Sports Metaverse Development: Top 10 Platforms to Consider in 2024

November 9, 2023

Top 10 DeFi Lending Trends to Watch Out For in 2024

November 10, 2023Table of Contents

Introduction of Web3 in Fintech

Ever since the incorporation of technology into the financial sector, it has progressed to greater heights and wider adoption. From cash to a cashless economy, the world has indisputably adapted to fintech, and today, the introduction of web3 development services is furthering this fintech revolution towards a decentralized era.

The size of the worldwide web3.0 market was $3.2 billion in 2021, and it is projected to grow at a 43.7% CAGR, achieving $81.5 billion in the year 2030. Fintech, coupled with web3 technologies, has given rise to decentralized finance (DeFi), which has witnessed many billion dollars of investments to date.

But how is Web3 shaping the DeFi realm? In this article, we explore the possibilities and challenges of integrating web3.0 technologies in DeFi and the popular companies in the DeFi-web3 development arena.

Integration of DeFi into the Web3 Ecosystem

Based on blockchain technologies, Web3 fosters a transparent, immutable, and secure environment for decentralized financial management and transactions. Considering the growth in trading volume across the DeFi industry, it is projected that the number of users will reach 9.33 million by 2027.

The web3.0 development is contributing to the DeFi landscape in the following aspects:

1. Better Inclusivity and Accessibility

Web3 paves the way for the unbanked population to access financial services conveniently. The highest number of users in developing countries shows a clear popular opinion about DeFi. Unlike the traditional financial system, decentralized modes of investment and payment exclude the need for intermediaries, third parties, or centralized authorities.

In other words, Web3 lays the foundation for more financial opportunities as well as cost-effective and faster transactions through a global DeFi ecosystem.

2. Improved Data Privacy and Security

Security and privacy are the foremost concerns of every individual and organization. These factors become even more crucial in the case of finances. However, the centralized systems are susceptible to breaches and hacking, owing to the involvement of governing authorities. With Web3 development services entering the financial sector, all user information is protected and stored in cryptographic algorithms and transactions are conducted directly via P2P networks.

This inherent impenetrability of web3 infrastructure enables strong security protocols for establishing DeFi.

3. Seamless Interoperability and Collaboration

The ability of Web3 to work on open standards facilitates P2P trading and hassle-free transactions across various DeFi platforms. Because of such interoperable protocols, different DeFi applications (DEXs, wallets, etc.) can interact and communicate in unison. Such kind of optimal utilization saves time and resources, resulting in greater efficiency of financial operations.

Using this attribute of the blockchain milieu, web 3.0 developers are creating groundbreaking DeFi products that span an increased range of financial services.

As the popular investor and author Hendrith Smith said, “The decentralization of finance is good for humanity, and it’s ultimately a win for each and every one of us. Since now that we can circumvent banks, exchanges, and brokerage companies by using smart contracts on the blockchain; every person and every business will experience more liberty, more freedom, more opportunities, more abundance, more power, and more wealth.”

Current Challenges of Web3 Adoption in Fintech

Despite the many advantages of Web3 in fintech, certain things impede its adoption. Here’s a brief overview of the prevalent barriers on the pathway to DeFi:

- Lack of Awareness

Web3 technologies abound with complicated-looking terms that cannot be grasped well by common non-technical users. This often discourages people from embracing DeFi or investing money in it. For effectively adapting to web3-powered FinTech, users need simplified and easy-to-understand interfaces, combined with quick guides. - Regulatory Framework and Legal Compliance

Legislation is a primary concern when it comes to accepting any new technology. Since the very inception of blockchain technology, different countries have had differing opinions regarding cryptocurrency, Web3, and related applications. While some nations like the UK, Japan, and Dubai are inclined towards DeFi, others like China and Bangladesh are not in favor of a democratized, decentralized economy. Nevertheless, currencies like stable coins and CBDCs are emerging as a fine middle-ground between the two sides.So, even if the regulations on web3 are in the initial phase, there is a bright future ahead, especially considering the ever-growing number of web3 development companies and DeFi platforms. - Scalability and Integration

It is not relatively easy to integrate conventional financial systems with the web3-driven decentralized architecture. Fintech structures are usually constructed with multiple elements, including payment gateways, bank-related data, KYC, security protocols, etc. However, some of the blockchain networks experience scaling limitations, leading to transaction delays and higher costs. The complexity of Web3 systems arises due to their decentralized and node-based infrastructure. Typically, the earliest blockchains faced a trilemma, implying they could emphasize only two of the following features: security, scalability, and decentralization. However, with the invention of layer 2 solutions and new consensus mechanisms, web3 development is evolving further to resolve these issues and build faster and more diverse blockchains.

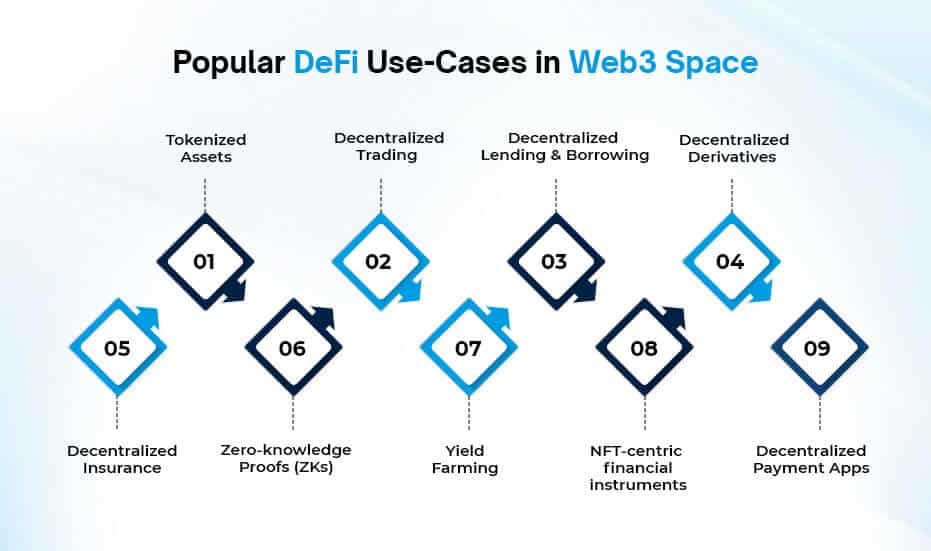

Popular DeFi Use-Cases in Web3 Space

DeFi forms the core of a variety of Web3-based financial products. These work on network-specific smart contracts in place of centralized bodies like banks. Here’s an overview of the most promising DeFi trends and projects to look out for:

- Tokenized Assets

To begin with, Web3 has enabled the tokenization of various kinds of assets – stocks, bonds, real estate, other financial instruments, etc. As a result, these assets become more liquid and accessible, making way for wider and better trading and investment prospects. Tokenization is an essential and prime element of the DeFi realm. - Decentralized Trading

DEXs are the key platforms for trading crypto assets. Unlike centralized exchanges (CEXs), DEXs let users trade directly without the need for third-party involvement. This sort of peer-to-peer trading facilitated by Web3 development allows for complete control, privacy, transparency, and censorship-resistant interaction between different parties. - Decentralized Lending & Borrowing

For making large purchases, individuals and companies often need to borrow funds from banks. However, web3-based borrowing and lending protocols do not require the user to seek permissions through governing authorities like banks. DeFi platforms facilitate the lending and borrowing of crypto assets via smart contracts.

The lenders earn interest, as determined by ongoing market conditions and the collateral deposited by the borrowers. - Decentralized Derivatives

DeFi derivatives are financial contracts based on blockchain. These derivatives can be utilized for speculation, hedging, and arbitrage to counter price volatility. Through Web3, DeFi derivatives can also be made in a transparent and unrestricted manner and also used as conventional derivatives. These are deployed by trading platforms and marketplaces. - Decentralized Insurance

In the DeFi space, insurance mechanisms are much more sturdy, owing to web3.0 development services. These work as per a decentralized governance framework and protect users from hackers and smart contract failures. An advanced level of smart contract is employed to implement the self-executing insurance processes. - Zero-knowledge Proofs (ZKs)

Zero-knowledge proofs verify information without collecting any data. With passwords based on hash functions, ZK enhances the security of on-chain interactions and creates a secure environment for DeFi users. - Yield Farming

Yield farming refers to the activity of lending or staking cryptocurrency assets on a DeFi platform to receive rewards. It is one of the most popular methods to earn passive income in the DeFi industry. These rewards are given to lenders/stakers via automated processes followed by smart contracts. - NFT-centric financial instruments

NFT is a rising class of crypto assets that have managed to span various areas like gaming, art, social communities, etc. Lately, these are serving as tools of digital identity, thus transforming modes of ownership. - Decentralized Payment Apps

Following the trend of using mobile-friendly apps, web 3.0 developers and creators are coming up with handy and easy-to-use software for facilitating DeFi functionalities. These apps work as wallets, NFT marketplaces, DEXs, dApps, and more. You can make quick payments and manage your crypto assets effectively with DeFi apps.

Get all-inclusive Superior Web3 Solutions

Schedule Free DemoRole of Web 3.0 Developers in Decentralized Economy

To build DeFi solutions with impeccable accuracy and robust security infrastructure, web 3.0 developers are going beyond the standard procedures and adhering to innovative approaches. Their contribution to propelling a decentralized economy follows through the given steps:

1. Selecting the Right Framework for DeFi-Specific Goals

The first step is to determine the programming languages and frameworks that would fulfill the requirements of the particular DeFi platform. The chosen framework should have a good set of tools for creating, evaluating, and implementing smart contracts. For instance, Rust is preferred for Solana, while Solidity is opted for Ethereum.

Creators generally need to investigate the needs thoroughly and then select the particular framework.

2. Developing Creative DeFi Solutions with Smart Contracts

Using smart contracts, web3 developers can craft customized DeFi solutions. Smart contracts assist in automating and simplifying financial operations, doing away with the need for middlemen. These also enable the transparency, sustainability, scalability, and accessibility of decentralized exchanges, DeFi insurance solutions, and similar services.

3. Fostering Permissionless and Trustless Environments with Web3 Protocols

With web3-powered technologies, developers can build decentralized apps (dApps) with peer-to-peer transactions that are fully secure and private. So, the users do not have to go through the lengthy processes of verification or authentication, thus having complete control and autonomy over their finances.

4. Fortifying User Data Against Cyber Threats

Owing to the cryptographic techniques and algorithms used in blockchain, user data is secured against all sorts of breaches, fraud, and hacking. Besides, common digital transaction issues like double-spending are absolutely prevented by blockchain-based security protocols. These protocols evaluate and verify each transaction, making sure that it cannot be altered or replicated through consensus procedures like proof of work or proof of stake.

4 Leading Web3 Development Companies for DeFi

If you are keen to utilize best-in-class and reliable web3.0 development services for your DeFi venture, refer to the following top 4 companies:

- Antier

Antier has been dominating the web3 sector, with hundreds of blockchain-enabled projects delivered for varied domains. Having been in the DeFi development area for over seven years, the company is known for making all kinds of exchange and trading platforms with a wide range of functionalities.

- Blockchain App Factory

With six years of expertise in developing blockchain-based products and DeFi applications, Blockchain App Factory has been assisting various industries like healthcare, logistics, etc. It also specializes in creating NFT marketplaces, DeFi fundraising platforms, and dApps.

- INORU

Another notable development company, INORU, is known to deliver premium DeFi solutions, smart contracts, NFT games, and other blockchain-generated services. They also offer upgraded services to businesses with existing blockchain systems and connected products.

- Cubix

Cubix, a prominent web3 development agency began as a software services company and progressed to building blockchain products including DEXs, NFT games, smart contracts, dApps, and more.

Summing up

Web 3.0 has been attracting attention from all sectors and organizations. Its potential is most felt by the financial sector, more so because of its ability to spur transparent, decentralized, and secure transactions.

A balanced strategy, including comprehending client needs, creating workable solutions, putting together a capable team, and designing a workable development plan, is necessary to succeed in the cutthroat financial market. And that makes Web3 the need of the hour! DeFi, being the most eminent application of web3 development services, is bound to experience more evolution and acceptance in the coming years.