Security Token Market is evolving and attracting emerging players to the industry with long-term opportunities. The major attraction of Security Tokens is its growth rate which is helping businesses increases their market share and reach consumers seamlessly. Unlike stocks, security tokens can be traded around the clock, 365 days a year. They settle promptly and straight to an investor’s bank account.

Though there has been a huge impact on the security token industry post-Covid-19 era, it has managed to show resurgence signs. Security tokens are simulated after the market for conventional stocks. This article throws light on the impact of security token development adoption- Evolution and growth, market trends, types of markets, their impact on private sectors and bankruptcy, and lastly, the pain points of their adoption.

- Evolution of Security Tokens and Their Growth

- Understanding The Market Trend of Security Tokens

- What are the three major categories of the security token market?

- Top 5 Industries- Driving The Growth of the Security Token Market

- How are Security Tokens unlocking Private Sectors?

- Key advantages of adopting Security Token Development Services by Private Sectors

- A Notable Example – Positive Impact of Security Tokens on Bankruptcy

- What if the Creditors Could Leverage The Potential of Security Tokens?

- Consult an Outstanding Token Development Company

Evolution of Security Tokens and Their Growth

The idea of Security Token offerings evolved from ICOs. It serves as utility tokens that are distributed to raise capital from investors. However, with ICO’s immense success, there was also an increase in the scams in the market. These challenges led to the emergence and creation of STOs. Security Token Offerings provide tokenization to the transactions of digital assets and a shield of compliance regulation. These tokens offered increased liquidity, fractional ownership, automated compliance, and the potential for global accessibility.

Security Tokens offered a bridge between traditional securities and the emerging world of blockchain technology, offering a more efficient, compliant, and accessible way to issue, trade, and manage asset ownership. The evolution of security token development has transformed the way traditional securities are issued, traded, and managed. As the market matures, further advancements in technology, regulation, and market infrastructure are expected. They will likely drive broader adoption and integration of security tokens into the global financial ecosystem. Let us update ourselves with the latest market trends of Security Tokens to have a better understanding.

Look at what Twitter has to say about the future of Security Tokens:

Understanding The Market Trend of Security Tokens

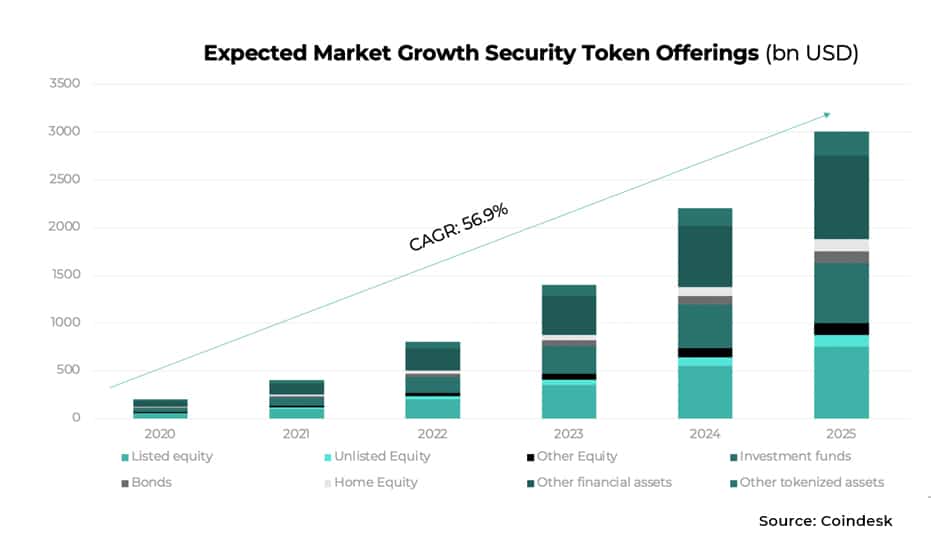

“Security Tokens Market size is projected to reach Multi-Million USD by 2029, In comparison to 2022, at an unexpected CAGR during 2022-2029.”

Security token development is increasingly gaining traction in the digital economy as institutional involvement in the crypto sector reaches unprecedented levels. The tokenized security ecosystem comprises numerous players, each playing a crucial role and focusing on specific aspects to bring the emerging digital asset industry to fruition. The widespread adoption of security token development is expected to drive the widespread adoption of blockchain technology by corporations, resulting in significant disruption to the traditional financial landscape. As security tokens find their way into the deep pockets of capital markets, the financial world will experience a paradigm shift that will forever change the way things operate.

Security Token Offering Expected Growth:

What are the three major categories of the security token market?

The market is segmented based on the product types that account for the highest proportion of security token sales.

Know These 3 Segments-

On-Cloud: It refers to a platform or system that enables the trading and exchange of security tokens through cloud-based infrastructure. In an on-cloud security token marketplace, the platform is hosted and operated on cloud servers, making it accessible to a wide range of participants via the Internet. This cloud-based infrastructure provides scalability, flexibility, and global accessibility, allowing investors and issuers from various locations to engage in token trading activities.

On-Premise: It refers to a platform or system that facilitates the trading and exchange of security tokens within a local or private network infrastructure. The use of an on-premise security token marketplace provides several benefits, including enhanced security and privacy. By keeping trading activities within a private network, organizations can have greater control over the security measures implemented and reduce the risk of external threats.

Hybrid: It refers to a platform or system that combines elements of both on-premise and on-cloud infrastructures for trading and exchanging security tokens. It represents a blended approach that utilizes the benefits of both models to create a flexible and versatile marketplace. Organizations or consortiums can maintain sensitive data and critical operations on-premise, providing enhanced control over security measures, and ensuring compliance with specific regulations or internal policies. At the same time, they can leverage the cloud infrastructure for non-sensitive activities, such as user interfaces, order-matching engines, or non-critical data storage.

No doubt, there are certain industries that have utilized these segments of the security token marketplace to drive growth. Let us see how certain industries have impacted the security token market growth.

Top 5 Industries- Driving The Growth of the Security Token Market

Healthcare- The healthcare industry has embraced the potential of security tokens to transform various aspects of healthcare, including funding, data management, efficiency, and global accessibility. The use of security tokens in this industry offers benefits such as increased liquidity, improved data security, streamlined processes, and innovative funding models, contributing to the growth and development of the security tokens marketplace.

Telecommunication- This industry has played a vital role in the growth and development of the security token marketplace. Through global connectivity, real-time data transmission, remote participation, mobile trading applications, and enhanced communication, the telecommunications sector has contributed to the accessibility, efficiency, and security of security token transactions, fostering the advancement of digital securities and blockchain-based financial ecosystems.

Media & Entertainment- It has leveraged security tokens to transform financing models, enable fractional ownership of creative assets, enhances fan engagement, and create new opportunities for content distribution and monetization. The increased adoption of security token development services by this industry has facilitated innovation, increased liquidity, and provided alternative funding avenues, shaping the future of media and entertainment ecosystems.

Travel and Hospitality- It has influenced the security token marketplace by providing opportunities for fractional ownership, alternative fundraising methods, enhanced liquidity, and streamlined transactions. The adoption of security tokens in this sector has the potential to unlock new investment avenues, increase market participation, and create innovative business models within the travel and hospitality ecosystem.

BFSI- BFSI (Banking, Financial Services, and Insurance) industry has had a significant impact on the security token marketplace – driving innovation, regulatory advancements, and market infrastructure development. Security Tokens have the potential to revolutionize traditional financial processes, expand investment opportunities, and create a more efficient, transparent, and inclusive financial ecosystem.

How are Security Tokens unlocking Private Sectors?

“Security tokens are digital contracts that leverage blockchain-based protocols and reside within the network. These tokens represent fractions of various existing assets, including but not limited to real estate properties, vehicles, or shares of corporate stock.”

Non-institutional investors face challenges in accessing high-quality private market investment opportunities due to various factors.

Factors Affecting Investment Opportunities-

- Limited access and lack of transparency in pricing

- Involvement of intermediaries,

- High minimum investment requirements,

- Limited options for liquidity

- Time-consuming and complex legal procedures

As a result, it is difficult for individual investors to conveniently and directly explore and participate in these lucrative investment possibilities. However, Security Tokens help overcome these challenges faced by investors. It enables investors to trade and exchange ownership rights to private company shares that are using digital tokens and are facing challenges in the secondary market for private equity.

Key advantages of adopting Security Token Development Services by Private Sectors

The key advantage of adopting security token development services by the private sector is the ability to record, issue, and validate transactions continuously. This ensures higher transparency and efficiency leading to bringing a positive impact on both current secondary market investors and extended access to a broader range of investors. Overall, security tokens have enhanced the integrity of the market and made secondary markets more inclusive.

A Notable Example – Positive Impact of Security Tokens on Bankruptcy

The collapse of Bernie Madoff’s $65 billion Ponzi scheme in 2008 had a profound impact on Wall Street. Even after almost 15 years since the first news broke about his crimes, investors who placed their trust in Madoff’s fund are still grappling with the task of recovering their losses. From pension funds to individual savers, the hard-earned money invested in Madoff’s scheme may never be fully recuperated. The recovery process has been sluggish, convoluted, and ineffective, leaving many investors with only a fraction of their stolen funds.

However, what if these same individuals had access to security tokens that could assist in the recovery of their losses and potentially generate profits through the revival of the business and the promise of future cash flows? Whether it involves cases like Madoff or instances such as the crypto lender Celsius Network, security tokens emerge as a viable solution to democratize and simplify the efforts of creditors and investors in the realm of bankruptcy recovery. Security Token development has the potential to level the playing field and offer a fairer chance of recovery for those affected by such financial catastrophes.

What if the Creditors Could Leverage The Potential of Security Tokens?

Security tokens have the potential to provide the long-awaited solution for bankruptcy recoveries sought by both investors and creditors. By issuing security tokens to investors, they can partake in the future cash flows or revenue generated by the company, without necessarily obtaining voting rights. In the present crypto industry, numerous bankruptcy cases are emerging. Thus, every creditor should carefully consider the option of utilizing security tokens as a means of navigating such situations. Enhanced deployment of security token development offers a promising avenue for creditors, empowering them with greater control and potential recovery in the face of bankruptcy proceedings.

Consult an Outstanding Token Development Company

From initial ideation and concept design to smart contract development, token issuance, and post-launch support, Antier offers a comprehensive suite of services. The company possesses the expertise and knowledge to create high-quality and reliable tokens tailored to specific business requirements. Whether it’s security tokens, utility tokens, or asset-backed tokens, it can provide comprehensive token development services.

Choose the best token development company for ongoing support and maintenance services post-token launch. We provide timely updates, address any issues that arise, and offer continuous enhancements to ensure the smooth functioning of the tokens and the success of the project in the long run.