The clock is ticking, and the momentum is undeniable. Every day, more fintech startups, institutional investors, and forward-thinking enterprises are moving into the UAE’s crypto neobanking ecosystem—and they’re not looking back. Regulatory bodies are setting a gold standard, financial institutions are diversifying into crypto, and businesses are rapidly integrating blockchain-based solutions. The UAE isn’t just adapting to change—it’s leading the charge as the world’s top destination for digital banking and Web3 finance.

For businesses, investors, and fintech pioneers, this is a rare moment in history—a chance to be part of a multi-billion-dollar transformation before the market reaches full maturity. So, what’s fueling this shift, and how can businesses and investors make the most of it? In this blog, we’ll explore the UAE’s growing crypto neo bank development landscape, its potential, and the costs involved. Let’s get into it!

Current State of Crypto Friendly Neobanking Solution in UAE

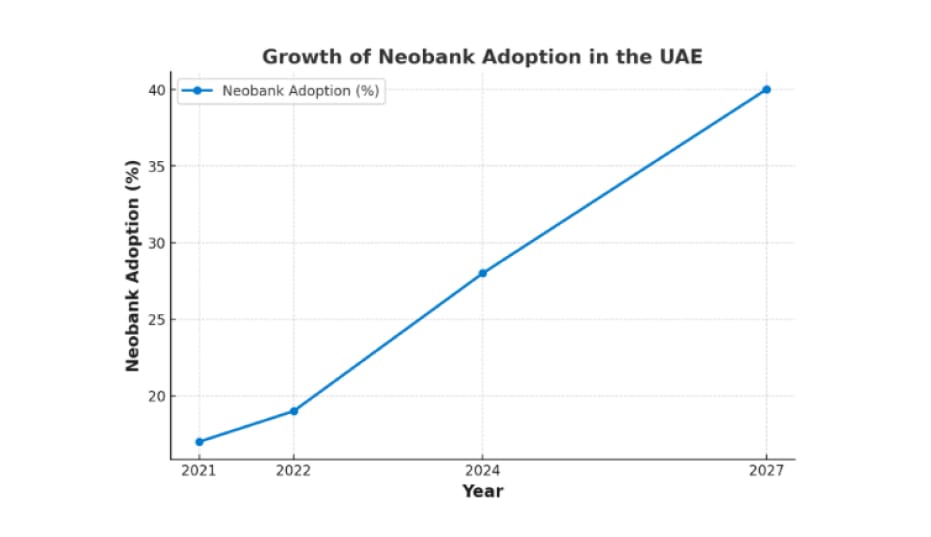

The UAE’s neobanking sector is surging, driven by rapid digital adoption and progressive financial regulations. In 2021, only 17% of UAE adults had neobank accounts. This figure grew to 19% in 2022 and is projected to exceed 40% by 2027, positioning the UAE among the world’s most digitally advanced banking ecosystems.

Also, the UAE is redefining banking in the Middle East, commanding the largest share of the region’s $3.2 trillion in assets while leading the charge in digital innovation, as highlighted in a recent Arthur D. Little report. The nation’s crypto friendly neobanking solution landscape has surged with an 8.7% CAGR over the past two years, and projections indicate sustained momentum, with a 4.8% CAGR expected between 2024 and 2029, setting the stage for a market valuation of $175.7 billion by 2029. The UAE is setting the pace for fintech innovation, becoming a global leader in digital finance.

UAE’s Rise as a Web3 Hub: The Role of Crypto-Driven Neo Banks

The UAE is cementing its status as a global hub for crypto adoption, Web3 talent, and blockchain innovation, fueled by proactive regulations. Strategic frameworks such as Dubai’s Virtual Asset Regulatory Authority (VARA) and Abu Dhabi’s ADGM crypto policies have laid the foundation for a flourishing ecosystem, attracting crypto neobank development services, fintech innovators, and blockchain enterprises.

The UAE is rapidly becoming a magnet for top-tier developers, pioneering entrepreneurs, and institutional investors eager to shape the next era of digital finance with global players like Binance and Crypto.com scaling their operations in the region. As the nation continues to embrace blockchain-powered financial solutions, a critical question arises: How does the rise of neobanking compare to traditional banking in shaping the UAE’s financial landscape? This evolving dynamic sets the stage for an in-depth exploration of the transformative shift from conventional banking models to agile, tech-driven neo banking solutions that are redefining financial accessibility, efficiency, and user experience in the UAE.

Neo Banking vs. Traditional Banking: Who’s Shaping UAE’s Finance?

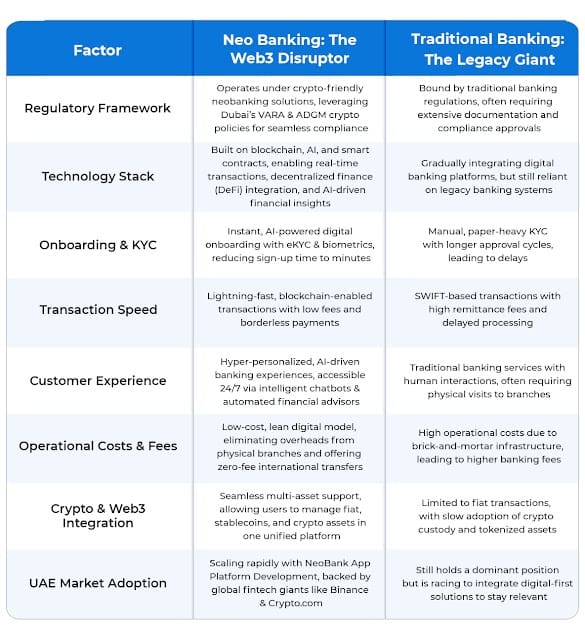

The UAE’s banking scene is at a turning point. NeoBank app platform development is rewriting the rules, bringing crypto-friendly, AI-driven finance to the forefront. Meanwhile, traditional banks are racing to keep up. But can it outpace traditional banks, or will legacy institutions evolve to stay ahead? Let’s explore:

The future of banking in the UAE is no longer confined to brick-and-mortar institutions. Crypto neobank development services are pioneering a digital-first revolution, seamlessly integrating crypto assets, AI-driven financial tools, and decentralized systems. While traditional banks strive to modernize, the real game-changers are the crypto-powered neo banks, redefining finance for the Web3 era.

As the UAE solidifies its position as a global hub for digital finance, investors are increasingly drawn to the potential of neo banking app development. These next-gen banking platforms are rapidly gaining traction with progressive regulations, a booming fintech sector, and growing blockchain adoption. The shift toward borderless, AI-driven, and decentralized financial services signals a new era.

Why Are UAE-Based Investors Pouring Capital Into Crypto-Friendly Neobanks?

The UAE’s investment landscape is undergoing a seismic shift, with crypto friendly neobanking solutions emerging as prime assets for institutional and venture capital funding. Several key factors are driving this surge, making the country a hotspot for digital banking innovation.

1. Strong Regulatory Framework : The UAE’s clear and progressive regulations—led by VARA in Dubai and ADGM in Abu Dhabi—offer a secure environment for crypto neobanks, reducing investor risk and fostering long-term growth.

2. Increasing Crypto Adoption : UAE residents and businesses are increasingly using crypto for transactions, remittances, and investments, making crypto neobanks a lucrative opportunity.

3. High Net Worth Individual (HNWI) Influx : The UAE has become a global wealth hub, attracting HNWI and institutional investors who seek secure and seamless digital banking solutions integrated with crypto assets.

4. Integration of AI & DeFi : Investors recognize the competitive edge of AI-driven risk management, lending, and DeFi services, making neo banking app development solution the future of smart banking.

5. Institutional Backing & Partnerships : Major financial institutions and VC firms are increasingly collaborating with neobanks, signaling strong market confidence.

6. Untapped Market Potential : Crypto neobanks have a massive first-mover advantage, making them an attractive bet for investors with traditional banks still hesitant to fully embrace crypto integration.

As the financial landscape in the UAE evolves, crypto-friendly neobanks are no longer just an alternative—they are becoming the cornerstone of next-generation banking. For businesses and entrepreneurs eyeing the UAE’s expanding fintech frontier, the real question isn’t if they should enter the market—it’s when. And with crypto adoption reaching new heights, institutional backing strengthening, and digital finance shifting gears, there has never been a more opportune moment to step in.

Why Is Now the Perfect Time to Enter the UAE’s Crypto Neobanking Market?

The market is primed for disruption with crypto regulations maturing, blockchain adoption skyrocketing, and a fintech-savvy customer base expanding. But the real question is—will you seize the opportunity or watch from the sidelines? Here’s why forward-thinking businesses, fintech innovators, and investors are making their move right now:

- Regulatory Clarity = First-Mover Advantage : The UAE has set the global benchmark with its progressive crypto banking regulations, ensuring security, compliance, and a fertile ground for growth. Early entrants can dominate the market before competition peaks.

- Soaring Demand for Crypto Friendly Neobanking Solutions : Consumers and businesses are actively seeking digital banks that seamlessly integrate fiat and crypto services, offering an untapped market with limitless potential.

- Investor Confidence at an All-Time High : There has never been a better time to secure funding, scale operations, and establish a stronghold in the region with major institutions backing crypto neobank development.

The window of opportunity is open, but it won’t stay that way forever. If you’re looking to break into the UAE’s booming crypto neobanking sector, the time to act is now. Partnering with crypto neobank solution providers streamlines compliance, accelerates blockchain integration, and ensures a secure, scalable launch. But before you take the plunge, one crucial factor remains—how much does it cost to develop a neobanking solution? Let’s break it down.

How Much Does NeoBank App Platform Development Cost?

Building a neo bank App platform isn’t just about cost—it’s about creating a secure, scalable, and regulation-compliant digital bank. Expenses vary based on features, security infrastructure, blockchain integration, and regulatory compliance. A crypto friendly neobanking solution with AI analytics, fiat-to-crypto transactions, and DeFi integrations requires specialized expertise, influencing development costs. Additionally, compliance with UAE’s financial regulations (VARA, ADGM, and Central Bank guidelines) and advanced security measures like biometric authentication and smart contracts add to the investment. Partnering with experienced crypto neobank solution providers ensures a cost-efficient approach without compromising innovation or security.

Unlock the UAE’s Crypto Neo Banking Potential with Antier

In the UAE’s fast-paced financial transformation, there’s an incredible opportunity for innovators to spearhead the next generation of banking. Antier, a leading crypto neobank development company, specializes in crypto neobank development services, delivering cutting-edge, scalable, and regulation-compliant solutions tailored for the UAE market. Our expertise in neobank app platform development ensures seamless integration of banking solutions, AI-driven automation, and decentralized finance capabilities. Whether you’re a fintech visionary or an enterprise looking to lead the Web3 banking revolution, we empower you with robust, future-ready digital banking solutions.

Let’s build the next-gen crypto neobank together—your success starts here.