In the dynamic realm of real estate finance, innovation takes center stage with the advent of Mortgage Tokenization. The blog delves into the intricacies of Mortgage Tokenization Platform Development, unraveling its applications, benefits, and transformative impact across industries.

Imagine a world where fractional ownership of a property unlocks doors for countless investors, where transactions are transparent and instant, and where innovative financial instruments offer unparalleled flexibility. This isn’t a futuristic pipe dream; it’s the very essence of mortgage tokenization. By converting real estate debt into digital tokens, we unlock a treasure trove of opportunities, not just for individual investors, but for the entire real estate ecosystem.

Understanding Mortgage Tokenization

Mortgage tokenization represents a revolutionary process, converting real estate assets, specifically mortgages, into digital tokens on a blockchain. These tokens, offering fractional ownership, redefine how investors engage with and benefit from real estate investments.

Mortgage tokenization introduces the concept of fractional ownership, democratizing access to high-value real estate assets. Investors, regardless of their financial capacity, can now participate in lucrative property markets.

Mortgage tokenization platforms enhance liquidity in real estate markets. By digitizing assets, investors can buy and sell tokens representing portions of mortgages, fostering a more dynamic and liquid real estate market. The integration of blockchain technology in mortgage tokenization fosters collaboration between traditional financial institutions and FinTech companies. This synergy leads to the creation of innovative financial products, sparking transformation across the broader financial sector.

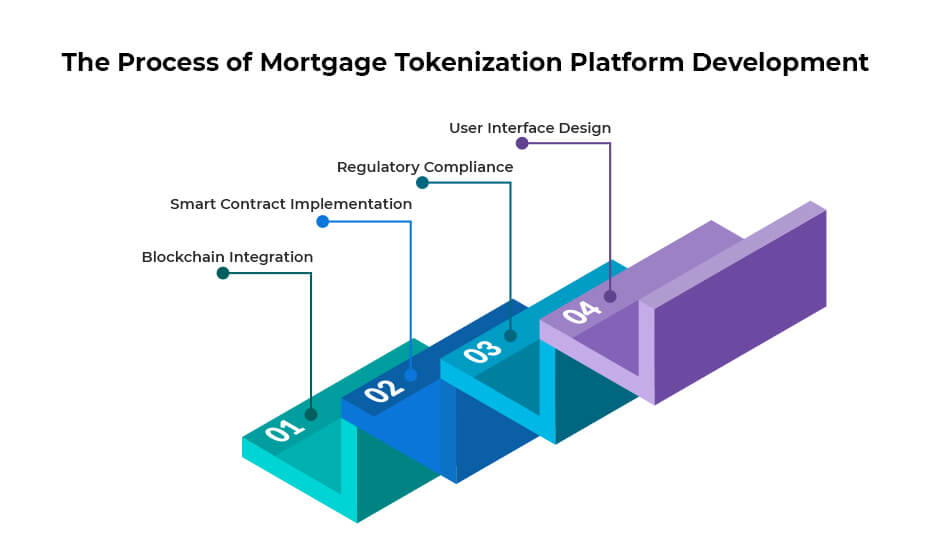

The Process of Mortgage Tokenization Platform Development

Blockchain Integration:

Carefully choose a blockchain platform, such as Ethereum or Binance Smart Chain, considering factors like security, scalability, and development resources.

Smart Contract Implementation:

Develop smart contracts that automate the tokenization process, ensuring transparency and efficiency in transactions. These contracts manage ownership transfers, revenue distribution, and compliance seamlessly.

Regulatory Compliance:

Adhere to regulatory requirements and legal frameworks governing real estate transactions. Maintain compliance with securities laws to uphold the legality and legitimacy of tokenized mortgages.

User Interface Design:

Design an intuitive user interface that empowers investors to interact seamlessly with the platform. This interface should facilitate actions such as purchasing, selling, and monitoring tokenized mortgage assets.

Benefits of Mortgage Tokenization Platforms

There are several benefits of mortgage tokenization platforms, some of them are listed below:

Democratized Access:

Inclusive Investment Opportunities: Mortgage tokenization democratizes access to real estate investments, allowing a diverse range of investors to participate in high-value properties that were traditionally exclusive.

Enhanced Liquidity:

Market Dynamism: Tokenized mortgages inject liquidity into traditionally illiquid real estate assets. Investors can trade digital tokens on secondary markets, providing flexibility and liquidity to the real estate market.

Reduced Entry Barriers:

Facilitating Fractional Ownership: Fractional ownership reduces entry barriers, enabling investors to own a portion of high-value properties that may have been financially out of reach in traditional real estate models.

Security and Transparency:

Immutable Record-Keeping: Utilizing blockchain ensures the immutability of ownership records. Every transaction and change in ownership are recorded on the blockchain, providing a transparent and secure system.

Challenges and Considerations in Mortgage Tokenization

Regulatory Challenges:

Evolving Regulatory Landscape: Navigating the complex and evolving regulatory landscape is paramount for mortgage tokenization platforms. Compliance with securities laws and real estate regulations is crucial for legal soundness.

Educating Stakeholders:

Building Trust through Education: Educating stakeholders, including investors and traditional financial institutions, is essential for widespread adoption. Building trust around a relatively new concept requires comprehensive education and communication strategies.

Case Studies: Realizing the Potential of Mortgage Tokenization

Residential Properties:

Unlocking Homeownership Through Fractional Ownership: Explore how mortgage tokenization facilitates homeownership by allowing individuals to invest in residential properties through fractional ownership, creating a more inclusive real estate landscape.

Commercial Real Estate:

Innovative Financing in Commercial Real Estate: Dive into the commercial real estate sector, where tokenization provides innovative financing solutions and transforms the dynamics of property investment, showcasing real-world examples of success.

Future Trends: The Evolution of Mortgage Tokenization

Let’s dive into the future trends that will unfold in the realm of mortgage tokenization:

Expansion of Tokenized Assets:

Diversifying Asset Classes: Anticipate the expansion of tokenized assets beyond mortgages, encompassing various real estate-related instruments, such as property-backed securities and rental income tokens, shaping a more diversified investment landscape.

Integration with DeFi Ecosystem:

Synergies with Decentralized Finance (DeFi): Explore the potential integration of mortgage tokenization with decentralized finance (DeFi) platforms, creating synergies that enhance liquidity and bring novel financial products to the market, paving the way for a more interconnected financial ecosystem.

Transforming Real Estate Finance Through Innovation

Mortgage tokenization platform development stands as a transformative leap in real estate finance. From democratizing access to high-value properties to enhancing liquidity and introducing new financial products, the benefits are substantial. While challenges exist, the potential for reshaping the real estate investment landscape is undeniable. As we navigate the future, mortgage tokenization platforms stand as a beacon of innovation, offering a more inclusive, dynamic, and liquid approach to real estate finance. Embrace the future of real estate investment with mortgage tokenization, where innovation meets opportunity, and traditional boundaries dissolve into new possibilities.

Looking for an experienced and expert Mortgage Tokenization Platform Development Company? Get in touch with subject matter experts at Antier who work closely with you to deliver a power-packed solution. Get in touch for a free consultation!