Memecoins live and die by their market momentum. These volatile assets surge on community-driven hype but often struggle with inconsistent liquidity, leading to drastic price swings and unpredictable trading conditions. In this fast-paced ecosystem, a crypto market making bot isn’t just an advantage—it’s a necessity. Businesses and traders can ensure seamless transactions, mitigate risks, and create a more sustainable trading environment by leveraging crypto market making software.

But how exactly do these bots work, and why do they matter in the unpredictable world of memecoins? Let’s dive deep into their mechanics, benefits, and the transformative role they play in shaping the future of memecoin markets.

Understanding the Role of a Memecoin Market Making Bot

A memecoin market making bot is an advanced algorithmic system designed to create liquidity in the marketplace. It operates by continuously placing buy and sell orders, reducing spreads, and mitigating price slippage for traders. Unlike traditional trading strategies that rely on human intervention, these bots leverage HFT and deep data analytics to enhance the trading dynamics of memecoins.

Types of Crypto Market Making Bots

HFT Bots – Execute thousands of trades per second to capitalize on micro-price movements and ensure liquidity.

Arbitrage Bots – Exploit exchange price differences to generate risk-free profits while balancing market spreads.

Spread Bots – Maintain optimal bid-ask spreads to stabilize market prices and enhance liquidity.

Crypto AI Bots – Use machine learning and predictive analytics to adapt trading strategies based on market sentiment and order flow.

For crypto startups and exchanges, these bots play a pivotal role in ensuring a seamless trading experience. An efficient crypto market making strategy powered by bots is essential to sustain trader confidence and drive market participation with memecoins known for their extreme price swings.

Manual Memecoin Market Making

Algorithmic trading may be the powerhouse of modern markets, but manual market making remains a crucial piece of the puzzle—especially for new memecoins and lower-volume projects. Unlike bots, human market makers rely on intuition and strategy to optimize orders, gauge sentiment, and fine-tune spreads on the go. Successful market making revolves around three key aspects. Whether automated or manual, the goal is to create a more efficient trading environment for buyers and sellers alike.

Key Aspects of Manual Market Making

- Human-Driven Decision Making – Unlike bots, manual market makers rely on experience and real-time market trends to adjust liquidity provisioning.

- Flexibility & Adaptability – Traders can modify orders dynamically based on breaking news, social media hype, or whale movements.

- Higher Risk Exposure – Manual market makers face greater risks from rapid price fluctuations and unexpected liquidity shortages without automation.

- Strategic Token Support – Manual market makers often work closely with memecoin projects to foster organic liquidity and community-driven price stability.

Despite its advantages, manual market making lacks the speed, efficiency, and scalability of automated crypto market making software, making it less viable for high-volume exchanges and rapidly growing tokens.

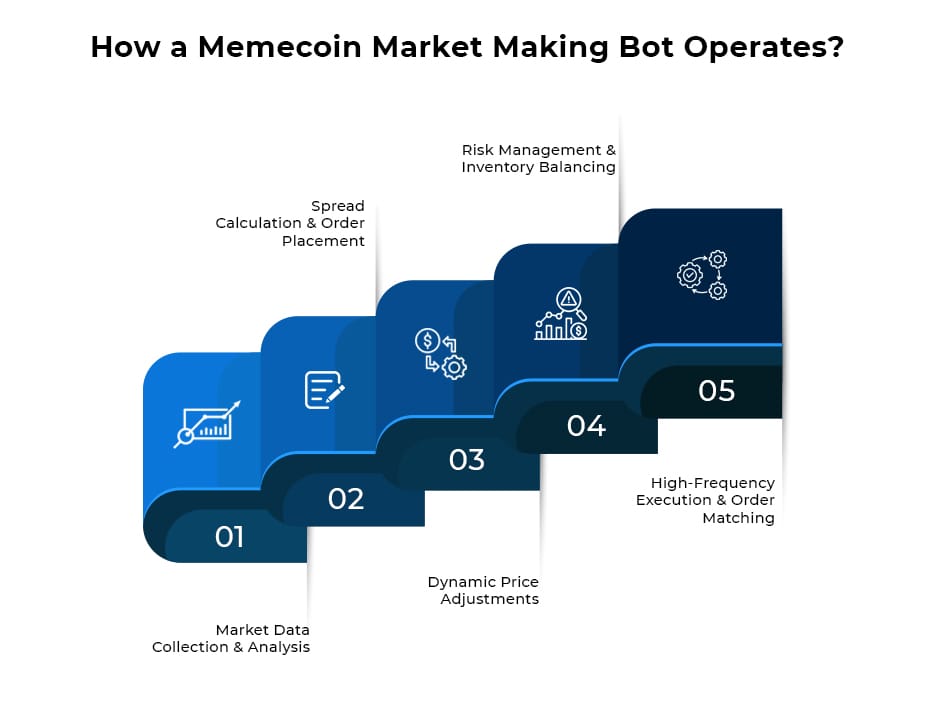

How Does a Memecoin Market Making Bot Work?

A crypto market making bot strategically executes trades, ensuring price stability and market efficiency. Here’s how it operates step by step:

- Market Data Collection & Analysis: The bot continuously scans the order books of multiple exchanges, collecting real-time data on trading volume, bid-ask spreads, price trends, and liquidity depth. Using AI-powered analytics, it interprets historical market behavior and volatility patterns to anticipate price fluctuations.

- Spread Calculation & Order Placement: An algorithmic market making bot determines optimal bid and ask prices by calculating spreads based on market conditions. It strategically places buy and sell orders at calculated price points, ensuring tight spreads that enhance liquidity while maximizing profitability.

- Dynamic Price Adjustments: Market conditions shift rapidly, and the bot adapts by dynamically adjusting order placements in response to price movements, order book shifts, and trading volume fluctuations. This prevents slippage and minimizes arbitrage risks, keeping liquidity provision seamless.

- Risk Management & Inventory Balancing: A high-end crypto market making software implements risk mitigation strategies such as hedging, rebalancing asset holdings, and limiting exposure to extreme price swings. It ensures that the bot maintains an optimal asset ratio without overcommitting capital.

- High-Frequency Execution & Order Matching: The bot operates at lightning-fast speeds, executing high-frequency trades in milliseconds to match market demand efficiently. This optimizes order flow, reduces inefficiencies, and maintains healthy trading activity.

For businesses, crypto startups, and exchanges, deploying an automated market-making bot is a game-changer, revolutionizing liquidity management and fostering sustainable trading ecosystems.

Key Features of a Memecoin Market Making Bot

A state-of-the-art Memecoin Market Making bot is engineered to provide unmatched liquidity, seamless trade execution, and risk-optimized market participation. Here are the most in-demand features that deliver tangible benefits:

- Dynamic Spread Optimization – The bot continuously fine-tunes bid-ask spreads based on market depth, volatility, and trading volume. This reduces slippage, tightens spreads, and enhances market efficiency.

- High-Frequency Order Execution – The bot places, modifies, and cancels orders in milliseconds, ensuring liquidity availability while capturing micro-price movements for optimal profitability with ultra-low-latency trade execution.

- Smart Inventory & Portfolio Management – The bot automatically rebalances assets, mitigating exposure risks and preventing overconcentration in volatile trading pairs. This ensures sustainable liquidity without unnecessary capital lock-up.

- Adaptive Risk Management – Equipped with AI-driven risk controls, the bot detects abnormal trading activity, prevents front-running attacks, and adjusts orders in real time to hedge against extreme price swings.

- Multi-Exchange Connectivity – A top-tier crypto market making software integrates with CEX and DEX platforms, expanding liquidity provisioning across multiple markets.

- Market Sentiment Analysis & AI Trading Signals – The bot adapts trading strategies to align with real-world hype cycles, improving market positioning by analyzing social media trends, on-chain activity, and news sentiment.

- Latency Arbitrage & Spread Efficiency – The bot capitalizes on price discrepancies across exchanges, executing arbitrage strategies to maximize profits while maintaining healthy market spreads.

- Automated Liquidity Injection – Ensuring sustainable liquidity, the bot deploys capital dynamically, preventing order book thinning and price manipulation by large players.

For businesses, crypto startups, and exchanges, leveraging an algorithmic market making bot ensures liquidity dominance, efficient order flow, and long-term market sustainability.

How Do You Choose the Right Crypto Market Making Bot for Memecoins?

Not all market-making bots are created equal. When selecting a bot for meme coin trading, consider these factors:

- Customization & Strategy Support: The bot should allow customization based on trading goals, volatility tolerance, and market conditions.

- Exchange Compatibility: Ensure it supports decentralized and centralized exchanges where memecoins are traded.

- Security & Reliability: Given the risks of smart contract vulnerabilities and API breaches, opt for bots with robust security protocols.

- Real-Time Analytics: Advanced bots provide insights into trading performance, liquidity levels, and market trends.

Choosing the right market making bot can be the defining factor between your memecoin thriving with consistent liquidity and struggling with erratic price swings and low trading activity. You can create a more stable and attractive ecosystem for traders and investors by selecting a bot that aligns with your project’s trading goals, security requirements, and exchange compatibility.

Stay Ahead in Memecoin Trading with Antier’s Market-Making Bots

Memecoin markets move fast—don’t get left behind. At Antier, we provide advanced market-making solutions designed to optimize liquidity, reduce volatility, and create a seamless trading experience. Our AI-powered bots execute real-time buy and sell orders, ensuring tight spreads and efficient price discovery. Whether you need exchange integration, algorithmic trading strategies, or liquidity enhancement, we tailor solutions to keep your memecoin competitive. As a renowned market making company, we empower projects with automated trading, 24/7 liquidity management, and strategic market positioning. Partner with us today and take control of your memecoin’s success!