Introduction: Setting the Stage

“Data is the new oil, but in the crypto world, real-time and accurate data is gold.”

The world of finance is on a perpetual quest for innovation, constantly seeking new tools and techniques to optimize processes and maximize returns. In the highly dynamic digital finance market, perpetual trading has been emerging as a popular option for traders seeking to capitalize on market movements without the constraints of traditional crypto futures contracts. The perpetual futures crypto trading mechanism thrives on real-time data for its success, as the speculative strategy in 24/7-running, highly volatile crypto markets demands reliable and fast data.

Let’s explore how Pyth Network, a next-gen Oracle solution, recasts perpetual trading through high-fidelity and low-latency market data feeds and enhances perpetual crypto exchange development.

What is the Pyth Network and How Does It Transform Perpetual Trading?

Perpetual contracts come with a unique challenge—”the funding mechanism.” To maintain a level playing field, perpetual contracts employ a funding rate system that ensures the perpetual contract price reflects the underlying spot price. This funding rate is periodically exchanged between long and short positions.

The Pyth Advantage: Oracle Efficiency for Crypto Perpetual Trading

Pyth offers a significant advantage over traditional Oracle solutions used in perpetual trading. Pyth Network is a high-performance decentralized oracle network designed to provide highly reliable real-time price data for DeFi protocols. It addresses a critical need in the DeFi ecosystem: accurate, low-latency, and tamper-proof data feeds for trading, staking, and more. So, it solves the bigger problems.

Pyth aggregates data from financial institutions, hedge funds, and trading platforms to cast the most recent data for on-chain activities, ensuring data integrity and reliability. Crypto perpetual trading platforms can leverage this to optimize the experience for their users.

The Role of Pyth in Optimizing trading perpetual futures crypto

1. Precision Data Feeds for Dynamic Pricing

Perpetual trading depends on price stability and accurate market data to prevent slippage and liquidation events. Pyth enhances the game by:

- Delivering sub-second data updates, which are crucial for highly volatile assets.

- Aggregating cross-asset price data from multiple sources, ensuring accuracy and decentralization.

This robust data layer allows perpetual traders to access precise price feeds and execute trades confidently.

2. Optimizing Perpetual Futures Markets

Trading perpetual futures Crypto often involves speculating on asset price movements. Pyth’s real-time oracles ensure that futures contracts are always anchored to accurate market prices, reducing:

- Funding rate mismatches: Accurate prices lead to fairer funding rates between long and short positions.

- Unnecessary liquidations: More accurate and precise pricing and margin calculations enhance the efficiency of the perpetual futures crypto trading platform and benefit traders.

3. Seamless Integration with Solana and Sui Ecosystems

Pyth Network is compatible with high-throughput DeFi blockchain protocols like Solana and Sui.

- Sui’s object-centric architecture allows Pyth’s data feeds to operate efficiently, fostering innovation in decentralized perpetual trading markets.

- Solana’s speed and scalability complement Pyth’s real-time data needs, enabling perpetual trading crypto platforms like Mango Markets to offer instant settlements and order matching.

Pyth, therefore, positions itself as a leading integration for those seeking perpetual crypto exchange development.

4. Security Through Decentralization

One of the biggest challenges in perpetual trading is data manipulation or Oracle attacks. Pyth mitigates this risk through its Super-safe and Proof-of-Authority (PoA) mechanism, which ensures that only trusted financial institutions contribute data. This decentralized approach:

- Reduces the possibility of single points of failure.

- Increases trust in perpetual futures crypto trading protocols relying on Pyth time-stamped feeds.

5. First-Price Auction Mechanism:

Pyth utilizes a unique first-price auction mechanism to determine the median price for each asset class, ensuring data accuracy and resistance to outlier manipulation.

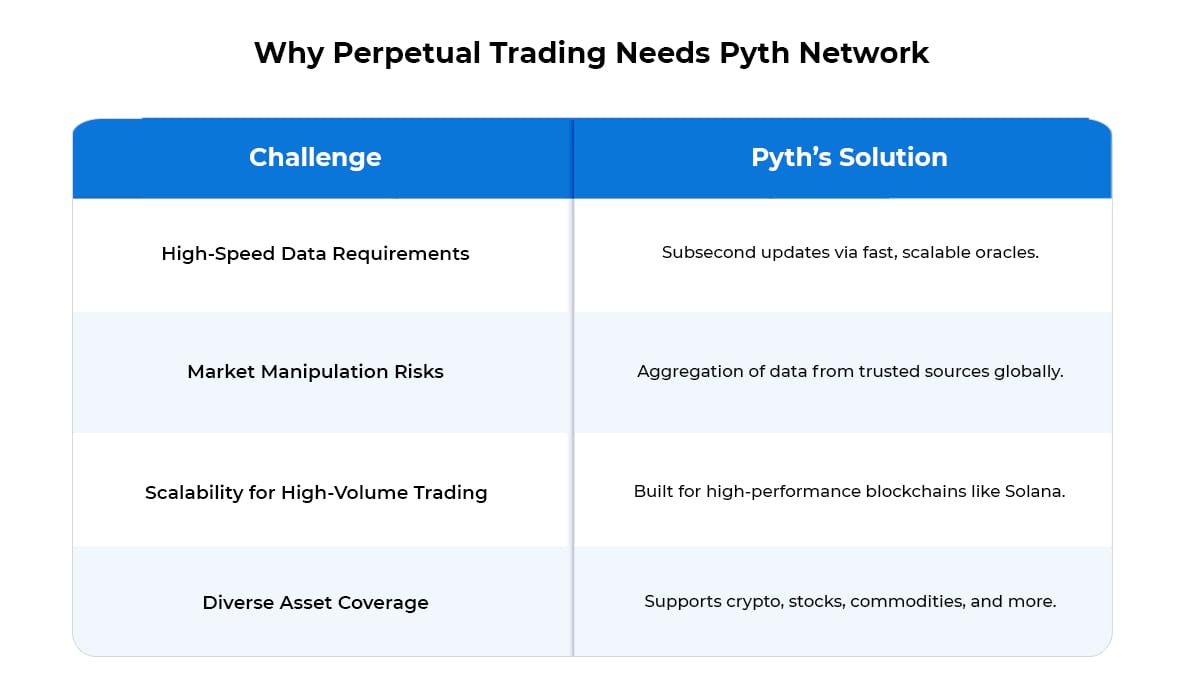

Perpetual trading has unique requirements that traditional oracles often struggle to meet. By tackling these issues, Pyth creates a trading environment where both institutional and retail traders can thrive.

Benefits of Pyth Integration for Crypto Exchange Development

By incorporating Pyth Network into their infrastructure during crypto exchange development, perpetual trading platforms can unlock a multitude of benefits.

- Enhanced Price Discovery: Pyth’s decentralized and reliable price feeds ensure that perpetual contracts accurately reflect the underlying market value, leading to fairer and more efficient trading.

- Innovation in Perpetual Trading Products: Pyth’s robust infrastructure paves the way for the development of innovative new perpetual trading crypto products, catering to a wider range of trading strategies.

- Reduced Risk of Oracle Manipulation: The elimination of a single point of failure through Pyth’s decentralized architecture significantly reduces the risk of Oracle manipulation, protecting traders from potential losses.

- Improved Capital Efficiency: Faster settlement times facilitated by Pyth enable traders to capitalize on fleeting market opportunities and optimize their capital allocation.

Future of Pyth in Perpetual Trading

As perpetual futures crypto trading continues to dominate the DeFi landscape, Pyth is poised to play an even bigger role in crypto exchange development. Upcoming advancements may include:

- Multi-chain Expansion: Beyond Solana and Sui, Pyth is exploring integrations with other blockchains, like Ethereum Layer 2 solutions, to enhance the user experience for perpetual futures trading as well as other on-chain engagement facilitating platforms.

- Enhanced Data Accuracy: Continuous improvements in data aggregation mechanisms for even more reliable feeds.

- Support for New Financial Instruments: Pyth aims to expand its offerings to cover exotic derivatives and algorithmic trading tools.

Closing Thoughts

Pyth Network is revolutionizing perpetual futures crypto trading by addressing its most critical bottleneck with real-time, accurate, and decentralized price feeds. In the future, it is going to play an essential role in optimizing user experience for a wide range of DeFi protocols and applications.

As such innovations lead the way, traders can expect a more efficient, inclusive financial system that embraces cutting-edge technology while fostering greater adoption across various industries. So, what are you waiting for? The future of perpetual trading looks bright as Pyth continues to push boundaries in this dynamic sector.

Expose your users to lower risks, increased transparency and better liquidity with Pyth-integrated perpetual crypto exchange development.