The growing blockchain adoption has made tokenization mainstream for businesses that want to raise capital without sacrificing equity. Tokenization Equity Platforms play a major role in this by providing solutions through non-dilutive tokenized offerings. By enabling investors to invest in emerging companies at the early stages of their lifecycle, tokenization transforms them from customers to stakeholders, contributing to a more inclusive economic future and addressing the challenges of the traditional equity market.

This guide explores how Tokenization Equity can help enterprises unlock the new model of capital raising through customized tokenization platforms.

The Challenge with Current Market: How Tokenized Equity Bridging the Gap

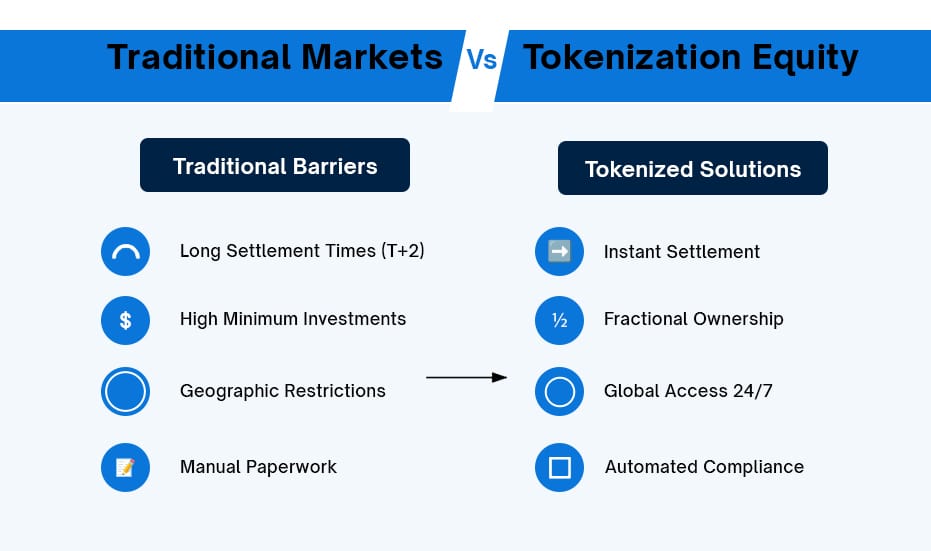

Traditional markets face challenges with manual processes, limited accessibility, and high compliance costs. Stock certificates and investor management remain paper-heavy, creating friction in trading and administration.

Tokenized equity fixes these challenges by providing digital interfaces for seamless investor management, automated compliance through smart contracts, and enhanced liquidity opportunities. This transformation enables companies to reach a broader investor base while reducing operational overhead and streamlining regulatory requirements, ultimately democratizing market access. To read more about Tokenized Equity, refer to this blog!

How Tokenization Enhances Investment Structures?

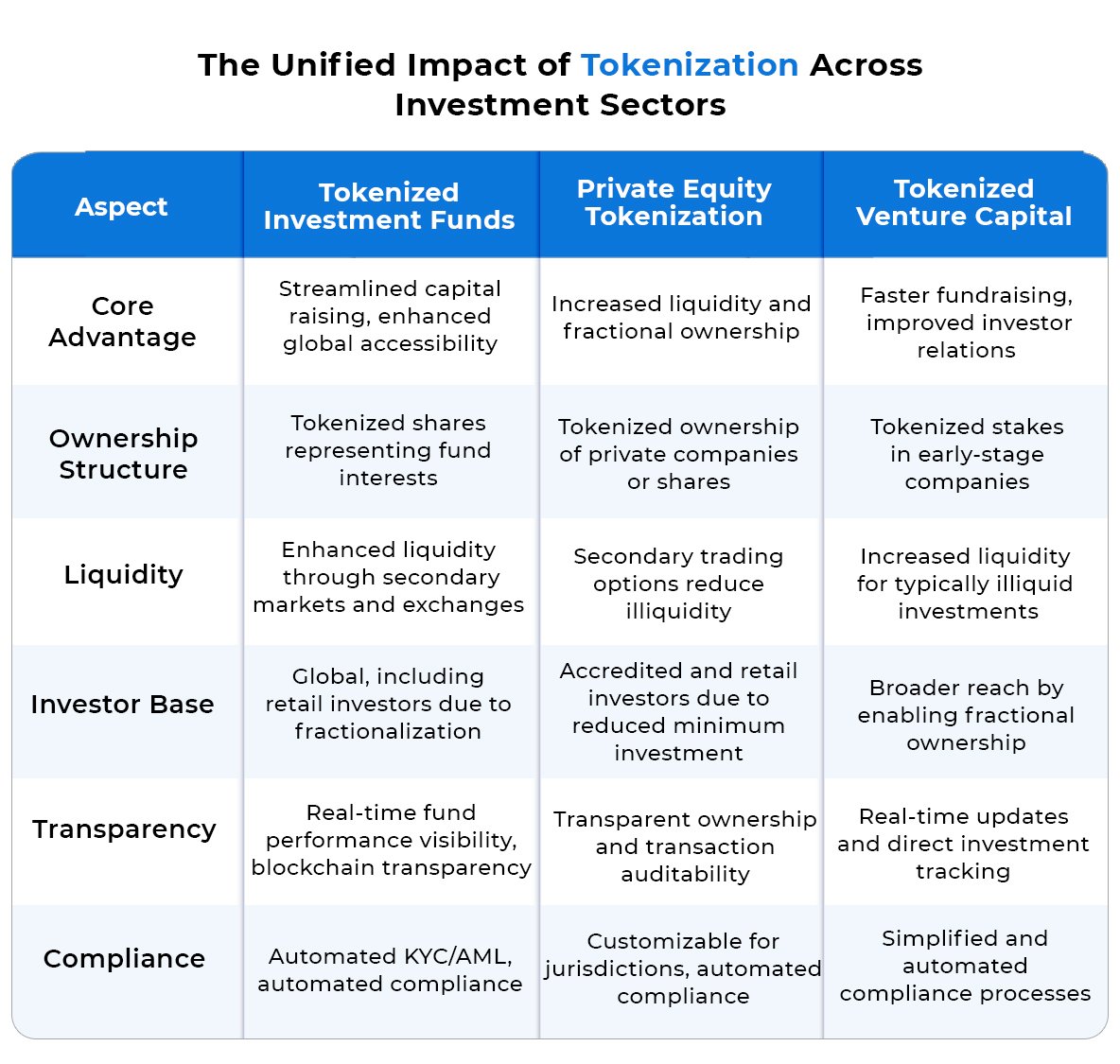

Tokenized equity has the potential to radically alter the fabric of investment funds, private equity, and venture capital by introducing the following capabilities:

Fractional Ownership & Democratization

With the Tokenization Platform, Fintech firms can reduce the barrier to entry for investors by enabling fractional ownership. This opens up the traditionally exclusive world of private equity and venture capital to a much wider audience and creates democratized investment opportunities. Small investors can now own a piece of what was previously reserved for institutional investors only.

Global Accessibility & Liquidity

Tokenized assets, whether they be part of an investment fund, a private equity portfolio, or a venture capital startup, can easily trade Tokenized Equity platforms. This creates a highly liquid market for traditionally illiquid assets, enabling faster exits and more efficient capital deployment. Blockchain t ensures seamless cross-border transactions, removing geographical and regulatory barriers.

Transparency & Security via Blockchain

By utilizing blockchain for tokenization, every transaction, ownership transfer, and dividend payout is recorded on an immutable ledger. This provides real-time, auditable transparency that gives investors greater confidence in their investments. Blockchain’s decentralized nature also reduces the risk of fraud, ensuring that ownership rights are secure and verifiable.

Automated Compliance & Smart Contracts

Tokenization platforms leverage smart contracts to automate processes like dividend distribution, capital calls, and compliance with regulatory standards. Automated Know Your Customer (KYC), Anti-Money Laundering (AML), and investor accreditation ensure regulatory compliance while reducing administrative costs and human error.

Real-Time Data & Reporting

With tokenization, investors and fund managers can access real-time data about their investments, including performance metrics, ownership distributions, and market conditions. This transparency leads to better decision-making and stronger relationships between investors and fund managers.

Key Considerations to Build Equity Tokenization Platforms

For organizations looking to build their Equity Tokenization Platforms, several technical and strategic elements must be in place to ensure success. Here’s a breakdown:

Technology Infrastructure

The platform must integrate with reliable blockchain networks (e.g., Ethereum, Polkadot, Solana) and incorporate key features such as smart contract frameworks, decentralized exchanges (DEXs), and secure custody solutions. Additionally, scalability is a major consideration—Layer 2 solutions or sidechains may be necessary for handling high transaction volumes efficiently.

Regulatory Compliance

Compliance with KYC, AML, and securities laws is crucial. The platform should feature automated compliance workflows, potentially integrating solutions to ensure adherence to both local and global regulations.

Security and Custody

Multi-party computation (MPC) and hardware security modules (HSMs) implementation can provide robust encryption for digital asset custody. Ensuring the security of private keys and assets will build trust with investors.

User Experience

To attract and retain users, the platform must feature an intuitive interface. The design should focus on simplicity while offering sophisticated data and reporting features. Providing educational resources and investment insights can also be valuable for less experienced investors.

Market Strategy and Ecosystem Partnerships

A comprehensive go-to-market strategy is critical. Building relationships with custodians, exchanges, legal advisors, and technology providers will ensure smooth operations and instill investor confidence. Creating a network of trusted partners will help establish the platform as a secure and credible player in the market.

Tokenized Equity: Real World Use-Cases

1. Tokenized Investment Funds

Case Study: ARCA

In 2020, ARCA launched a tokenized fund that allowed investors to access private equity investments through blockchain. Through this Tokenized Equity Platform ARCA opened investment opportunities to individuals who previously faced high entry barriers.

2. Private Equity Tokenization

Case Study: Hamilton Lane

Hamilton Lane partnered with Securitize to launch a blockchain-enabled fund that tokenized a portion of its private equity assets. This fund allowed fractional ownership, significantly lowering the capital commitment required from investors.

3. Tokenized Venture Capital

Case Study: SPiCE VC

SPiCE VC tokenized its entire portfolio, allowing investors to trade tokens representing shares in a diversified portfolio of tech startups. This model addressed common pain points in venture capital by providing liquidity and reducing traditional lock-up periods and attracted a diverse investor base, including tech-savvy millennials and seasoned financiers, eager for liquidity and transparency.

Tokenized Equity: Market Evolution 2025-2030

Regulatory Momentum

Global regulatory frameworks will solidify, offering clear guidelines on token classifications and creating standardized compliance protocols, ensuring a stable, secure environment for tokenized securities to thrive.

Institutional Adoption

Major financial institutions will fully embrace tokenized equity, with banks launching platforms and traditional exchanges integrating blockchain, while investment firms roll out innovative tokenized investment products.

Market Growth

The tokenized asset market will reach a staggering $16 trillion by 2030, driven by surging growth in private equity and the mainstream rise of real estate tokenization.

Tech Advancements

Smart contracts will streamline governance with automation, cross-chain interoperability will rise, and institutional-grade security will bolster trust in tokenized systems, setting new standards for blockchain technology.

Operational Transformation

The industry will evolve to offer automated dividend distributions, real-time settlements, and seamless KYC/AML processes, significantly improving operational efficiency and reducing friction in trading activities.

Market Democratization

Investment opportunities will become accessible to everyone, with lower minimum thresholds, 24/7 trading worldwide, and fractional ownership models enabling a more inclusive market for tokenized assets.

Enhanced Liquidity

A more liquid marketplace will emerge through secondary market development, automated market making, and higher trading volumes, allowing for more robust price discovery and efficient trading environments.

Infrastructure Maturity

Advanced custodial solutions and institutional-grade trading platforms will evolve, while standardized token protocols ensure smooth interoperability, providing the foundational stability needed for a global tokenized asset market.

As demand for alternative investment opportunities continues to grow, equity tokenization platforms are well-positioned to capitalize on this trend.

Built Custom Tokenization Platform with Antier

Don’t just digitize assets – unleash their true potential. While others talk about tokenization, we’re already building tomorrow’s financial infrastructure.

Our Edge:

- Zero-to-Launch in 90 Days

- Battle-tested by $2B+ in tokenized assets

- Proprietary Security Protocol with 0 breaches

- 99.9% Uptime Guarantee

- Institutional-Grade Infrastructure

- Multi-Chain Flexibility (Ethereum, Polygon, Binance)

The market won’t wait. Neither should you.