Unveiling the Role of Blockchain in Telemedicine for Seamless Care

April 9, 2025

Top 5 Crypto Stablecoin Wallets for USDT, USDC, BUSD, TUSD & FDUSD in 2025

April 9, 2025Inspired by the Polymarket’s success during the US presidential elections when it made $3.6 billion, Robinhood recently launched their prediction market hub. It allows users to place bets on topics like Federal Reserve interest rates and NCAA college basketball tournaments. And even before Polymarkets cashed in on the opportunity, crypto.com stepped into the burgeoning prediction market, allowing users in the US to engage with upcoming sporting events.

See where the market’s headed? Without much ado, let’s explore the prospects of integrating prediction platforms into crypto exchange development while covering:

-

- Crypto Exchanges Are No Longer Just Trading Hubs

- How Crypto Exchanges Can Expand: Strategies & Advanced Modules

- Prediction Platforms: The Game-Changer for Exchange Software Development

- Cost Breakdown: Crypto Exchange Development With Prediction Platform Integration

- Conclusion: Prediction Platforms Are the Future of Exchange Engagement

Crypto Exchanges Are No Longer Just Trading Hubs

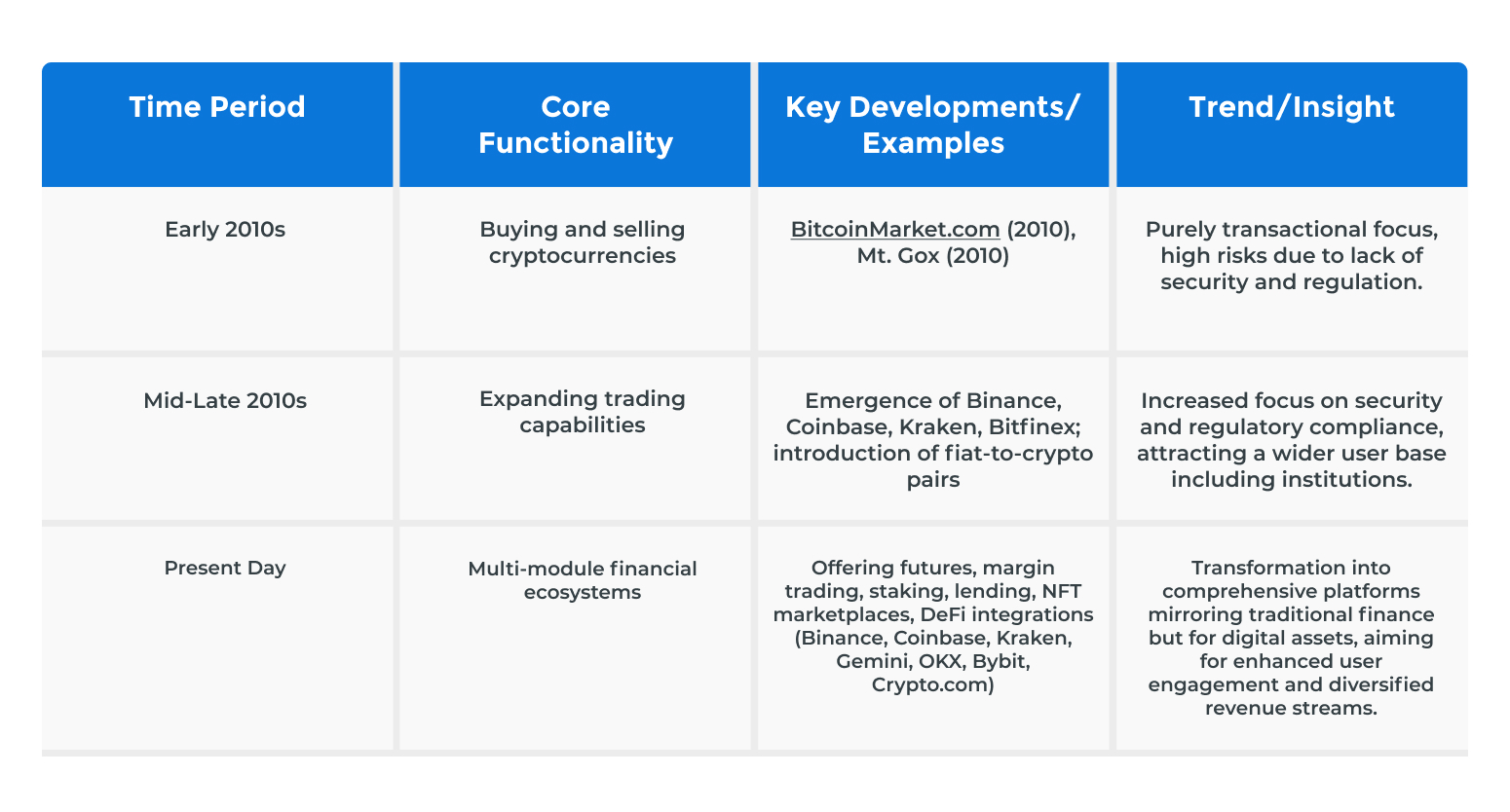

Cryptocurrency exchange software has transcended the single-purpose trading platform stature, evolving into all-in-one financial ecosystems offering diverse services such as staking, yield farming, derivatives trading, and portfolio management. This not only reflects the growing demand for cryptocurrencies but also demonstrates the increasing sophistication of cryptocurrency users.

As competition intensifies, giants like Binance, Coinbase, and Bybit are expanding beyond conventional spot and futures trading to offer services like staking, launchpads, educational resources, NFT marketplaces, payment solutions, and DeFi integrations. Kraken also launched advanced trading tools, crypto-backed loans, and institutional custody, whereas OKX combined DEX aggregation with Web3 wallets and GameFi partnerships.

This shift reflects a broader trend that needs urgent attention: “Cryptocurrency exchange software solutions are becoming super-apps, bundling diverse financial modules to retain users, boost engagement, and monetize new revenue streams.”

The next frontier in this multi-module evolution? Prediction platforms—decentralized or hybrid systems where users bet on real-world events, market movements, or social trends.

How Crypto Exchanges Can Expand: Strategies & Advanced Modules

Crypto exchange platform development companies adopt multi-dimensional growth strategies to build standout crypto ecosystems.

1. Feature Expansion

- Derivatives trading (perpetual futures, options).

- Yield farming and liquidity mining pools.

- Margin trading and algorithmic trading tools

- NFT marketplaces with minting tools.

- Portfolio management tools with AI-based analytics-driven dashboards

- Multi-chain support for a seamless cross-chain trading experience

- Advanced security features such as anti-DDoS modules, registry locks, and multi-factor authentication.

- Gamified education and engagement: Interactive courses with quizzes, achievement badges, and real-time challenges

- QR-based payments, NFC-enabled transactions

- Customer support systems

- OTC Desk

- Payment Gateway Integration

- Crypto Debit & Credit Cards, Voucher Cards

- AI-powered Trading Bots

- AI-voice Assistant Integration

- Social trading features (copy trading, sentiment analysis).

Also Read>>> Antier’s White Label Exchange Platform: Updated Feature List

2. Technical Innovation

- AI-driven portfolio analytics and management, AI-based fraud detection for crypto exchange platform development

- Cross-chain interoperability bridging various L1s and L2s (e.g., integrating Solana, Ethereum, and Cosmos)

- Oracle’s integration for fetching market data in real-time

- Support for tokenized RWAs

- Zero-knowledge proofs (ZKPs) for privacy-focused trading

3. Community-Centric Models

- Tokenized governance (exchange tokens with voting rights)

- Gamified rewards (leaderboards, quests)

- Educational hubs with trading courses

4. Regulatory Readiness

- KYC/AML-compliant fiat gateways

- Partnering with reliable legal counselors who specialize in the global/target region’s jurisdictions

- Licensed staking services

- Jurisdiction-specific product tailoring

Also Read>>> The Crypto Call: Why Banks Can’t Afford to Ignore the Digital Asset Revolution

Prediction Platforms: The Game-Changer for Exchange Software Development

Prediction platforms allow users to speculate on various events, ranging from sports events and election results to fluctuations in economic indicators and crypto price movements.

Like digital assets are on cryptocurrency exchange software platforms, anticipated outcomes of future events are traded on prediction platforms. Users can buy and sell contracts or shares that represent the likelihood of specific events occurring. The market prices of these contracts dynamically adjust to reflect the aggregated probability of the event as perceived by the collective wisdom of the participants.

This mechanism harnesses the power of crowd intelligence, where the diverse knowledge and insights of a large group can lead to remarkably accurate forecasts regarding a wide array of future occurrences. By transforming speculation on future events into tradable assets, prediction marketplaces offer a unique and dynamic form of market-driven forecasting, using blockchain to ensure transparency and instant payouts.

Platforms like Polymarket and Augur have already proven their appeal, attracting millions in trading volume.

Why Integrate Prediction Platforms?

- User Retention: Gamified betting keeps users engaged longer.

- New Revenue: Fees from prediction markets and liquidity pools.

- Data Insights: Market sentiment data from prediction trends can inform exchange strategies.

Key Features of Prediction Platforms

- Event Creation: Let users propose and vote on markets (e.g., “Will Bitcoin hit $100K by 2025?”).

- Real-Time Odds: Dynamic pricing based on participant bets.

- Liquidity Incentives: Reward liquidity providers with platform tokens.

- Cross-Chain Settlements: Support multiple tokens (e.g., USDC, ETH) for bets.

- Dispute Resolution: Decentralized oracles (e.g., Chainlink) to verify outcomes.

Cost Breakdown: Crypto Exchange Development With Prediction Platform Integration

1. Crypto Exchange Development Costs

- Basic Exchange (Spot Trading): $40k–$100k

- Advanced Exchange (Derivatives + DeFi): $70k–$250k.

- Key Cost Drivers:

- Blockchain integration (EVM vs. non-EVM chains).

- Security audits (smart contracts, penetration testing).

- Regulatory compliance (licenses, legal advisory).

2. Prediction Platform Integration Costs

- Custom Prediction Module With Third-Party API Integration: $40k–$200k.

- Additional Expenses:

- Oracle setup (e.g., Chainlink integration)

- Liquidity bootstrapping (initial rewards pool).

- UI/UX design for seamless user experience.

3. Ongoing Costs

- Maintenance: $15k–$30k/month (updates, server costs).

- Marketing: $50+/month (user acquisition campaigns).

- Compliance: $10k–$20k/month (legal updates, audits).

Conclusion: Prediction Platforms Are the Future of Exchange Engagement

As cryptocurrency exchange software solutions race to become holistic financial hubs, prediction platforms offer a unique blend of entertainment, utility, and profitability. By integrating advanced modules, including prediction marketplaces, exchanges can tap into a billion-dollar prediction market industry, diversify revenue, and foster loyal communities. The winners of tomorrow won’t just facilitate trades—they’ll let users bet on the future itself.

So, are you ready to build the future of crypto exchange platform development? Partner with blockchain developers at Antier who specialize in multi-module DeFi and hybrid ecosystems.