Central Bank Digital Currency:

The Future of Monetary System

The convergence of new technologies and the emergence of information systems have transformed the banking and financial ecosystem. Financial institutions are revolutionizing their services by embracing the profound, positive changes brought about by ingenious technologies like blockchain.

The introduction of Bitcoin and other cryptocurrencies catapulted the revolution. Over the years, the concept of digital currencies has gained significant traction and adoption, leading to the introduction of central bank digital currency.

A central bank digital currency (CBDC) is a digital version of a fiat currency that can be integrated into different monetary systems to make them capable of supporting innovation and serving the public interest. CBDCs have taken center stage when it comes to conversations between government, central banks, and private industry, and are opined to be the future of the digital financial ecosystem.

Central Bank Issued Digital Currency:

Moving from Conceptual Analysis to Design

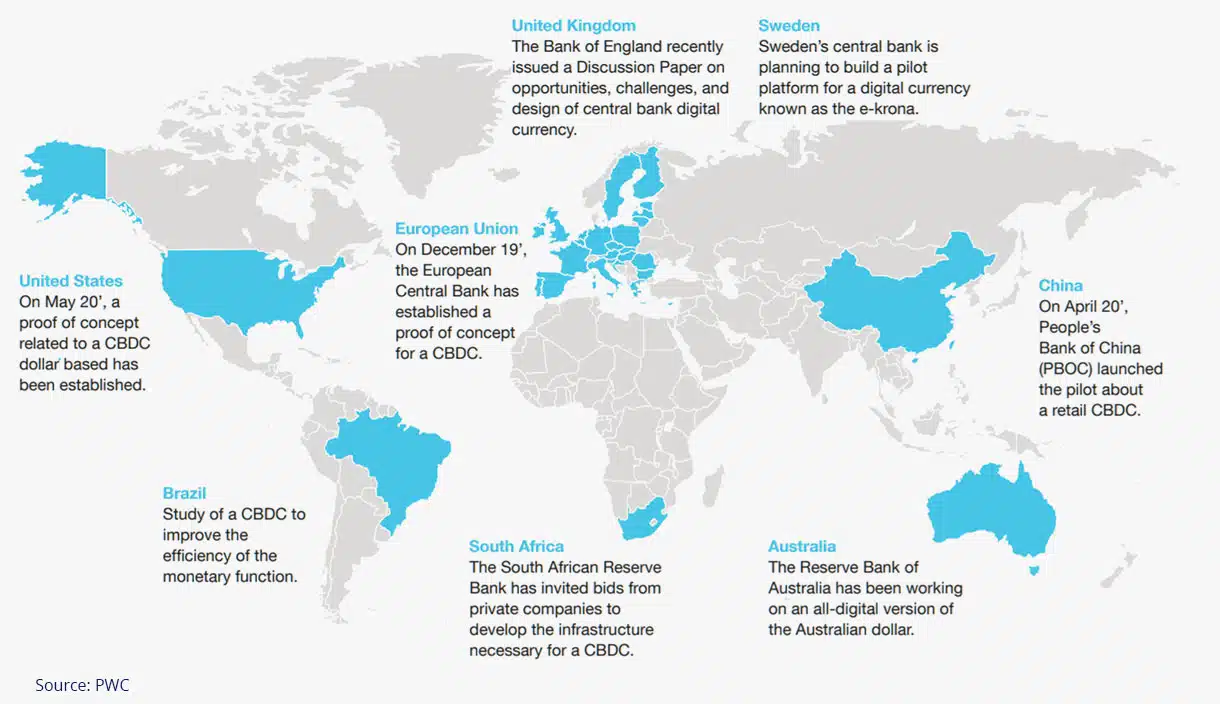

The Bank of International Settlements (BIS) revealed that more than 70% of central banks are interested in issuing a digital central bank currency. The early pilots of central bank digital currencies have shown potential to augment the efficiency and transparency of central banks to offer capital. In addition, CBDCs enable central banks to leverage near real-time data with a monetary system to solidify their decisions.

Antier’s Expertise: Central bank Backed

Digital Currency Development

As more and more central banks are intrigued with the idea of CBDC and running pilot programs, the demand for central bank issued digital currency development is escalating.

At Antier, we offer world-class solutions for digital central bank currency development. Our seasoned blockchain engineers and subject matter experts devise a coherent roadmap to navigate your development journey. We start with understanding your specific requirement, followed by the application of blockchain innovation, to fulfill your unique infrastructure, challenges, and strategic vision.

Connect with our subject matter experts to share your business plan.

Your Roadmap to Successful CBDC Development

Step 1

Comprehend the implications, risks, and opportunities offered by CBDC

Step 2

Devise an intelligent strategy for adoption across business and technology

Step 3

Evaluate, implement, and deploy core technology infrastructure for central bank digital currency systems

Step 4

Fortify CBDC systems for security and resiliency

Why Choose Us for Central Bank Digital Currency Development?

By partnering with Antier, you can rely on a team of technical professionals and finance experts with real-world experience creating multiple success stories.