Understanding DeFi Yield Farming: A Comprehensive Beginner’s Guide to Earning Passive Income

August 21, 2024

Earn Passive Income with Smart Contracts: A Comprehensive Guide

August 22, 2024The world of cryptocurrency has been advancing at an incredible pace. Those who want to ride the wave as business owners build intriguing trading infrastructures to support investors jumping on the bandwagon to enhance their principal factor.

Among the rising trends, crypto exchange bots present an opportunity for investors to enhance their profits significantly. These automated trading sidekicks help traders go the extra mile to ensure that most trading opportunities are caught and capitalized on. Think of them like your motor cars. You could walk and reach your destination. Similarly, you could trade manually but with the help of these, you can make it faster, enhancing your average trading experience and profits.

Overloaded with potential, these automated trading tools are becoming a valuable addition to cryptocurrency exchange software solutions. If you are an entrepreneur planning to integrate a trading bot into your existing crypto trading software or build a trading platform packed with an amazing automated crypto trading bot, here’s a guide tailored to equip you with everything you need to know.

Trading Bot X Trading Exchange: Assessing the Possibility

Yes, there’s a possibility. You can certainly integrate an automated crypto trading platform into a crypto exchange but it requires technical expertise to make it possible without any errors. Moreover, the development team needs to take care of the fact that the operation of crypto exchanges is not disturbed in any sense due to these automated trading tools. For that, they have to assess all the possible situations and then modify the development of both platforms to achieve the desired results.

Let’s now discuss the benefits of this promising integration…

Benefits of Integrating Crypto Exchange Bot For Crypto Entrepreneurs

Integrating trading automation tools into crypto trading software platforms isn’t only beneficial for customers who can benefit from enhanced trading efficiency, 24/7 trading, emotionless trading, backtesting capabilities, etc. Businesses can also benefit from expanding their cryptocurrency exchange software offerings with a crypto exchange bot in many ways.

Let’s first discuss how this potentially favorable integration benefits end traders.

Benefits for Customers:

- Enhanced Trading Efficiency: Bots can execute trades at lightning speed, capitalizing on market fluctuations that humans might miss. With set parameters, these automation tools work precisely and can manage more than one trade at a time.

- 24/7 Tireless Trading: Unlike humans, automated crypto trading platforms can operate continuously, ensuring that no trading opportunities are lost. Moreover, they can work 24/7 without a change in efficiency due to tiredness.

- Risk Management: Sophisticated trading bots, backed by experienced trading bot development teams and forward-thinking cryptopreneurs, can incorporate robust risk management strategies to protect capital.

- Backtesting Capabilities: Crypto exchange bots built by experts allow users to test trading strategies on historical data, helping to refine approaches. This technique can be highly beneficial for beginners as well as experienced traders who want to ensure the profitability of their strategy.

- Diversification: Bots can be built to manage multiple trading strategies and cryptocurrencies simultaneously. Therefore, customers can enjoy a holistic trading automation experience with these automated crypto trading software platforms.

- Emotionless Trading: Bots eliminate the effect of emotional factors that often cloud human judgment. They trade as per the set strategies, leading to more rational decision-making and consistent trading.

- Saving Traders’ Precious Time: Crypto exchange bots can automate routine tasks, freeing up traders’ time for other productive activities.

Convinced already?

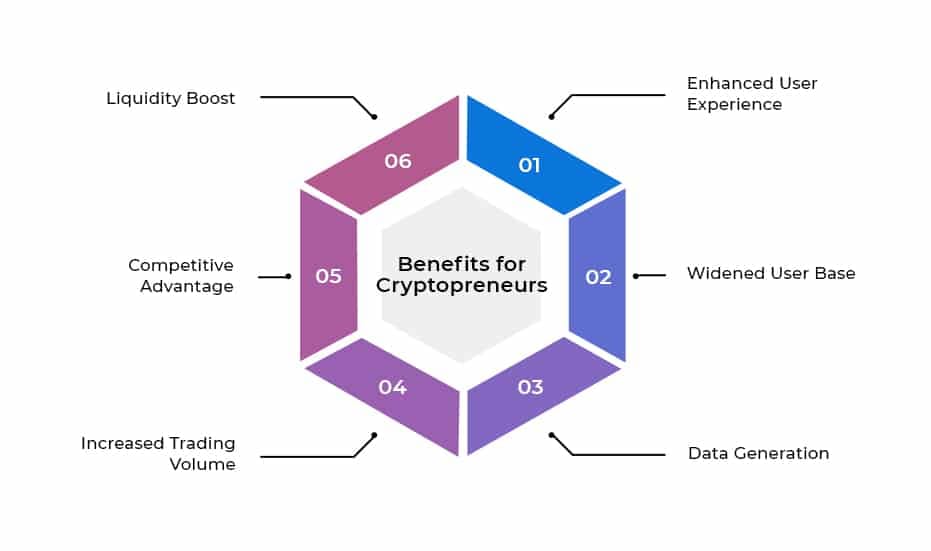

Benefits for Cryptopreneurs

It is obvious that when customers are content with a feature or functionality, entrepreneurs can also reap many benefits. Let’s discuss the benefits that cryptopreneurs planning to implement trading automation tools as a feature in crypto trading software can reap:

- Enhanced User Experience: As discussed above, bots can provide a more sophisticated trading experience, attracting both novice and experienced traders.

- Widened User Base: Automated trading solutions cater to a wider range of traders, including those who prefer a hands-off approach. With a feature that attracts all classes of traders and appropriate marketing tactics, crypto trading platforms can significantly grow their user base.

- Data Generation: Bot activity can generate valuable data for market analysis and platform improvements. Future-oriented businesses can leverage such data to efficiently plan their next move. This enhances their chances of success.

- Increased Trading Volume: Crypto exchange bots can execute trades more frequently, leading to increased trading volumes and transaction fee revenue for the exchanges.

- Competitive Advantage: Offering advanced trading features like algorithmic trading, backtesting, robust risk management, artificial intelligence-based trading, customizable trading experiences, and machine learning-powered analysis can set the exchange apart from competitors.

- Liquidity Boost: Unlike traders who might trade 24/7, these automated crypto trading platforms always execute small-size trades, which enhances the activity on trading platforms. Possibly, there will always be someone on the other side of the trade if a trader wants to buy or sell something immediately.

Limitations of Integrating Crypto Exchange Bots

- Dependency on Programming: Creating and maintaining bots requires programming expertise. Therefore, cryptopreneurs need to shake hands with a reliable cryptocurrency exchange software and bot development company.

- Market Volatility: Even the best bots can be caught off guard by unexpected market movements. So, it is essential for entrepreneurs to either build AI-based features or give precautionary notice to all the traders who are using the functionality.

- Overreliance on technology: This one’s for the traders. Excessive reliance on crypto exchange bots can lead to a lack of understanding of market dynamics.

- Regulatory Compliance: Ensuring that bot activities comply with relevant regulations can be complex. Therefore, it should be taken into consideration during crypto trading platforms and bot development.

- Cost: Developing and maintaining a high-quality crypto trading bot and feature-rich exchange platform can be expensive.

- Technical Issues: Bots can malfunction due to software bugs, internet connectivity problems, or exchange API issues, deteriorating traders’ experience. However, bugs can be resolved with proper cryptocurrency exchange software development and timely upgrades.

Types of Trading Bots That Can Be Integrated into Cryptocurrency Exchange Software

Selecting the appropriate types of crypto exchange bots is essential for trading platforms focused on offering their users a more advanced and competitive trading experience. Here are a few types of trading bots that can be integrated into a fully-functional crypto exchange platform.

- Arbitrage bots

- High-Frequency Trading Bots

- Grid Trading Bots

- Trend Following Bots

- Backtesting Bots

- Signal Bots

While choosing the type of trading bot for cryptocurrency exchange software, entrepreneurs must take into consideration the platform’s target audience, technical capabilities, and regulatory compliance.

Conclusion:

Integrating automated crypto trading platforms can be a strategic move for entrepreneurs looking to expand their services and gain a competitive edge in the crowded crypto space. By carefully considering the benefits and challenges and choosing the right type of bot solution, exchanges can offer a more attractive and feature-rich crypto trading platform for their users.

If you are running a cryptocurrency exchange and planning to step ahead by integrating an auto trading bot within your trading platform or planning to launch all of this from scratch, Antier is a leading technology leader you can count on. Our Web3 consulting firm specializes in building cutting-edge trading infrastructures for diverse business needs.

Explore our products and services to ace the crypto space. Contact today!