Top Solana Projects Set to Dominate Crypto Market in 2025

December 11, 2024

A Detailed Cost Analysis Of How Lightning Network Crypto Wallets Are Built

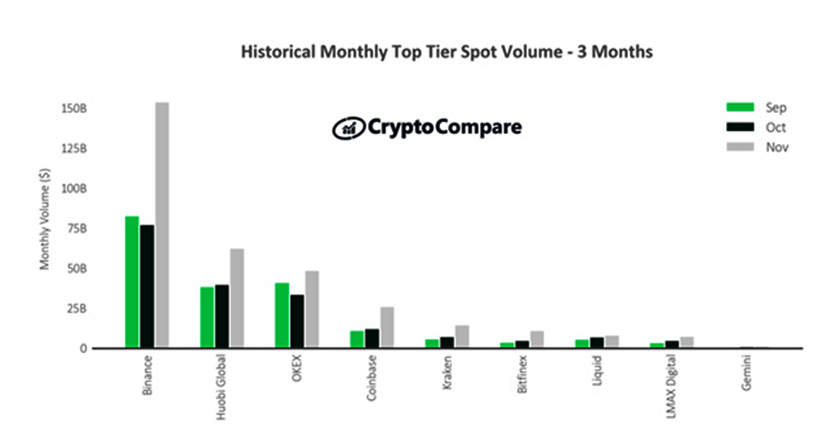

December 11, 2024“Digital asset trading on CEXs topped $10 trillion in November for the first time, surging 101% to hit $10.4 trillion.” – CCData

Donald Trump’s promise of crypto-friendliness and electoral victory ushered in a wave of optimism in the cryptosphere, pushing the ATHs to a new level. The centralized exchanges became the epicenter of the activity and it was not the first time when a certain market surge stirred up things for these platforms. Their consistent profitability makes centralized crypto exchange development a lucrative business opportunity.

Impact of the Latest November 2024 Bitcoin Bullrun on Popular Centralized Exchanges

- Binance was the largest exchange by volume in November, trading at $176.2bn (up 133%).

- Huobi Global was observed trading at $72.1bn (up 73%), and OKEx was trading at $45.9bn (up 43%).

- Coinbase, Kraken, and Bitfinex followed with $30.0bn (up 166%), $16.6bn (up 156%), and $12.8bn (up 198%).

Whether it is a bull run, ETF approval, or any activity stimulating trading activity or influx of users, CEXs remain dominant due to their ability to offer secure, regulated, intuitive, and efficient trading environments. This makes Centralized Cryptocurrency Exchange Development a sure-shot strategy for success in ever-evolving crypto markets.

Here’s Why are Centralized Exchanges So Popular?

Centralized Crypto Exchange Development: Creating A Web2 infrastructure for Trading Web3 Assets

Centralized crypto exchange platforms smoothly bridge the transition from web2 to web3 world for the customers and platform owners. These CeFi platforms act as an intermediary managing user funds and transactions, ensuring uncompromised liquidity and efficient trading experience in all conditions. By partnering with a centralized crypto exchange development company, businesses can construct a familiar trading environment with advanced trading tools, making the platform suitable for novices as well as experienced traders.

Also Read>>> Develop a Thriving Centralized Exchange: Top Features to Include

Centralized Cryptocurrency Exchange Development: Unique Features That Excite Users

- Seamless Speedy Transactions Powered By A Robust Trading Engine

- Robust Liquidity Supporting High Trading Volumes and Minimizing Price Slippage

- User-Friendly Onboarding With Fiat-to-Crypto and Viceversa Transactions

- Advanced Trading Features Like Limit Orders, Algorithmic Trading, Margin Trading, etc.

- Robust Risk Management Tools To Enable Traders to Mitigate Potential Losses

- Adherence With Privacy Regulations For User Data Protection During Centralized Crypto Exchange Development and Operations

- High-Performance Matching Engine For Seamless Order Matching and Execution

- Multi-layered security, Cold Storage, and Insurance Coverage For Extended User and Fund Security

- Mobile Optimized, Clean, and Intuitive User Interface With Sufficient Educational Resources For Web2 Users

- Stringent Third-Party KYC/AML Procedures For Regulatory Compliance

- Round-the-clock Customer Support To Address Queries and Issues

Additional Best Practices For Centralized Crypto Exchange Development:

- Partner With Market Makers To Ensure Sufficient Liquidity

- Conduct Regular Security Audits To Identify and Address Vulnerabilities

- Offer Regular Incentives To Attract Liquidity Providers

- Cater To Global Audience By Offering Multilingual Support

- Strengthen Multi-Channel Community Engagement and Support

Also Read>>> Top Strategies For Centralized Exchange Success in 2025

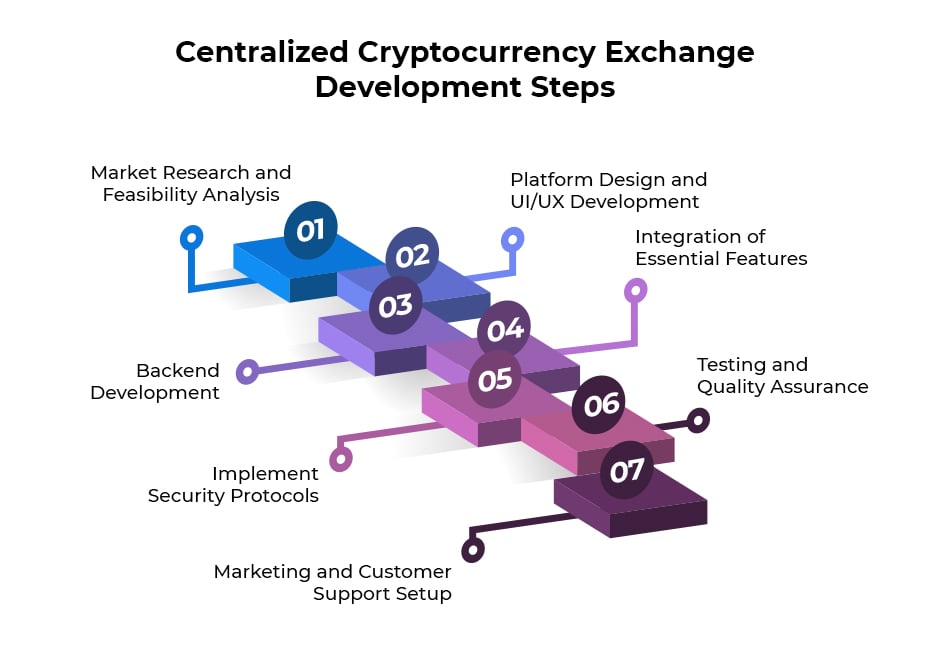

Centralized Cryptocurrency Exchange Development Steps

1. Market Research and Feasibility Analysis

Start with thorough market research to understand your target audience and the competitive landscape. Identify regulatory requirements in your desired regions and assess potential challenges.

2. Platform Design and UI/UX Development

Focus on creating an intuitive user interface that enhances navigation. Consider integrating customizable charting tools and real-time price updates in centralized crypto exchange development to improve the user experience.

3. Backend Development

Set up a robust backend infrastructure that includes servers, databases, and APIs to manage transactions securely. High-performance infrastructure is crucial for handling large volumes of trades.

4. Integration of Essential Features

Incorporate features such as user registration, KYC/AML compliance, wallet integration, and various payment gateways during your centralized cryptocurrency exchange development. Ensure that your trading modules support multiple order types.

5. Implement Security Protocols

Security is an uncompromising factor no matter which kind of cryptocurrency exchange you’re building. Ensure to utilize encryption, firewalls, DDoS protection, and multi-factor authentication to safeguard user data and funds.

Also Read>>> Top Security Considerations for 2025 and Beyond

6. Testing and Quality Assurance

Conduct rigorous testing phases including unit tests, integration tests, and stress tests after you’re done with centralized crypto exchange development. A thorough testing ensures that all vulnerabilities are identified and addressed before the final launch.

7. Marketing and Customer Support Setup

Develop a marketing strategy and launch plan to attract users while establishing a responsive customer support system for user retention. Once you’re done, you are ready to launch your centralized cryptocurrency exchange development project.

Cost Considerations for Centralized Crypto Exchange Development in 2025

The centralized crypto exchange development cost can vary widely based on UI/UX design requirements, development project complexity, team expertise, security protocols integration, module and feature requirements, blockchain integrations, and geographic location. A general estimate suggests that the total investment to launch a centralized cryptocurrency exchange may fall anywhere between $50k – $300k.

Here’s a tentative breakdown of centralized cryptocurrency exchange development costs.

- Development Team Cost

- Server Infrastructure

- Compliance Costs

- Marketing and Branding Expenses

Also Read>>> Top 5 Centralized Crypto Exchange Development Companies in 2025

Future Trends in Centralized Crypto Exchange Development

As the crypto industry continues to evolve, centralized exchanges will need to adapt to changing market dynamics. Without much ado, let’s study a few trends that can potentially shape the future of centralized exchanges.

Key trends to watch include:

-

- Integration with DeFi: Incorporating DeFi features like yield farming, staking, lending and borrowing and many more protocols famous amongst the crypto enthusiasts can enhance the utility of your centralized cryptocurrency exchange development project.

- NFT Marketplaces: Centralized exchanges can offer a one-stop experience by integrating platforms for trading NFTs and other digital assets such as tokenized RWAs, crypto ETFs, perpetuals and derivatives, etc.

- Advanced Trading Tools: Centralized trading platforms can provide sophisticated charting, drawing tools, historic analysis, algorithmic trading and backtesting capabilities, built-in bots, etc. while facilitating derivatives and margin, social trading, portfolio management, etc.

- Enhanced Security: Centralized crypto exchange development projects can implement cutting-edge security measures such as MFA, hardware security, multi-signature mechanisms, biometric and end-to-end verification, cold storage, to protect against cyber threats.

- Regulatory Compliance: Staying up-to-date with evolving regulations, complying with local laws and integrating advanced KYC/AML processes will be essential as the regulatory landscape evolves.

- AI Integration: Businesses planning centralized cryptocurrency exchange development can leverage artificial intelligence for fraud detection, personalized user experiences, trading automation modules, predictive analysis for complex strategies and various other use-cases.

- Gamification: Incorporating gamified elements like points and badges, leaderboards, quests and challenges, levelling system, social features, in-app currency and rewards, may attract younger demographics to trading platforms.

- MPC Custody: Multi-party computation custody offers a robust, secure and hybrid approach for safeguarding digital assets. Integrating MPC custody in centralized crypto exchange development enhances security, reduces operational risks, improves user trust and helps the platforms attain regulatory acceptance.

By staying ahead of the curve and embracing innovation, centralized exchanges can continue to thrive in the dynamic crypto market. Since the most common challenges with centralized finance platforms include lack of privacy, hack risks, high fees and limited control of assets, businesses can partner with the best centralized crypto exchange development company to innovate and eradicate such challenges.

You may also read this dedicated blog on centralized exchange trends 2025 for an in-depth analysis.

Top 10 Centralized Exchanges in 2025

As per Coingecko, the largest centralized exchanges in 2025 as per the trading volumes include:

- Binance

- Crypto.com

- UpBit

- Bybit

- Coinbase

- OKX

- Gate.io

- MEXC

- Bitget

- HTX

Also Read>>> Understanding the Centralized Exchange Market

Conclusion

Despite the technical complexity of centralized cryptocurrency exchange development, these are an easier alternative. They operate under the hood so they can simplify a lot of processes, making it appealing for crypto investors as well as platform owners. However, there are a lot of factors that can make these centralized finance platforms stand apart and all such future-oriented and competitive upcoming players must consider those factors during centralized crypto exchange development. Some of them include security, cryptocurrencies available, fee charged by the exchange and ease-of-use. These are the factors considered by the traders while choosing a crypto exchange platform.

So, you want to create a competitive platform that meets the growing demands of the cryptocurrency market? The key is to stay focused on your unique selling proposition, enhance user experience and security while staying ahead of the industry trends.

At Antier, we believe that centralized centralized exchange development is more than creating trading platforms—they are the foundation of the digital economy, connecting people and opportunities across the globe. We specialize in transforming ambitious ideas into market-leading platforms, delivering end-to-end solutions that align with your business objectives and the industry’s future.

Let’s together sculpt the future of centralized finance. Schedule your call today!