Decentralized finance (DeFi) is a rapidly growing financial system that is built on top of blockchain technology. One of its popular use cases is DeFi Lending Platform Development, which has gained traction. DeFi lending platforms allow users to lend, borrow, and trade assets without the need for a central authority. It allows users to earn interest on their idle assets and to borrow funds without having to go through a bank.

What Sets Apart the Best DeFi Lending Platforms?

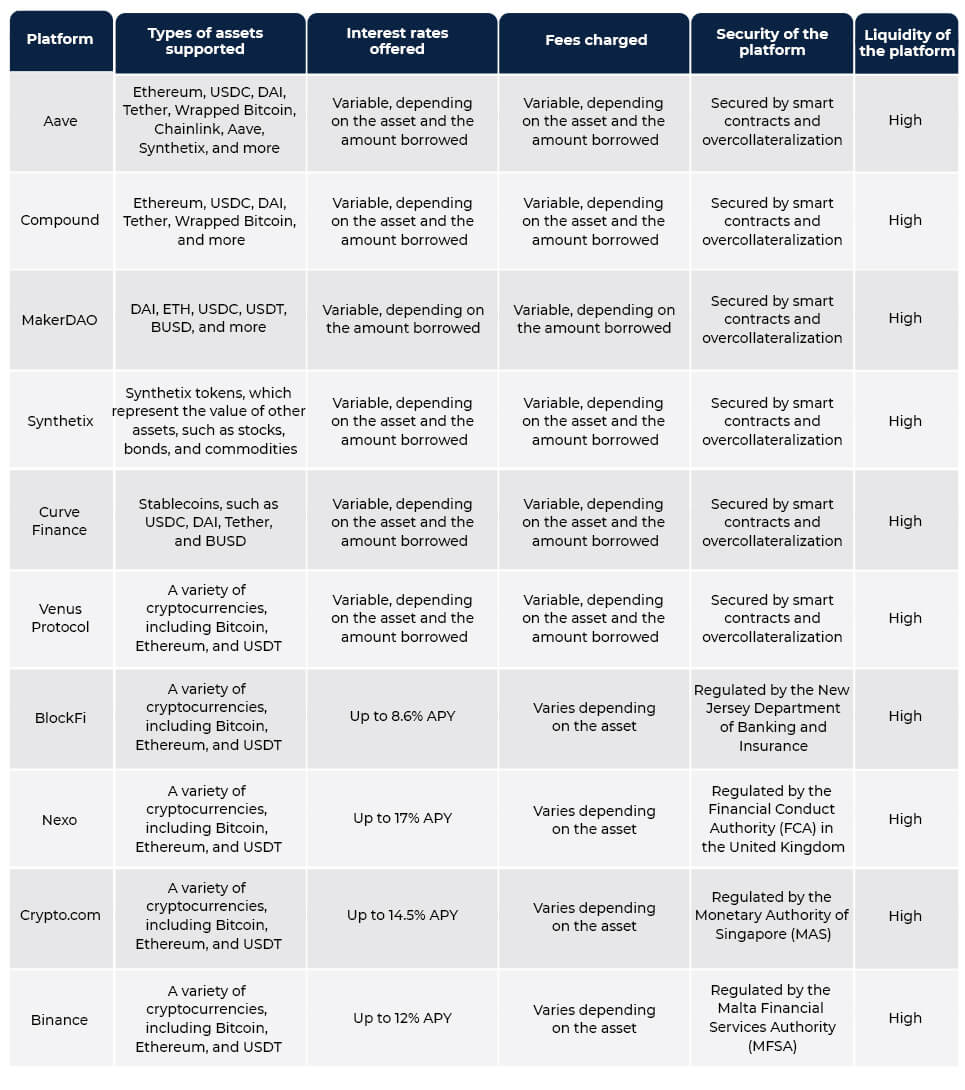

The best DeFi lending platform for you will depend on your individual needs and preferences. However, some factors to consider include:

- The liquidity of the platform. Liquidity refers to how easy it is to buy and sell assets on a platform. If you are looking to borrow or lend a large amount of assets, it is important to choose a platform that has high liquidity.

- The types of assets that are supported. Not all DeFi lending platforms support the same assets. If you are looking to lend or borrow a specific asset, make sure the platform you choose supports it.

- The interest rates offered. Interest rates vary from platform to platform. Some platforms offer higher interest rates than others. However, it is important to note that higher interest rates often come with higher risks.

- The security of the platform. DeFi lending platforms are secured by smart contracts. However, there is always a risk of hacks or exploits. It is important to choose a platform that has a good security reputation.

The top 10 DeFi lending platforms of 2023

There are a number of DeFi lending platforms available, each with its own unique features and benefits. Here are the top 10 DeFi lending platforms of 2023:

1. Aave

Aave is one of the most popular DeFi lending platforms, with over $4.5 billion in total value locked (TVL). It is built on the Ethereum blockchain and uses smart contracts to automate lending and borrowing. The interest rates for lending and borrowing are determined by the market, and they can fluctuate over time.

Aave also offers a number of features that make it a popular choice for DeFi users. These features include:

Overcollateralization: When you borrow funds on Aave, you are required to provide collateral that is worth more than the amount you are borrowing. This helps to protect lenders from losses in the event that a borrower defaults on their loan.

Flash loans: Flash loans are a type of uncollateralized loan that can be used to quickly and easily execute a trade or arbitrage opportunity.

Aavegotchi: Aavegotchi is a gamified non-fungible token (NFT) that is built on the Aave platform. Aavegotchis can be used to earn rewards, participate in games, and vote on platform governance proposals.

2. Compound

Compound is one of the oldest and most popular DeFi platforms. It is built on the Ethereum blockchain. Users can lend any supported cryptocurrency on Compound, and they can borrow any cryptocurrency that is in demand.

Compound also offers a number of features that make it a popular choice for DeFi users. These features include:

- Overcollateralization: When you borrow funds on Compound, you are required to provide collateral that is worth more than the amount you are borrowing. This helps to protect lenders from losses in the event that a borrower defaults on their loan.

- Liquidity pools: Compound uses liquidity pools to match lenders and borrowers. This makes it easy for users to lend and borrow funds, even if the amount they want to lend or borrow is small.

- Governance: Compound is a decentralized platform, so users have the ability to vote on platform governance proposals. This gives users a say in how the platform is run.

3. MakerDAO

MakerDAO is built on the Ethereum blockchain and uses smart contracts to automate the creation and management of DAI, DAI is a cryptocurrency that is pegged to the US dollar, and it can be used to lend, borrow, and trade on a variety of DeFi platforms.

To create DAI, users must deposit collateral into a MakerDAO vault. The collateral can be any Ethereum-based asset, such as ETH, USDC, or BAT. The amount of collateral that is required depends on the volatility of the asset. Once the collateral is deposited, users can mint DAI by paying a small fee.

Users can then use DAI to lend, borrow, or trade on a variety of DeFi platforms. When DAI is borrowed, the borrower must provide collateral that is worth more than the amount they are borrowing. It helps to protect lenders from losses in the event that a borrower defaults on their loan.

4. Synthetix

Synthetix is one of the most popular DeFi lending platforms that allows users to mint synthetic assets, which are tokens that represent the value of other assets, such as stocks, bonds, and commodities. To mint a synthetic asset, users must deposit collateral into a Synthetix pool. The collateral can be any Ethereum-based asset, such as ETH, USDC, or BAT. The amount of collateral that is required depends on the volatility of the asset that is being tracked. Once the collateral is deposited, users can mint synthetic assets by paying a small fee. The amount of synthetic assets that can be minted is limited by the amount of collateral that is deposited.

5. Curve Finance

Curve Finance is a decentralized finance (DeFi) platform that specializes in stablecoin swaps. Curve Finance supports a variety of stablecoins, including USDT, USDC, DAI, and BUSD. It also supports a variety of trading pairs, such as USDT/USDC, DAI/USDC, and USDT/BUSD.

To swap stablecoins on Curve Finance, users simply deposit the stablecoins they want to swap into a Curve pool. The pool will then automatically find the best exchange rate for the swap.

Curve Finance charges a small fee for each swap. This fee is used to pay for the gas costs of the transactions and to incentivize liquidity providers. Main Pros of Curve Finance are:

- Decentralized: Curve Finance is a decentralized platform, which means that there is no central authority that can control it. This makes it more secure and resistant to fraud.

- Low fees: Curve Finance charges a small fee for each swap. This fee is much lower than the fees charged by centralized exchanges.

- Liquidity: Curve Finance has a large pool of liquidity, which means that users can easily swap stablecoins.

6. Venus Protocol

Venus Protocol is a DeFi lending and borrowing platform that operates on the Binance Smart Chain (BSC). It aims to provide users with a way to earn interest on their cryptocurrencies by lending them out or borrowing assets by collateralizing their existing holdings. Venus Protocol shares similarities with other DeFi lending platforms but is unique in that it specifically leverages the BSC, making it faster and more cost-effective compared to platforms operating on the Ethereum network.

Venus supports a variety of assets, including popular cryptocurrencies like Binance Coin (BNB), Bitcoin (BTC), and stablecoins such as BUSD and USDT. Users can lend or borrow these assets and earn or pay interest accordingly.

7. BlockFi

BlockFi stands at the forefront of the rapidly evolving world of DeFi Lending Platform Development offering a comprehensive suite of services that blend traditional finance with the innovative capabilities of cryptocurrencies. Founded in 2017, BlockFi has emerged as a prominent DeFi lending platform, facilitating crypto lending, borrowing, and interest-bearing accounts.

With support for a diverse array of cryptocurrencies, including Bitcoin, Ethereum, and stablecoins, BlockFi appeals to a broad spectrum of users seeking to maximize the potential of their digital assets. The platform’s high-yield interest accounts offer competitive returns, often surpassing traditional savings accounts, and its crypto-backed loans provide a practical way for users to access liquidity without relinquishing their crypto holdings. BlockFi’s commitment to security and regulatory compliance adds to its appeal, ensuring users’ assets are safeguarded while navigating the exciting and dynamic crypto landscape.

8. Nexo

Nexo supports a variety of cryptocurrencies, including Bitcoin, Ethereum, and stablecoins like USDC. These interest rates often surpass those offered by traditional bank savings accounts, making Nexo an appealing choice for those looking to grow their crypto assets passively.

Security is a paramount concern in the crypto world, and Nexo takes this seriously. The platform employs robust security measures and partners with trusted custodial services to safeguard users’ assets. Additionally, Nexo adheres to regulatory standards such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, ensuring a secure and compliant environment for its users.

The NEXO token, the platform’s native utility token, adds another layer of utility to the ecosystem. Holding NEXO tokens can offer users various benefits, such as reduced loan interest rates and higher interest payouts on their deposits. Nexo also shares a portion of its profits with NEXO token holders in the form of dividends, providing an additional incentive for users to participate in the platform.

9. Crypto.com

Crypto.com is known for its user-friendly interface, making it accessible to both newcomers and experienced crypto enthusiasts. This simplicity is essential for attracting a broader audience and encouraging wider adoption of DeFi services.

Security is a paramount concern in the world of cryptocurrencies, and Crypto.com addresses this by implementing robust security measures. The platform employs advanced encryption techniques and multi-factor authentication to protect users’ assets. Additionally, they typically work with reputable blockchain networks and smart contract protocols to minimize the risk of vulnerabilities.

The platform offers a variety of cryptocurrencies that users can lend or borrow, allowing for flexibility in investment strategies. Users can choose from popular cryptocurrencies like Bitcoin and Ethereum or explore newer tokens, depending on their risk tolerance and investment goals. This diversity is appealing to investors looking to diversify their portfolios within the DeFi space.

10. Binance

Binance’s DeFi lending platform offers a diverse selection of cryptocurrencies for lending and borrowing, providing users with flexibility in their investment strategies. Users can choose from a range of assets, from well-established cryptocurrencies like Bitcoin and Ethereum to a variety of altcoins. This diversity allows users to tailor their DeFi activities to their specific preferences and risk tolerance.

As a key player in the cryptocurrency industry, Binance’s DeFi lending platform contributes to the broader adoption of DeFi services. Its seamless integration with the exchange, strong security measures, and support for a wide range of cryptocurrencies make it a notable choice for users looking to participate in the DeFi space.

Key Features and Functionality of a DeFi Lending Platform

Here are the key features and functionalities of a DeFi lending platform:

1. Decentralization

DeFi lending platforms are built on blockchain technology, ensuring that they are decentralized and not controlled by any single entity. This decentralization enhances security, transparency, and trust in the platform.

2. Lending and Borrowing

Users can lend their crypto assets to earn interest or borrow assets by providing collateral. Borrowers can access loans without going through traditional credit checks, making DeFi lending platforms more inclusive.

3. Collateralization

To borrow assets, users are required to provide collateral, usually in the form of other cryptocurrencies. The collateral provides security to lenders in case the borrower defaults.

4. Smart Contracts

Smart contracts, typically built on Ethereum or other blockchain platforms, facilitate lending and borrowing transactions. These contracts automatically execute when predefined conditions are met, eliminating the need for intermediaries.

5. Interest Rates

DeFi lending platforms use algorithms to determine interest rates. Rates can be variable or stable, depending on the platform’s design. Interest rates are often influenced by supply and demand dynamics within the platform.

6. Liquidation Mechanisms

To maintain collateralization ratios, DeFi lending platforms have automated liquidation mechanisms. When a borrower’s collateral value falls below a certain threshold, their assets are sold to repay the lender.

7. Asset Variety

DeFi lending platforms support various cryptocurrencies and tokens, allowing users to lend and borrow a wide range of assets. This diversity enables users to manage their portfolios effectively.

8. User Wallet Integration

Users connect their wallets (e.g., MetaMask) to interact with the platform. It provides users with control over their funds and transaction approvals.

9. Interest Accrual

Interest on lent assets accrues continuously or periodically, depending on the platform. Users can monitor their earnings and borrowings in real-time.

10. Governance Tokens

Many DeFi lending platforms issue governance tokens that grant users voting rights on platform changes, upgrades, and decision-making. These tokens may also be used for fee discounts or rewards.

11. Risk Management

Platforms often implement risk management strategies, such as overcollateralization, dynamic interest rates, and algorithms to determine loan-to-value ratios.

12. Liquidity Pools

Some platforms operate on the principle of liquidity pools, where users contribute assets to a common pool, which is then lent out to borrowers. Contributors earn a share of the interest earned by the pool.

13. Flash Loans

Certain DeFi platforms offer flash loans, which are uncollateralized loans that must be repaid within a single transaction. These are typically used for arbitrage opportunities or other time-sensitive strategies.

14. Integration with Other DeFi Protocols

DeFi lending platforms often integrate with other DeFi protocols and decentralized exchanges, allowing users to move assets seamlessly between different DeFi services.

15. Security Audits

To ensure the safety of users’ funds, many DeFi lending platforms undergo security audits by reputable firms to identify vulnerabilities and mitigate risks.

16. User Interface

User-friendly web interfaces or mobile apps make it easy for users to interact with the platform, view their balances, and manage their lending and borrowing activities.

17. Transparency

All transactions and activities on DeFi lending platforms are recorded on the blockchain, providing complete transparency and traceability.

18. Regulatory Considerations

DeFi lending platforms need to consider and navigate evolving regulatory frameworks, as they operate in a rapidly changing landscape with various legal implications.

Get Obligation Free Quote

[widget id=”custom_html-3″]

Conclusion

DeFi lending platforms offer a number of benefits over traditional lending platforms. They are more transparent, more efficient, and offer lower fees. If you are considering using a DeFi lending platform, it is important to do your own research and understand the risks involved.

Looking for a reputed DeFi Lending Platform Development Services provider? Get in touch with Antier to discuss your requirements.