Missed Ethereum & Solana? Don’t Miss Cronos For Your Decentralized Exchange Development

April 15, 2025

Top 10 Blockchain Supply Chain Development Companies You Can Hire in 2025

April 16, 2025The urgency to combat climate change has driven corporations, governments, and enterprises to embrace carbon offsetting strategies. One of the most transformative solutions to ensure transparency, authenticity, and efficiency in this process is blockchain carbon trading software. While its benefits are clear, a critical question that concerns every business seeking blockchain carbon credit solutions is — What is the cost of developing blockchain carbon trading software?

Understanding the carbon credit development cost is not a straightforward answer. It depends on several technical, operational, and strategic factors that cumulatively define the financial investment required to build a scalable, secure, and regulatory-compliant blockchain carbon trading platform. This blog dives deep into all such cost-driving components to help you make informed budgeting decisions.

Blockchain in Carbon Trading: Why It’s a Game-Changer

Before diving into the cost structure, it’s essential to understand why blockchain is being prioritized in the carbon credit ecosystem.

The carbon credit market has been marred by issues like double counting, lack of transparency, fraudulent claims, and inefficient manual record-keeping. Blockchain technology addresses these challenges by:

- Offering an immutable digital ledger for tracking carbon credits

- Enabling real-time verification of transactions

- Automating compliance through smart contracts

- Facilitating peer-to-peer trading without intermediaries

- Supporting global interoperability among carbon registries

However, developing blockchain-based carbon trading software is a multi-layered process, and the cost is governed by how these layers are designed and implemented.

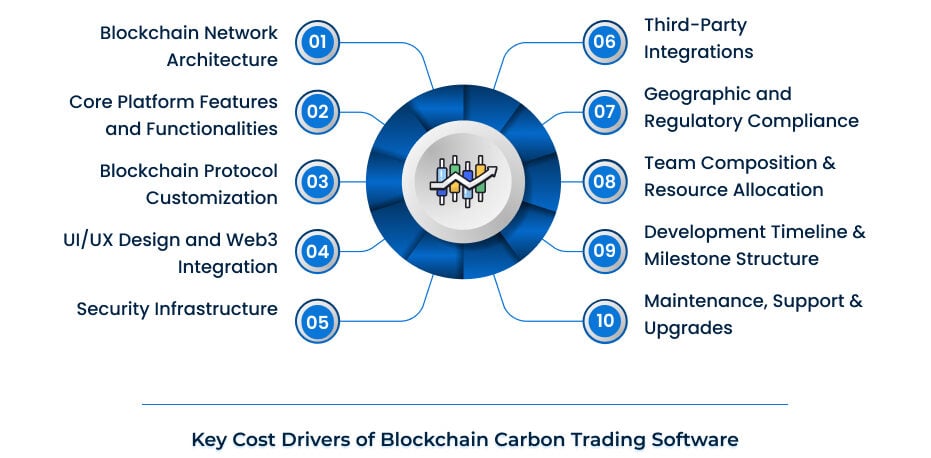

Factors Affecting the Cost of Blockchain-Based Carbon Trading Software Development

1. Blockchain Network Architecture

The first major cost-driving factor is the choice of blockchain network:

- Public Blockchain: Decentralized, permissionless networks like Ethereum or Polygon increase transparency but come with scalability and transaction fee considerations.

- Private Blockchain: Permissioned networks like Hyperledger Fabric or Corda offer better control and privacy but require higher infrastructure costs.

- Consortium Blockchain: A hybrid model where multiple verified entities govern the network, balancing transparency and control.

The architecture you choose will dictate the cost of node setup, maintenance, consensus mechanisms, and network governance.

2. Core Platform Features and Functionalities

The scope and complexity of the platform features significantly impact development costs. A standard blockchain-based carbon trading platform comprises:

(a) User & Admin Modules

- User registration & KYC verification

- Dashboard for buyers, sellers, and brokers

- Admin panel for managing participants, transactions, and regulatory compliance

(b) Carbon Credit Registry Integration

Integration with international, regional, or proprietary carbon credit registries increases development complexity and resource consumption.

(c) Tokenization Engine

- Creation of digital carbon tokens

- Verification mechanisms to prevent double counting

- Audit trails for credit origin and usage

(d) Smart Contract Development

Smart contracts automate:

- Credit issuance

- Trade execution

- Ownership transfer

- Compliance validation

The complexity of these smart contracts affects the development time and cost.

(e) Marketplace & Trading Engine

The marketplace module may include:

- Order book management

- Bidding & auction mechanisms

- Peer-to-peer trade execution

- Automated clearing & settlement

Advanced trading engines require significant backend development and quality assurance.

(f) Wallet Integration

Development costs increase when incorporating:

- Multi-currency wallets

- Hot & cold wallet options

- Private key management

(g) Compliance & Reporting System

Carbon markets are heavily regulated. Compliance modules to adhere to standards. Regional emission schemes must be built, which increases complexity.

3. Blockchain Protocol Customization

If you opt for a custom blockchain protocol, development costs will surge due to:

- Development of consensus algorithms

- Blockchain node setup and management

- Security hardening

- Throughput optimization

Alternatively, leveraging existing blockchain frameworks reduces cost but limits customization.

4. UI/UX Design and Web3 Integration

A seamless, intuitive interface is essential for widespread adoption. The cost varies depending on:

- Frontend complexity (web, mobile, or both)

- Real-time data dashboards

- Token portfolio visibility

- Accessibility standards compliance

Additionally, integrating Web3 wallets like MetaMask, Trust Wallet, or custom wallets contributes to development costs.

5. Security Infrastructure

Blockchain platforms handling carbon credits must be fortified against:

- Smart contract vulnerabilities

- DDoS attacks

- Wallet breaches

- Identity theft

Security implementation costs include:

- Code audits

- Penetration testing

- Multi-signature wallet integration

- KYC/AML compliance mechanisms

The higher the security protocols, the higher the development and maintenance costs.

6. Third-Party Integrations

Many carbon trading platforms require integration with:

- External verification bodies (Verra, Gold Standard)

- Payment gateways

- Data oracles for carbon offset data

- Regulatory reporting APIs

These third-party integrations demand additional development time and cost.

7. Geographic and Regulatory Compliance

Different regions impose different compliance and taxation requirements. Customizing your platform to comply with several regulatory requirements increases development complexity, as each regulation demands additional modules for data capture, reporting, and audit trails.

8. Team Composition & Resource Allocation

The technical team’s expertise and geographic location heavily influence development costs. A typical blockchain carbon trading software development team includes:

- Blockchain Architects

- Smart Contract Developers

- Backend & Frontend Developers

- Security Analysts

- DevOps Engineers

- UI/UX Designers

- QA Testers

- Project Managers

Outsourcing to specialized blockchain development companies may optimize cost without compromising quality.

9. Development Timeline & Milestone Structure

Faster delivery timelines often demand more resources and parallel team deployment, increasing development costs. The cost also depends on whether you opt for:

- MVP Development: Basic version with core trading and compliance features

- Full-scale Production Platform: Advanced trading features, AI-based carbon credit analytics, real-time reporting dashboards

10. Maintenance, Support & Upgrades

Post-deployment maintenance is an ongoing cost factor that businesses often overlook. It includes:

- Server and node management

- Security patching

- Software updates for regulatory compliance

- Technical support

- Scaling infrastructure for increased users

This is a recurring operational cost necessary to keep the platform running securely and efficiently.

Additional Factors That Influence Development Cost

While the above cost components cover the technical aspects, the following operational factors also shape the final cost:

1. Business Model & Customization Needs

Platforms designed for enterprise use with private blockchain models may require heavy customization, inflating costs. Conversely, SaaS models with shared infrastructure reduce cost per client.

2. Transaction Volume & Scalability

If the platform is expected to handle high trading volumes, scalability solutions such as Layer 2 protocols, sidechains, or off-chain storage mechanisms may need to be implemented, impacting the overall cost.

3. Carbon Credit Verification Methodology

The more rigorous and multi-tiered the verification process (like integrating satellite data, IoT-based emissions tracking), the higher the development effort and cost.

4. Geo-specific Language and Currency Support

For businesses aiming at a global carbon credit marketplace, multi-language support and regional currency integration will add to development efforts.

Conclusion

The development of blockchain carbon trading software is a highly technical and resource-intensive endeavor. The cost of such development is influenced by multiple factors. No one-size-fits-all pricing exists because each business’s requirements, operational geography, scalability goals, and regulatory obligations vary.

If you are a business seeking to eliminate opacity and inefficiencies from your carbon credit operations, it is advisable to partner with an experienced blockchain development company.

Antier, a global leader in blockchain solutions, offers blockchain carbon credit development support. The company has years of expertise in developing robust, secure, and scalable blockchain-based carbon credit trading platforms tailored to your business needs. Our technical expertise, regulatory knowledge, and end-to-end development services ensure your carbon trading platform is future-proof, compliant, and capable of driving real environmental impact.

Partner with us for carbon trading software development support, and assistance!