A Comprehensive Guide On Layer 2 Dex Development: The Popular BTC Rootstock Protocol

December 19, 2024

Top Blockchain Platforms for dApp Development in 2025

December 20, 2024The global fintech ecosystem is witnessing an unprecedented transformation with the rise of white-label neo banking integrated with cryptocurrency exchange capabilities. Combining the stability of traditional banking with the dynamic potential of digital assets, the combination of crypto neo-banking and crypto exchanges is redefining the financial ecosystem. This collaboration could eventually usher in a new era of financial systems by creating resilient infrastructure that can support decentralized technologies in addition to traditional frameworks. This amalgamation ensures that businesses and consumers can navigate the complexities of both systems without compromising on efficiency or security, addressing the growing preference for diversified financial tools.

Let’s Begin!

Top Notch Reasons To Invest In White label Neo Bank With Crypto Exchange Integration

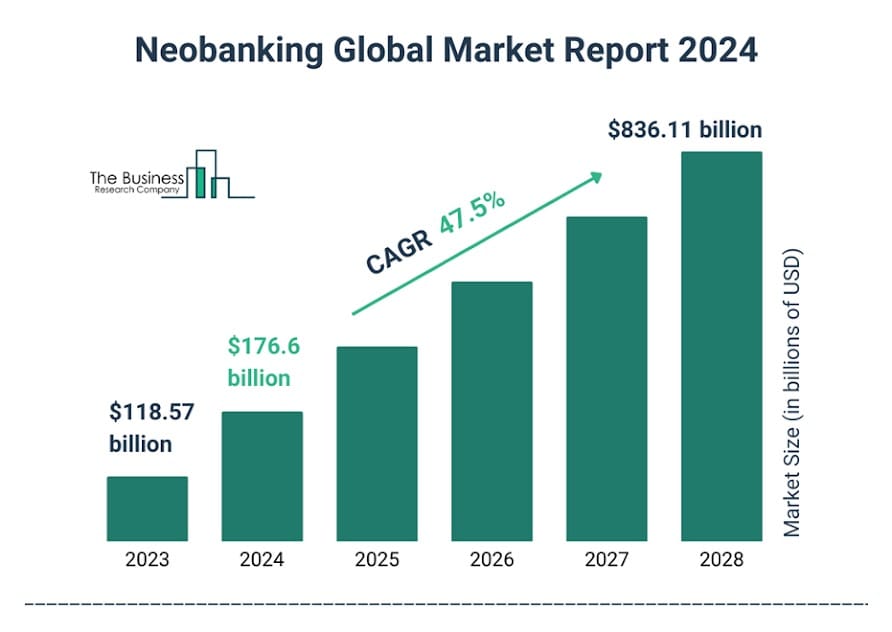

The neobanking sector is poised for exponential growth, projected to reach $836.11 billion by 2028 with a CAGR of 47.5%. One key trend driving this boom is the integration of crypto exchanges into crypto neo-banking platforms. This fusion, alongside advancements like AI, embedded finance, and open banking, is reshaping the future of digital financial services. Let us have a closer look at why this integration is a smart investment-

Source Link: https://www.thebusinessresearchcompany.com/report/neobanking-global-market-report

- Seamless Integration of Crypto and Fiat Currencies

Benefit : Combining traditional banking services with cryptocurrency exchange capabilities enables users to manage both fiat and digital currencies on the same platform.

Impact : This integration allows for smoother transactions, making it easier for consumers to switch between crypto and fiat currencies with minimal friction

- Expanded Service Offerings

Benefit : By integrating a crypto exchange, white-label neo-banking platforms can offer additional services such as crypto-to-crypto trades, crypto-to-fiat exchanges, portfolio management, and even investment opportunities in blockchain assets.

Impact : Customers get access to a broader range of financial tools, giving businesses a competitive edge in the evolving digital finance landscape

- Diversification of Revenue Streams

Benefit : Crypto exchange integration introduces new avenues for revenue generation, including trading fees, liquidity provision, and other crypto-related financial products.

Impact : This can significantly boost profitability for businesses that offer white label neo bank solutions, contributing to sustainable growth

- Attracting a Broader Customer Base

Benefit : White-label crypto neo banking platforms can appeal to both traditional bank customers and crypto enthusiasts by offering a dual ecosystem of services.

Impact : By tapping into the growing demand for digital asset solutions, businesses can expand their reach and diversify their customer base

- Security and Trust with Blockchain Technology

Benefit : Integrating a crypto exchange within a white-label neo bank solution enhances transaction security through blockchain’s inherent transparency and immutability.

Impact : This fosters trust among users and ensures that all crypto transactions are secure, protected by robust protocols

- Cross-Border Payments at Lower Costs

Benefit : Crypto exchange integration enables faster and more cost-effective international transactions compared to traditional banking methods.

Impact : This is especially beneficial for businesses with a global customer base, offering quick and low-cost remittances and cross-border payments

- Flexibility and Customization

Benefit : White-label neo bank solutions with integrated crypto exchanges offer businesses the ability to customize the platform according to their brand, supported cryptocurrencies, and services.

Impact : This flexibility helps businesses cater to different customer needs, giving them the ability to innovate in a highly competitive market

- Positioning as Innovators in the Market

Benefit : Integrating crypto exchanges into white-label neo bank platforms positions businesses as forward-thinking leaders in both traditional finance and the rapidly growing crypto space.

Impact : This helps institutions attract tech-savvy consumers who are increasingly seeking digital-first financial services

- Enhanced Customer Engagement

Benefit : Providing an all-in-one platform where users can trade crypto, manage their accounts, and access banking services enhances the overall user experience.

Impact : Increased customer satisfaction leads to higher retention rates and greater lifetime value for businesses offering white-label crypto neo bank platforms

- Regulatory Compliance and Risk Mitigation

Benefit : Many white-label solutions include built-in features to ensure regulatory compliance, such as KYC and AML protocols.

Impact : This ensures that businesses can safely operate within the evolving regulatory frameworks surrounding cryptocurrencies

The integration of crypto exchanges in white-label neo-banking solutions is revolutionizing the financial services industry. It offers businesses the ability to tap into new revenue models, broaden their customer base, and provide a comprehensive, secure, and efficient banking experience for both fiat and crypto users.

Exclusive Features: White Label Crypto Neo Banks With Crypto Exchange Integration

✔ DeFi Integration

Allowing users to access DeFi protocols directly from their white label crypto neo bank platform development enables features like lending, staking, yield farming, and liquidity pools. This integration enhances the user experience by offering a hybrid financial ecosystem where traditional and decentralized finance coexist. Crypto neo banking is thus empowered to provide a comprehensive service to users.

✔ Cross-Border Payments with Crypto Settlements

Through crypto neo banking development companies, businesses can offer faster, cheaper cross-border payments by utilizing crypto settlements. By integrating crypto exchanges, users can send funds globally, bypassing traditional financial systems’ limitations. This ability to manage cross-border payments efficiently is a key feature for any white-label neo bank.

✔ Automated Portfolio Diversification

The white-label crypto neo bank app offers automated portfolio diversification using advanced AI algorithms. Users’ crypto assets are distributed across various cryptocurrencies, optimizing returns while mitigating risk. This feature enhances the overall user experience on the white label neo bank platform by allowing passive asset growth through smart automation.

✔ Crypto Collateralized Loans

With white-label neo bank solutions, users can secure loans using their crypto assets as collateral. Integration with crypto exchanges ensures that these assets can be quickly liquidated if needed to meet loan obligations. This provides liquidity for users without them needing to liquidate their positions entirely, and the white-label crypto neo bank app ensures a seamless loan experience.

✔ Advanced Security Protocols with Multi-Sig Wallets

White-label crypto neo bank platforms leverage multi-signature wallets to provide enhanced security for both crypto and fiat transactions. Multiple private keys are required to authorize any transaction, making unauthorized access significantly more difficult. This feature ensures that the platform offers a high level of trust and security for users.

✔ Crypto Taxation Tools

The white-label neo bank solutions can integrate crypto taxation tools that automatically calculate taxes on crypto transactions. Users will benefit from automated tax reporting, streamlining the compliance process for businesses operating in multiple jurisdictions. Such tools help businesses and consumers avoid the complexities of crypto taxation through white-label crypto neo bank platform development.

✔ Native Staking and Yield Generation

Users of crypto neo banking platforms can stake various cryptocurrencies to earn rewards directly on the white label neo bank platform. This feature, combined with automatic yield generation, creates a source of passive income for users, enhancing the overall value proposition of the app for both businesses and consumers.

✔ Fiat-Backed Stablecoins

White-label neo banks can provide customers with the advantages of both fiat and cryptocurrency without the volatility that comes with crypto assets by supporting fiat-backed stablecoins. This ensures that businesses can maintain stable balances for daily operations while benefiting from the solutions integrated with crypto exchanges.

✔ Customizable Blockchain Tokens for Loyalty Programs

White-label crypto neo bank solutions allow businesses to create customizable blockchain-based loyalty tokens. These tokens can be used to reward customers for purchases or engagement. This loyalty system, integrated into the white-label crypto neo bank platform development, ensures customer retention and enhances the experience on crypto neo banking platforms.

✔ Smart Payment Solutions for E-Commerce

The integration of crypto payments directly within white-label neo bank platforms allows e-commerce merchants to accept digital currencies seamlessly. This feature is crucial for businesses looking to tap into the growing crypto market, making transactions easy for both consumers and businesses, thanks to white-label crypto neo bank solutions.

✔ AI-Powered Risk Management

AI-driven algorithms embedded in white-label crypto neo bank platforms analyze market conditions and detect potential risks or anomalies. This crypto neo banking feature allows users to safeguard their investments by receiving real-time alerts on suspicious activities or market changes, enhancing user protection.

These features contribute to making white-label crypto neo bank solutions an all-encompassing financial platform that integrates traditional banking with cutting-edge crypto exchange capabilities.

How To Create a White Label Neo-Bank with Crypto Exchange Integration?

The integration of crypto exchanges into neo-banking services has become essential for staying competitive in the evolving financial landscape. This fusion lays the foundation for advanced financial ecosystems, enabling businesses to tap into transformative opportunities and drive significant long-term ROI. Here are the 5 simple steps on how to create a white label neo-bank with crypto exchange Integration, with the targeted keywords seamlessly incorporated :

Step 1. Define Your Business Model and Regulatory Compliance

Before creating a white-label neo bank, it’s essential to outline the business model and ensure regulatory compliance. Decide on the services you want to offer, such as savings, lending, staking, and crypto trading, and understand the legal requirements (e.g., KYC/AML compliance, financial licenses). Regulatory frameworks like MiCA (Markets in Crypto-Assets) in Europe and FINRA in the US must be considered. These regulations will ensure that your white-label crypto neo bank app operates within legal boundaries while providing services to businesses and consumers.

Step 2. Partner with a White-Label Neo-Banking Solution Provider

To develop your crypto neo banking platform, find a white-label neo bank development company with experience in integrating crypto exchange solutions. These companies offer ready-made software that is customizable and scalable to suit your needs. Choose a partner that provides white-label neo bank solutions for crypto integration, ensuring smooth interoperability between fiat and digital currencies. A well-integrated solution will support platforms that help enhance user experience while maintaining a secure ecosystem.

Step 3. Integrate a Crypto Exchange into the Platform

A white label crypto neo bank platform development includes integrating a crypto exchange feature to enable users to trade and manage cryptocurrencies. This can be done by utilizing established crypto exchange APIs or building a custom solution with robust blockchain technology. Ensure the exchange supports multiple cryptocurrencies and facilitates the buying, selling, and storing of crypto assets within your crypto neo banking ecosystem. The bank app will allow users to seamlessly manage both fiat and crypto assets from a single interface.

Step 4. Customize the User Interface and User Experience

Customization is essential for establishing your unique brand identity. A white-label neo bank platform allows you to design a user interface that is simple to use and intuitive. Ensure that your platform’s white-label crypto neo bank solutions allow for personalized dashboards, real-time tracking of crypto investments, and easy access to wallet balances. The ability to switch between fiat and crypto seamlessly is a key feature of white-label crypto neo bank app solutions, providing a superior experience for users who are familiar with both traditional and crypto finance.

Step 5. Implement Security and Risk Management Measures

Security is a crucial component when developing a customzied banking app. To protect user assets, implement advanced security protocols such as MFA, end-to-end encryption, and cold storage for cryptocurrencies. A white-label neo bank must also include AI-powered risk management systems to monitor market trends and detect fraudulent activities. With robust security and risk measures, your crypto neo banking platform will inspire confidence in businesses and consumers, ensuring safe transactions and asset management.

You can successfully build a white label neo bank with crypto exchange features by following these steps, giving your users a complete and safe platform for handling both fiat and cryptocurrency. Partnering with a skilled white label neo bank development company ensures that your platform will be both scalable and adaptable to future financial trends.

The Future of White label Neo-Banks & Crypto Exchange Integration: What’s Next?

The future of crypto-friendly neo-banks integrated with crypto exchanges presents vast investment and business opportunities. Neo-banks offer a previously unheard-of degree of financial efficiency and inclusivity by fusing digital assets with traditional banking. The ROI potential for businesses lies in offering multi-currency wallets, staking features, and tokenized assets that attract both crypto investors and retail customers. As adoption increases, crypto neo banking will capitalize on growing demand for DeFi services. For investors, this integration opens new revenue streams from trading fees, liquidity pools, and cross-border payments.

The scalability of white-label neo banks promises exponential growth, positioning early adopters at the forefront of financial innovation. The combined ecosystem allows businesses to reach broader markets, enhance customer engagement, and ensure long-term profitability. With regulatory advancements and increasing crypto adoption, the future is poised for sustainable growth in crypto-friendly neo banking solutions.

Plan For Instant Integration & Immediate Profitability With Antier

Make an investment that promises to evolve industries and yield enormous profits as you venture into the future of innovation. Designed as a market-fit marvel, crypto neo banking with exchange empowers sectors like dealerships and beyond, driving unparalleled growth and efficiency. Unlock new horizons and redefine success across the evolving business landscape.

As a leading white-label neo banking development company, we excel at creating cutting-edge white label neo bank platforms that seamlessly integrate crypto exchanges. Our team of seasoned blockchain professionals leverages extensive expertise and innovative technology to deliver customized, business-oriented solutions that empower your success. We create platforms that are suited to the changing demands of companies in the fintech sector by emphasizing high return on investment and providing 100x growth potential. Partner with us and hire comprehensive crypto neo bank development services to redefine financial offerings, enhance operational efficiency, and position your business at the forefront of the market revolution.