The art world, steeped in tradition and shrouded in mystique, is undergoing a seismic shift fueled by blockchain technology. It revolutionizes the way that art is bought, sold, and owned today through tokenization—the process whereby an artwork’s ownership rights are digitized into tokens on a blockchain. The blog looks at this exciting innovation of tokenization of art that can democratize ownership, further authenticity, and change the face of the art market—backed by real-life examples and the power of this transformative technology.

Art Tokenization: From Physical Canvas to Digital Ownership

Imagine a world wherein Vincent van Gogh’s “Sunflowers” is not just a breathtaking masterpiece housed in a museum but also has a digital representation secured on a blockchain. Each token forms a portion of ownership, thus giving many people the possibility of co-ownership of this historical piece. That is what the tokenization solution for art does. In 2018, in what might be termed a pioneering move, the Picasso work “La Petite Maison Rouge,” valued at $5 million, was tokenized by Sygnum Bank based in Liechtenstein. As many as 1 million tokens were made out of this piece of art, free for a much broader audience to invest in and become owners of a piece of art history. This case study is one of the first examples of the ability for tokenization to democratize high-value art, previously available to and preserved for high-net-worth individuals and institutions.

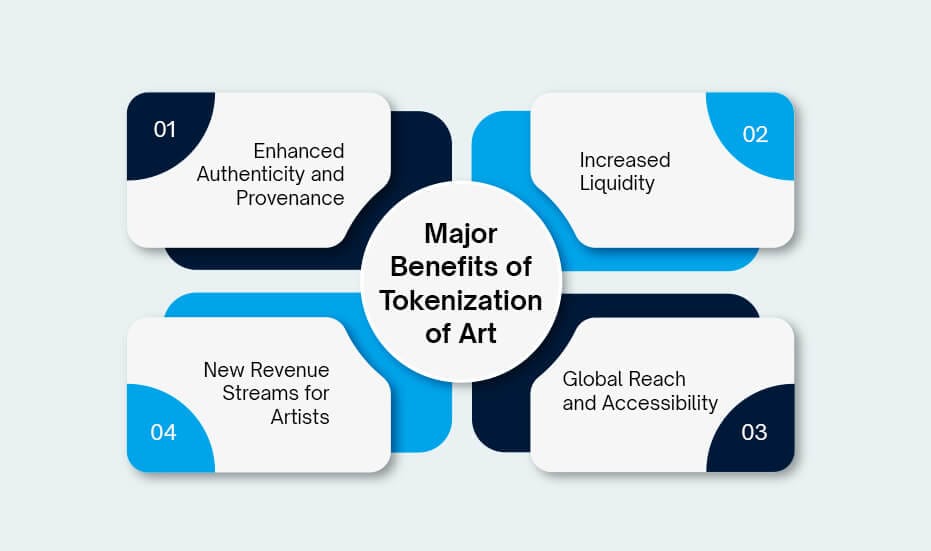

Major Benefits of Tokenization of Art

While opening doors for a wider audience is a significant advantage, art tokenization offers a multitude of benefits that can revolutionize the art market:

- Enhanced Authenticity and Provenance: Blockchain technology provides an immutable record of ownership history. Every transaction involving a piece’s tokens is permanently recorded, creating a transparent and secure audit trail. This combats art forgery, a multi-billion-dollar problem according to a 2020 report by the FBI’s Art Crime Team. Potential buyers can now have greater confidence in the authenticity of an artwork, reducing the risk of fraud.

- Increased Liquidity: To a large extent, art has been an illiquid asset. A Tokenized Art Platform opens the way to a more liquid market in which owners could more easily sell or exit their investment compared to traditional methods of selling physical artworks with auction houses or private dealers.

- Global Reach and Accessibility: Blockchain technology knows no borders. In this respect, since tokenized art can be traded 24/7, the circle of a possible potential pool of investors and collectors would automatically expand all around the globe. Moreover, it will open up totally new channels toward appreciation and investment in art for a more connected and accessible art market.

- New Revenue Streams for Artists: By utilizing smart contracts—self-executing agreements on the blockchain—the artists will have automated payment for royalties every time their artwork is resold as tokens in the secondary market. It will, therefore, provide them with a sustainable new income stream that goes beyond the primary sale and enables the creative ability of artists to fully focus on creative pursuits. In 2021, digital artist Mike Winkelmann sold a collage entitled “Everyday: The First 5000 Days” for $69 million, a record at a Christie’s auction. This record sale really showed that because of tokenization, digital artists were now in a position to cash in on their work in new and creative ways.

A Glimpse into the Tokenized Art Future

Tokenization itself is nascent, but the disruption potential is vast. Herewith a view on what the future may look like:

Fractional Ownership of High-value Collections

Imagine a day when through tokenization, you can co-own a collection of Monet’s water lilies or Van Gogh’s starry nights. This would make an investment in the renowned art collections more accessible and open the doors to a new generation of art patrons looking to invest in this market.

New Investment Vehicles: Tokenized art

It could give rise to new investment vehicles in the form of funds or vehicles focused on tokenized art, thereby making it possible for investment in diversified portfolios of artworks without the traditionally high upfront costs involved in art investment. This could democratize access to the art market for a greater range of investors.

Democratized Patronage of the Arts

Possibly, tokenization will enable fans to invest directly in up-and-coming talent by purchasing tokens that equate to a share in their future creative output. This creates a much more direct relationship between the artist and their audience, allowing fans to become investors who can benefit from any potential upside of an artist in the future.

The Art World, Reimagined

What used to be exclusively available for just a few now opens up to a much larger audience—the art world. Tokenization isn’t solely about technology; it’s about behavior. It’s an opportunity to give art lovers a piece of history, investors a look at new classes of assets, and artists the capability of getting in touch with their audience worldwide while unlocking new streams of revenue. The future of art ownership is going to become more and more democratized, transparent with tokenized artwork. The new frontiers in art stretch way beyond traditional museums and galleries into the vast digital frontier, with myriad possibilities for a future when owning a piece of art literally means a click away.

Education Is the Key for Tokenization of Art

As in the case of any new technology, education would be essential to garner broad acceptance. From art lovers and investors to traditional art institutions themselves, the potential for the market to grow will rest on adequate education about the associated benefits and risks related to tokenized art. Much may be given toward the processes of demystifying blockchain technology for prospective tokenized art market participants through educational initiatives and awareness campaigns, ensuring responsible participation.

Final Words

The future of tokenized art lies in collaboration. Established art institutions, galleries, and auction houses can leverage their expertise and reputation to curate and validate tokenized art offerings. Combining traditional art world knowledge with blockchain technology can create a robust and secure ecosystem for art enthusiasts and investors alike. As technology advances, regulations are established, and education efforts take root, the future of art ownership promises to be more democratic, transparent, and undeniably more exciting. Tokenization is not just a revolution in ownership; it’s a revolution in how we experience and interact with art. The art world is on the cusp of a transformation, and the possibilities are as limitless as the human imagination itself. Want to tokenize your artwork or build a reputed art tokenization platform? Get in touch with Antier, the leading art tokenization platform development company today and get a free consultation!