Why Businesses Should Adopt Blockchain Technology in Logistics

April 3, 2025

Blockchain in Cold Chain Logistics: How It Solves Supply Chain Gaps

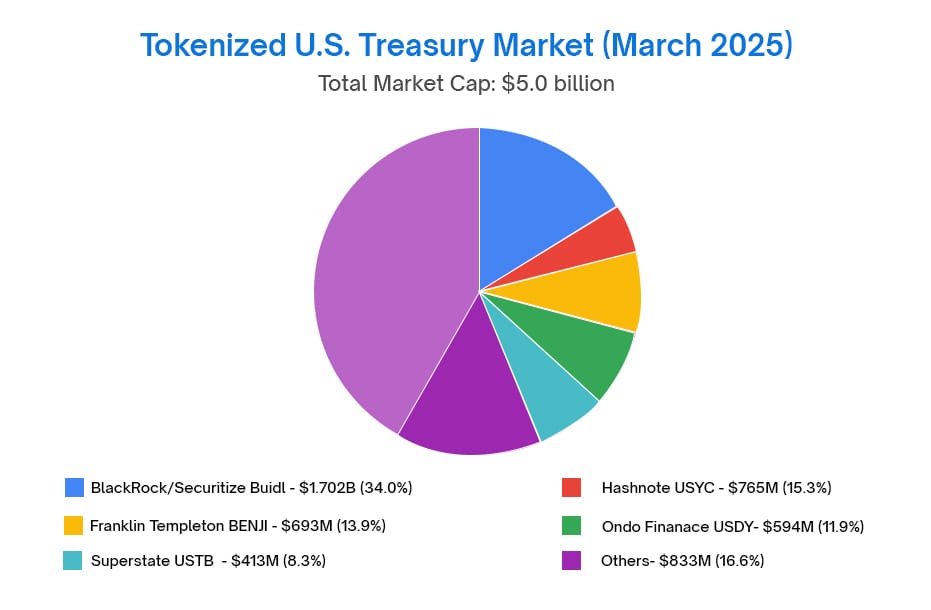

April 3, 20252025 is a hot year for tokenization investments, but how can we make them compliant, secure, and scalable? Many companies are choosing Tokenized US Treasury Platform Development for investors to grow their wealth and professionally manage their treasury bills in a digitized manner. By providing access to regulated digital assets, these platforms are reshaping how investors engage with treasury bills and create new financial opportunities.

This guide explores the opportunities for businesses to unlock with the Blockchain Platform for Tokenized Treasury Bills and how it can benefit investors in their financial growth.

Understanding U.S. Treasury Bills and The Need for Tokenization

Treasury bills (T-bills) are short-term, fixed-income debt securities issued and backed by the U.S. Department of the Treasury. Unlike traditional bonds, T-bills do not offer periodic interest payments. Instead, they are sold at a discount to their face value, with the yield effectively determined by the difference between the purchase price and the amount received upon maturity.

T-bills are available with various maturity periods ranging from as short as four weeks to as long as 52 weeks (one year). Their interest rates are typically established through competitive auctions, reflecting current market demand and offering a reliable, low-risk yield.

Five key characteristics make T-bills an appealing investment option:

- Short-Term Maturity: T-bills have maturities ranging from a few days to one year, commonly available in durations of 4, 8, 13, 26, and 52 weeks.

- Zero-Coupon Structure: Sold at a discount to their face value, investors earn returns through the difference between the purchase price and the face value upon maturity. For example, purchasing a T-bill for $980 that matures at $1,000 results in a $20 profit.

- No Periodic Interest Payments: Returns are realized exclusively at maturity when the full-face value is repaid.

- High Liquidity: T-bills are easily tradable on the secondary market, offering investors prompt access to funds if needed.

- Safety and Stability: As government-backed securities, T-bills present minimal credit risk, making them a preferred choice during periods of economic uncertainty.

The tokenization of treasury funds is the process of converting the treasury bill into digital tokens on blockchain, which can be managed, traded, and transferred. The tokenized US Treasury platform development enables investors to deploy these funds and maximize the returns.

Why Investors Must Tokenize Their Treasury Bills?

-

Global Accessibility to US Treasury Yields

Investors looking to invest in U.S. treasury bills in regions like the USA or Europe often face trouble due to traditional limitations like currency conversion, license fees, and manual management. But tokenized US Treasury Bills on Blockchain Platforms made it easy. Now, Banks and Fintech firms can provide tokenized T-bills in exchange for USDC, eliminating cross-border fees and complexities. This innovation opens the door for countless individuals globally to leverage one of the safest investment vehicles.

-

Automated Yield Optimization

Tokenized T-bills streamline yield-maximizing strategies, such as rolling down the yield curve. Instead of manually managing trades, investors can acquire tokenized assets that automatically optimize returns. This frictionless approach offers convenience and efficiency, especially for those without the expertise or capacity to handle complex investment strategies.

-

Enhanced Collateral Options

Unlike conventional T-bills that require liquidation for collateralization, tokenized T-bills offer unique flexibility. Their liquidity and cash-redeemable nature allow them to serve as collateral directly, continuing to generate yield for their holders. This innovation offers a dynamic, yield-generating alternative to static collateral models.

How To Issue the Tokenized Treasury Bills to Investors?

To offer the Tokenized U.S. treasury Bills to investors, businesses need to embed their products using the Platform Solutions for Tokenized Treasuries to connect with the yield pools. The platform must be compliant, regulation-friendly and safe. With one solution, FinTech’s and Banks can offer their users access to safe and highly liquid investments across borders.

Which Blockchain Platform Is Best for U.S. Tokenized Treasury?

For Developing Platforms for Tokenized US Government Bonds and bill issuance, Ethereum is the most widely used blockchain, with around 70% of the tokenized T-bill market cap at nearly $2.8 billion. Stellar and Solana are considered to be the second and third-best options, with market caps of over $281 million and $135 million, respectively.

Requirements That the U.S Tokenized Treasury Bill Platform Must Accommodate:

- Legal Framework and Compliance: It is crucial to create a robust legal framework is essential to ensure the tokenization of Treasury bills complies with regional and international financial regulations. This framework must recognize digital security tokens as valid representations of government debt, ensuring their legitimacy as investments. It also ensures that tokenized T-bills can be legally traded, settled, and redeemed, providing investors with regulatory clarity and confidence.

- Digital Representation of Assets: The Treasury bill selected for tokenization is digitally represented on the Tokenization Platform for US Treasury Bills. This process ensures a one-to-one backing between each token and the underlying U.S. Treasury bill. Such a mechanism guarantees that the tokenized version maintains the same value and authenticity as the original T-bill, fostering investor trust and security.

- Smart Contracts for Automation: The smart contract must automate the execution of T-bill terms, including maturity dates, interest rates, and redemption processes. By embedding these rules into the Blockchain Platform for Tokenized Treasury Bills, the entire lifecycle of the tokenized T-bill, from issuance to maturity, is automated. This reduces administrative tasks and minimizes the risk of errors.

- Issuance and Trading on Blockchain: Once tokenized, T-bills are issued on a blockchain platform, allowing them to be traded like traditional financial assets. Blockchain platforms offer global accessibility and enhanced liquidity, enabling investors to purchase Treasury bills with ease. This approach resembles traditional markets, making the transition to blockchain-based assets smooth and familiar for conventional investors.

- Seamless Settlement and Redemption: The Tokenization Platform must offer instant settlement upon maturity. Tokenized T-bills should be automatically redeemed, with investors receiving the face value in either digital currency or fiat, as specified in the smart contract. This streamlined process enhances the efficiency and transparency of handling U.S. Treasury bills, reducing reliance on intermediaries and minimizing delays.

Partner With Antier for Tokenized US Treasury Platform Development

U.S Treasury bills are becoming the most significant investment option, and building a Building Platform for Tokenized Government Bonds can open up billions of dollars in opportunities for FinTech’s and Business firms. At Antier, we have a team of dedicated experts to provide the licensed platform for tokenizing U.S. Treasury bills. With strategic partnerships, our team can help token issuers connect with millions of verified investors across borders for investments. Let’s connect and discuss your tokenization strategies.