The world of cryptocurrency exchanges is no exception to this wisdom. CEXs are canonized for loads of liquidity, and ease-to-use, and condemned for lack of transparency and custodial risks. DEXs differentiate by addressing unmet needs with autonomy, and unparalleled security yet struggle with scalability and user-friendliness. Hybrid crypto exchange software or semi-centralized exchanges identify their opportunity and capitalize on the constraints by blending the best of both worlds, offering users a balanced approach to trading.

Let’s explore more about semi-centralized exchanges and why they might just be the future of crypto trading.

Hybrid Exchanges: Bridging Familiar Territories of CEXs and Uncharted Waters of DEXs

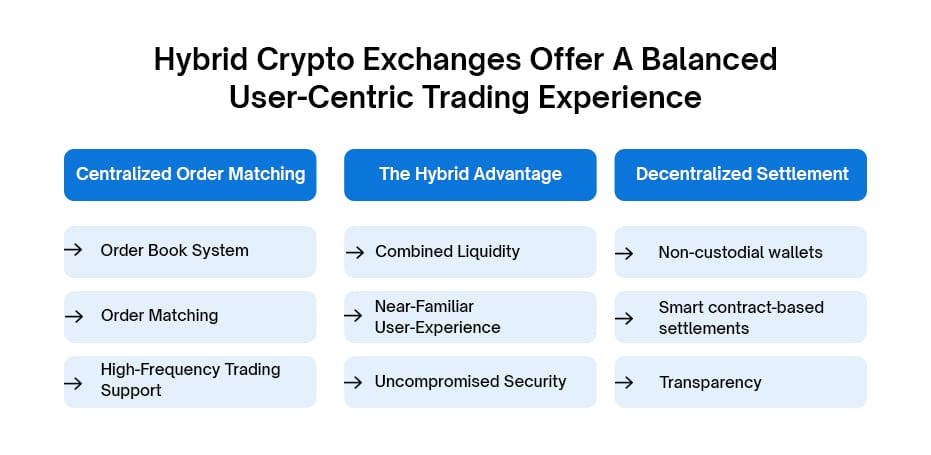

Semi-centralized or hybrid crypto exchange development presents a mid-way approach between traditional finance and the decentralized world, bringing together the efficiency, liquidity, and simple navigation of CEXs and transparency, autonomy, and security of DEXs. Mitigating the limitations of both, these hybrid trading models ensure high-speed transactions, regulatory compliance, deep liquidity pools, user control, and security, all that a user would want.

Also Read>>> Evolution of Hybrid Crypto Exchange

Components Of Hybrid Exchange Development

- Order Book: Hybrid exchange development takes in this core component of a centralized exchange that showcases the buy and sell orders from different users.

- Order Matching: The semi-centralized exchange’s software efficiently matches buy and sell orders based on price and time priority.

- HFT Support: Some hybrid crypto exchange software solutions may incorporate high-frequency trading capabilities to enhance order execution speed.

- Smart Contracts: Instead of relying entirely on centralized servers, semi-centralized exchanges leverage smart contracts to execute and settle trades.

- Decentralized Custody: Users may have the option to hold their funds in their own non-custodial wallets, minimizing the risk of exchange hacks.

- Transparency: Distributed ledger technology in hybrid exchange development maintains and provides a transparent and immutable record of all transactions.

- Improved Security: Semi-centralized exchanges aim to enhance security and reduce counterparty risk by combining centralized order matching with decentralized settlement.

- Enhanced User Experience: Hybrid exchanges offer a user-friendly experience and better customer support while maintaining the security and decentralization benefits of blockchain technology.

- Faster Transaction Speeds: Hybrid crypto exchange software combines the efficiency of centralized order matching with the speed of blockchain technology to offer faster transaction times.

- Regulatory Compliance: These exchanges can more easily comply with regulatory requirements as they implement compliance mechanisms without compromising most principles of decentralization, making them more accessible to institutional investors.

- Cross-Chain Compatibility: Supports trading across multiple blockchain networks.

Depending on the unique blockchain specifications and business requirements, a hybrid crypto exchange development company may create distinct combinations and blends of centralization and decentralization. It may include centralized order matching, transaction processing, decentralized custody, and governance models like Phemex or a centralized model leveraging blockchain for account segregation. They may also create some other combinations that match the vision of a hybrid exchange provider.

Also Read>>> Hybrid Exchange Development: Steps to cover

Reasons Why Hybrid Crypto Exchange Development is Profitable in 2025

If you’re planning to launch your trading platform in 2025, hybrid exchange development presents a compelling opportunity. As the cryptosphere evolves and expands, the demand for secure efficient, and non-custodial trading platforms will rise, giving rise to more hybrid models. Let’s discover the reasons for the surging popularity of hybrid crypto exchange software solutions.

1. CEX Shakeups and Enhanced Need For Security:

Several shake-ups have eroded customers’ trust in centralized exchanges. As per 2024’s web3 security report by CyVers, CEXs accounted for $275.1 million in lost funds, a 900% increase compared to the previous year. Conversely, DEXs are plagued by lower liquidity, complicated user experience, slower transactions, and higher network fees. Hybrid exchange development combines the best elements of centralized and decentralized trading models in all aspects, making it difficult to exploit any vulnerabilities. As users are not obliged to deposit funds into a central wallet, it reduces the risk of hacks and thefts. Funds remain in users’ wallets, and trades are executed via smart contracts, ensuring security and transparency.

2. The Fusion Brings User-Centric Trading Experience:

Hybrid crypto exchange development may involve blending the speed, liquidity, and user-friendliness of centralized platforms with the security, transparency, and autonomy of decentralized systems. This fusion creates a compelling offering for users who want the efficiency of CEXs without sacrificing control over their assets. Blockchain-based settlements enhance transparency, building trust among traders. Moreover, unlike DEXs that suffer from liquidity lags, hybrid crypto exchange software solutions leverage centralized order books and order matching mechanisms, ensuring that traders are executed instantaneously at competitive prices.

3. Regulatory Compliance

Governments and regulators worldwide are tightening their oversight of trading platforms. As CEXs continue to be under the constant scrutiny of regulatory bodies and DEXs might be the next hit as the DeFi regulations evolve, hybrid exchanges become better positioned to comply with regulations. Hybrid trading models can achieve regulatory approval and enhance acceptance among institutional investors by incorporating KYC/AML protocols during hybrid exchange development.

4. Cross-Chain Trading Made Easy

In 2025, the cryptocurrency market will be more fragmented than ever, with numerous blockchains and tokens. Hybrid exchanges leverage cross-chain compatibility to enable seamless trading across multiple blockchain networks. This capability allows users to trade assets without the limitations of single-chain DEXs or the custodial risks of CEXs.

5. Scalability to Meet Growing Demand

With crypto adoption reaching unprecedented levels in 2025, hybrid crypto exchange software solutions must be prepared to handle a surge in transaction volumes. Hybrid exchanges leverage centralized order books to ensure scalability while employing blockchain technology for secure settlements, creating a robust infrastructure for high-frequency trading.

6. DeFi Integration and Passive Income Opportunities

Hybrid exchanges can be designed to work frictionlessly with various decentralized finance protocols. This creates additional value for users as they can benefit from staking, lending, and yield farming opportunities, all in a hybrid crypto exchange software. As users get to earn passive income while trading, it further increases the user base for these platforms.

7. Growing Awareness of Self-Custody

The “Not Your Keys, Not Your Coins” movement has gained significant traction, encouraging users to prioritize platforms that offer self-custody solutions. Hybrid exchanges strike the perfect balance, allowing users to maintain control over their funds while enjoying centralized conveniences.

8. Catering to Institutional Investors

Institutional investors demand platforms that offer deep liquidity, regulatory compliance, and secure asset custody. Hybrid exchange development meets these requirements by providing a transparent and efficient trading environment, making them the preferred choice for hedge funds, family offices, and corporations.

9. Evolution of Blockchain Technology

Advancements in blockchain scalability, such as Layer-2 solutions and zkRollups, have made hybrid exchanges more efficient. These technologies enable faster and cheaper transactions, enhancing the user experience and driving the popularity of hybrid trading platforms.

10. Resilience Against Downtime and Censorship

Hybrid crypto exchange software solutions offer decentralized backups and censorship-resistant features, ensuring continuous operation even during technical issues or regulatory crackdowns. This resilience makes them a reliable choice for traders in uncertain market conditions.

11. Community Trust and Transparency

Hybrid exchanges leverage the transparency of blockchain technology to build trust among users. Features like on-chain audits, decentralized governance, and open-source protocols foster a sense of community ownership, further, boost their appeal, and make hybrid crypto exchange software development, an advantageous endeavor for businesses.

Challenges Faced by Hybrid Crypto Exchange Software Solutions

While promising, semi-centralized or hybrid exchanges are not without challenges:

- Complex Development: Building a hybrid platform requires expertise in both centralized and decentralized technologies. An experienced hybrid exchange development company can assist you explore and exploit the potential of centralization and decentralization.

- Regulatory Uncertainty: Hybrid crypto exchange software solutions usually operate in grey. Navigating the global regulatory landscape remains a challenge as they may or might not fall under various regulatory frameworks.

- User Education: Many traders are unfamiliar with the concept of semi-centralized systems, necessitating awareness campaigns.

Popular Hybrid Crypto Exchange Software in Action

Some platforms have already ventured into the semi-centralized or hybrid trading space, offering innovative solutions that combine the strengths of centralized and decentralized models. Here’s how they exemplify the hybrid exchange development concept:

- Loopring: The leading platform combines centralized order books for high-speed trade matching while ensuring decentralized custody through zkRollups. This approach enables users to retain control over their funds while benefiting from fast, low-cost transactions and scalability.

- Bitget: Bitget integrates centralized liquidity management with decentralized wallet solutions, offering a secure and user-friendly trading experience. The hybrid crypto exchange software allows users to enjoy the efficiency of a centralized exchange while ensuring asset security through non-custodial wallets.

- Binance DEX: The top-notch exchange operates as a semi-centralized exchange, leveraging Binance’s robust infrastructure for liquidity while maintaining user custody of assets. Users trade directly from their wallets via smart contracts, ensuring a balance between security and efficiency.

- Gemini: The hybrid crypto exchange software blends centralized compliance measures like KYC/AML with decentralized wallet options for advanced users. This dual approach allows the platform to cater to institutional investors while offering retail users the freedom of self-custody.

- Coinbase: Coinbase’s hybrid model is evident in its wallet services that enable users to store funds in non-custodial manner while still accessing centralized exchange features like high liquidity and advanced trading tools. This hybrid approach bridges the gap between traditional and decentralized crypto trading.

Final Words

The rise of semi-centralized or hybrid crypto exchange software solutions marks a pivotal moment in the evolution of cryptocurrency trading. These platforms represent a pragmatic middle ground, offering users the benefits of both centralized and decentralized systems while addressing their respective limitations.

At Antier, we specialize in building cutting-edge blockchain solutions, including semi-centralized or hybrid exchange development that redefines trading for businesses and users alike.

Are you ready to exploit the potential of centralization and decentralization altogether with hybrid crypto exchange software development? If so, partner with Antier to build your semi-centralized exchange and take charge to innovate in a rapidly evolving exchange ecosystem.

Contact us today to build a secure, scalable, and innovative trading platform!