Table of Contents:

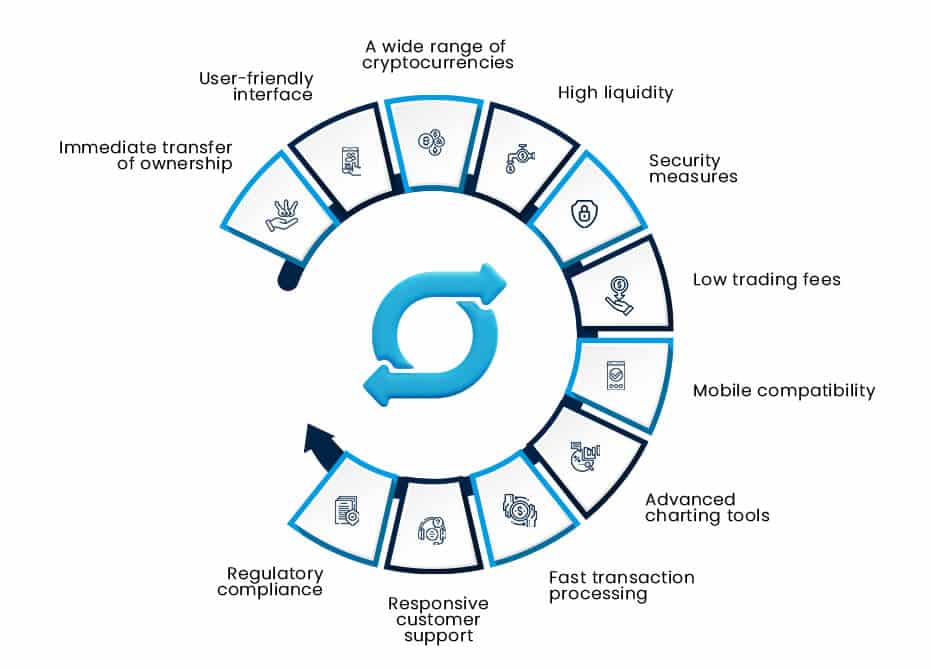

Features For Spot Trading Exchange Development

Spot Trading Exchange Development: Pros For Businesses

Spot Trading Exchange Development: Cons for Businesses

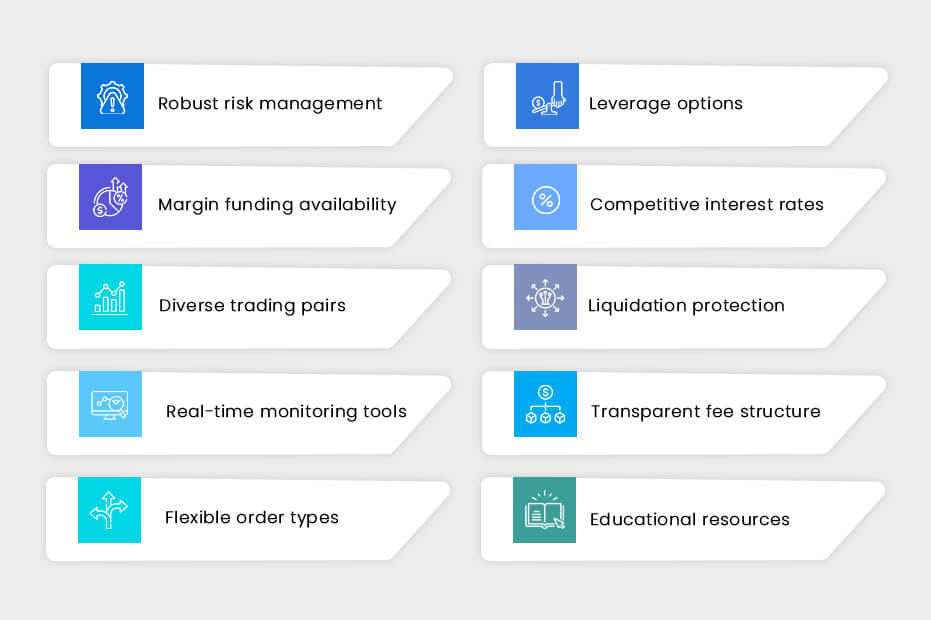

Ideal Features of a Margin Trading Exchange

Pros of Leverage and Margin Trading Exchange Development

Cons of Leverage and Margin Trading Exchange Development

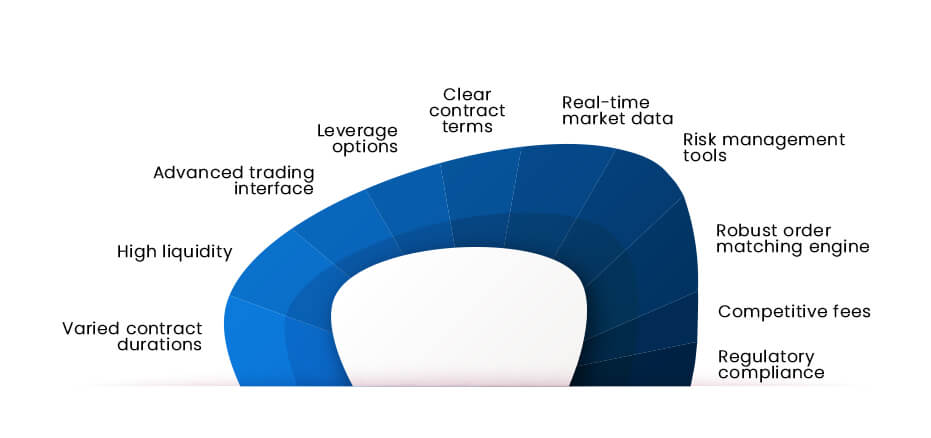

Ideal Features of Futures Trading Exchanges

Pros of Futures Trading Exchange Development

Cons of Futures Trading Exchange Development

Introduction

The crypto landscape can feel like a bustling bazaar where traders hover to buy or sell diverse crypto assets or contracts from different outlets such as spot, derivatives futures, and margin trading exchanges. The prices depicted in the charts determine the footfall in the market.

These markets become digital battlegrounds where entrepreneurs running different outlets try to outpace other businesses, everyone vying for attention and revenues.

Before any entrepreneur swings his metaphorical sword into the chaotic crypto arena characterized by 2024’s Bitcoin Halving and spot crypto ETFs’ craze, he must comprehend the differences and nuances of these marketplaces. If you are one of those entrepreneurs seeking an overview of popular exchange modules, this blog is your ultimate resource to learn about spot, futures, and leverage trading crypto exchange.

Understanding Spot Trading: The Most Familiar Crypto Marketplace

Spot trading is the most straightforward arena, closest to buying and selling in a traditional market. This type of exchange offers traders a platform to directly buy and sell cryptocurrencies at real-time market prices. Unlike their other counterparts, such as derivatives and margin trading exchanges, these exchanges are a simple, low-risk entry point for new crypto wranglers, enabling them to experiment and build their crypto portfolio at their own pace.

Traders purchase cryptocurrencies outright, get immediate delivery, and hold them in their exchange wallets for as long as they want. The buying and selling process is further defined depending on the type of exchange offering spot exchange facilities.

Features For Spot Trading Exchange Development

Spot Trading Exchange Development: Pros For Businesses

- Boosts brand recognition

- A straightforward revenue model with the potential for scaling and innovation.

- Requires full payment upfront, providing immediate liquidity to businesses

- No additional complexities like expiration dates or leverages, making them simpler to develop than futures, leverage, and margin trading exchange

- A spot exchange can be a valuable addition to your existing financial services, expanding your business scope and attracting new customer segments

- A well-established spot trading exchange can capitalize on the booming cryptocurrency market, generating significant revenue through a simple revenue model – transaction fees

Spot Trading Exchange Development: Cons for Businesses

- Limited profitability for traders as they can only profit from price appreciation. Also, restricted profitability for businesses as they can only charge transaction fees with a spot trading module.

Understanding Leverage and Margin Trading Exchange: Borrowing For Bigger Battles

Bigger profits require more capital. Leverage injects more capital into the trading process and enhances profitability for the traders. It can be defined as a loan taken from the market or borrowed from a leverage and margin trading exchange platform to enter a larger trade than you already have reserved for a trade.

Let’s understand with an example:

Say X costs $20 at a particular time and the trader has a capital of only $2000. In a spot market, a trader can only buy 100 units of X, even if he believes its price will rise by 10%. He pockets a profit of $200 by selling at $2200 when the price rises by 10%. If the trader has access to the Leverage Trading Crypto Exchange platform offering 5X leverage, he can buy $10,000 worth of X or 500 units of X and then sell it when the price rises by 10% (amounting to $11,000), giving $1000 as profit.

In short, 5X leverage increases the profit by 5X.

Now that we know what leverage is, it will be easier to understand the concept of margin trading exchanges. Unlike spot trading exchanges, where traders pay the entire amount of crypto purchased upfront, margin exchanges allow traders to borrow funds from a broker or exchange to leverage trading positions and amplify potential profits. Traders realize profits or losses from the volatile crypto market after enhancing their position and return the borrowed funds ultimately. Leverage and margin trading exchange platforms can therefore help traders multiply their profits or losses in the market, making it riskier for traders than spot markets.

Ideal Features of a Margin Trading Exchange

Pros of Leverage and Margin Trading Exchange Development

- A distinctive module, enabling exchanges to stand apart from their spot-only competitors

- Lures retail traders who want to make more money with their limited capital

- Suitable for attracting high-volume traders seeking amplified returns, translating to enhanced profits from transaction fees, interest on borrowed funds, liquidation fees, etc.

- Margin trading exchanges enter a niche market, attracting a loyal and active customer base

- The ability to leverage positions welcomes heightened user engagement and trading activity, boosting exchange volume and platform liquidity.

- Opens the door for the integration of innovative features like automated margin management tools, risk assessment calculators, and unique margin lending options.

Cons of Leverage and Margin Trading Exchange Development

- Increases risk due to potential losses exceeding the initial investment (liquidation risk) and therefore scares novice traders away.

- Meeting strict compliance requirements can be costly and time-consuming if your Leverage Trading Crypto Exchange development company doesn’t offer legal services.

Understanding Futures Trading: Betting On Colosseum Grounds

Just like understanding leverage was essential to learning about margin exchanges, one must first understand what futures are before diving into the futures market. Futures are complex contracts that draw their value from an underlying asset. Like on a spot or margin trading exchange, you don’t buy or sell digital assets directly. Instead, it is an agreement implying buying or selling contracts to purchase or sell cryptocurrencies at a predetermined price at a future date. Traders speculate on the future price movements of cryptocurrencies without owning the underlying asset and take advantage of downward and upward price movements. Traders need not necessarily buy or sell at the predetermined dates but their profits depend on the accuracy of their speculation and the difference between prices on the date when they enter the market and on the delivery date. Like leverage and margin trading exchanges, futures exchanges enable traders to buy a larger quantity of a particular digital asset by paying a lesser amount.

Ideal Features of Futures Trading Exchanges

Pros of Futures Trading Exchange Development

- The popularity of futures contracts is growing steadily as they allow both long and short positions, enabling them to profit from price fluctuations in both directions.

- Unique features differentiate exchanges from the rest and attract a loyal user base seeking sophisticated trading tools.

- Attracts experienced and big-ticket traders seeking diverse investment tools and potential for amplified gains.

- For existing exchanges, futures trading exchange development can diversify their user base.

- Presents a lucrative opportunity due to its growing popularity and remunerative revenue streams through transaction and listing fees.

Cons of Futures Trading Exchange Development

- Requires understanding of contract terms, including expiration dates and settlement mechanisms.

Building A Spot, Futures and Margin Trading Exchange: Cost Estimation

A basic spot exchange may cost around $50,000. Adding a comprehensive leverage and margin trading exchange module with risk management systems, margin calculation engines, and collateral can cost around $200k. Additionally, you can also add a robust futures trading exchange module that provides a complex order matching engine, risk management for derivatives, settlement mechanisms, and market data feeds for $100k. Summing up, a full-featured exchange can cost anywhere from $80,000 to $3,00,000.

However, the costs provided here are estimates and can vary significantly based on numerous factors, including:

- Complexity of the exchange

- Technology stack

- Team size

- Location of development teams

- Regulatory requirements.

Final Words

Cryptocurrency trading offers various avenues for investors and entrepreneurs to engage with the market, including spot trading, futures trading, and leverage trading crypto exchange. Understanding the differences and nuances of each can empower beginners to make informed trading and entrepreneurial decisions and navigate the complexities of the dynamic cryptocurrency market effectively.

At Antier, we build cryptocurrency exchanges that thrive. Whether you wish to build an extraordinary spot trading experience, a futuristic future, or a marvelous margin trading exchange, we can assist you, as we have unparalleled expertise and experience in the domain. Harness our solutions to stay ahead of the curve.

Share your unique requirements right away!