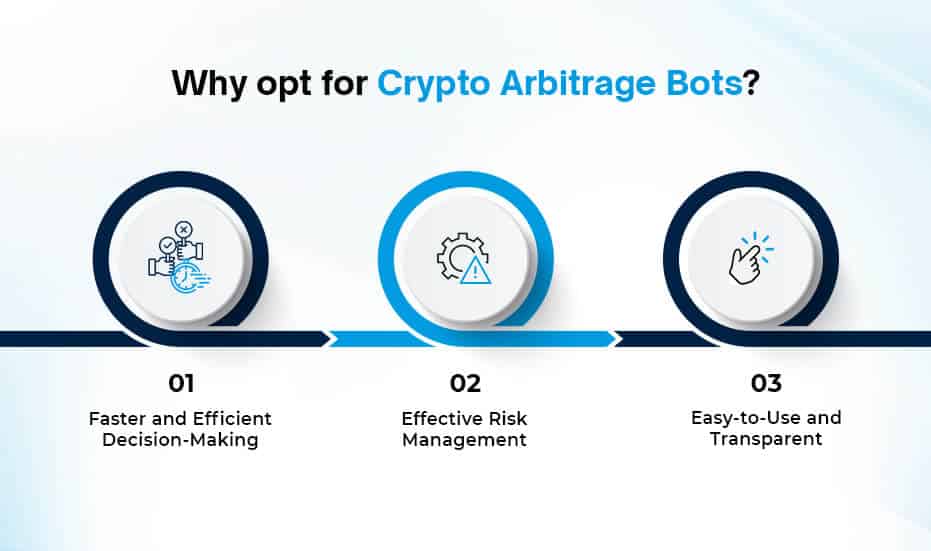

Need for Crypto Arbitrage Bot Development

In the age of cryptocurrency investments, there is a persistent need to stay abreast of market fluctuations and ongoing trends. By November 2022, there had been an increase of 127% in trading volumes of cryptocurrencies. This calls for the use of crypto arbitrage bots that can keep an eye on market conditions 24×7, make the right decisions, and implement suitable trading strategies.

- Faster and Efficient Decision-Making

Compared to manual trading, arbitrage bots can execute strategies far more quickly and instantly profit from price differences across several exchanges. After analyzing the price and market data, they conduct transactions in milliseconds and are able to utilize arbitrage opportunities that manual traders can mistakenly overlook.

Being active round the clock, these bots can trade continuously. And for users with high trading volumes, the hefty task of managing multiple portfolios is lessened. - Effective Risk Management

Crypto arbitrage bots greatly reduce trading risk by deploying relevant management techniques effectively and avoiding human error completely. At the same time, they help in better diversification of crypto assets, accurate evaluation of market risks, and emotionless trading. - Easy-to-Use and Transparent

Most of the crypto arbitrage bot development involves open-source coding, resulting in easily understandable software applications. These bots can be directed to perform a variety of trading procedures at the same time.

Process of Crypto Arbitrage Bot Development

Here’s a brief on the development procedure of a crypto arbitrage bot:

- Set the Strategy

In the first step, there is a need to establish a particular arbitrage tactic that the trading bot needs to employ – triangular, cross-exchange, convergence, or any other. Alongside, decide which exchanges and cryptocurrency pairs need to be included.

Other factors to consider are transaction frequency, transaction costs, etc. Accordingly, the coding language and architecture for the bot are selected. - Build an Integration with Exchange API

Secondly, exchange accounts are made and API keys are obtained from the platforms to access market data on the chosen crypto exchanges and facilitate trading. A code is developed to link the bot to the relevant exchange APIs. - Implement Mechanisms for Data Collection and Analysis

In this step of arbitrage bot development, some algorithms are created and deployed for gathering data, scanning price differences for requisite trading opportunities, and identifying market patterns. For this, developers usually need to make way for recurring API calls or real-time data streams. - Create Algorithms for Detecting Arbitrage Opportunities

To find arbitrage avenues in the collected data, certain logic needs to be applied that will direct the bot to sort out and rank suitable trading prospects. - Develop Trade Logic

A key step in crypto arbitrage bot development, this stage entails determining transaction fees, liquidity, and possible price fluctuations before executing a trade. So, here, appropriate frameworks are incorporated to make sure that trade confirmations, order fills, tracking, management, and cancellations are handled accurately. - Integrate Tools to Monitor and Tackle Errors

It is important to integrate bots with sturdy monitoring systems and establish tools to handle network outages, API issues, and other unforeseen occurrences properly. - Testing and Further Development

The functioning of the arbitrage bot has to be backtested using past market data, which also helps in performance evaluation and draws out the scope for more improvement. - Deployment and Management

Finally, the trading bot is set up in a dependable hosting environment, which guarantees its smooth functionality and access to market information and transactions. Alongside this, maintenance protocols are established for regular updates and optimized performance.

Furthermore, the developers of the arbitrage bot must stay abreast of changing regulations and market conditions and modify the bot’s parameters as necessary.

Best Crypto Arbitrage Bot Development Companies

If you are interested in capitalizing on the efficiencies of crypto arbitrage bots, you can consider the following top technology companies:

1. Antier

A leading crypto trading bot development company, Antier holds supreme prowess and experience in creating future-oriented and advanced arbitrage bots. It builds trading bots with AI-enabled portfolio management, business-specific solutions, effective integrations, and more.

2. Beleaf Technologies

One of the latest blockchain development companies, Beleaf Technologies, offers a range of crypto arbitrage bot solutions, including triangular, statistical, spatial, cross-exchange trading, etc.

3. Maticz

Another prominent name in the arbitrage bot development sector, Maticz provides white-label as well as customized bot solutions equipped with innovative features and versatile functionalities.

4. Mobiloitte

Mobiloitte is a reputed firm in the field of arbitrage bot development, known for extending a wide variety of bots, spanning token swaps, spot exchanges, futures exchanges, etc.

Final Thoughts

The growth of crypto arbitrage trading bot development services presents an alluring opportunity for businesses seeking to diversify their revenue streams. Besides, enterprises in the cryptocurrency industry need to keep up with emerging innovations, among which automated trading bot services are an ever-evolving area. So, it is crucial to opt for a reliable crypto arbitrage trading bot service provider who can assist you in navigating the ever-changing financial landscape.