Why do even the most sophisticated crypto exchanges struggle with liquidity constraints, inefficient trade execution, and unpredictable market fluctuations? In an era where algorithmic dominance dictates market velocity, AI-powered trading assistants are not just ancillary tools—they are the bedrock of next-gen crypto exchange platform development. These autonomous, self-optimizing systems employ quantum-state predictive analytics, dynamic liquidity engineering, and deep reinforcement learning to execute trades at a scale and accuracy beyond human cognition.

Institutional-grade market-making, real-time arbitrage mapping, and adaptive portfolio rebalancing have transitioned from elite trading desks to AI-enhanced cryptocurrency exchange development. As capital efficiency and risk asymmetry become paramount, integrating AI into your cryptocurrency exchange development company’s infrastructure is not innovation—it’s survival in an algorithmically contested trading landscape.

What are AI-powered Trading Assistants?

“In volatile crypto markets, milliseconds define profits and losses. AI ensures you’re always ahead.”

AI-powered trading assistants are transforming the crypto trading landscape by leveraging deep learning algorithms, real-time predictive analytics, and high-frequency execution models. Unlike human traders, these intelligent systems operate without bias, making data-driven, precision-optimized decisions even in extreme market conditions.

Embedded within crypto exchange software, they enhance liquidity management, optimize order execution, and automate risk mitigation strategies at an unmatched scale. On-chain metrics, market sentiment analysis, and sophisticated algorithmic models are used by AI-powered assistants to give institutional and retail traders self-optimizing, extremely adaptive, and infinitely scalable trading capabilities. As crypto exchange platform development advances, AI is no longer optional—it is the cornerstone of next-gen trading infrastructure.

The Core Mechanics of AI-Powered Trading in Crypto Exchanges

AI-powered trading assistants operate as high-frequency analytical engines, continuously ingesting and interpreting market data through deep learning models and probabilistic forecasting. These systems autonomously refine strategies, adjusting to volatile market conditions with reinforcement learning and pattern recognition algorithms.

At their foundation, smart order routing (SOR) protocols scan multiple liquidity sources to execute trades at optimal price points, mitigating slippage. Simultaneously, anomaly detection frameworks leverage NLP-driven sentiment analysis to identify manipulative activities like spoofing and wash trading, ensuring integrity in market operations.

By synthesizing real-time data streams with algorithmic execution, AI redefines crypto trading dynamics, fostering precision, adaptability, and self-optimizing trade intelligence.

AI Trading Bots vs. Human Traders: Who Wins In the Crypto Exchange Market?

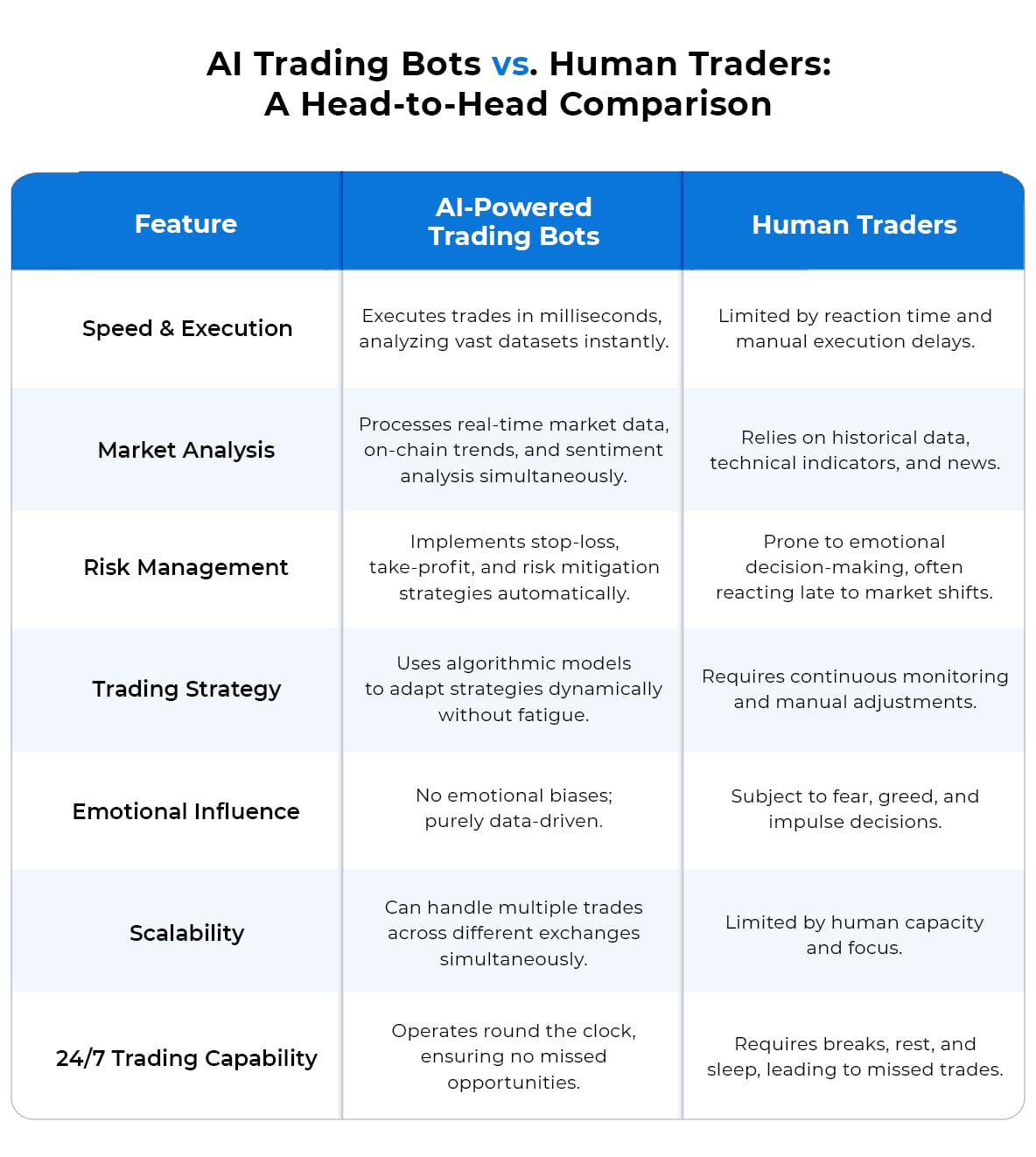

The battle between AI-powered trading assistants and human traders is reshaping the future of crypto exchange software. As markets become increasingly volatile and data-driven decision-making gains prominence, AI is proving to be a formidable force against human intuition. While human traders rely on experience, analytical skills, and market psychology, AI trading assistants leverage machine learning, predictive modeling, and ultra-fast execution to outperform even the most skilled professionals. The question isn’t whether AI will replace human traders—it’s how much of an edge it provides. Let’s break down the critical differences between AI and human traders in crypto exchange platform development and see who dominates the trading arena.

While human traders bring intuition and experience, AI-powered trading assistants dominate in speed, precision, and efficiency. Their ability to process immense amounts of data, execute trades in real time, and minimize risk makes them an indispensable part of cryptocurrency exchange development. As AI technology advances, it is clear that crypto exchange platform development will integrate these smart systems even further. Now, let’s explore the broader benefits of AI-powered trading assistants and how they revolutionize cryptocurrency exchange platforms.

Why is AI-Powered Trading the Future of Crypto Exchange Software?

Is your crypto exchange software truly maximizing profitability, or is human error limiting its potential? In today’s high-stakes cryptocurrency market, where price movements are driven by algorithmic precision and data supremacy, investors can no longer rely solely on manual trading. The demand for AI-powered trading assistants is surging as they eliminate emotional biases, enhance risk-adjusted returns, and execute split-second trades with pinpoint accuracy. For those considering crypto exchange platform development, integrating AI-driven automation isn’t just an innovation—it’s a necessity for staying competitive.

Here’s why investing in AI-powered crypto exchange software is a game-changer:

- Institutional-Grade Precision & Speed – AI trading assistants process high-frequency market data, real-time order book analysis, and liquidity depth within milliseconds. Unlike manual traders, these systems execute trades with zero lag, reducing slippage and maximizing profitability. A cryptocurrency exchange development company integrating AI ensures that every trade is strategically optimized for market conditions, delivering institutional-grade execution quality.

- Predictive Analytics for Superior Market Insights- Traditional traders react to price movements, but AI-powered systems predict them. Using deep learning models, pattern recognition, and sentiment analysis, AI assistants anticipate market shifts before they occur. This proactive approach enhances crypto exchange software by enabling traders to capitalize on arbitrage opportunities, detect whale movements, and hedge against volatility.

- Automated Risk Management & Loss Prevention- Market downturns and flash crashes can wipe out capital in seconds. AI-driven trading solutions implement adaptive stop-loss mechanisms, volatility hedging models, and real-time liquidity tracking to mitigate risks dynamically. Crypto exchange platform development with AI ensures that investor portfolios are protected against sudden price manipulations and systemic risks, fostering a safeguarded trading environment.

- Intelligent Portfolio Rebalancing & Asset Allocation- Diversification is the cornerstone of sustainable investments, yet human traders often fail to reallocate assets dynamically. AI-powered trading assistants continuously monitor asset correlations, portfolio weights, and sectoral risk exposure to automatically rebalance holdings for maximum yield. A cryptocurrency exchange development company integrating AI-based portfolio management enables optimized asset allocation without manual intervention.

- 24/7 Autonomous Trading Without Human Limitations- Unlike human traders bound by time zones and fatigue, AI trading bots analyze, strategize, and execute trades around the clock. With unsupervised machine learning capabilities, they self-improve over time, refining strategies based on historical performance and evolving market conditions. This makes crypto exchange software inherently more efficient, adaptive, and profitable.

- Real-Time Fraud Detection & Security Enhancements- AI doesn’t just optimize trading; it fortifies security. Advanced AI-powered anti-fraud systems detect suspicious transactions, identify abnormal trading patterns, and prevent market manipulation before damage occurs. AI-enhanced cryptocurrency exchange development ensures regulatory compliance by flagging illicit activities and optimizing KYC/AML measures.

- Democratization of Institutional-Grade Trading for Retail Investors- AI-powered crypto exchange platform development bridges the gap between institutional and retail traders. Advanced quantitative trading strategies, predictive modeling, and liquidity aggregation—once exclusive to hedge funds—are now accessible to retail investors. AI levels the playing field, allowing high-frequency trading, arbitrage, and strategic hedging for all market participants.

- AI-Driven Smart Order Routing & Liquidity Optimization- Liquidity fragmentation remains a major challenge in crypto trading. AI-driven Smart Order Routing (SOR) optimally distributes orders across multiple liquidity pools, ensuring best execution at the lowest spreads. By incorporating AI-powered market-making algorithms, crypto exchange software becomes more efficient, cost-effective, and capable of handling institutional trading volumes.

AI-powered trading assistants are no longer optional—they are the defining edge of next-generation crypto exchange infrastructure. Investors looking to develop cutting-edge cryptocurrency exchange software must embrace AI-driven automation, predictive modeling, and self-optimizing trade execution to maintain a competitive advantage with the help of a crypto exchange development company. With market dynamics evolving at an unprecedented pace, the question isn’t whether AI-powered trading will dominate crypto exchange platform development—it’s how soon you will integrate it into your investment strategy.

How to Create a Crypto Exchange Software With AI-Powered Trading Assistants?

Before investing in crypto exchange software, understanding the intricate development process is crucial. Investors and business leaders seeking to capitalize on AI-driven trading solutions must recognize that success in the crypto market is not just about integrating AI but about architecting a platform that ensures precision, scalability, and security. A well-structured crypto exchange platform development process guarantees seamless AI adoption, empowering trading ecosystems with automation, predictive analytics, and real-time decision-making.

Step 1: Define the Exchange Architecture & AI Framework

A strong foundation begins with defining the exchange architecture, selecting a blockchain infrastructure, and integrating an AI-driven trading framework. Smart contracts facilitate automated settlements, while AI models—such as machine learning and predictive analytics—power trade execution, risk assessment, and sentiment analysis.

Step 2: Implement Core Trading Engine with AI Optimization

The trading engine is the backbone of cryptocurrency exchange development, handling order matching, price feeds, and liquidity aggregation. AI-powered optimization enhances predictive market analytics, high-frequency trading (HFT), and dynamic order execution. Reinforcement learning models continuously refine trading strategies based on real-time market behavior.

Step 3: Develop Secure User Wallets & AI-Enhanced Risk Control

Security is paramount in crypto exchange software. Multi-signature wallets, biometric authentication, and cold storage solutions are integrated alongside AI-driven fraud detection. Advanced anomaly detection algorithms proactively monitor transactions, preventing suspicious activities and cyber threats.

Step 4: Integrate AI-Driven Trading Strategies & Market Analytics

AI-powered trading assistants analyze historical trends, order book depth, and sentiment data to execute profitable strategies. Market-making algorithms, arbitrage analytics, and AI-enhanced portfolio management help traders optimize their positions in volatile market conditions

Step 5: Deploy Regulatory Compliance & AI-Governed KYC/AML

Compliance automation is vital for sustainable crypto exchange platform development. AI-driven KYC/AML frameworks streamline identity verification, detect illicit trading patterns, and ensure adherence to global regulatory standards. Automated compliance monitoring enhances operational transparency and investor confidence.

A proficient cryptocurrency exchange development company follows a structured approach to embedding AI-driven trading assistants, ensuring market adaptability, high-frequency execution, and enhanced risk management. By comprehending the key development stages, investors can assess technical feasibility, evaluate AI’s role in optimizing trading, and make strategic financial commitments toward a next-generation cryptocurrency exchange development solution.

Hire Certified Experts For Your Cryptocurrency Exchange Platform

As algorithmic intelligence continues to evolve, AI-powered trading assistants are becoming an indispensable force in shaping the digital asset market. Their ability to adapt to volatile conditions, execute trades with mathematical precision, and enhance market efficiency underscores their transformative role in modern exchange platforms.

Are you planning to integrate AI into your crypto exchange? Align with Antier, a globally recognized leader in cryptocurrency exchange development. With a team of seasoned blockchain architects, AI specialists, and quantitative analysts, Antier engineers sophisticated trading ecosystems, seamlessly blending AI-driven automation with robust market intelligence to future-proof your exchange in an increasingly algorithmic-driven financial landscape.