How Can AI Agents in Margin Trading Exchange Offers Investors a Competitive Edge?

March 3, 2025

Million-Dollar ROI? The Winning Strategy Behind AI Agent Meme Coins Like $Mind of PEPE

March 3, 2025Introduction

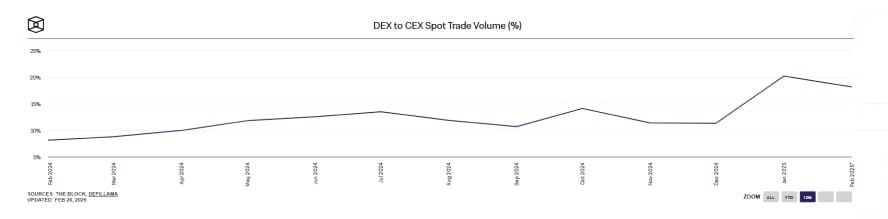

The DeFi ecosystem is exploding albeit being fragmented. According to the dApp industry report by dAppRadar, TVL in DeFi grew by 211% in 2024, reaching the $214 billion mark which was only 20% short of the December 2021 peak. Even the DEX to CEX trading spot volumes achieved an ATH ratio of 20.18% in January 2025. SEC closed their proceedings against UniSwap, a big win for DeFi. MiCA in Europe and Trump in the United States set the stage for a positive regulatory landscape for crypto and DeFi. It seems like a clear regulatory sky for DEXs now.

As all of these developments breathe new life into the DeFi, DEX development is a goldmine opportunity for businesses seeking to dip their toes in the cryptoscape. With a plethora of DEXs offering varying liquidity and pricing, gaining an edge is a grave challenge. Enter DEX aggregators, the unsung heroes, concentrating the liquidity, streamlining trading, and unleashing the best user experience for traders. Jupiter shines as a DEX aggregator redefining trading by unifying liquidity, illuminating the path for traders by finding the best prices and routing orders with stellar precision. No doubt, its trading volumes reached $184 billion in January 2025.

Now how do you carve your own DEX aggregator that rivals giants like Jupiter? Let’s decode the Solana DeX development blueprint.

Why Launch A DEX Like Solana Jupiter Exchange in 2025?

Because traders no longer settle for siloed, fragmented liquidity, slippage-prone experience, suboptimal pricing, or high gas fees. Cross-chain trading, instantaneous transaction settlement, and low-transaction transactions are the new normals of the DEX landscape. And if your DEX development plan can’t compete like this, there’s no point in entering the highly competitive market.

1. DEX Aggregators Solving Crypto’s Trillion-Dollar Liquidity Problem

While standalone DEXs struggle with shallow order books, leading to slippage rates as high as 12%, aggregators like Jupiter pool liquidity from 35+ sources, slashing slippage to under 0.5% for major pairs.

2. Speed and Scale Advantage With Solana DEX Development

Solana isn’t just another blockchain, it’s a high-performance engine powering the future of DeFi.

“The trajectory of DEX growth we’ve seen over the past year is something I expect to continue in 2025. Solana (with 48% of overall DEX volume) and Solana meme coins have been driving much of this growth,” said Jason Lau, Chief Innovation Officer at OKX.”

DEXs on Solana facilitate lightning-fast transactions, 100x cheaper transactions (than ethereum), cross-chain dominance (with wormhole bridge), MEV Resistance, etc.

3. A Well-Executed DEX Aggregator is A Revenue Machine:

DEX aggregators can create a sustainable revenue model by including the following:

- Transaction Fees: DEXs can comfortably charge 0.1%–0.3% per trade.

- Premium Features: DEX aggregators like Solana Jupiter Exchange can offer subscription models for advanced analytics or API access.

- Partnership Revenue: Aggregators can also charge DEXs for priority routing or liquidity incentives.

- Token Appreciation: Native tokens gain value as platform usage grows.

4. First-Mover Advantage With Expanded Ecosystems:

Like Jupiter DAO, a leading DEX aggregation platform expanding in DeFi with perpetual futures trading, stablecoin development, etc, you can also build a comprehensive ecosystem. Except for these, emerging Solana Dex Jupiter can also launch lending & borrowing platforms, staking modules, NFT marketplaces, etc.

5. Enhanced Trading Efficiency and User Adoption:

Reduced slippage and optimal pricing with aggregated liquidity means traders can execute complex trades with ease without the need to navigate multiple DEX platforms. Well-integrated DEX aggregators have significantly higher trading volumes as compared to standalone exchanges. The seamless transactional experience enhances Solana DEX development appeal, attracting both novice and experienced traders.

More users → More liquidity → More partnerships → Exponential growth

6. Lower Operational Costs:

By eliminating multiple intermediaries, these platforms typically incur lower fees. Many leading aggregators operate with transaction fees as low as 0.5%, making micro-trades and high-frequency trading economically viable.

Must-Have Features to Outperform DEX Giants Like Jupiter

1. Smart Order Routing: Heart of Your Aggregator

Implement an algorithm during your Solana DEX development that efficiently scours multiple DEXs, identifying the optimal paths for token swaps. This involves analyzing liquidity pools, transaction fees, slippage, and splitting trades across DEXs for the best transactional experience.

2. Real-Time Price Discovery

Aggregators like Solana Dex Jupiter scan 50+ DEXs instantly and offer users up-to-the-minute market data, including price charts, trading volumes, and liquidity pool information, empowering them to make informed trading decisions.

3. Cross-Chain Compatibility A Powerful Feature

Like Jupiter offering cross-chain and fiat support, upcoming DEX aggregator development projects can integrate real-time fiat onramps and bridges for Ethereum, Solana, BSC, and emerging chains like Sui or Aptos. This allows your platform to serve a worldwide audience, breaking down geographic barriers and fostering a truly trustless and borderless trading ecosystem. Cross-chain functionality also opens up a world of liquidity and attracts a wider user base.

4. User-Centric Design:

Include intuitive, sleek dashboards, real-time analytics, portfolio tracking, trade histories, and one-click trades for beginners and pros during Solana DeX Jupiter development to allow users to easily compare prices, and track and execute transactions. Remember, even experienced crypto traders appreciate a streamlined experience.

5. Security First:

The DeFi sector remains a primary target for hackers despite CeFi featuring honey pots.

Source: Merkle Science

During Solana DEX development, implement stringent security protocols, regular smart contract audits from trusted service providers (CertiK, Hacken), and MEV attack prevention to safeguard assets and ensure transactional integrity. This builds trust and fosters long-term adoption.

6. Gas Fee Optimization:

Your DeFi exchange development company can help you with the best technologies and techniques to optimize gas fees for your users. You can also allow traders to predict and minimize transaction costs with dynamic fee calculators.

7. Loyalty Programs and Gamification

Loyalty programs like token rewards, fee discounts, and governance rights are just some starters to boost retention. You can include leaderboards, milestone rewards, and other tailored gamification strategies to achieve desired results for your DEX aggregators.

Other Features:

- Token Swapping

- Liquidity Pools

- Yield Farming

- Governance Participation

- Wallet Integration

- User Dashboard

- Transaction History

- Notifications and Alerts

- Token Launchpad

- NFT Marketplace Integration

- Advanced Order Types

- Staking

- DCA

- Metis Routing Engine

- Advanced Swap Aggregation

- Limit Orders

Solana DEX Development: The Cost Breakdown

Launching an Aggregator like Solana DeX Jupiter isn’t cheap, but the ROI justifies the spend. It requires a team of skilled developers, smart contract auditors, and UI/UX designers. This can be a significant investment of around $50k-$300k, so you should be very careful while picking your DeFi exchange development company.

Here’s what the cost breaks down into:

- Development & Tech Stack: Includes smart contracts, APIs, and backend infrastructure.

- UI/UX Design: Prioritize responsive design and interactive analytics.

- Cross-Chain Integration: Bridge development and chain-specific optimizations.

- Security Audits: Non-negotiable for trust and compliance.

- Liquidity Partnerships: Incentivize DEXs and market makers to join your network.

- Marketing & Community: Airdrops, influencer campaigns, hackathons, etc. to drive adoption.

- Ongoing maintenance, server costs, and customer support contribute to operational expenses.

Pro Tip:

- You can start with a MVP focusing on 1-2 chains to validate demand before scaling.

- Don’t Get Fooled by substandard Jupiter clone scripts.

Your Launch Strategy For Solana Jupiter Exchange Development With Timeline

Phase 1: Protocol Incubation (Months 1-3)

- Technical Stack: Rust for Solana-based systems, Vyper for Ethereum L2

- Liquidity Partnerships

- Testnet Launch: Simulate 10,000+ concurrent users with GoLoad balancers

Phase 2: Mainnet Blastoff (Months 4-6)

- Tokenomics Design:

- 45% liquidity mining

- 30% staking rewards

- 15% team (4-year vesting)

- 10% treasury

This is just a hunch. Your DeFi exchange development company can help you with the best tokenomics design as per your business vision and objectives.

- Bug Bounty Program

- Market Maker Onboarding

Phase 3: Growth Singularity (Months 7-12)

- Cross-Chain Expansion: NEAR, Avalanche, Cosmos IBC integration

- Governance Launch: Snapshot voting + on-chain execution

A Stellar Future With Solana DEX Development

The DEX aggregator market is still nascent, with less than 10 major players dominating the market. For entrepreneurs, this is the golden hour to build. By combining robust tech, strategic partnerships, and relentless user focus, your platform could become the next Jupiter—or even surpass it.

At Antier, a leading DEX development company, we have the experience and resources to help you bring your vision to life. From smart contract auditing to liquidity war chest strategies, we engineer not just platforms, but market dominators. The question isn’t whether to build, but how soon you’ll eclipse Jupiter’s $100bn trading volume.

Let us guide you on your Solana DEX Development journey to creating a powerful and innovative aggregator that will dominate the DeFi frontier.