Table of Contents

Binance Smart Chain is now BNB Chain. A recent announcement was made regarding the amalgamation of Binance Smart Chain and Binance Chain, which resulted in the formation of BNB Chain. Many opine that BSC is a part of Binance since it carries its parent name, but in reality, the BNB Chain development experts are putting lots of effort into making it go beyond Binance.

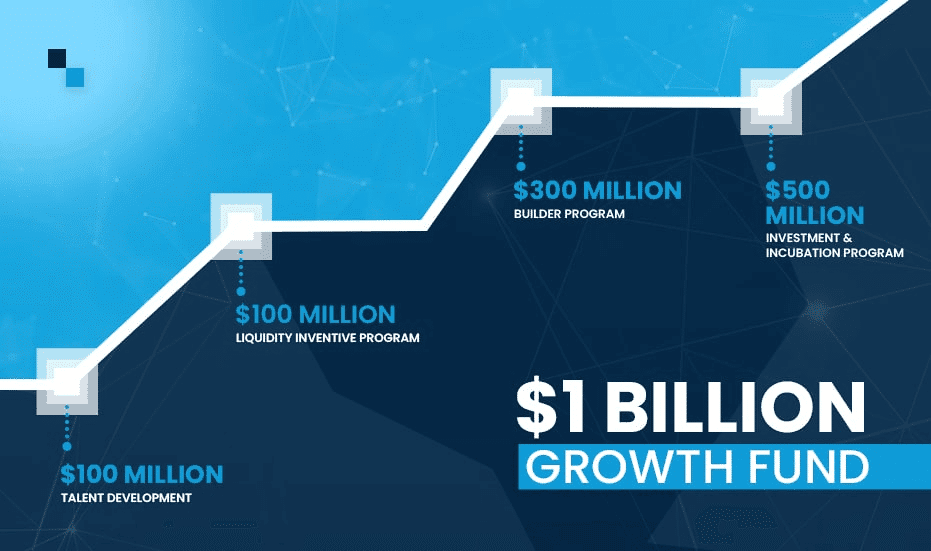

Till now, Binance has spent more than $1 Billion on the BSC ecosystem to extend its support to help it stand ahead of Ethereum with other layer1 Blockchain systems. The primary goal is to eliminate the notion of the centralized nature of BSC.

An Insight into BNB Chain

As per Binance CEO Chanpeng Zhao, the abbreviation BNB stands for Build and Build which means build the community and also let the community build.

This Chain consists of a BNB Beacon Chain that performs tasks like stalking and voting and a BNB Chain that is compatible with Ethereum Virtual Machine.

The ultimate goal is to boost interoperability and build a virtual environment, thereby supporting the MetaFi efforts of Binance.

The Main Goal of the BNB Chain

As the name BSC changed, users, developers, and entrepreneurs connected to the BNB community could take advantage of the enhanced features. As a result, even huge applications like Metaverse, GameFi, SocialFi, and others will be combined with BNB Chain by BNB Chain development professionals.

In a statement, Binance revealed that it is a community-driven, open-source, and decentralized ecosystem.

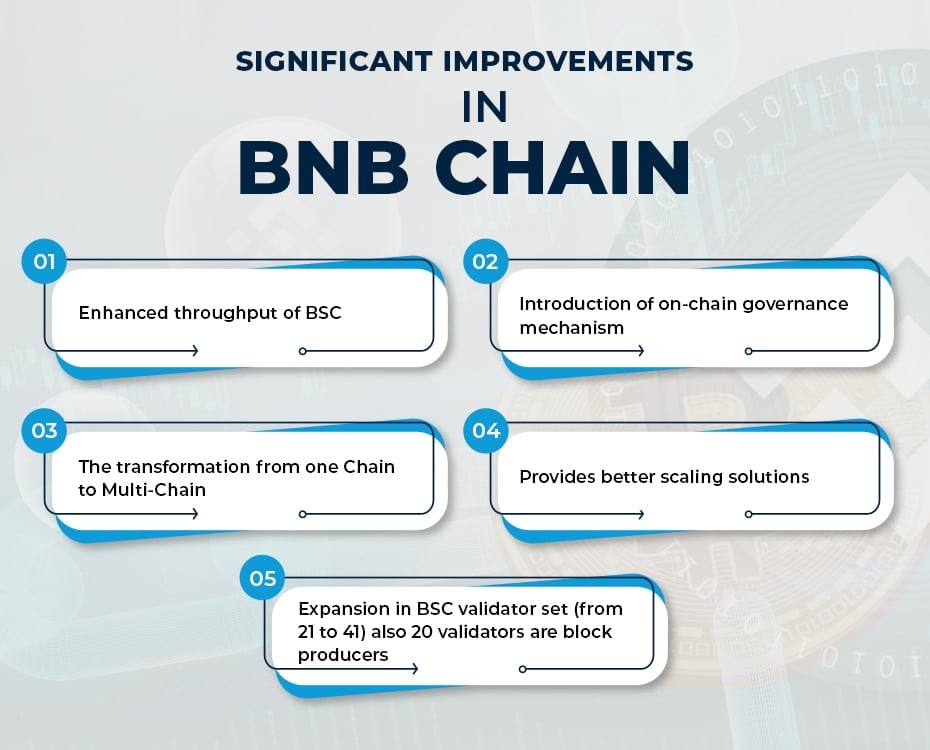

Significant Improvements in BNB Chain

Practical Applications of BNB Chain

BNB comprises several use cases that aren’t confined to the ecosystem but goes way beyond that. The use cases of BNB fall under the following categories:

- Payment

- Travel

- Entertainment

- Service

- Finance

Transaction Fees and its Offerings to the Binance Ecosystem

BNB is extensively used to pay transaction fees. According to data calibrated by Binance, almost 2 Million users have paid trading fees of more than 40 Million BNB. Also, more than 127 Billion deals were performed on the Binance trading platform.

Also, paying standard trading fees on Binance Exchange would give special discounts to the users. Every trade carried out on exchange levies 0.1% paid by users via trading assets or BNB.In addition, traders who depend on Binance are encouraged to invest in BNB to save money on transaction fees.

Follow the steps mentioned below to purchase BNB on exchange:

- Visit your profile and access your dashboard

- Find out your trading fee level

- Turn the button on where it is written: “Using BNB to pay fees(25% discount).”

Other Segments that Leverage BNB

- Payments

Using BNB, one can pay for goods, virtual gifts, and several other things. The list of integrations has been mentioned on the BNB page, like Pundi X, CoinGate, Monetha, and others.

- Travel

Use BNB to pay for airfare and hotel bookings and obtain other travel facilities such as TravelbyBit, Trip.io, and Travala.com.

- Entertainment

Users can procure the benefits of BNB integrated into platforms like Vibe, which gives them a chance to earn BNB from games. They can use it to buy music copyright on MachiX or virtual land on Axie Infinity (AXS).

- Service

BNB has other practical applications, including freelancer recruitment, creating smart contracts, accessing Torrents, and paying for cloud and web server subscriptions.

- Finance

BNB is also used for taking loans, trading stocks, investing, splitting bills and expenses using financial applications such as ETHLend, NAGA, Moeda, LNDR, and Nexo.

- MetaFi

Even MetaFi development takes advantage of the BNB Chain.

MetaFi is a combination of Meta referring to the Meta Ecosystem, and DeFi combines numerous projects, including Metaverse, GameFi, DeFi, Web3, SocialFi, and NFTs, under one roof.

MetaFi joins an array of Blockchain functionality under a single Meta ecosystem using Metadata that signifies asset ownership. Furthermore, the Metadata assets were used across various platforms, and Blockchain also has helped users take advantage of features like interoperability.

It is vivid from MetaFi’s tagline,” Think BNB Chain, Think MetaFi.” The goal of the BNB Chain is the innovation that MetaFi aims to achieve by delivering robust, interoperable projects with multi-chain capabilities and assisting in huge amounts of assets and data transfers.

Using BNB Chain development, creators and entrepreneurs can create an infrastructure that makes the parallel ecosystem run seamlessly.

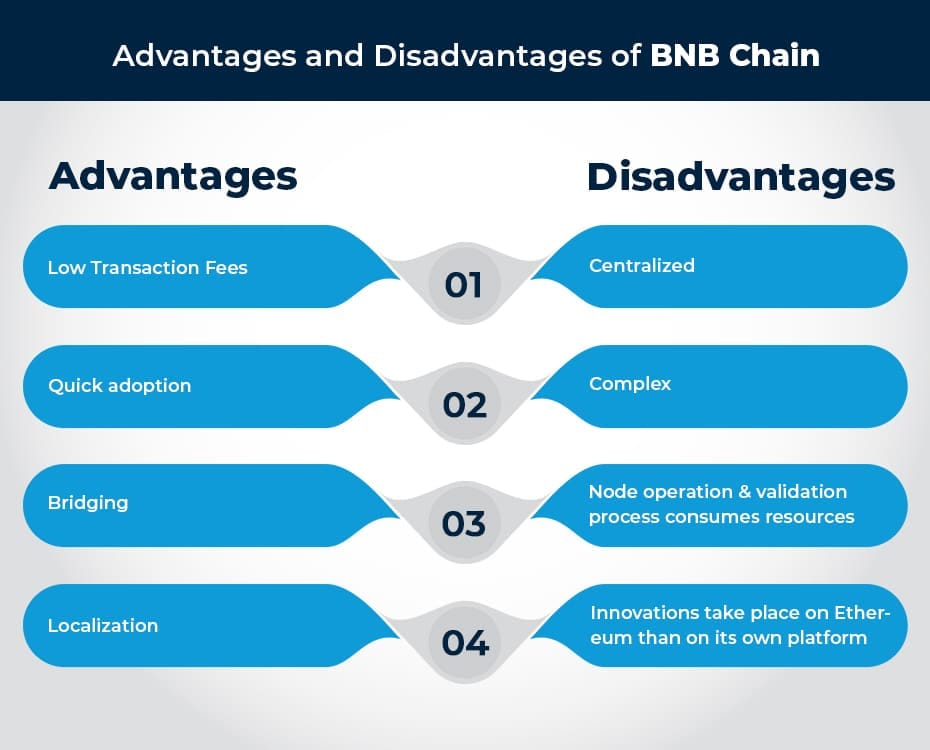

Advantages and Disadvantages of BNB Chain

The advantages outweigh the disadvantages and have allowed investors and entrepreneurs to leverage BNB Chain development.

The Future of the BNB Chain

The main emphasis is on MetaFi, and it is expected that more advancements will occur on the Chain in 2022. These advancements will be BSC Application Sidechains and new BSC partition chains.

What is BNB Token, and How does it Work?

BNB introduced a BNB Chain token system in 2017. It was issued and launched during an Initial Coin offering crowdfunding event between the 26th of June to the 3rd of July 2017.

Initially, the coin was issued as ERC20 Token on Ethereum Blockchain and was quickly moved to Binance Chain as BEP-2. The total supply, in the beginning, was fixed at 200,000,000 coins, and the supply dropped as the coin burn events started taking place regularly.

Develop your own BNB Chain

Schedule Free DemoIs BNB Chain Ideal for DeFi Platforms?

BNB Chain is built for decentralized Finance platforms. Tokens from different chains can be used on the thriving DeFi ecosystem on BNB Chain. One can trustless exchange assets on Pancakeswap in the same way as Ethereum counterpart Uniswap which is indulged in yield farming and casting votes on proposals.

The moment it was launched, BSC started giving a lot of attention to DeFi applications and aimed to move head to head with the Ethereum ecosystem by providing lower costs to the users. This strategy was working in favor of Binance.

In January 2021, Pancakeswap and BNB contributed significantly to the BNB ecosystem. They produced revenue of $1 billion and $14 billion, respectively, of the total transaction volume of $15 billion in January 2021; after this, more investors have started venturing into the BNB Token segment with BNB token development professionals to boost their revenue.

What is Binance Smart Chain?

Binance was the first Blockchain introduced by Binance. Initially, it came up with some programming restrictions and Binance Smart Chain was developed to get rid of these concerns. Binance Smart Chain is basically a Blockchain network with rich Smart Contract functionality.

The existing Binance’s native Binance Chain possesses excellent transaction capabilities and helps users get the best of both worlds. Even Binance Smart Chain introduced the Ethereum Virtual Machine, allowing it to execute Ethereum-based applications.

The ultimate goal was to allow developers to build decentralized applications and help users manage high-capacity assets in a cross-chain and low latency environment, so let us further understand how Binance Smart Chain evolved.

How the Binance Smart Chain Evolved?

Binance and BNB were introduced in 2017 while BNB came into the limelight after 3 years. As Binance grabbed the users’ attention, so did BSC.BSC, which was launched at the same time as the BSC movement was taking place. Since the users started looking for alternative financial solutions, it led to the surge in use cases of Blockchain technology.

As per Binance, the BNB token kept on growing since its inception. In 2017, it was initially launched as an ERC20 token on the Ethereum network. In 2019, it was changed into Binance Chain and led to the formation of the BSC network, officially launched in September 2020.

Salient Features of Binance Smart Chain

Binance Smart Chain Blockchain works follow four basic principles. Even the development and architecture depend on these principles:

Stalking

Binance Smart Chain adopts a stalking model to make sure that the BSC community participates in Blockchain creation and Governance. Stalking was preferred because the emphasis was laid on speed rather than security and decentralization. Also, Stalking models generate blocks rapidly and are environment friendly.

Stand Alone Blockchain

Binance targeted Binance Smart Chain to stand alone. By combining two applications, there were no chances of service interruption, even if a single between them failed. Moreover, since the two networks have separated, Binance can implement new technologies and eliminate side effects if there are any.

Native Cross Platform Compatibility

BSC runs synchronously with Binance Chain, and cross-chain compatibility is often noticed between two blockchains.

Consensus

It has 3 seconds of Block time and incorporates the Proof of Stake Authority mechanism. If a valid block gets approved, transaction fees would be levied with transactions included.

Ethereum Compatibility

Whenever the discussion about the Smart Contract platform takes place, Ethereum is the first name that comes to everyone’s mind. Binance followed a similar path as Ethereum and modified itself to a great extent. The specific one is the consensus mechanism that the platform adopts. By coping with Ethereum source code, one can transfer native Ethereum apps to Binance Smart Chain.

How Binance Smart Chain Works?

Ethereum integrates the Proof of Work(PoW) mechanism and is planning to switch to the Proof of Stake(PoS) mechanism. In addition to this, Binance Smart Chain is already working on a modified version of Proof of Stake, which is Proof of Staked Authority(PoSA).

This platform works the same way as others by stalking a native token to carry out certain tasks. Every time a transaction processes successfully, the users are rewarded in return.

In BSC, the participants generally stake the native tokens to become validators. Once the transactions are validated and proposed, the validators receive the transaction fee in return.

It is vital to note that the transaction fees obtained by validators on Binance are also provided in the form of native tokens. This is because they are obtained from the existing supply and are not freshly minted.

You might be wondering why this happens.

This is because BNB isn’t inflatory, so the Binance team has to burn a portion of its supply. According to data, the maximum supply at the start is 200 Million and the burns occur until the supply drops to 100 Million.

Proof of Stake Authority(PoSA) Consensus Mechanism

To obtain consensus over a network Binance Smart Chain integrates the Proof of Stake Authority(PoSA) mechanism. Not many of us know, but PoSA combines Proof of Authority (PoA) and Delegated Proof of Stake (DPoS). Delegated Proof of Stake has been integrated into several Blockchains like EOS.

DPoS is a staking model in which validators add the native tokens so that they get a chance to create Blocks and their transactions get validated. In case someone has a minimum stake, that person can still become a validator. This would prevent a reduction in the network speed. After this, the token holders are supposed to vote for a specific number of delegates. Note that the number of validators on EOS and Binance Smart Chain must be 21.

The same is true for Binance Smart Chain in the PoA model in which a central party chooses validators. In this case, Binance is the central party. Therefore, everything depends on Binance’s approval as it is the only one to decide who can participate in Block creation.

Antier: Kickstart Your Journey with BSC or BNB Chain Solutions

If you are planning to venture into Binance Smart Chain or the BNB Chain platform, commence your journey with the leading BNB Chain development firm Antier. They would create innovative Blockchain applications from scratch and deploy them on Chain, considering your requirements. Moreover, every application would be integrated with advanced features like interoperability, programmability and standalone Blockchain with Ethereum compatibility also aims to enhance the user experience.

Discuss your requirements with our subject matter experts today!