Over-the-counter (OTC) markets are emerging as a vital terminal of the cryptocurrency ecosystem. These trading desks, like the DEXs, CEXs, and hybrids, cater to a niche trader/investor base, including institutional investors, big-ticket traders, and high-net-worth individuals, making OTC crypto exchange development a lucrative venture. OTC trading platforms are opaque trading settings insulated from market price jolts. While trading, no one but the parties transacting is familiar with the price and volumes being traded.

As the popularity of such niche trading environments heightens due to several reasons, including spot crypto ETF approvals and increased institutional interests, we can expect more entrepreneurial investment in OTC crypto trading platform development.

If you are one of the entrepreneurs planning to build your own OTC crypto trading platform to tap into the tiding trends, here’s a blog equipping you with insights on:

Let’s Begin…

Why is it profitable to set up your OTC crypto exchange?

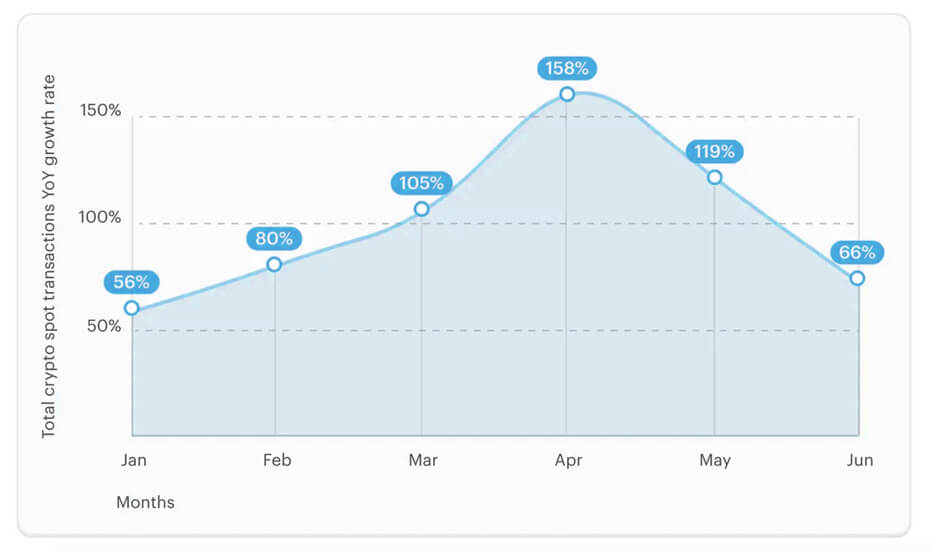

“As per a report by Finery Markets, the cryptocurrency over-the-counter market experienced exponential growth in the first half of 2024. Trading volumes skyrocketed by 95%, highlighting staggering year-over-year growth driven by surging institutional interest.”

Source: Bitcoin.com, Finery Markets

Before building such bespoke trading platforms to facilitate seamless, secure, and private large transactions outside the conventional exchange settings, you must learn how they contribute to your business profits. So, here’s why OTC crypto trading platform development is beneficial:

- Increased institutional investment: As mentioned above, the significant growth of OTC markets is primarily attributed to spot crypto ETF approvals. Spot BTC and ETH ETFs are already live in the trading markets and more are yet to be approved. This presents huge potential ahead, as more approvals will bring gushes of new institutional investments in the cryptocurrency sector. OTC crypto exchanges predominantly serve institutional investors so their demand is expected to rise.

- Heightened Demand for Privacy: As institutional interest in cryptocurrency intensifies, the need for robust, scalable, private, and secure OTC exchanges will rise. The reason? Institutional traders usually trade in large volumes. They prefer OTC crypto trading platforms as they offer a higher degree of privacy compared to centralized exchanges and efficiently process large orders without the risk of slippage.

- A Valuable Addition to Your Exchange: If you are already running a crypto exchange and are planning to integrate OTC desks, these will become your money magnets as they fasten a new loyal user base to your trading platform. Moreover, OTC crypto exchange development adds a high-yielding revenue stream that includes substantial transaction fees. Exchanges can also generate generous returns from wide spreads and additional financial services provided within the module.

- A Distinct Feature Serving Niche Markets: OTC desks cater to a niche market, including only large-volume traders. A unique OTC crypto trading platform that perfectly aligns with the target audience’s expectations can stand out in the crowded cryptocurrency exchange market. Due to limited competition in the domain, the prospects of business success are higher if one chooses to add this functionality to their existing trading platform or develop an OTC-only crypto trading platform.

- Higher Profit Potential: These opaque trading environments have a shadier side that customers are well aware of. OTC crypto exchanges usually have higher profit margins and customers don’t care because there are limited reliable options in the market. Moreover, no other exchange type, without disclosure (through order books or on-chain records), can facilitate such huge trades seamlessly. Their unmatched liquidity allows them to efficiently serve high-net-worth individuals and institutions.

- Regulatory Advantage: OTC crypto trading platforms enjoy a more favorable regulatory environment compared to traditional cryptocurrency exchanges. So, targeting this category of traders is easier as well as profitable.

Top 6 OTC Crypto Exchange Development Companies

1. Antier

Antier is a pioneering web3 consulting company known for its expertise in advanced OTC crypto exchange development. They create sophisticated and scalable trading infrastructures with features like multi-layer security, customizable trading interfaces, and high liquidity management.

Known for:

- Unparalleled Customer Support

- Advanced Technology Solutions

- Compliance with Regulatory Standards

- Unwaivering Industry Focus and Proven Experience

- Enhanced Privacy and Multi-Currency Support

- Building Advanced OTC Crypto Trading Platforms from Scratch

2. RisingMax

RisingMax is a blockchain development company offering a wide range of services, including OTC cryptocurrency exchange development. They focus on delivering high-performance platforms tailored to the specific needs of their clients.

Stand Out For:

- Highly Customizable Solutions

- Unparalleled Security Emphasis

- Intuitive and Seamless User Experiences

3. QuyTech

QuyTech is a technology development company offering a wide range of blockchain solutions, including OTC crypto trading platform development. They are known for their innovative approach and commitment to quality.

Strengths:

- Innovational Approach

- Comprehensive Post-Launch Support Services

- Transparent Development Process

4. Zab Technologies

Zab Technologies is a leading cryptocurrency exchange development company that offers end-to-end solutions for creating advanced OTC desks. They have experience building secure and scalable blockchain-based platforms for various use cases.

Stands out for:

- End-Customer-Centric OTC Crypto Exchanges

- Strong Track Record in Blockchain Development

- Inclination towards Security and Compliance

5. Bealeaf Technologies

Beleaf Technologies is an IT services company with a focus on fintech solutions. They offer diverse classes of customized blockchain-based solutions, including OTC trading platforms designed to meet the unique needs of their clients.

Known for:

- Business-Centric Solutions

- Cost-Effective Development Solutions

- Strong Security Measures

6. HashCash Consultants

HashCash Consultants specializes in blockchain technology and offers comprehensive OTC crypto exchange development services. Their solutions focus on security, scalability, and a seamless user experience.

Key Features:

- Robust Risk Management Tools

- Institutional-Grade Security

- Flexible Architecture

Picking the Best OTC Crypto Trading Platform Development Company: Selection Criteria

You need no rocket science expertise to create a robust OTC crypto exchange platform with the help of a reliable technology provider. Once you select the best trading platform development experts, you can rest assured that your solution is in adept hands.

Let’s move on to the selection criteria you can consider to evaluate the OTC crypto trading platform development companies in the space:

- Experience: Without any doubt, experience should be your foremost requirement. Look for companies with a proven track record in blockchain and exchange development. Those with a strong over-the-counter exchange platform portfolio should lead the list.

- Customization: Unless you’ve got a low budget, you need not compromise on user experience and features. Ensure that the OTC crypto exchange development company can tailor the exchange to your specific needs and preferences and is not offering you a customized pre-built solution (unless you ask for it).

- Security: Prioritize companies with a strong focus on security to protect user funds and data. Security should be a top priority for your OTC crypto trading platform development, as huge amounts of money are involved in this mode of cryptocurrency exchange.

- Scalability: With luck and the right technology company by your side, your OTC crypto trading desk can grow by leaps and bounds. A robust infrastructure with high scalability can accommodate large trading volumes seamlessly. So, always choose an OTC crypto exchange development company that can build an exchange capable of handling your future growth.

- Cost: Compare pricing and features provided to find the best value. Cost should not be your priority if you wish to ace the crypto space with a safe and sound OTC desk. However, you still need to carefully evaluate the cost-effectiveness of the solutions offered by the different OTC crypto trading platform providers.

- Reputation: At last, don’t contact a company before you contact their clients and ask about their work. Research the company’s reputation in every way you can to avoid being deceived after you have transferred a huge sum of money to their accounts. Read client reviews on various platforms and carefully examine their technical and industry expertise while you are sharing your project requirements.

Bottomline

OTC crypto exchanges are emerging as a popular alternative to CEXs. Those who fear on-chain disclosure or don’t want to be troubled by slippage are counting on these trading platforms, expecting completely customized trading experiences. If you are one of the existing crypto exchanges in the industry or an upcoming newcomer, you must know that the success of your platform largely depends on the development partner you choose.

Among the top companies in the OTC crypto trading platform development space, Antier stands out as a leader with deep expertise, an innovative approach, and a commitment to client success. Antier’s extensive experience in blockchain and cryptocurrency solutions, combined with its ability to deliver highly customizable and secure OTC crypto exchange platforms, makes it the ideal partner for businesses looking to capitalize on the growing demand for OTC trading.

Leverage their cutting-edge technology, industry insights, and comprehensive support to launch a platform that not only meets today’s needs but is also future-ready.