Blockchain is evolving as a disruptive force with the potential to transform the banking industry by transparent, accelerated, cost-efficient, more secure transactions. The industry is witnessing an increase in number of advocates for blockchain technology as the latter enables huge savings in the transaction and administrative costs. According to a report, a blockchain-based system can help the finance industry to reduce the following costs:

—> 70% potential cost savings on central finance reporting

—> 50% potential cost savings on centralized operations

—> 30% potential cost savings on compliance

—> 50% potential cost savings on business operations

Furthermore, blockchain disintermediates the transfer of digital financial assets while mitigating the role of central counterparties. It improves the level of accuracy, trust, and resilience in the financial ecosystem. This is why many start-ups and incumbents are harnessing blockchain to start digital asset bank.

Signature Bank – with $49 billion asset size – became the first U.S. bank to launch a blockchain-driven proprietary payments platform by partnering with trueDigital Holdings – a FinTech focusing on blockchain-based infrastructure, exchange, and settlement technology.

Foundational Elements of Blockchain

• Decentralization

Blockchain creates a shared infrastructure by distributing the control among all of the peers in the transaction chain. This is in contrast to a centralized system where the control lies with a central authority.

• Digital Signature

Blockchain uses a unique digital signature to enable an exchange of transactional value. These digital signatures count on public keys and private keys to create proof of ownership.

• Mining

A distributed consensus mechanism incentivizes miners for verification and confirmation of transactions and stores transactions in blocks while employing strict cryptographic rules.

• Enhanced security

Banks work relentlessly to safeguard their and customers’ data, but security breaches are indispensable. Blockchain improves security through cryptography and tamper-proof design while eliminating a single point of failure.

• Data Integrity

The combination of complex algorithms and a consensus mechanism ensures that transaction-related data, once agreed upon, cannot be manipulated. Data recorded on the blockchain serves as a single source of truth, thereby mitigating the risk of fraud.

Role of Cryptocurrency in Banking

Cryptocurrencies are tokens on a distributed consensus ledger (DCL) that represent a unit of account and a medium of exchange. As a digital asset, a cryptocurrency can be acquired, stored, exchanged, and accessed electronically. It enables peer-to-peer exchange while making third-party functions redundant.

Given that blockchain technology underpins cryptocurrencies, the latter can potentially revolutionize the financial ecosystem by enabling secure, expedited, and cost-efficient settlement. Together, blockchain and cryptocurrencies can forge the path for a democratic ecosystem where people have complete control over their assets.

Blockchain in Banking: Use-cases and Benefits

The banking industry is burdened with various time-consuming, redundant, and costly processes. Blockchain can transform these processes, thereby bringing profound and positive changes across the financial services industry.

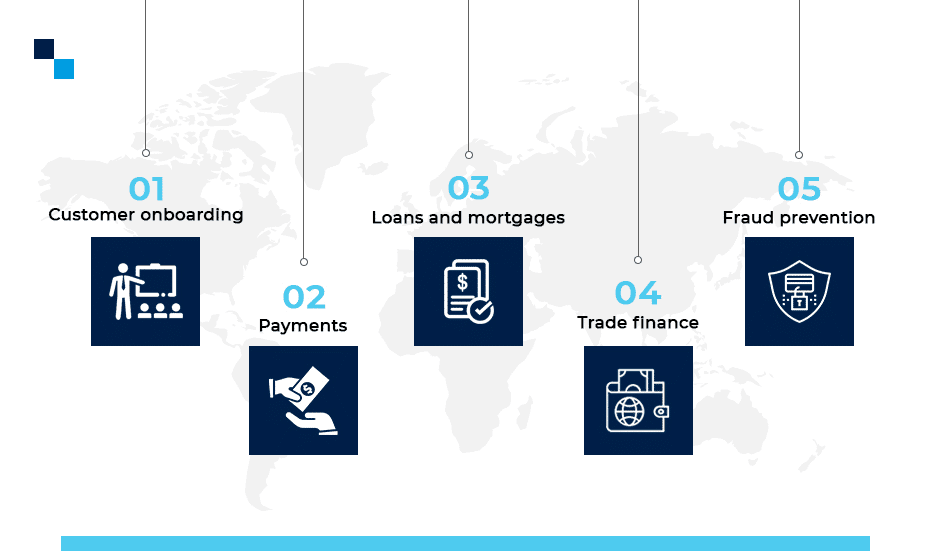

The following are the key processes that are ideal for blockchain transformation and can be offered by a crypto friendly core banking solution:

1. Customer onboarding

Customer onboarding is an inevitable process that requires Know Your Customer (KYC) and Anti-Money Laundering (AML) verification across various departments. The conventional KYC and AML processes are time-and-effort-intensive and often lead to duplication of records. According to research by a leading corporate brand, Thomson Reuters, it takes 32 days to complete KYC checks. Besides, the traditional processes often fail to safeguard users’ sensitive data.

Blockchain can augment the KYC and AML processes by digitizing them. FinTech and non-financial industry players that adopt these solutions can safely record the digital identities of their consumers in one place while ensuring a single source of truth. In addition, blockchain technology can help ensure the security of users’ data.

2. Payments

The existing payment process, especially cross-border payments across correspondent banks, requires a central counterparty to drive transfers using SWIFT. This leads to the involvement of third-party entities – further escalating transaction and administrative costs.

Blockchain can simplify and accelerate transactions, enabling faster, accurate, and cost-efficient settlements. According to a report, blockchain deployments will enable banks to leverage savings on cross-border transactions of up to $27 billion by the end of 2030, thereby reducing costs by over 11%. However, to achieve this, those looking to start digital asset bank need to create a backbone network or partner with an existing network. By creating such a solution, financial or non-financial institutions can replace SWIFT and reduce the settlement time from a few days to near real-time.

3. Loans and mortgages

One of the key benefits of blockchain is smart contracts. A smart contract is a self-executing contract that includes the rules and restrictions pertinent to a contract – similar to a traditional contract. Smart contracts automate the processes while mitigating human intervention, thereby resulting in easy, instantaneous, cost-efficient, and more accurate processes.

Blockchain-driven smart contracts can facilitate the management of loans, mortgages, and credits by creating shared copies of agreements. They can simplify the release of funds through quick payment settlement and higher traceability.

4. Trade finance

Trade finance is referred to as the fuel for global commerce. The current trade finance system is beset with inefficiencies – such as delivery delays because of process overheads, lower traceability of goods, and effort-intensive processes to perform counterparty due diligence and contractual compliance.

A blockchain-driven trade finance solution with a letter of credit, bill of lading, and multi-signature solutions can digitize the processes across the system. With the implementation of smart contracts, businesses can ensure greater speed, transparency, and traceability.

5. Fraud prevention

A blockchain-based network can mitigate fraud by improving the visibility and transparency of transactions. Blockchain makes transactions immutable – which means that they cannot be changed or deleted once they are deployed on the blockchain. Furthermore, blockchain can be permissioned to limit participation in the network. Each of the members is invited and validated before being able to contribute to any transaction. This prevents outsiders from gaining access to critical information and records.

Conclusion

The financial services industry is witnessing significant disruption with blockchain. Those looking to become digital service providers and offer crypto friendly core banking solution cannot overlook the potential of blockchain to transform banking processes like user onboarding, payments, loan management, and more. Blockchain-based solutions can help financial and non-financial institutions to reduce costs and efforts and achieve near real-time settlement capabilities.

How Antier Solutions can help

Antier Solutions can help start-ups, well-established organizations, and financial institutions to launch their crypto banks. Strengthened by a team of finance and technical experts, we provide complete solutions – from guiding on compliance to acquiring a bank license to providing a white label banking ecosystem packed with all essential banking functions, including bank accounts, credit/debit cards, payments, trading, lending, and user onboarding.