The global interest in Solana for RWA tokenization is rapidly gaining traction due to its potential to unlock higher liquidity and reduce operational efficiencies. While Ethereum has been a popular choice for platform development, its higher fees and slower speed often hinder its widespread adoption. But here’s the catch: not all blockchains are created equal when it comes to RWA tokenization. Enter Solana— a compelling solution for platform development for institutional and retail-focused RWA projects with high-speed, and low-cost blockchain.

If you explored Solana as your go-to choice for RWA Tokenization Platform Development yet, you are missing out on the huge opportunity of liquifying in the $16 Trillion Market. This guide explores how Real-World Assets on Solana helps you unlock the future of tokenization and unlock higher returns on your investments.

The Global Interest in the Solana Powered Real Work Tokenization Platform is Rushing!

Recently, Taurus, the FINMA-regulated digital asset company, has integrated its platforms with Solana. This means banks and asset managers can now use Taurus to securely manage and issue tokenized assets directly on Solana. This happened right after Franklin Templeton made a similar move. It seems like Solana is becoming the place for real-world assets!

Why Tokenize the Real-World Assets?

The Tokenization of Real-World Assets on Solana is the process of digitizing real-world assets into tokens on blockchain networks. Each token ties an asset’s ownership rights and characteristics. While the illiquid real-world assets are confined to limited market access, RWA presents significant opportunities to tap into the Trillion-dollar market by offering a dynamic framework that overcomes the traditional market limitations.

The Role of Real-World Asset Tokenization Platform

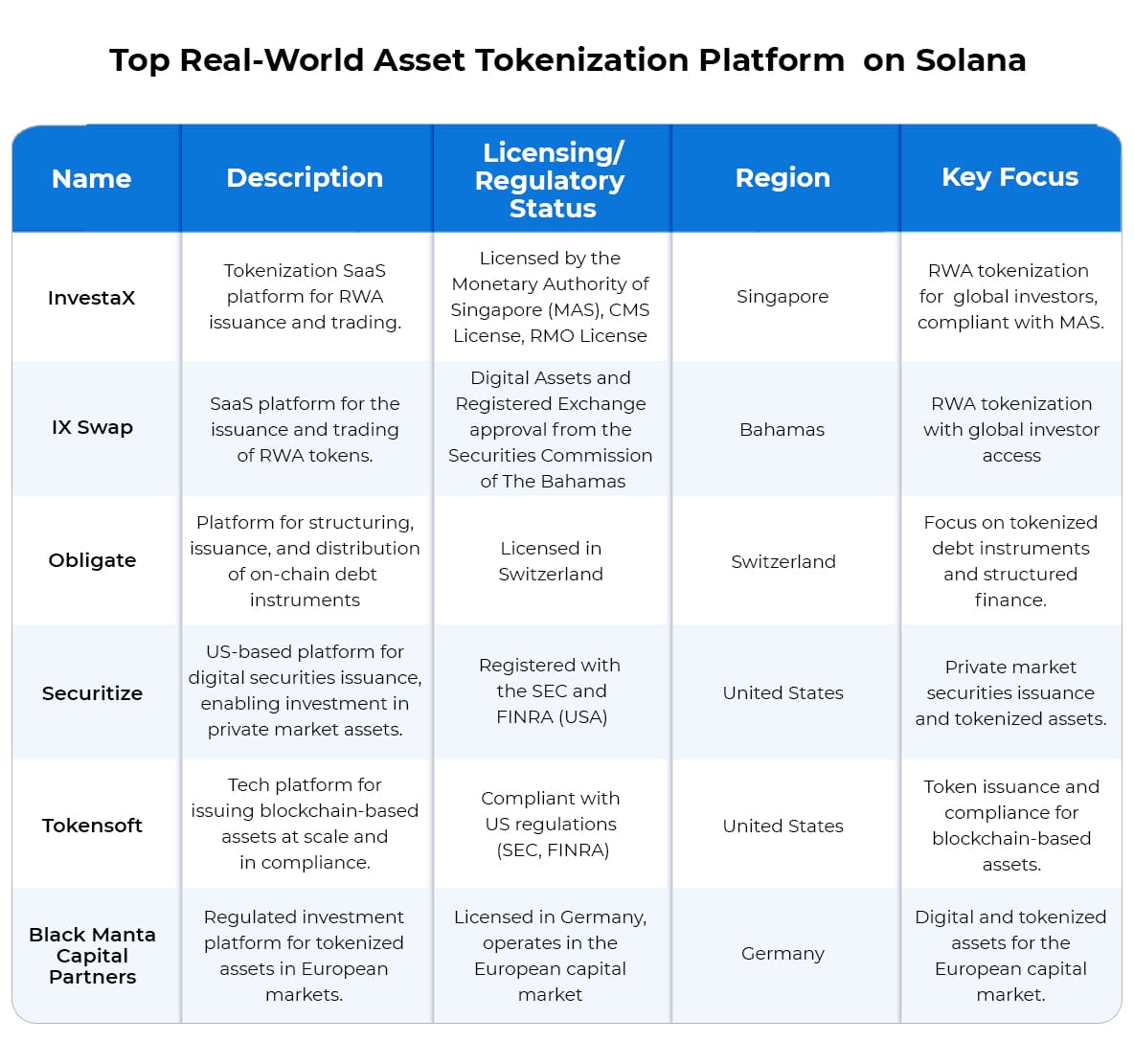

The Tokenization platform provides enterprises with technology for the structuring, issuance, distribution, and trading of tokenized real-world assets including real estate, Fintech, Bonds, Treasury, and Commodities. These platforms are licensed by the Regulatory Authorised for global trading. With the RWA Tokenization Platform Development, businesses can provide their investors with access to invest in tokenized RWA and trade in global capital markets.

The Solana Advantage: Why Build RWA Platforms Here (And Not Anywhere Else)

1. Lightning-Fast Operations

Solana’s network can process up to 65,000 transactions per second (TPS), drastically outpacing its competitors. The cost per transaction on Solana is as low as $0.01, compared to Ethereum’s hundreds of dollars in gas fees. Solana’s high throughput and ultra-low transaction costs enable the seamless processing of millions in tokenized RWA trades for pennies. This scalability is a true game-changer for institutional adoption of RWAs.

2. Built for Big Money

Solana’s infrastructure is not just crypto-native; it’s built for serious institutional players looking to tokenize real-world assets:

- Bridge Split: Businesses can instantly tokenize and trade real-world assets across multiple platforms with ease.

- Real-time Pyth Oracle: This feature delivers Wall Street-grade price feeds every 400 milliseconds, allowing institutional users to make informed decisions in real-time.

- Token-2022: A powerful tool enabling confidential transfers and compliance controls, key for meeting traditional financial regulatory requirements.

3. Enterprise-Ready Security

Solana’s Solana Permissioned Environments (SPEs) enable the creation of private, regulated environments that cater to the strictest compliance standards. This functionality ensures that businesses can operate within highly regulated industries without compromising on security or flexibility. No other blockchain offers this level of customization and control, making Solana an ideal choice for institutional-grade applications.

4. The Complete RWA Stack

Tokenization on Solana delivers an end-to-end solution for trading RWAs. Other chains may promise solutions, but Solana has already built them:

- SPL Tokens: Battle-tested and capable of handling billions in transactions, these tokens form the backbone of Solana’s ecosystem.

- Metaplex: A tool that allows users to mint and manage complex asset-backed NFTs, bringing real-world assets onto the blockchain securely and efficiently.

- Cross-chain Bridges: Solana is compatible with all major blockchains through Wormhole, facilitating interoperability and enhancing the reach and liquidity of RWAs across networks.

- DEX Infrastructure: Platforms like Raydium, Jupiter, and Orca provide instant liquidity for tokenized assets, ensuring smooth trading of RWAs in decentralized environments.

5. Scalability and Speed

Solana’s architecture, powered by Proof-of-History (PoH) and Proof-of-Stake (PoS), can handle over 50,000 transactions per second (TPS), making it the fastest blockchain in terms of real TPS as of May 2024. The efficiency and speed of Solana support large-scale RWA activities, enabling quick processing of tokenized assets and cross-border transactions.

6. Low Transaction Costs

Solana’s average transaction fee stands at just $0.028, making it highly cost-effective for micro-transactions as well as institutional financial products. This affordability is crucial for the mass adoption of RWA tokenization.

7. Robust Ecosystem

Solana’s ecosystem supports multiple aspects of RWA tokenization:

- Decentralized Exchanges (DEXs) like Jupiter, Raydium, and Orca provide liquidity for tokenized assets.

- Oracle Services such as Pyth Network and Switchboard offer accurate, real-time data for pricing and trading of RWAs.

- On/Off Ramps make it easy for users to convert fiat to crypto, driving broader adoption of tokenized RWAs.

8. Developer Tools

Solana provides a rich set of tools that streamline the creation and deployment of RWA tokens. These include:

- Anchor: A framework for building smart contracts.

- Solana Program Library (SPL): Used for creating fungible and non-fungible tokens, ensuring smooth and efficient token management.

- Solana SDKs: These pre-built modules and APIs help developers quickly deploy RWA-focused applications, enabling faster innovation and iteration.

9. Security and Decentralization

Solana’s dual-layer consensus mechanism, combining PoH and PoS, ensures both high-speed finality and decentralized validation, making it highly secure. Solana has undergone extensive security audits and stress tests to ensure resilience against potential attacks, making it ideal for institutional-grade RWA applications that require both security and decentralization.

10. Interoperability

Solana supports cross-chain functionality through tools like Wormhole Bridge, enabling RWAs to be transferred seamlessly across blockchain networks, including Ethereum. This interoperability expands market reach and liquidity, allowing tokenized assets to be used in decentralized finance (DeFi) applications across ecosystems.

Key Growth Drivers for RWA Tokenization on Solana: 2025 and Beyond

ETF Developments

VanEck’s Solana ETF filing in July 2024 signals growing institutional interest. If approved, this could bring significant new capital into Solana’s RWA ecosystem, similar to how Bitcoin ETFs increased mainstream adoption, providing RWA investors with more liquidity and enabling platform providers to expand their services.

Technical Improvements

Solana’s network continues to advance with important upgrades. The new Firedancer system can now process up to 1 million transactions per second, making the network more reliable for large-scale asset trading, and making it easier for investors to trade and invest in tokenized real-world assets.

Growing Ecosystem

New platforms are joining Solana’s RWA space. Superstate is creating tokenized investment funds. Realio Network’s recent expansion to Solana brings additional RWA management capabilities. This will increase investor access to diverse assets and offer platform providers more integrations and growth opportunities.

Strong Developer Community

Solana has become a leading blockchain for developers, ranking second globally in active developers and first for new developers, with 83% growth year-over-year in 2024, enabling developers to add new functionalities to the RWA platform for better user experience and security.

Institutional Support

Anchorage Digital Bank, a federally chartered crypto bank, now supports Solana’s SPL tokens. This institutional backing provides the security and compliance needed for traditional finance to adopt Solana-based RWA solutions, increasing platform legitimacy.

Ready to Build the futuristic RWA Platform on Solana?

Antier offers comprehensive Real World Asset Tokenization Platform development services specifically customized to your RWA tokenization projects. Our team of Solana experts can help you:

- Design and implement secure smart contracts for asset tokenization

- Develop user-friendly interfaces for asset management and trading

- Ensure regulatory compliance through built-in KYC/AML solutions

- Create custom solutions for specific asset classes and use cases

The future of asset management is being built on Solana, and the opportunity is ripe for innovation.

Don’t let this opportunity pass you by!

Frequently Asked Questions

01. What is the advantage of using Solana for Real-World Asset (RWA) tokenization?

Solana offers lightning-fast transaction speeds and low fees, making it a compelling choice for RWA tokenization compared to other blockchains like Ethereum, which can have higher costs and slower processing times.

02. How does RWA tokenization benefit investors?

RWA tokenization allows investors to access a $16 trillion market by digitizing real-world assets, providing greater liquidity and overcoming traditional market limitations.

03. What types of assets can be tokenized on Solana's RWA platform?

The RWA tokenization platform on Solana can handle various assets, including real estate, fintech products, bonds, treasury, and commodities, enabling structured issuance and trading in global capital markets.