Blockchain for Health Insurance: A Game-Changer in Claims & Fraud Prevention

April 7, 2025

Missed Doge and Pepe? Your Second Chance Lies In Meme Coin Development On BNB Chain

April 7, 2025How secure are your assets when centralized platforms hold the keys to your wealth? Security breaches remain a persistent threat, especially with centralized exchanges managing billions of digital assets. In 2023 alone, hackers exploited vulnerabilities in centralized platforms, stealing over $1.8 billion in crypto assets. Upon reviewing the data, it’s clear that while the total cryptocurrency stolen in 2023 was approximately $1.7 billion, only a portion was specifically from centralized exchanges. Losses on centralized platforms, such as exchanges and trading platforms, totaled around $256 million across seven cases in 2023.

The risk intensifies as regulatory scrutiny tightens, often leading to frozen funds and asset seizures. This is driving a paradigm shift toward on-chain, self-custodial trading, where users retain full control over their assets without intermediaries. Decentralized trading leverages smart contract security, zero-knowledge proofs, and multi-chain interoperability to ensure trustless transactions and robust protection. As institutional adoption rises, the need for tamper-proof, self-sovereign asset management is more critical than ever. The shift to decentralized trading isn’t just an option—it’s the inevitable future of digital asset security.

Why Bring Your Asset Security Exchange Platforms On-Chain?

Can you trust centralized entities with the security of digital assets in an era of rising cyber threats and financial collapses? Traditional exchanges remain vulnerable to custodial failures, liquidity crises, and opaque asset management, exposing investors to systemic risks. Moving your asset security exchange on-chain ensures trustless, tamper-proof, and real-time asset security—eliminating single points of failure.

Blockchain-driven exchange platform development revolutionizes trade settlement with smart contract automation, eradicating manual inefficiencies. Cryptocurrency Exchange Software fortifies transactions with decentralized consensus, cryptographic security, and non-custodial asset control, significantly mitigating counterparty risks. Crypto Exchange Development Services on Layer 2 networks provide high-speed, low-cost scalability, making institutional-grade security accessible to global markets.

Beyond security, cryptocurrency exchange development fosters regulatory transparency, instant liquidity, and auditability, redefining how digital assets are safeguarded. In a landscape where trust is earned, not assumed, an on-chain Asset Security Exchange is the only viable path toward resilient, future-proof financial infrastructure. Are you prepared to lead the transformation?

Why is BTC L2 the Best Infrastructure for On-Chain Asset Security Exchanges?

Is your asset security exchange platform prepared for the next phase of blockchain evolution? With market volatility, counterparty risks, and regulatory shifts redefining digital asset security, BTC Layer 2 emerges as the most resilient and scalable foundation for on-chain asset security exchanges. It preserves Bitcoin’s uncompromised security while introducing high-performance financial infrastructure, making it the ultimate choice for institutional and enterprise-grade cryptocurrency exchange operations.

- Institutional-Grade Security Without Centralized Custodians- BTC L2 inherits Bitcoin’s cryptographic integrity, ensuring that assets remain safeguarded from hacks, fraudulent activities, and unauthorized interventions. This eliminates reliance on centralized custodians, reducing single points of failure while reinforcing financial sovereignty.

- Scalability That Meets Global Trading Demands- Traditional blockchain networks struggle with high transaction fees and congestion, but BTC L2 introduces low-latency execution, ensuring high-frequency transactions without bottlenecks. Whether for institutional trading or retail participation, it guarantees real-time settlements without compromising efficiency.

- Optimized Cost Efficiency for Large-Scale Transactions- BTC L2 minimizes gas fees and operational costs, making on-chain trading, settlement, and asset transfers significantly more economical. By moving asset security exchanges on-chain, firms can optimize capital efficiency while reducing overhead costs tied to traditional settlement systems.

- Regulatory Transparency with Immutable Audit Trails- Compliance in digital finance is non-negotiable. BTC L2’s decentralized ledger ensures verifiable, tamper-proof records that align with global regulatory standards, facilitating on-chain identity verification, transaction auditing, and financial reporting without exposing user data.

- Seamless Cross-Chain Interoperability- As financial markets demand greater liquidity, BTC L2 facilitates cross-chain connectivity, allowing asset security exchanges to integrate multi-chain trading environments and support tokenized assets, securities, and digital commodities without friction.

- Future-Proof Infrastructure for Next-Gen Digital Asset Security- With innovations in smart contracts, zero-knowledge proofs, and DeFi integrations, BTC L2 ensures that on-chain asset security exchanges remain adaptive, resilient, and at the forefront of blockchain evolution.

By embracing BTC L2, businesses can build trustless, transparent, and high-performance exchange platforms, positioning themselves ahead of market trends and regulatory shifts. The question is no longer why- it’s when will you make the move.

Core Features Of Asset Security Exchange Development on BTC L2

How can asset security exchanges leverage Bitcoin Layer 2 to redefine digital asset trading? As the demand for scalable, trustless, and regulation-ready trading environments intensifies, BTC L2 delivers cutting-edge blockchain infrastructure for seamless execution, enhanced security, and liquidity optimization. With cryptocurrency exchange development evolving beyond centralized models, BTC L2 introduces a highly efficient framework that ensures speed, decentralization, and institutional-grade reliability.

✔️Smart Contract-Driven Trade Execution for Secure Settlements

BTC L2 integrates automated smart contracts into its exchange platform development, ensuring trustless trade execution with predefined settlement conditions. These on-chain mechanisms eliminate counterparty risks while streamlining high-value transactions in asset security exchange environments.

✔️Bitcoin-Native Rollups for Scalable and Cost-Effective Transactions

With cryptocurrency exchange software facing scalability challenges, BTC L2 employs rollup technology to batch-process trades, significantly lowering transaction fees while increasing throughput. This ensures high-frequency trading without congestion, a crucial factor in crypto exchange development services.

✔️ Non-Custodial Wallets for Enhanced Asset Control

Unlike traditional centralized systems, BTC L2 enables direct wallet-to-wallet transactions, eliminating the need for intermediaries. This approach enhances security in asset security exchange platforms by giving users complete control over their digital assets, a growing demand in cryptocurrency exchange development.

✔️ Atomic Swaps for Cross-Chain Liquidity and Interoperability

BTC L2 empowers exchanges with atomic swap capabilities, allowing traders to securely exchange assets across multiple blockchain networks without relying on centralized liquidity providers. This functionality enhances crypto exchange development services by enabling borderless trading opportunities.

✔️ On-Chain Order Books with Hybrid Liquidity Models

BTC L2 optimizes exchange platform development by combining fully decentralized order books with hybrid liquidity aggregation. This feature ensures deep liquidity pools while maintaining decentralized execution, a crucial factor for modern asset security exchange platforms.

✔️ MEV-Resistant Trade Architecture for Market Fairness

BTC L2 mitigates Miner Extractable Value (MEV) vulnerabilities, ensuring fair sequencing of trades without front-running or price manipulation. This creates an equitable trading environment, reinforcing the integrity of cryptocurrency exchange software.

✔️ Zero-Knowledge Proofs (ZKPs) for Privacy-Driven Compliance

Regulatory compliance is paramount during crypto exchange development, and BTC L2 addresses this with ZKP technology. It enables confidential yet verifiable transactions, ensuring that asset security exchanges adhere to AML and KYC standards without compromising privacy in cryptocurrency exchange development.

BTC L2’s highly specialized features are revolutionizing asset security exchange platforms, providing a future-proof trading infrastructure that combines scalability, security, and interoperability. As crypto exchange development services continue to evolve, BTC L2 positions itself as the most efficient and resilient foundation for next-generation digital asset trading.

Top Security Features for Asset Security Exchanges Built on Bitcoin Layer 2

How can asset security exchanges achieve uncompromised security while maintaining high-speed, trustless trade execution? As institutional players and high-net-worth traders demand ironclad security, Bitcoin Layer 2 emerges as the most resilient blockchain infrastructure for any crypto exchange development. It integrates cutting-edge cryptographic mechanisms, trustless security layers, and anti-exploit architectures, ensuring that cryptocurrency exchange development remains protected from evolving cyber threats. Below are the core security features that BTC L2 brings to asset security exchange platforms, designed exclusively to fortify their defense mechanisms.

- Non-Custodial Asset Control with Private Key Sovereignty- BTC L2 enforces a non-custodial security model, ensuring that traders retain exclusive control over their private keys. This removes third-party custodianship risks, mitigating vulnerabilities associated with centralized cryptocurrency exchange software.

- Zero-Knowledge Proofs for Privacy-Preserving Security- By leveraging ZKPs, BTC L2 enables transaction verification without exposing sensitive user data. This ensures that exchange platform development adheres to privacy-preserving compliance measures while maintaining anonymity in asset security exchanges.

- Multi-Signature Authorization for Secure Transaction Validation- BTC L2-based crypto exchange development services integrate MultiSig authentication, requiring multiple parties to authorize high-value transactions. This eliminates risks related to single-point failures, unauthorized transfers, and fraudulent asset withdrawals.

- DID and Biometric-Enabled Authentication- BTC L2-powered cryptocurrency exchange development utilizes DID frameworks, replacing traditional login credentials with biometric authentication and decentralized verification methods. This prevents credential-based attacks, phishing attempts, and unauthorized account takeovers.

- Anti-Frontrunning Protections with MEV-Resistant Trade Execution- BTC L2 neutralizes frontrunning exploits and Miner Extractable Value (MEV) vulnerabilities by implementing encrypted memepools and fair sequencing protocols. This safeguards asset security exchanges from trade order manipulation and market abuse.

- AI-Powered Risk Monitoring and On-Chain Surveillance- BTC L2 integrates AI-driven fraud detection and real-time on-chain transaction monitoring, enhancing the security of cryptocurrency exchange software. These systems identify suspicious activities, illicit trading patterns, and insider collusion, ensuring a highly regulated and secure trading environment.

- Post-Quantum Cryptography for Future-Resistant Security- BTC L2 employs post-quantum cryptographic techniques, making crypto exchange development services resistant to potential quantum computing threats. This future-proofs asset security exchange platforms against emerging cryptographic vulnerabilities.

- Tamper-Proof Ledger with Immutable Trade Records- Every trade executed on BTC L2-based asset security exchanges is permanently recorded on-chain, ensuring full transparency and auditability. This prevents unauthorized trade reversals, data tampering, and fraudulent record modifications, enhancing the trust layer in cryptocurrency exchange development.

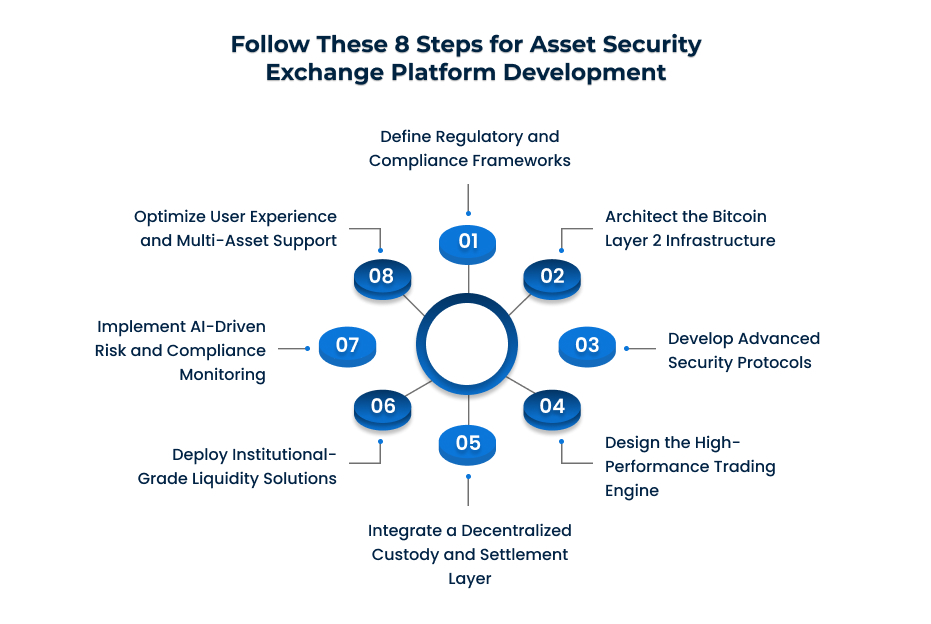

How To Build An Asset Security Exchange Platform on Bitcoin Layer 2?

Developing an asset security exchange platform on Bitcoin Layer 2 requires a highly strategic and technically advanced approach. With the increasing demand for trustless, high-performance, and security-centric trading platforms, top-tier cryptocurrency exchange development companies follow a rigorous methodology to ensure seamless deployment. Let us have a closer look at the structured roadmap outlining the critical phases of exchange platform development on BTC L2.

Step 1: Define Regulatory and Compliance Frameworks

Before initiating crypto exchange development services, the project must align with global regulatory mandates. Establishing a compliant architecture with AML/KYC protocols, digital asset custody regulations, and jurisdiction-based licensing is imperative to ensure the platform’s legitimacy and institutional adoption.

Step 2: Architect the Bitcoin Layer 2 Infrastructure

Selecting the right BTC L2 scaling solution—such as Lightning Network, Stacks, or Rootstock (RSK)—is critical for ensuring high-speed transactions, low fees, and enhanced security mechanisms. The exchange platform development must incorporate smart contract-driven security layers, non-custodial asset control, and interoperability protocols to enhance asset security exchange capabilities.

Step 3: Develop Advanced Security Protocols

Security is the backbone of cryptocurrency exchange software. Implementing multi-signature authentication, decentralized identity frameworks, zero-knowledge proofs (ZKPs), and post-quantum cryptographic measures fortify the platform against hacks, fraud, and unauthorized asset withdrawals. BTC L2 enhances exchange platform development by embedding MEV-resistant trade execution and encrypted mempools for frontrunning protection.

Step 4: Design the High-Performance Trading Engine

The trading engine must process millions of orders per second, enabling seamless liquidity aggregation, smart order routing, and cross-chain compatibility. BTC L2-based cryptocurrency exchange development integrates deterministic execution models, layer-2 transaction rollups, and order-matching algorithms to ensure scalable and ultra-fast trading performance.

Step 5: Integrate a Decentralized Custody and Settlement Layer

Building a non-custodial asset security exchange on BTC L2 demands a trustless settlement mechanism. The use of self-custodial wallets, decentralized escrows, and programmable asset-locking mechanisms eliminates counterparty risk. Smart contracts power automated collateralized settlements, ensuring secure and transparent asset transfers within cryptocurrency exchange software.

Step 6: Deploy Institutional-Grade Liquidity Solutions

Ensuring deep liquidity pools is essential for sustaining market efficiency in crypto exchange development services. BTC L2 facilitates automated liquidity providers (ALPs), on-chain market-making protocols, and decentralized automated market makers (AMMs), enabling seamless liquidity provisioning for institutional traders and retail users.

Step 7: Implement AI-Driven Risk and Compliance Monitoring

Real-time surveillance mechanisms powered by AI and ML algorithms enhance fraud detection and risk mitigation within asset security exchange platforms. BTC L2-based exchange platform development incorporates automated trade surveillance, AI-driven anomaly detection, and decentralized reporting frameworks to combat wash trading, insider collusion, and money laundering risks.

Step 8: Optimize User Experience and Multi-Asset Support

A seamless user interface UI and UX play a pivotal role in cryptocurrency exchange development. The platform should support multi-asset trading, fiat on-ramp integrations, DeFi staking models, and institutional-grade dashboards to cater to diverse trader needs. BTC L2 enhances crypto exchange development services by ensuring scalable, frictionless, and trustless asset management.

By following these strategic steps, a renowned cryptocurrency exchange development company can build a next-gen asset security exchange on Bitcoin Layer 2, ensuring unparalleled security, institutional-grade efficiency, and seamless trade execution.

Build Your Asset Security Exchange Platform With Certified Experts!

In a time when centralized systems continue to falter under growing cybersecurity threats, moving your asset security exchange on-chain is no longer optional—it’s inevitable. Building on Bitcoin Layer 2 not only fortifies your infrastructure with unmatched cryptographic resilience but also equips your platform for high-speed, scalable, and trustless trading.

At Antier, we specialize in cryptocurrency exchange development, empowering institutions with end-to-end expertise—from protocol integration and liquidity infrastructure to secure smart contract deployment and Layer 2 scaling. Whether you envision a regulated asset hub or a decentralized trading venue, we architect exchange platforms engineered for compliance, performance, and longevity. It’s time to lead the shift—future-proof your exchange with Antier.