How Much Does it Cost to Develop NFT Game?

October 13, 2023

Grow Your Income with Non-Custodial White Label Crypto Wallet

October 16, 2023Table of Contents:

2. Understanding Flash Loan Arbitrage Bots

3. How to leverage crypto flash loan arbitrage bot to maximize profits

4. What are Flash Swap Arbitrage Bots?

5. Differences between a Flash Loan and Flash Swap

6. How to Build a Flash Loan Arbitrage Bot

Introduction

A few years ago, no one ever imagined that investors could execute trades without involving banks and intermediaries. The appearance of DEXs (decentralized exchanges) in 2017 changed the story.

If you are not new to the world of DeFi, you must have heard of flash loans and the Arbitrage flash loan bot. Flash loans are a novice in the crypto world but their prominence skyrocketed significantly when an anonymous trader executed a flash loan worth $200 million to generate a profit of $3.

The transaction caught the attention of thousands of traders, entrepreneurs, and web3 enthusiasts, and people were suddenly interested in learning more about flash loans and crypto flash loan arbitrage bots and strategies. In brief, flash loans are like super quick loans that traders can get without having to put up collateral. A trader can make use of funds from flash loans to capitalize on price differences and make some quick profits.

Did you know?

“Arbitrage trading is a way to make money when two platforms have different prices for the same asset. This has nothing to do with flash loans, arbitrage flash loan bots, or blockchain. It’s like buying something cheap in one store and selling it for a higher price in another store.”

Let’s study more about these amazing bots making headlines with their exclusive way of minting profits.

Understanding Flash Loan Arbitrage Bots

The Flash Loan Arbitrage Bot is a decentralized application (dApp) that aims to leverage the benefits of price inefficiencies in the cryptocurrency market and generate profits through arbitrage trading. The bot basically utilizes Flash Loans for borrowing funds temporarily from lending protocols, along with executing trades across various decentralized exchanges (DEXs) to make a profit.

How to leverage crypto flash loan arbitrage bot to maximize profits

- Familiarize Yourself with Basics : Before you learn more about the arbitrage flash loan bot, you must know what flash loans are.

– Flash loans are uncollateralized loans that make use of smart contracts on Ethereum or several other blockchain networks. - Pick a Flash Loan Platform : Based on your preferred borrowing terms, fees, and other conditions, choose a DeFi platform that offers flash loans.

– Some popular options are Aave, Uniswap, dYdX, etc. - Build a Flash Loan Arbitrage Bot : Configuring or building a specialized arbitrage bot for flash loans requires a thorough understanding of smart contract development, blockchain technology, and latest DeFi developments.

– Specify your target exchanges, trade conditions, borrowing logics, etc., and ensure proper risk management for smart contract and bot development. - Spot Arbitrage Opportunities : After getting your crypto flash loan arbitrage bot developed by a reliable technology provider, test it thoroughly and start working with it.

– Spot generous price differences for the same trading pair or asset across multiple exchanges. - Flash Loan Application : Initiate a flash loan by submitting a request via platforms like Aave or other DeFi (Decentralized Finance) providers.

– Specify the loan amount you require for arbitrage and keep yourself prepared to repay the loan and interest amount within same transaction. - Execute the Arbitrage Transactions: : As soon as the smart contract’s logic is executed, the requested loan amount is transferred to the borrower through the DeFi lending platform.

– Utilize these funds to execute buy and sell orders via the flash loan arbitrage bot. - Loan Repayment : Within the same transaction, the smart contract automatically repays the borrowed funds to the lender, typically accompanied by a fee, which is usually around 0.09% if a profit is realized.

– As everything is automated with an arbitrage flash loan bot, ensure that things go as intended. - Verification and Transaction Completion : If the repayment falls short, the transaction is reversed in accordance with the smart contract’s terms.

– However, if the loan and the nominal fee are successfully returned in the same transaction, the loan is considered repaid, and the transaction is finalized.

“Did you know that features like high scalability and throughput make Solana a lucrative choice for those who are looking for efficient arbitrage flash loan bot development services in a rapidly evolving DeFi ecosystem?”

Build Your Own Flash Loan Arbitrage Bot With US

Schedule Free DemoWhat are Flash Swap Arbitrage Bots?

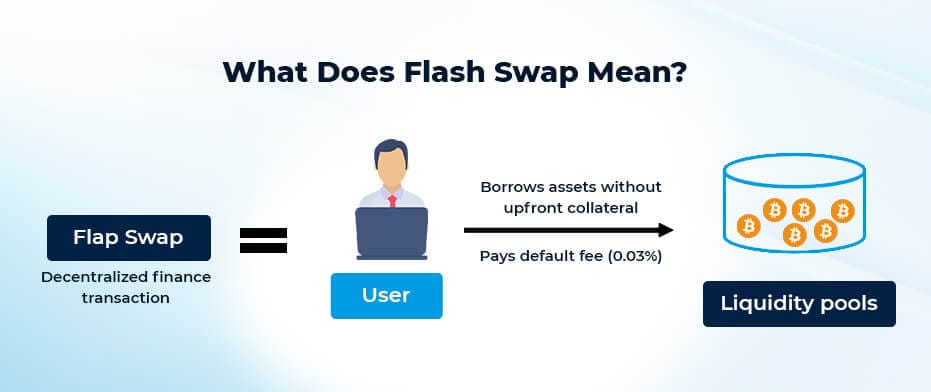

Along with flash loans, another related term is gaining significant prominence, known as flash swaps. Flash swaps are like a mix of loans and swaps between different things you can trade. They allow users to instantly borrow and repay assets within a single transaction without making an upfront payment of any collateral. Flash swaps provide decentralized finance (DeFi) platforms liquidity, enabling complex trading strategies and arbitrage opportunities. One of the most notable uses of flash swaps is in flash swap arbitrage bots.

These kinds of deals are usually used by people who completely understand how it all works. They set up a special group of transactions where people can borrow stuff from the group. This group is like a big pile of different tokens that people have put in. When you borrow something, the system checks to ensure it all works out and then lets you make some profit from the price difference using flash swap arbitrage bots.

Also, these flash swaps work a bit differently from regular swaps. In flash swaps, you could borrow one thing or many things, and you only pay when the final group balance is perfect. In simple words, the time it takes for the group to get balanced determines how long the deal lasts.

Differences between a Flash Loan and Flash Swap

Before you develop your flash swap or flash loan arbitrage bot, you must know how flash loans and swaps are different. It helps you figure out which bot you truly want to create.

Flash loans and flash swaps are both financial tools used in the world of decentralized finance (DeFi), but they have distinct differences:

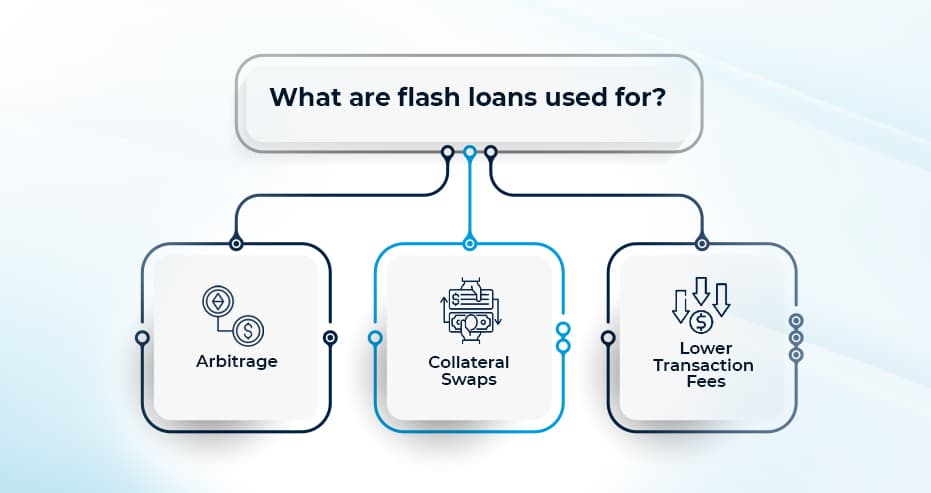

- Flash loans are primarily used for their role in flash loan arbitrage bots, liquidation of undercollateralized loans, and executing complex trading strategies that require large amounts of capital for a short time. However, flash swaps are versatile and can be used for a wide range of purposes, including providing liquidity to decentralized exchanges, yield farming, and executing strategies that involve multiple DeFi protocols.

- Flash swap arbitrage bots and loan bots might function in a similar way but there are critical differences between them that entrepreneurs and investors must know. Flash loans must be repaid within the same transaction block. If the user fails to repay the borrowed assets within the block, the entire transaction is reverted, and the loan is canceled. On the contrary, flash swaps do not require immediate repayment within the same block. Users can borrow assets and use them for multiple actions within the transaction.

How to Build a Flash Loan Arbitrage Bot

Building a Flash Loan Arbitrage Bot is something only blockchain experts and coders can do. However, it has now become much simpler, all thanks to platforms with tools and APIs. Here’s a simplified outline of the steps involved:

- Define the Objectives Clearly

- Technology Stack Selection

- Smart Contract Development

- Security Audits

- Deployment and Infrastructure

- Liquidity Pool Management

- Monitoring and Alerting

- Compliance Reporting

- Perform Testing and Simulation

To build a flash loan arbitrage bot, engage with highly experienced tech experts for essential insights and guidance.

Conclusion:

Flash loans are a new and unique thing introduced in the blockchain ecosystem, which can lead to lots of impressive ideas. Building a Flash loan arbitrage bot presents an exciting opportunity in the ever-evolving landscape of DeFi. This endeavor needs a strong understanding of blockchain technology, smart contracts, and market dynamics. As the DeFi space continues to mature, building and deploying such bots can offer an incredible way to participate in the decentralized financial ecosystem and potentially unlock profitable opportunities for skilled developers and traders.

The blockchain experts at Antier can help you with your crypto arbitrage bot development. Feel free to reach out for more information.