The real estate industry often displays high barriers to entry and illiquidity, but Blockchain is now changing those norms. The emergence of Real Estate Tokenization is unlocking new opportunities for investors by democratizing access to property investments. With access to exclusive investment opportunities, it is enabling investors to buy and trade fractions of properties worth millions of dollars.

While tokenization of real estate has a strong potential to enhance liquidity and accessibility in the market, investors must be aware of how they take advantage of emerging market opportunities. This guide provides deep insights into what exactly is real estate tokenization, and why investors should care.

Real Estate Tokenization: A New Era of Property Investment

Real estate tokenization is the process of converting ownership rights in a property into digital tokens on a blockchain. These tokens represent fractional ownership of Real estate, Blockchain allows multiple investors to own a piece of property with transparency, security, and liquidity. The tokenization unlocks faster, more inclusive, and highly efficient investment opportunities that were once unimaginable and now accessible to anyone, anywhere.

For example: Rather than purchasing the entire apartment building, investors can buy tokens representing 10% of the property. This opens up real estate investment to a broader audience, including smaller investors who previously couldn’t afford to enter the market.

How Tokenization Is Helping Investors to Unlock Better Market Opportunities?

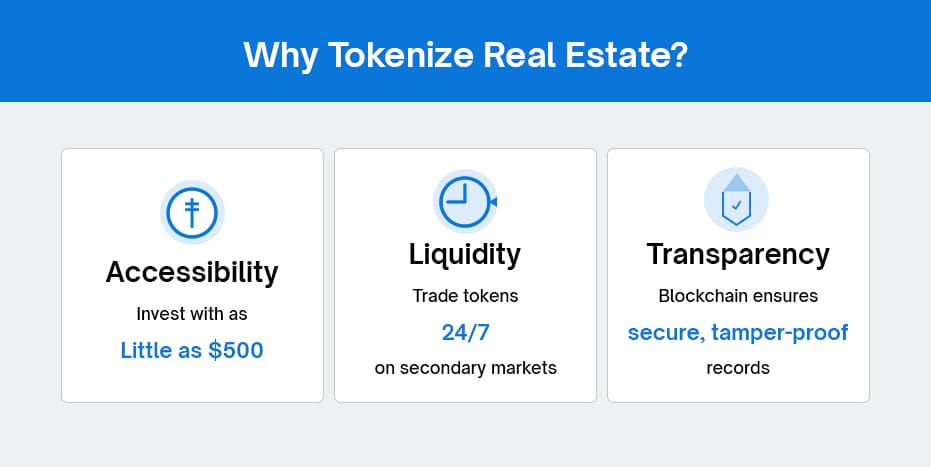

- It Democratizes Real Estate Investment

Traditionally, real estate investment has been reserved for the wealthy or institutional investors. Real Estate Token Investment lowers the entry barrier, allowing individuals to invest the smallest amount.

As per the Deloitte report by 2030, the Real Estate tokenization platform could unlock $1.4 trillion worth of new Tokenized investment via Blockchain opportunities for investors.

- Enhanced Liquidity

One of the biggest challenges that investors often face in real estate is its illiquidity- It could take months or even years to sell a property. Tokenized Real Estate Platform solves this issue with fractional ownership and secondary markets where tokens can be traded 24/7.

A study by PwC predicts that tokenized real estate funds could account for 10% of global GDP by 2030, with real estate leading the charge.

- Enhance Transaction Transparency and Security

Frauds are quite common in the real-estate Industry. In 2023, The FBI’s Internet Crime Complaint Center (IC3) reported 9,521 real estate fraud complaints resulting in total losses exceeding $145 million. But, Tokenization is resolving the issue.

While Blockchain records all transactions on an immutable ledger, Smart contracts for Real Estate automate processes like rent distribution and property management, eliminating fraud and building trust among parties.

Market Potential of Real Estate Tokenization

Explosive Growth: Market Size Projections for Tokenized Real Estate

As per Grand View Research, the Real Estate Tokenization of the property asset market valued at $1.3 billion in 2022, could grow at a CAGR of 19.8% by 2030.

Key Statistics

- In 2021, $23 billion worth of real estate assets were tokenized globally.

- 76% of executives believe digital assets will replace traditional assets within the next decade.

Global Perspective: Countries Leading the Charge in Tokenization

North America

North America leads in real estate tokenization, driven by advanced financial markets and tech-savvy investors. In 2024, the market is valued at $3.8 billion, projected to reach $26 billion by 2034. This growth is fueled by regulatory clarity and a surge in blockchain startups, enhancing liquidity and accessibility for investors.

Europe

Europe’s real estate tokenization is spearheaded by Switzerland, Germany, and the UK, supported by progressive regulations. The EU’s digital market strategy facilitates cross-border Real Estate investment via Tokenization, attracting institutional interest. By 2030, tokenized assets may hit a CAGR of 2.60% with a market value of USD 8.4 Billion by 2030.

Asia-Pacific

In the Asia-Pacific region, rapid urbanization and a burgeoning middle-class drive demand for tokenized real estate. Countries like Singapore and Japan are at the forefront, backed by government initiatives in fintech. Tokenization offers liquidity in high-value markets, transforming Real Estate Token investment opportunities for both local and international investors.

LAMEA

In Latin America, the Middle East, and Africa (LAMEA), tokenization enhances financial inclusion. Countries like Brazil and the UAE leverage blockchain to democratize access to real estate investments. This approach attracts foreign capital while boosting liquidity, making real estate more accessible to a diverse range of investors.

Real Estate Tokenization Market Analysis

RWA Success Stories: Investors Reaping Rewards

Tokenized in 2018, this luxury resort raised $18 million in just 24 hours, with investors earning rental yields and capital appreciation.

Luxury Apartments in San Francisco

In 2024, a portfolio of high-end apartments in San Francisco was tokenized. Here investors purchase fractional ownership starting at $50.

As more tech-savvy investors enter the market, demand for digital assets will skyrocket. Experts predict that tokenized real estate will become a $4 trillion market by 2030, offering investors significant returns through rental income and capital appreciation.

How to Get Started with Tokenized Real Estate Investments?

Here Is the Step-by-Step Guide to Entering the Market

- Create Platform: Create a secure and transparent real estate Tokenization Platform.

- Create an Account: Sign up and complete the verification process.

- Browse Listings: Explore available properties and review their details.

- Invest: Purchase tokens using cryptocurrency or fiat currency.

- Monitor Your Investment: Track performance and receive regular updates.

Tips for Identifying High-Potential Opportunities

- Look for properties in high-demand locations.

- Check the track record of the platform and property sponsor.

- Analyze projected returns and rental yields.

Takeaway

With its unparalleled accessibility, liquidity, and transparency, Real Estate Tokenization opens doors for investors of all sizes. The market is growing rapidly, and the opportunities are endless.

Don’t wait—build your tokenized real estate platform today and secure your place in this growing market.

Choose Antier for Your Real Estate Tokenization Platform Development

When it comes to real estate asset tokenization development, Antier stands out as a trusted partner. As a leading real estate tokenization development company, Antier offers end-to-end solutions tailored to your needs. Whether you’re looking to tokenize residential, commercial, or luxury properties, Antier’s expertise in tokenization of real estate assets ensures a seamless and secure experience.

With a focus on smart contracts for real estate, fractional ownership real estate blockchain, and digital real estate ownership, Antier empowers you to unlock the full potential of investing in tokenized real estate.

Partner with Antier today and explore the world of tokenized Property Investment.

Frequently Asked Questions

01. What is real estate tokenization?

Real estate tokenization is the process of converting ownership rights in a property into digital tokens on a blockchain, allowing multiple investors to own fractional shares of real estate with enhanced transparency, security, and liquidity.

02. How does real estate tokenization democratize investment opportunities?

Real estate tokenization lowers the entry barriers for investment, enabling individuals to invest smaller amounts in properties that were previously accessible only to wealthy or institutional investors.

03. What are the benefits of tokenization for real estate investors?

Tokenization enhances liquidity by allowing fractional ownership and enabling the trading of tokens on secondary markets 24/7, addressing the traditional illiquidity challenges in real estate investments.