Developing a Next-Gen Crypto Derivatives Exchange on L2: Complete Guide

January 3, 2025

How can AI crypto agents transform P2P lending software in 2025?

January 3, 2025Stablecoins are swiftly emerging as a pivotal force in the world of digital finance, offering a unique blend of stability and flexibility that appeals to both investors and businesses alike. With their ability to maintain a fixed value against traditional fiat currencies, they mitigate the inherent volatility of other cryptocurrencies, making them an attractive option for those seeking to protect assets in an ever-fluctuating market. Their growing adoption across diverse sectors—ranging from DeFi platforms to cross-border payments—signals a broader trend toward integrating blockchain into mainstream financial operations.

As the new year unfolds, positioning yourself for success with a strategic investment in stablecoin development solutions is a decision that could define your financial trajectory in 2025. Their increasing prominence and stability make them a powerful addition to any portfolio. Starting the year with this investment could be the most rewarding move you make—ensuring long-term growth and profitability in the ever-evolving digital landscape. Don’t wait; seize this opportunity to elevate your financial future.

Let’s Scroll Down To Check The Trends!

1: Dominance of Fiat-Backed Stablecoins (USDT & USDC)

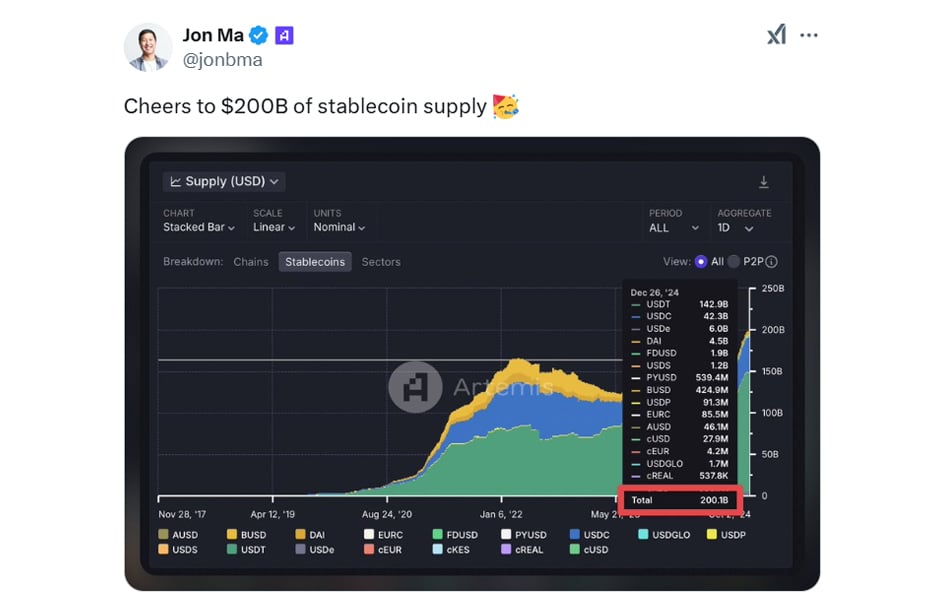

Why It’s Important: Fiat-backed stablecoins, primarily Tether (USDT) and USD Coin (USDC), have established themselves as the go-to stablecoins within the crypto space due to their credibility, liquidity, and extensive use across dApps and global transactions.

2025 Outlook: Tether and USDC are expected to retain their dominant market positions as the largest stablecoins by market capitalization. These stablecoin development solutions will continue to be essential tools for users and businesses, enabling secure, fast, and predictable transactions. They are particularly favored for their low volatility and widespread acceptance.

Source Link: https://x.com/jonbma/status/1872856195058548807/photo/1

Impact: This will lead to broader adoption of stablecoin development in both traditional finance and crypto markets, contributing to the $300 billion target for the stablecoin market cap in 2025, with further market dominance expected from these two giants.

2: Stablecoin Payments and Cards

Why It’s Important: Stablecoin development solutions offer a significant opportunity to modernize the global payment infrastructure, reducing reliance on traditional banking systems and fiat currencies. Payment cards linked to stablecoins provide users with a seamless way to spend their crypto holdings in the real world.

2025 Outlook: Visa’s focus on stablecoin-linked payment cards is one of the major developments for 2025. As more wallets and platforms enable stablecoin adoption, these cards will allow users to spend stablecoins directly at merchants who accept Visa, bypassing the need for traditional bank accounts. This will drive further mainstream adoption and integrate decentralized stablecoins into daily financial transactions.

Impact: This trend will significantly boost the usability and practicality of stablecoins, particularly for cross-border transactions, providing users with an easier way to transfer and spend crypto without converting it into fiat.

3: Expansion of Stablecoin Usage in Cross-Border Payments

Why It’s Important: Cross-border payments traditionally face challenges such as high fees, slow transaction times, and reliance on intermediaries. Stablecoins are well-suited to address these challenges by providing a faster, cheaper, and more efficient way to transfer value across borders.

2025 Outlook: New stablecoins like Ripple Labs’ RLUSD are specifically designed for cross-border settlements, allowing for faster transactions without the need for traditional intermediaries such as banks. Ripple’s involvement highlights how stablecoins can facilitate global payments, particularly in regions with underdeveloped financial infrastructures.

Impact: Stablecoins will play a crucial role in enhancing global commerce, especially in emerging markets where traditional banking services are limited. This shift could lead to significant cost savings and faster transaction processing for both businesses and consumers.

4: Stablecoins in DeFi

Why It’s Important: Stablecoins are already a staple in the DeFi ecosystem, used for lending, borrowing, yield farming, and liquidity provision. As DeFi platforms continue to scale, stablecoin development solutions offer a hedge against the volatility of cryptocurrencies, enabling users to earn returns without exposure to price fluctuations.

2025 Outlook: The integration of decentralized stablecoins will continue to accelerate, with vast and experienced stablecoin providers creating more robust solutions for the DeFi platforms. As the demand for stablecoins grows, they will be integral to advanced financial services in the DeFi sector.

Impact: The use of decentralized stablecoins in DeFi is expected to grow as new DeFi platforms integrate stablecoins for more complex financial services. This will create additional demand for well-regulated and reliable stablecoins, leading to further innovation in their use within DeFi protocols.

5: Regulatory Divergence and Clarity

Why It’s Important: The regulatory landscape for stablecoin development remains fragmented, with different countries and regions adopting their approaches. Regulatory clarity is essential for the stablecoin development solutions to thrive, as it provides confidence to investors, businesses, and users in the market.

2025 Outlook: As governments around the world continue to develop regulations for crypto and stablecoins, 2025 could see the introduction of clearer, more unified standards. This would provide much-needed transparency and create an environment where decentralized stablecoin development projects can innovate within regulatory frameworks. The European Union’s Markets in Crypto-Assets Regulation (MiCA) is an example of such an initiative.

Impact: Regions with clear and balanced regulations will attract innovation, while areas with restrictive or ambiguous rules could stifle growth. Therefore, consistent and well-defined regulatory frameworks will be crucial for the continued expansion of stablecoin development and the widespread adoption of stablecoin use.

6: Layer 2 (L2) Adoption

Why It’s Important: Layer 2 solutions like Arbitrum, Optimism, and Base help scale blockchain networks by processing transactions off-chain and then settling them on-chain. This results in faster and more cost-efficient transactions, making stablecoin development even more practical for users.

2025 Outlook: The integration of stablecoin development solutions with Layer 2 solutions will be a key development area in 2025. Decentralized stablecoin development can provide almost instantaneous transactions at a fraction of the price of on-chain transfers by leveraging these technologies. This is particularly useful in DeFi, where users need to execute many transactions quickly and cheaply.

Impact: Layer 2 adoption will enable stablecoin development to be used more efficiently within the DeFi ecosystem, boosting their overall utility and attracting more users to the crypto space.

7: Interoperability Across Blockchains

Why It’s Important: The current state of the blockchain ecosystem is fragmented, with various chains operating in silos. Interoperability allows stablecoins to move seamlessly between different blockchain networks, making them more versatile and useful across the entire crypto space. Stablecoin development solutions are focused on creating this seamless experience, enhancing the functionality of stablecoins across multiple platforms.

2025 Outlook: As stablecoin development becomes more sophisticated, stablecoins will become increasingly integrated with multiple blockchain networks. Efforts to improve interoperability will unlock new use cases, including seamless transfers across different DeFi platforms, exchanges, and wallet systems, expanding the potential applications of decentralized stablecoin development beyond their current ecosystems.

Impact: Enhanced interoperability will make stablecoin development more valuable as they can be used across various platforms and networks without requiring multiple conversions or intermediary steps, increasing their adoption and use cases. This will significantly boost the market for stablecoin development company solutions, driving innovation and usability in the crypto ecosystem.

8: Yield-Generating Stablecoins

Why It’s Important: Yield-bearing stablecoins are a groundbreaking innovation in stablecoin development, offering rewards or interest simply for holding them. These stablecoins provide a passive income stream for investors and users, enhancing the utility of stablecoin development solutions in the financial ecosystem.

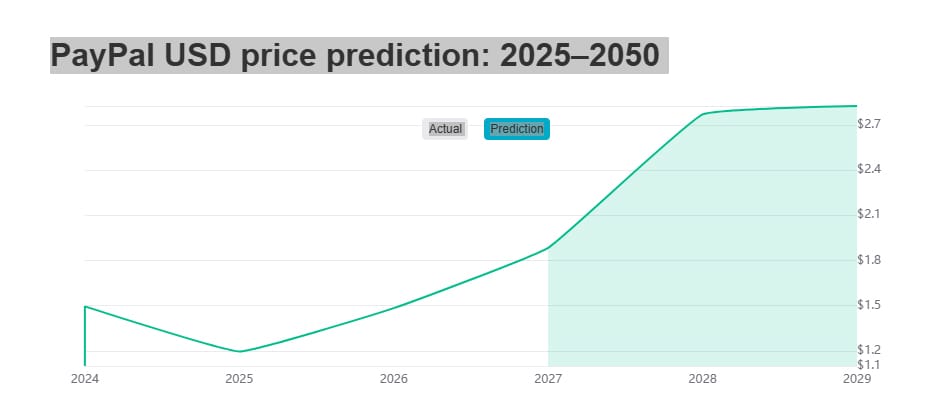

2025 Outlook: Yield-generating stablecoins, such as PayPal USD (PYUSD), are poised for increased adoption in 2025. The price of PayPal USD is predicted to fluctuate by +10.04% in 2025. It is anticipated that the price of PayPal USD will hit $1.1 by the end of 2025, yielding a cumulative return on investment of +9.96%. More companies, including leading stablecoin development companies, are likely to create stablecoins that reward holders with interest or dividends. This trend aligns with the demand for decentralized stablecoin development that ensures stability and growth opportunities for users without exposing them to the volatility of other cryptocurrencies.

Source Link : https://www.bitget.com/price/paypal-usd/price-prediction

Impact: Yield-generating stablecoins will add another layer of utility, especially for long-term holders, while accelerating the expansion of the broader stablecoin ecosystem. However, ensuring regulatory compliance and maintaining transparency will be critical for the safety and sustainability of these products, reinforcing the importance of robust stablecoin development solutions.

9: “Exotic” Stablecoins Offering Higher Yields

Why It’s Important: As demand for higher yields grows, some projects within stablecoin development will focus on creating “exotic” stablecoins designed to offer returns higher than typical fiat-backed stablecoins. These innovative solutions, part of stablecoin development solutions, could introduce additional risks due to the complexity of the products.

2025 Outlook: The rise of exotic stablecoins will attract retail investors seeking higher returns but may also bring challenges that highlight the importance of decentralized stablecoin development. These products might mimic structured financial instruments, offering increased yields but embedding risks related to liquidity, volatility, or counterparty exposure.

Impact: While these stablecoins may appeal to more experienced users, they could present significant risks to less-informed retail investors. A stablecoin development company can play a crucial role in mitigating these risks by ensuring clear risk disclosures and implementing investor education initiatives.

10: Rise of Central Bank Digital Currencies (CBDCs)

Why It’s Important: Stablecoin development is increasingly being seen as a foundation for CBDCs. Many governments and central banks are exploring or developing digital versions of their fiat currencies to bring more efficiency, security, and transparency to their financial systems. This trend underscores the importance of stablecoin development solutions in shaping the future of digital finance.

2025 Outlook: In 2025, the rise of CBDCs could create a more stable and regulated environment for decentralized stablecoin development. Governments advancing CBDC projects are likely to influence the broader adoption of stablecoins by aligning them with robust regulatory frameworks. These initiatives will also likely enhance interoperability between stablecoins and CBDCs, enabling seamless integration within global financial systems.

Impact: CBDCs will drive regulatory clarity, fostering trust and adoption of stablecoin development solutions. Additionally, their integration with blockchain ecosystems could boost the utility of stablecoins for cross-border transactions, financial services, and retail payments. Collaboration between a stablecoin development company and policymakers will be pivotal in maximizing the potential of these advancements.

11: Stablecoin Adoption in Emerging Markets

Why It’s Important: Stablecoin development presents a transformative opportunity for people in emerging markets to gain access to a stable store of value, bypassing traditional banking infrastructure.

2025 Outlook: As stablecoins like USDC and USDT continue to establish themselves as critical tools for global transactions, their adoption will accelerate in emerging markets. These regions will benefit from stablecoin development solutions such as low transaction fees and global reach, particularly in areas with limited access to traditional financial services.

Impact: The growing use of decentralized stablecoin development in these markets will drive financial inclusion, enabling individuals and businesses to securely and efficiently participate in the global economy. Partnering with a reliable stablecoin development company will further facilitate this adoption and innovation.

12: Stablecoins as a Store of Value (SoV) in Emerging Markets

Why It’s Important: In regions with high inflation or unstable currencies, stablecoin development serves as a reliable store of value, protecting purchasing power and reducing exposure to currency volatility. This is especially impactful in emerging markets where citizens seek stable, digital alternatives to fiat.

2025 Outlook: The adoption of stablecoin development solutions is set to rise in emerging markets, driven by economic instability and innovation in decentralized stablecoin development. Leading stablecoin development companies are expected to enhance accessibility, making stablecoins vital for savings, trading, and remittances.

Impact: Stablecoins are transforming economies like Venezuela and Turkey by offering stability amid hyperinflation, positioning stablecoin development as a critical tool for financial resilience.

13: Stablecoin Legal Landscape

Why It’s Important: A clear legal framework is essential for the growth of stablecoin development, enabling businesses and users to operate without uncertainty regarding their rights and obligations. Legal clarity fosters trust and drives the adoption of stablecoin development solutions across industries.

2025 Outlook: The legal landscape for decentralized stablecoin development is expected to evolve significantly in 2025. Countries introducing comprehensive laws for stablecoins will balance innovation with consumer protection, making them attractive hubs for investment and innovation.

Impact: Clear legal frameworks empower stablecoin development companies to innovate confidently, creating a stable environment that drives adoption and strengthens trust in stablecoin ecosystems.

These trends highlight the significant evolution of the decentralized stablecoin space in 2025. From the increasing dominance of fiat-backed stablecoins to the growing adoption of Layer 2 solutions and yield-bearing stablecoins, each trend reflects the broader maturation of the crypto market. Stablecoin development solutions are set to become even more embedded in the global financial system, with the potential to transform how we send, store, and earn value. However, regulatory clarity and transparency will remain critical to ensuring their long-term success and sustainable growth.

Tap The Billion-Dollar Market of Decentralized Stablecoins With Antier

Investing in decentralized stablecoins is not just a trend but a powerful, forward-thinking decision for businesses and investors aiming for high returns. Stablecoins are positioned for exponential growth due to their increasing use in emerging markets, DeFi ecosystems, and cross-border payments. You are laying the groundwork for long-term success in this industry by placing yourself strategically. The stablecoin market holds immense potential for generating high ROI, and now is the time to act.

We at Antier are experts at creating cutting-edge, feature-rich decentralized stablecoin development solutions. With our vast expertise and cutting-edge technologies, we design tailored solutions that meet the specific needs of your business. Our team works tirelessly to create stablecoins that are secure, scalable, and ready to revolutionize the way you do business. Leverage our knowledge to maximize your ROI and lead the way in this bull market.