5 Proven Ways Gamification & Metaverse is Transforming Collaborative Learning

February 27, 2025

How Tokenizing Rental Income Creates Opportunities for Global Investors?

February 28, 2025DeFi staking has come a long way, but let’s be honest—scalability issues, rising gas fees, and fragmented liquidity are still roadblocks. If institutional players will stake assets at scale, they need a solution that’s efficient, scalable, and secure—without the bottlenecks of Layer 1 networks.

This shift has put Bitcoin L2 in the spotlight, as enterprises seek solutions that offer a more sustainable and adaptable approach. DeFi staking development is now shifting towards models that integrate Bitcoin L2 for enhanced efficiency. But what factors are driving this change, and what does it mean for the future of staking? Let’s explore.

The Growing Need for DeFi Staking Platform Development Solutions

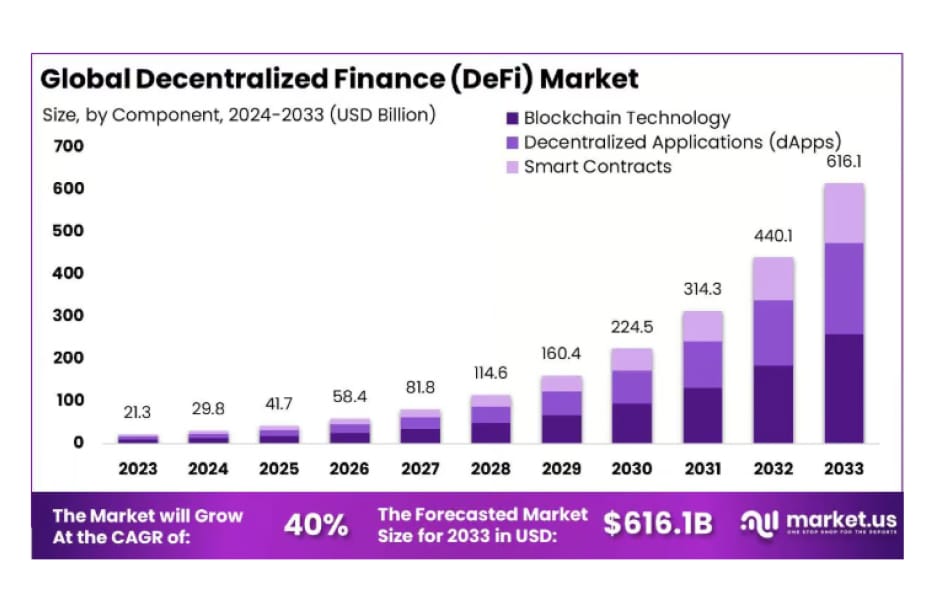

The rapid expansion of DeFi has fueled demand for DeFi staking platform development solutions that transcend the limitations of traditional staking models. Network congestion, security vulnerabilities, and fragmented liquidity have hindered large-scale staking adoption. Did you know? The global DeFi market is set to soar from USD 21.3 billion in 2023 to USD 616.1 billion by 2033, growing at a 40% CAGR. North America led in 2023, securing over 36% of the market with USD 7.6 billion in revenue.

Source:– Market.US

Enterprises require infrastructure that mitigates network congestion, optimizes staking rewards, and enhances liquidity flow. In response to these challenges, Bitcoin L2 is emerging as the most efficient and scalable pathway for next-generation DeFi staking solutions.

Why Bitcoin L2?

The lighting network leverages advanced cryptographic primitives, including zero-knowledge proofs and optimistic rollups, to facilitate high-efficiency DeFi staking development. L2 solutions drastically reduce gas fees while maintaining cryptographic integrity by executing staking operations off-chain and settling on Bitcoin’s Layer 1.

Moreover, Bitcoin L2 integrates seamless liquidity channels and atomic swaps, enabling cross-chain staking interoperability. This allows enterprises to optimize capital deployment and access diverse staking pools with minimal friction. As the DeFi industry matures, enterprises must pivot towards Bitcoin L2 staking to enhance efficiency, security, and yield generation. Those who embrace this innovation will redefine the future of decentralized staking infrastructure. However, despite the promising potential of Bitcoin L2 for DeFi staking platform development, enterprises still face a range of challenges. These hurdles must be addressed to fully unlock the capabilities of these next-generation platforms.

What Challenges Do Enterprises Face in DeFi Staking Development?

Venturing into DeFi staking development presents enterprises with technical and regulatory hurdles. From network inefficiencies to compliance complexities, navigating this landscape demands expertise and innovation.

- Scalability Constraints: As staking adoption grows, network congestion leads to sluggish transaction speeds and exorbitant gas fees. Enterprises must harness Bitcoin L2 solutions or rollups to enhance scalability and ensure seamless staking operations.

- Smart Contract Security Risks: Even the slightest vulnerability in smart contract logic can result in catastrophic exploits. Enterprises must employ rigorous audits, formal verification methods, and real-time monitoring to fortify their DeFi staking platform.

- Liquidity Fragmentation: A thriving staking ecosystem hinges on robust liquidity. Cross-chain interoperability and liquidity aggregation strategies prevent capital inefficiencies and foster sustainable DeFi staking development.

- Regulatory Uncertainty: Ensuring compliance without compromising decentralization is a delicate balance with DeFi operating in a dynamic regulatory environment. Implementing KYC/AML frameworks while maintaining non-custodial models is essential for long-term viability.

- Adoption & User Experience Challenges: Overly complex staking mechanisms can deter institutional adoption. Intuitive UI/UX, automated staking processes, and transparent reward structures are key to accelerating mainstream adoption of DeFi staking platform development.

Overcoming these challenges requires a strategic fusion of cutting-edge blockchain innovations, security enhancements, and regulatory foresight.

Why Is Bitcoin L2 the Best Alternative for DeFi Staking Platform Development?

The evolution of DeFi staking platform development has necessitated solutions that prioritize security, scalability, and cost-efficiency—three pillars that Bitcoin L2 seamlessly delivers. Unlike traditional staking architectures that rely on L1 transaction processing, Bitcoin L2 employs advanced off-chain computation mechanisms to optimize staking transactions without compromising finality.

Bitcoin L2 facilitates high-throughput staking operations, reducing gas fees to negligible levels while ensuring fast transaction confirmations with rollup-based architectures. Additionally, cross-chain interoperability between Bitcoin L2 and Ethereum bridges expands staking liquidity pools, enabling enterprises to stake assets across multiple ecosystems. This makes Bitcoin L2 an ideal foundation for multi-asset staking solutions integrated with automated liquidity rebalancing mechanisms.

From a security standpoint, Bitcoin L2 utilizes fraud proofs and cryptographic verification layers to eliminate vulnerabilities associated with centralized validators. Bitcoin L2 is poised to become the gold standard for high-performance DeFi staking with institutional investors demanding predictable, secure, and scalable staking solutions. As we enter 2025, more enterprises are integrating Bitcoin L2 into their DeFi Staking Platform Development strategies. But what’s fueling this widespread adoption, and why is Bitcoin L2 staking becoming the industry standard?

Why Is Enterprise Adoption of DeFi Staking Development on Bitcoin L2 Surging in 2025?

Institutional staking is reaching new heights, unlocking liquidity, and driving decentralized innovation by combining Bitcoin’s security with L2’s scalability. Here’s why this adoption is accelerating in 2025:

- Scalability With Security- Bitcoin’s L1 offers unmatched security but lacks scalability. L2 solutions leverage rollups and state channels to enable high-speed, low-cost transactions, making them ideal for DeFi Staking Platform Development.

- Liquid Staking Benefits- Liquid staking on Bitcoin L2 allows enterprises to stake assets while maintaining liquidity, earning staking rewards, and leveraging DeFi lending for enhanced capital efficiency.

- Compliance-Ready Staking- Bitcoin L2 staking frameworks integrate KYC-enabled staking pools and audited smart contracts, positioning DeFi Staking Platform Development Companies as leaders in compliant institutional DeFi.

- Cross-Chain Compatibility – Bridges on Bitcoin L2 connect assets with Ethereum, Solana, and other DeFi networks, allowing enterprises to optimize capital allocation and diversify yield strategies.

- Lower Fees & Faster Transactions- Bitcoin L2 significantly reduces gas fees and accelerates transaction speeds, making staking operations more cost-effective and efficient.

- Institutional-Grade Security- Advanced cryptographic models and enterprise custody solutions ensure institutional staking remains secure and risk-mitigated.

- Bitcoin’s Liquidity Advantage- As the most liquid crypto asset, Bitcoin’s integration into L2 staking creates a resilient, future-proof staking ecosystem for enterprises.

Enterprises adopting Bitcoin L2 for staking are leading the charge in scalable, secure, and institutional-grade DeFi innovation. However, harnessing the full potential of Bitcoin L2 requires a well-structured approach to development.

How to Develop a DeFi Staking Platform on Bitcoin L2?

Here’s a step-by-step approach to crafting a sophisticated DeFi staking platform development ecosystem:

- Choose the Ideal Bitcoin L2 Solution: Evaluate L2 protocols like Lightning Network, Stacks, or Rootstock, balancing security, smart contract capabilities, and transaction finality to establish a resilient foundation.

- Architect Smart Contract Frameworks: Leverage Rust or Solidity (for EVM-compatible layers) to design staking contracts governing rewards, slashing, and validator participation, ensuring trustless execution.

- Implement Multi-Asset Staking Mechanisms: Enable seamless staking for BTC and wrapped assets while incorporating yield optimization strategies through liquidity pools and automated rebalancing.

- Optimize Security & Compliance: Deploy robust security layers, integrating MPC, zk-rollups, or multi-sig authentication to fortify against exploits, aligning with global regulatory frameworks.

- Develop a Seamless User Interface: Ensure intuitive dashboards with real-time staking metrics, APY tracking, and non-custodial wallet integrations for frictionless user experience.

- Test & Deploy with Institutional-Grade Liquidity: Execute rigorous audits, stress-test contracts, and onboard liquidity partners to amplify staking rewards and engagement.

Choosing a renowned DeFi staking platform development company ensures precision-engineered solutions aligned with institutional needs.

Power Your DeFi Staking Vision on Bitcoin L2 with Antier

Antier is a leading DeFi staking platform development company, empowering enterprises to build cutting-edge staking solutions on Bitcoin Layer 2. We craft seamless, scalable staking platforms that enhance liquidity, optimize rewards, and ensure compliance with deep expertise in blockchain engineering, smart contract development, and institutional-grade security. Our end-to-end services cover DeFi staking development, multi-asset staking, and high-performance infrastructure integration. Whether you’re launching a bespoke staking protocol or leveraging Bitcoin L2 for efficiency, we provide future-proof solutions tailored to your vision. Partner with us to revolutionize DeFi staking on Bitcoin L2.