Wallets & Token Standards: Enhancing Crypto Compatibility & Functionality

July 12, 2023

Top 10 White Label Wallet Development Companies of 2024

July 13, 2023Turning tangible or digital assets into digital tokens on a distributed ledger or blockchain is known as asset tokenization. The market for tokenized digital assets is growing. The size of the worldwide tokenization market was estimated at USD 2.03 billion in 2021, and it is anticipated to increase at a CAGR of 24.09% from 2022 to 2030.

When we speak of digital asset tokenization, tokens for real estate, automobiles, and conventional financial assets like bonds, funds, or company stocks are also being considered. For instance, JP Morgan has disclosed its plans to tokenize trillions of dollars’ worth of assets in order to create new frameworks for financial activities including trading, borrowing, and lending.

Understanding Digital Assets & tokens

While discussing digital assets, you could imagine cryptocurrencies like Bitcoin & Ethereum or NFTs like CryptoPunks & Bored Ape Yacht Club. However, digital assets cover a lot more, and you need to consult a seasoned digital asset tokenization service to convert your intellectual property or artwork into a crypto asset. It may include NFTs, crypto assets like digital currencies and stablecoins, and even central bank digital currencies (CBDCs) are all included in this growing asset class. Apart from these, physical assets like real estate, fine art, and precious metals can also be converted into digital assets. One more asset class includes tokenized versions of traditional financial products like equities, bonds, derivatives, and ETFs.

Digital asset tokenization means subdividing ownership of an asset, physical or digital, through digital tokens. These tokens can be traded and stored on a blockchain, and smart contracts help manage fractionalized ownership rights.

Types of Digital Assets

Stocks, bonds, real estate, digital assets, and currencies are the asset classes that are most likely to be tokenized. Tokens come in five different varieties, each with a special purpose:

- Cryptocurrency: These digital assets are maintained on a blockchain and are frequently used as a mode of payment or a store of value.

- Stablecoins: These digital assets are made to keep a constant, 1:1 value in relation to a particular asset. Most stablecoins are pegged with fiat currencies like the US dollar.

- NFTs, or non-fungible tokens: An NFT has a unique digital identifier with certified authenticity and ownership that is recorded on a blockchain.

- (CBDCs) Central bank digital currencies: These assets are issued and backed by central banks in addition to serving as a digital version of a country’s fiat currency.

- Security Tokens: These digital assets are tokenized representations of any asset that satisfies the criteria for a security or financial investment, such as stocks or bonds.

Significance of Digital Asset Tokenization

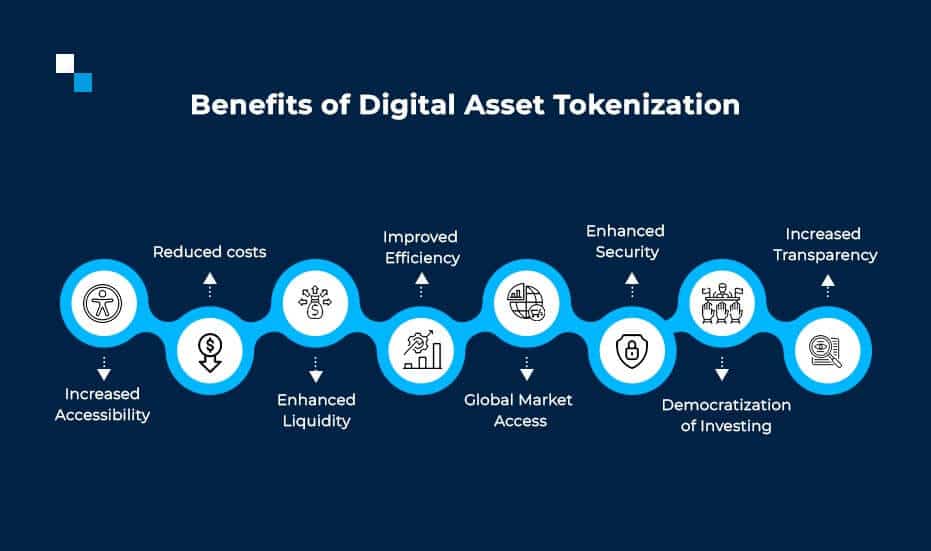

Asset tokenization has the potential to revolutionize the way assets are owned, traded, and invested in. It offers numerous benefits, ranging from increased accessibility and liquidity to improved efficiency, security, and market access. Digital asset tokenization service providers can help harness the power of blockchain technology through tokenization to reshape industries and create new economic opportunities.

Here are some specific examples of how tokenization is being used to benefit different types of assets:

- Real estate: Tokenization is being used to make real estate more liquid and accessible to a wider range of investors. For example, the company Propy has tokenized a $10 million property in New York City, which allows investors to buy fractional ownership of the property.

- Art: Tokenization is being used to make art more liquid and accessible to a wider range of collectors. For example, the company Masterworks has tokenized a $16 million painting by Pablo Picasso, which allows investors to buy fractional ownership of the painting.

- Intellectual property: Tokenization is being used to make intellectual property (IP) more liquid and accessible to a wider range of investors. For example, the company SingularDTV has tokenized the rights to a TV show, which allows investors to buy fractional ownership of the show.

Benefits of Digital Asset Tokenization

The significance of digital asset tokenization lies in its transformative potential across various industries and sectors. Here are some key points highlighting its significance:

Increased Accessibility

Digital asset tokenization allows fractional ownership, enabling broader access to investments and assets that were previously inaccessible to smaller investors. It opens up opportunities for individuals to invest in assets like real estate, art, or venture capital that were traditionally reserved for high-net-worth individuals or institutions.

Reduced costs

Tokenization can also reduce the costs associated with asset ownership and trading. This is because blockchain technology can automate many of the processes that are currently handled by intermediaries, such as settlement and clearing.

Enhanced Liquidity

Tokenization provides liquidity to traditionally illiquid assets. By breaking down assets into digital tokens, it becomes easier to buy, sell, and trade them on blockchain-powered platforms. This liquidity can unlock value and enable faster transactions, reducing settlement times and associated costs.

Improved Efficiency

A digital asset tokenization company can make use of blockchain technology and smart contracts to streamline processes, reduce intermediaries, and automate tasks. This efficiency eliminates the need for manual paperwork, reduces administrative costs, and minimizes the potential for errors or fraud.

Global Market Access

Tokenization removes geographical barriers, allowing investors from around the world to participate in previously localized markets. It enables cross-border transactions, facilitates international investment, and broadens opportunities for diversification.

Enhanced Security

Digital asset tokenization utilizes cryptographic security provided by blockchain technology. This ensures transparency, immutability, and tamper resistance, mitigating the risk of fraud or unauthorized manipulation of asset records. Additionally, ownership and transaction details can be recorded on the blockchain, enhancing the traceability and auditability of assets.

Democratization of Investing

Tokenization democratizes investing by providing equal opportunities to a wider range of individuals. It enables retail investors to access asset classes that were typically reserved for institutional investors, thereby reducing wealth disparities and promoting financial inclusion.

Increased Transparency

Tokenization improves transparency in asset ownership and transactions. The decentralized nature of blockchain allows anyone to verify the ownership and history of a token, promoting trust and accountability within the ecosystem.

Why Should Businesses Try Digital Asset Tokenization?

By embracing tokenization, businesses can leverage the benefits of blockchain technology and position themselves at the forefront of innovation, creating opportunities for growth and competitive advantage in a rapidly evolving digital economy.

Digital asset tokenization can also help businesses in the following ways:

- Raise capital: Tokenization can be used to raise capital for businesses by issuing tokens that represent ownership in the business. This can be a more efficient and cost-effective way to raise capital than traditional methods, such as issuing stock or bonds.

- Create new revenue streams: Tokenization can be used to create new revenue streams for businesses by selling tokens that give access to products or services, or by using tokens to reward customers for their loyalty.

- Improve customer engagement: Tokenization can help businesses to improve customer engagement by giving customers a stake in the business and by providing them with new ways to interact with the business.

Here are some examples of businesses that are already using tokenization:

- Propy: Propy is a real estate company that is using tokenization to make real estate more liquid and accessible to a wider range of investors.

- Masterworks: Masterworks is an art investment company that is using tokenization to make art more liquid and accessible to a wider range of collectors.

- SingularDTV: SingularDTV is a media company that is using tokenization to make intellectual property (IP) more liquid and accessible to a wider range of investors.

Final Thoughts

Digital asset tokenization represents a groundbreaking shift in how assets are owned, traded, and invested in. Businesses can unlock a myriad of benefits by leveraging blockchain technology. It includes increased accessibility, enhanced liquidity, improved efficiency, cost reduction, and global market access.

Antier, an ace digital asset tokenization service provider has the potential to democratize investing, foster innovation, and promote financial inclusion. As we know, tokenization offers enhanced security, transparency, and regulatory compliance, instilling trust and accountability in the digital ecosystem.

As a business owner, you can explore the potential of asset tokenization, and position yourself at the forefront of a transformative wave, poise to reshape your business, drive economic growth, and unlock new opportunities in a rapidly evolving digital landscape. Contact Antier today!